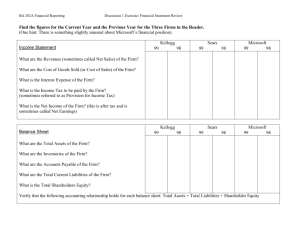

Find the figures for the Current Year and the Previous Year

advertisement

BA 202A Financial Reporting Discussion 1 Exercise: Financial Statement Review Find the figures for the Current Year and the Previous Year for the Three Firms in the Reader. (One hint: There is something slightly unusual about Microsoft’s financial position). Kellogg Income Statement Sears Microsoft 99 98 99 98 99 98 What are the Revenues (sometimes called Net Sales) of the Firm? 6984.2 6762.1 41071 41575 19747 15262 What are the Cost of Goods Sold (or Cost of Sales) of the Firm? 3325.1 3282.6 27212 27444 2814 2460 What is the Interest Expense of the Firm? 118.8 119.5 1268 1423 0 0 What is the Income Tax to be paid by the Firm? (sometimes referred to as Provision for Income Tax) 198.4 279.9 904 766 4106 2627 What is the Net Income of the Firm? (this is after tax and is sometimes called Net Earnings) 338.3 502.6 1453 1048 7785 4490 Kellogg Balance Sheet Sears Microsoft 99 98 99 98 99 98 What are the Total Assets of the Firm? 4808.7 5051.5 36954 37675 37156 22357 What are the Inventories of the Firm? 503.8 451.4 5069 4816 Can’t say Can’t say What are the Accounts Payable of the Firm? 305.3 386.9 6992 6732 874 759 What are the Total Current Liabilities of the Firm? 1587.8 1718.5 13701 14222 8718 5730 What is the Total Shareholders Equity? 813.2 889.8 6839 6066 28438 16627 Verify that the following accounting relationship holds for each balance sheet: Total Assets = Total Liabilities + Shareholder Equity BA 202A Financial Reporting Discussion 1 Exercise: Financial Statement Review Kellogg Statement of Cash Flows Sears Microsoft 99 98 99 98 99 98 What is the Net cash from Operating Activities? 795.2 719.7 3697 3890 10030 6880 What is the Net Cash from Investing Activities? (244.2) (398.0) (983) (1026) (11191) (7272) 14.2 (36.8) 234 137 1084 162 What is the Increase (Decrease) in Cash (and cash equivalents) for the year? Verify that Cash (and Cash Equivalents / Short-term Investments) amount for the year in the Cash Flow Statement is equal to the Cash amount that appears in the Balance Sheet. Notes to the financial statements Accounting Policies are usually reported in the first note to the Financial Statements. Within this note, review how the firm values its Property and Equipment. Also review how the firm depreciates the Property and Equipment. Kellogg 99 Stated at cost less accumulated depreciation. Depreciated using straight line method. Sears 99 Stated at cost less accumulated depreciation. Depreciated using straight line method Microsoft 99 Stated at cost less accumulated depreciation. Depreciated using straight line method BA 202A Financial Reporting Discussion 1 Exercise: Financial Statement Review Financial Statement Analysis The Debt-Equity Ratio is calculated as follows: Debt-Equity Ratio = Total Liabilities Total Liabilities + Shareholders Equity Kellogg Debt-Equity Ratio 99 Calculate the Debt-Equity Ratio for the two years Has the ratio increased of decreased? Sears 98 .831 .824 (83.1%) (82.4%) Increased 99 98 .815 .839 (81.5%) (83.9%) Decreased Microsoft 99 98 .235 .256 (23.5%) (25.6%) Decreased The Profit Margin Ratio (before interest effects) is calculated as follows: Profit Margin Ratio (before interest effects) = Net Income + Interest Expense Net Sales (or Revenues) Kellogg Profit Margin Ratio Calculate the Profit Margin Ratio (before interest effects). Has the ratio increased of decreased? 99 Sears 98 .065 .092 (6.5%) (9.2%) Decreased 99 98 .066 .059 (6.6%) (5.9%) Increased Microsoft 99 98 .394 .294 (39.4%) (29.4%) Increased Final Question: What is the interesting aspect about Microsoft’s financial position? Microsoft does not have any liabilities, aside from those associated with the operating of the business. For example, they have an accounts payable amount but no long-term debts. Consequentially, Microsoft does not have any interest expenses.