Unemployment

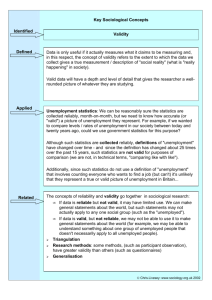

advertisement

Unemployment: Full Employment and Underemployment Full employment: Full employment in an economy does not mean that there is absolutely no unemployment. Full employment is considered the situation wherein everybody in an economy that wants to work and is willing to work at market wage is able to. Even under full employment there will be some unemployed people who do not want to work and there will also be people who are unemployed because they are between jobs. Graph A shows an economy operating at full employment. Graph A Price Level Full Employment AS Pf AD Output Qf Underemployment: A situation wherein a worker is employed, but is not at the desired capacity. Their current position could be below them in terms of skill level, work hours, or wage rate. Underemployed persons are not being used to their full capacity such as a college graduate working as a street vendor. Unemployment Rate: A measure of unemployment which accounts for the normal increase in unemployed persons as a result of an increase in population. The unemployment rate is expressed as a percentage and is calculated using the formula Unemployment Rate = Unemployed Workers Total Labor Force Costs of Unemployment: The costs of unemployment can be broken down into two groups personal and societal. Under personal costs of unemployment are the issues of homelessness, mental illness, debt, and poor health. Homelessness can result from an unemployed person’s inability to pay their mortgage or rent. Mental illness may occur from the lack of self esteem associated with unemployment, as well as the psychological pressures which occur for the unemployed. Debt is an obvious consequence of unemployment as unemployed persons are unable to pay for things with actual capital and are forced to use credit cards. Poor health is a consequence of unemployment as many people’s health insurance is tied to their job. Also, independent health insurance is astronomically expensive so without a job people cannot afford to purchase it. Under societal costs of unemployment are the issues of not fully utilizing resources, as well as a decrease in GDP. The productions possibilities frontier may shift in as a result of high unemployment as due to a lower level of workers an economy is not able to produce at its maximum level of output and efficiency. Because of lower levels of employment and therefore income there will be lower levels of demand and consumer spending which will cause aggregate demand to shift in therefore signaling a decrease in GDP. Types of Unemployment: 1. Structural Unemployment: Structural unemployment is long term perpetual unemployment. It results from discrepancies in the skill levels and demands of workers with the needs of employers. It generally results from lack of demand for workers by employers either because the prospective employees do not possess the desired skills or are not in the specific job market (in terms of physical location) as prospective employees. An example of this would be a deep sea fisherman looking for work in Kansas where there is not job market for his skills. 2. Frictional Unemployment: Frictional unemployment is unemployment which occurs in the transitional period between jobs. During the period that an employee is searching for a new job either because they have quit their previous job or because they are a recently graduated student just entering the job market, they are frictionally unemployed. An example of this would be a business student just out of college searching for their first job. 3. Seasonal Unemployment: Seasonal unemployment is unemployment which occurs yearly at a specific time due to a lack of demand for the worker at that given time of year. Seasonal unemployment generally tends to occur in industries such as tourism, hotel and catering, and fruit/crop picking/harvesting. An example of a seasonally unemployed person would be a ski instructor during the summer. 4. Cyclical/Demand Deficient Unemployment: This type of employment is based on inefficiency in the market in that there is not enough demand for employees to employ every person who wants to work. Cyclical unemployment varies with the trade/business cycle. This means that when the economy is up that the rate of cyclical unemployment is much lower. However, when the economy goes into recession cyclical unemployment will increase and workers will get laid off as demand for them decreases. An example of a cyclically unemployed person would be any of the thousands of laid off workers who have lost their jobs during this current recession. Real Wage Unemployment: Real wage unemployment is also known as classical unemployment. It occurs when real wages are set above the market-clearing level and as a result employers cannot afford to employ as many workers. This setting at the market clearing price is often caused by government intervention, such as minimum wage, or labor unions. Measures to Deal with Unemployment: Demand Side Policies: Unemployment may be approached from many perspectives. Demand side policies may be used to help remedy unemployment. Under the auspice of demand side policies include taking measures to help increase aggregate demand. As the demand for goods and services increases so will revenue to the companies producing and providing these things. As revenue and profit rises these corporations will demand more workers and unemployment will fall. Monetary Policy: Monetary policy may be used to increase growth in the economy and shift out the aggregate demand curve thereby increasing the demand for labor. Expansionary monetary policy would be employed through increasing the money supply. This is done through the purchase of open market operations, the reduction of the reserve requirement, and the decrease of the discount rate. All of these actions would serve to increase the amount of hard currency in a market which would make