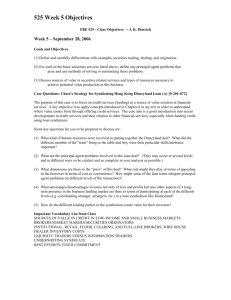

V. The Culture of Risk and Regulation

advertisement