Finance 462

advertisement

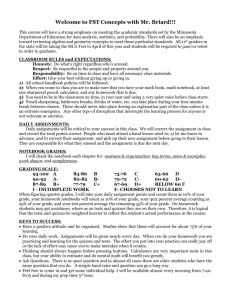

March 2, 2004 Derivative Markets and Financial Institutions Finance 462 - Spring 2004 Lundquist College of Business University of Oregon Professor: Wayne Mikkelson Office: Lillis 382 Telephone: 346-3390 Email: wmikkels@lcb.uoregon.edu Website: http://lcb1.uoregon.edu/wmikkels/homepage.html Office hours: Tuesday and Thursday, 2:00 to 3:00 p.m. and at other times by appointment Course overview and objectives The course focuses on the theory, pricing and uses of derivatives in corporate finance and investments. Topics covered include the trading arrangements, valuation and use of various types of financial derivatives. The course also covers the theory and implementation of risk management policies by financial and nonfinancial corporations. There will also be an overview of financial institutions. At the end of the term students should be able to: Value basic derivative contracts; Identify and measure exposures to risk; Design risk management strategies using futures, forwards, swaps and options; Critically evaluate risk management policies; and Explain the core functions of financial markets and institutions. Prerequisites Students must have satisfactorily completed Finance 316 and either completed or be concurrently enrolled in Finance 380. Textbook and other course materials The required text is Derivatives Markets by Robert L. McDonald, Addison Wesley. A supplementary required book is When Genius Failed by Roger Lowenstein, Random House. A packet of readings and cases will be available at the UO Bookstore. Announcements, a course calendar, and assignments can be found on the course website at http://blackboard.uoregon.edu. It is important to regularly check the Blackboard website for announcements and updates. Course requirements and grading The course grade will be based on contribution to class discussion, ungraded homework assignments, online quizzes, case assignments, quizzes, and a final exam. In determining the final course grade the weights will be Contribution to class discussion Ungraded homework assignments Case assignments Quizzes (excluding lowest score) Final exam 5% 5% 25% 40% 25% There will be at least four quizzes given during the term. A missed quiz cannot be made up. Any excused absences or late assignments must be arranged in advance of a quiz or an assignment due date. The professor determines whether an absence or late assignment will be accepted. Derivatives markets and financial institutions Finance 462 – Spring 2004 Professor Wayne Mikkelson Course outline 1. Introduction and overview McDonald, Chapters 1, 2, and 3 Crawford, “Introduction to the Financial Services Industry” 2. Motives for risk management McDonald, Chapter 4 Stulz, “Rethinking risk management” The Economist, “Too hot to handle” Lewent and Kearney, “Identifying, measuring, and hedging currency risk at Merck” Case: Harvard Business School, Phelps Dodge 3. Forward and futures contracts: Markets, pricing and hedging McDonald, Chapters 5, 6, and 7 Case: Darden Business School, Delta Beverage 4. Swaps McDonald, Chapter 8 5. Options McDonald, Chapters 9, 10, 11, and 12 Case: Harvard Business School, Sally Jameson: Valuing stock options in a compensation package 6. Identifying and measuring risk McDonald, Chapter 24 7. Financial institutions Merton, “A functional perspective of financial intermediation” List of articles and cases for course packet Finance 462 – Derivative Markets and Financial Institutions Spring 2004 Professor Wayne Mikkelson Lillis 382, 346-3390 1. Stulz, Rene, “Rethinking risk management,” Journal of Applied Corporate Finance, volume 9, number 3, Fall 1996, pp 8-24. 2. “Phelps Dodge Corporation,” Harvard Business School Case 9-295-132. 3. “Delta Beverage Group, Inc.,” University of Virginia Darden School Case UVA-F-1188. 4. Merton, Robert, “A functional perspective of financial intermediation,” Financial Management, volume 24, number 2, summer 1995, pp 23-41. 5. Lewent, Judy and A. John Kearney, “Identifying, measuring, and hedging currency risk at Merck,” Journal of Applied Corporate Finance, volume 2, number 4, winter 1990. 6. “Introduction to the financial services industry, Darden Business School Case UVA-F-1042 7. “Too hot to handle: A survey of corporate risk management,” The Economist, February 10, 1996. 8. “Sally Jameson: Valuing stock options in a compensation package,” Harvard Business School Case 9-293-053