Introduction to e-Commerce - University of Houston

advertisement

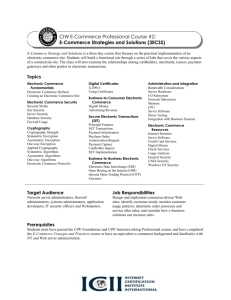

Introduction to Electronic Commerce Electronic Commerce Electronic commerce (e-commerce or e-business) in its broadest sense can be defined as the process of buying and selling or exchange of products, services, and information using telecommunication technology, primarily those that are part of the Internet and Web, that improve existing business processes and to identify new business opportunities. Three technologies that contributed to the rapid development of electronic commerce are: The Internet The World Wide Web The networked PCs These technologies helped implement business processes that could not be implemented before in the global scale and in reduced transaction costs. Copyright 2002: Mohammad A. Rob 1 Classification of e-Commerce Electronic commerce can be classified into several categories according to the nature of transaction. For example: Business-to-Consumer (B2C): Frequently people refer electronic commerce as the shopping on the part of the Internet called World Wide Web (or on-line shopping), because it is the most visible part of the ecommerce. This is termed as business-to-consumer electronic commerce. Business-to-Business (B2B): When the electronic business transactions take place between two trading partners or businesses, it is termed as business-to-business e-commerce. Consumer-to-Consumer (C2C): In this category, consumers sell directly to consumers. Examples are, individuals selling personal property through classified ads (www.classified2000.com) and auctions. Consumer-to-Business (C2B): This category includes individuals who sell products or services to organizations, as well as individuals who seek sellers, interact with them, and conclude a transaction. Copyright 2002: Mohammad A. Rob 2 History of Electronic Commerce Although the Internet and World Wide Web made electronic commerce very popular among businesses, consumers, and government agencies, electronic commerce existed for many decades. Electronic Fund Transfer (EFT): Traditionally, banks have been using electronic fund transfer (EFTs or wire transfer), which are electronic transmissions of account information over private communication networks. Banks have been using ATM machines to provide account information and cash transactions to customers through electronic fund transfers. Electronic Data Exchange (EDI): Businesses have been using electronic data exchange (or EDI) to transmit invoices, purchase orders, and payments vouchers between trading partners. In this case, business partners transmit computer-readable data in a standard format that is understandable by both partners. A common example is the purchase of gas from a gas station using credit cards and gas cards. Using EDI, businesses not only reduced cost by avoiding printing and mailing, but also using a standard format, they were able to reduce errors that occur every time new data is entered to print a form. Until recently, the cost of EDI was high due to high cost of hardware and software, and especially the telecommunication network that was needed to make direct connections between the trading partners using leased telephone lines or subscribing to a Value Added Network. Copyright 2002: Mohammad A. Rob 3 Pure versus Partial Electronic Commerce Electronic commerce can take many forms depending on the degree of digitization of product (or service) sold, the process, and the delivery agent. A product can be physical or digital, an agent can be physical or digital, and the process can be physical or digital. These create eight cubes, each of which has three dimensions. In traditional commerce, all dimensions are physical (lower left cube), and in pure e-commerce all dimensions are digital (upper right cube). All other cubes include a mixture of physical and digital dimensions. If there is at least one digital dimension, we consider the situation as ecommerce, but not a pure one. Buying a book from Amazon is not pure, because the book delivery is through FedEx. However, buying a software through download is pure, because the delivery, payment, and agent are digital. Copyright 2002: Mohammad A. Rob 4 The Framework of Electronic Commerce Electronic commerce is more than a Web site. It encompasses areas such as home banking, shopping in online stores and malls, buying and selling stocks, finding jobs, conducting an auction, and collaborating on research and development projects. To execute these applications, it is necessary to have supporting information and organizational structure and systems. Electronic commerce applications are supported by technology infrastructure and their implementation is dependent on four major pillars: people, public policy, technical standards and protocols, and other organizations. The electronic commerce management coordinates the applications, infrastructures, and supporting pillars. In this course, we will concentrate more on the technical infrastructure of e-commerce. Copyright 2002: Mohammad A. Rob 5 Essential Elements of an Electronic Commerce There are certain key elements that are required to set-up an electronic commerce site. These elements work together to provide marketing opportunities for buyers and sellers over the telecommunication network. The most common elements or activities that are required to have an electronic commerce presence and complete a secured electronic transaction for an online merchant are: Technology Electronic Market Electronic Shops