money more available and prompt spending which would result in a shift out of Aggregate demand and a decrease in unemployment. Fiscal Policy: Easy money Fiscal Policy can be used to help stimulate aggregate demand and reduce unemployment. An easy money fiscal policy includes increasing government spending, which as a factor of GDP, would directly result in a shift out of the aggregate demand curve. Also, easy money policy includes decreasing taxes. This leaves the population with more disposable income which would result in increased demand and therefore a shift in the aggregate demand curve and decreased unemployment. Supply Side Policy: Supply side policy may also be used to combat unemployment. These policies include making the labor market more flexible to the needs of employers. This could translate into dissolving minimum wage requirements and reducing labor union power. Education and improving the skills of workers in order to make them more attractive to prospective employers is also an approach of supply side policies. A. Inflation a. Inflation- rate at which the general level of prices for goods and services is rising i. Costs: 1. Decrease in purchasing power, cause individuals to purchase inferior goods ii. Example: As inflation rises, every dollar will buy a smaller percentage of a good. For example, if the inflation rate is 2%, then a $1 pack of gum will cost $1.02 in a year. b. Deflation- general decline in prices, often caused by a reduction in the supply of money or credit. Deflation can be caused also by a decrease in government, personal or investment spending. i. Costs: 1. Side effect of increased unemployment: since there is a lower level of demand in the economy, which can lead to an economic depression, this creates a fall in profits, closing factories, shrinking employment and incomes, and increasing defaults on loans by companies and individuals c. Causes of Inflation i. Cost push 1. Price levels rise (inflation) due to increases in the cost of wages and raw materials. Cost-push inflation develops because the higher costs of production factors decrease in aggregate supply (the amount of total production) in the economy, a shift of the AS to the left. Because there are fewer goods being produced (supply weakens) and demand for these goods remains constant and the prices of finished goods increase 2. Since AS decreases and less is produced the decrease in productivity causes less need of workers, causing unemployment to increase. ii. Demand pull 1. A result of too many dollars chasing too few goods. This type of inflation is a result of strong consumer demand, shifting AD to the right. When many individuals are trying to purchase the same good, the price will inevitably increase. 2. As AD increases there is a need to increase production in goods so there is a need of more workers to produce more, causing the unemployment rate to decrease. iii. Excess monetary growth 1. Monetary growth in excess of increases in the public’s demand for money balances will eventually decrease the purchasing power of money or, equivalently, raise the general price level d. Methods of measuring inflation i. Consumer Price Index-A measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. 1. The CPI is calculated by taking price changes for each item in the predetermined basket of goods and averaging them; the goods are weighted according to their importance. Changes in CPI are used to assess price changes associated with the cost of living. 2. CPI = 100 X Cost of basket in current year Cost of basket in base year 3. Inflation rate = CPI this year – CPI last year X 100 CPI last year ii. Problems of CPI measuring inflation 1. Substitution bias – a. some prices rise faster than others over time b. consumers substitute toward goods that become relatively cheaper c. CPI misses this substitution because it uses fixed basket of goods d. CPI overstates increases in cost of living 2. Introduction of new goods a. when new goods become available variety increases allowing consumers to find products that more closely meet their needs b. making each dollar more valuable c. CPI misses effect because it uses a fixed basket of goods d. overstates increases in cost of living 3. Unmeasured quantity change a. improvements in quantity of goods in the basket increases value of each dollars e. Phillips curve i. Inflation and unemployment have a stable and inverse relationship. According to the Phillips curve, the lower an economy's rate of unemployment, the more rapidly wages paid to labor increase in that economy. The theory states that with economic growth comes inflation, which in turn should lead to more jobs and less unemployment. ii. Unemploy. Rate = natural rate – (actual infla.- expected inflation) Of unemplo. iii. Short run- Fed can reduce unemployment rate below natural unemployment rate by making inflation greater iv. Long run- unemployment rate goes back to natural unemployment rate (NU) no matter inflation is high or low v. A Shift of AS then there is a shift of PC but a shift in AD then there is a movement of PC vi. AS shifts in b/c wage pressure vii. AD shifts out b/c Fed makes inflation increase viii. Increases in expected inflation causes PC to shift out ix. Showing economic growth f. Natural Rate of unemployment i. Hypothetical unemployment rate consistent with aggregate production being at the "long-run" level, shown on the graph as NU. This level is consistent with aggregate production in the absence of various temporary frictions such as incomplete price adjustment in labor and goods markets. g. Non-Accelerating Inflation Rate of Unemployment (NAIRU) i. NAIRU is calculated from the Philips Curve. The point at which the Philips curve, which relates unemployment to inflation, intersects the horizontal axis indicates the NAIRU. In terms of output, the NAIRU corresponds to potential output, the highest level of real gross domestic product that can be sustained at any one time.