Find the figures for the Current Year and the Previous Year

advertisement

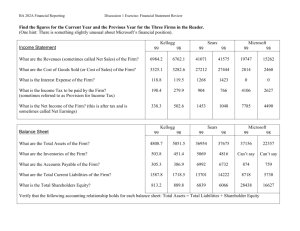

BA 202A Financial Reporting Discussion 1 Exercise: Financial Statement Review Find the figures for the Current Year and the Previous Year for the Three Firms in the Reader. (One hint: There is something slightly unusual about Microsoft’s financial position). Kellogg Income Statement 99 Sears 98 99 98 99 98 Microsoft 99 98 98 Microsoft 99 98 What are the Revenues (sometimes called Net Sales) of the Firm? What are the Cost of Goods Sold (or Cost of Sales) of the Firm? What is the Interest Expense of the Firm? What is the Income Tax to be paid by the Firm? (sometimes referred to as Provision for Income Tax) What is the Net Income of the Firm? (this is after tax and is sometimes called Net Earnings) Kellogg Balance Sheet 99 Sears What are the Total Assets of the Firm? What are the Inventories of the Firm? What are the Accounts Payable of the Firm? What are the Total Current Liabilities of the Firm? What is the Total Shareholders Equity? Verify that the following accounting relationship holds for each balance sheet: Total Assets = Total Liabilities + Shareholder Equity BA 202A Financial Reporting Discussion 1 Exercise: Financial Statement Review Kellogg Statement of Cash Flows 99 Sears 98 99 98 Microsoft 99 98 What is the Net cash from Operating Activities? What is the Net Cash from Investing Activities? What is the Increase (Decrease) in Cash (and cash equivalents) for the year? Verify that Cash (and Cash Equivalents / Short-term Investments) amount for the year in the Cash Flow Statement is equal to the Cash amount that appears in the Balance Sheet. Notes to the financial statements Accounting Policies are usually reported in the first note to the Financial Statements. Within this note, review how the firm values its Property and Equipment. Also review how the firm depreciates the Property and Equipment. Kellogg 99 Sears 99 Microsoft 99 BA 202A Financial Reporting Discussion 1 Exercise: Financial Statement Review Financial Statement Analysis The Debt-Equity Ratio is calculated as follows: Debt-Equity Ratio = Total Liabilities Total Liabilities + Shareholders Equity Kellogg Debt-Equity Ratio 99 Sears 98 99 98 Microsoft 99 98 Calculate the Debt-Equity Ratio for the two years Has the ratio increased of decreased? The Profit Margin Ratio (before interest effects) is calculated as follows: Profit Margin Ratio (before interest effects) = Net Income + Interest Expense Net Sales (or Revenues) Kellogg Profit Margin Ratio 99 Calculate the Profit Margin Ratio (before interest effects). Has the ratio increased of decreased? Final Question: What is the interesting aspect about Microsoft’s financial position? Sears 98 99 98 Microsoft 99 98