Payment Settlement Security Copyright 2002: Mohammad A. Rob 6 Technology The fundamental basis of electronic commerce is the Internet, a global network of computers and the World Wide Web, Web servers with hypermedia pages. The Internet provides the data transmission service between two computers and the Web servers provide the hosting service for the electronic shops. Thus a client computer in one part of the global network can request a hypermedia page from the Web server connected in another part of the global network. Several other hardware and software components must be in place to support an electronic commerce application. These are: Web browser, network server, database server, commerce server, network switches and hubs, encryption hardware and software, and multimedia tools (HTML, DHTML, ASP, XML, Java Applets, etc.). Electronic Market A market is a network of interactions and relationships where information, products, services, and payments are exchanged. When the market place is electronic, the business center is not a physical location but rather a network-based location where business interactions occur. Electronic market is the place where shoppers and sellers meet. It is virtual trading area where deals are struck over a network. The market handles all the necessary transactions, including the transfer of money between banks. The size and scope of the electronic market is open. The principal participants – transaction handlers, buyers, brokers, and sellers, are not only at different locations but they seldom know each other. Copyright 2002: Mohammad A. Rob 7 Copyright 2002: Mohammad A. Rob 8 Electronic Shops The electronic shop can be thought of as the ‘look and feel’ of the screen that fronts the customer. Just like street-stores, the aim is to attract the customer to browse and ultimately, to buy. The fundamental requirement for presentation of online products and services in the e-business world is the catalogue, which may range from a simple Web page to a large-scale corporate catalogue that can be customized. There is difference between the electronic shops that are made for business-to-business and business-to-consumer markets. The consumeroriented catalogues tend to be stronger on presentation to attract consumers. The business catalogues are more focused on quick access to another business’s needs, and these tend to be high volume and fairly routine. Payment In traditional business, there are three basic ways of payment for a purchase; cash, check, or credit card. When a customer arrives at an electronic store’s checkout counter, merchants also want to offer them payment options that are fast, safe, convenient, and widely accepted. Various payment mechanisms are developed for electronic commerce that can handle large payments, small payments of few dollars (micropayments), or even payments of a fraction of a dollar (nanopayments). Four technologies are commonly used in business-to-consumer ecommerce. They are: electronic cash, software wallets, smart cards, and credit/debit cards. Business-to-business e-commerce commonly use EDI to exchange electronic accounting documents to pay for multiple purchases, payment of which are cleared directly from banks. Copyright 2002: Mohammad A. Rob 9 Settlement The ‘virtual payment’ for goods and services offered over the Internet by a customer, needs to be converted into dollar bills, by a merchant offering electronic shopping. In a traditional credit/debit card transaction, typically a store-clerk runs a credit card through an online terminal and the customer’s account is charged immediately. The process is slightly different for Internet shopping. For some credit cards such as American Express and Discover, who offer these cards directly to consumers, banks and other financial institutions serve as a broker between the card users and the merchants accepting the cards. In other cases, such as VISA or MasterCard, which is offered by multiple financial institutions, a third-party clearinghouse is used who is responsible for handling authorization and transactions between the customer’s bank and merchant’s bank. Thus, technologies (hardware and software) must be in place and an online merchant must set up an account with a clearinghouse to process customer credit card transactions through a clearinghouse Web server. Copyright 2002: Mohammad A. Rob 10 Security In a typical business, a physical location and human beings are involved in transactions. A virtual shop does not have these properties even it is offered by a trusted merchant. Thus there are concerns about hackers stealing credit card and personal information while data are transmitted over the Internet. Data communication in a secured environment is necessary to provide confidence on the shopper to shop in an electronic marketplace. Various methods of ‘encryption’ and ‘coding’ mechanisms are used to handle secured data transmission. As a merchant in the Web opens a virtual shop and there is no physical location, there is a need to have a third party who provides authenticity of an online merchant. Thus in addition to encrypted data transmission, there are various trusted third party, who provides a Web site’s digital certificate in the form of a public key-private key pair. The public key can be same for all merchants and it is used in the encryption algorithm to lock a data packet during transmission. Only the merchant who has the ‘paired’ private key (stored in their Web server) can open the data packet. Copyright 2002: Mohammad A. Rob 11