Accounting Exercise Solutions: Inventory & Income Statement

advertisement

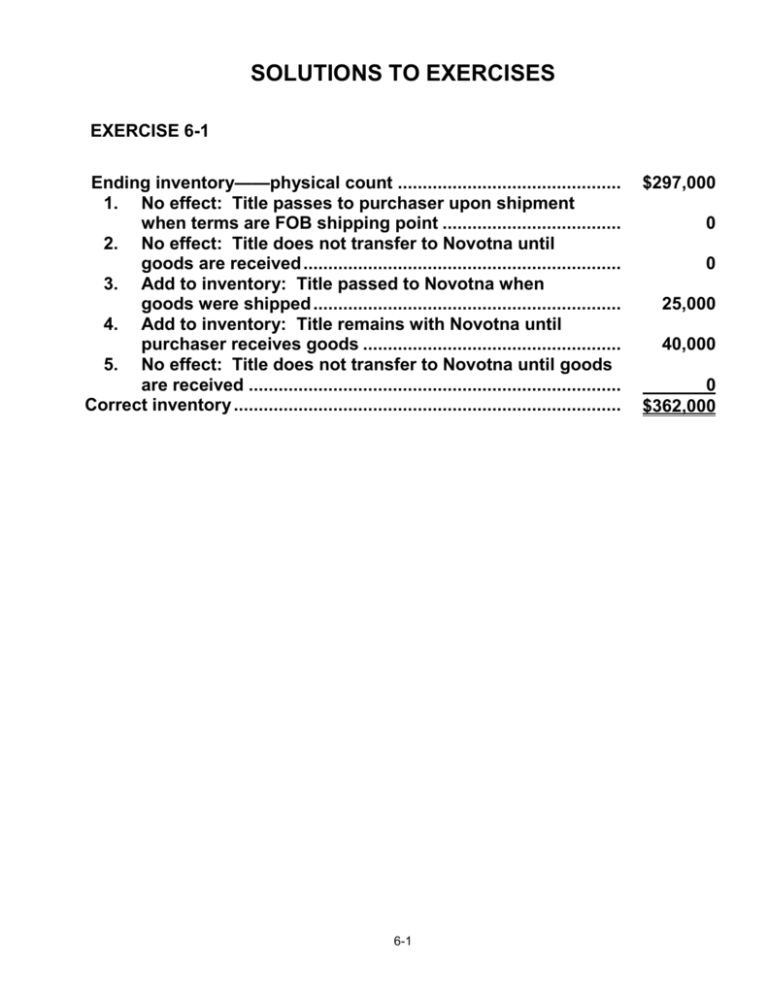

SOLUTIONS TO EXERCISES EXERCISE 6-1 Ending inventory——physical count ............................................. 1. No effect: Title passes to purchaser upon shipment when terms are FOB shipping point .................................... 2. No effect: Title does not transfer to Novotna until goods are received ................................................................ 3. Add to inventory: Title passed to Novotna when goods were shipped .............................................................. 4. Add to inventory: Title remains with Novotna until purchaser receives goods .................................................... 5. No effect: Title does not transfer to Novotna until goods are received ........................................................................... Correct inventory .............................................................................. 6-1 $297,000 0 0 25,000 40,000 0 $362,000 EXERCISE 6-3 LEBLANC COMPANY Income Statement (Partial) For the Year Ended August 31, 2003 Cost of goods sold: Inventory, September 1, 2002 ......................... Purchases ........................................................ Less: Purchase returns and allowances ...... Net purchases ................................................. Add: Freight in ............................................... Cost of goods purchased ............................... Cost of goods available for sale ..................... Inventory, August 31, 2003 ............................. Cost of goods sold .......................................... 6-2 $017,200 $142,400 2,000 140,400 4,000 144,400 161,600 0 26,000 $135,600 EXERCISE 6-5 (a) OKANAGAN COMPANY Income Statement For the Year Ended January 31, 2003 Sales revenues Sales ........................................................................... Less: Sales returns and allowances ......................... Net sales ......................................................................... Cost of goods sold Inventory, February 1, 2002 ....................................... Purchases .................................................. $200,000 Less: Purchase returns and allowances . 6,000 Net purchases ........................................... 194,000 Add: Freight in........................................... 10,000 Cost of goods purchased .......................................... Cost of goods available for sale ............................... Inventory, January 31, 2003....................................... Cost of goods sold ........................................................ Gross profit .................................................................... Operating expenses Salary expense ........................................................... Rent expense .............................................................. Insurance expense ..................................................... Freight out .................................................................. Total operating expenses .................................... Net income ..................................................................... 6-3 $312,000 13,000 $299,000 $ 42,000 204,000 246,000 63,000 183,000 116,000 $ 61,000 20,000 12,000 7,000 100,000 $ 16,000 EXERCISE 6-5 (Continued) (b) Jan. 31 Sales ............................................................... Merchandise Inventory (Jan. 31, 2003) ......... Purchase Returns and Allowances............... Capital ..................................................... 312,000 63,000 6,000 Capital ............................................................. Merchandise Inventory (Feb. 1, 2002) ... Purchases ............................................... Freight In ................................................ Salary Expense ...................................... Rent Expense ......................................... Insurance Expense ................................ Freight Out.............................................. Sales Returns and Allowances ............. 365,000 6-4 381,000 42,000 200,000 10,000 61,000 20,000 12,000 7,000 13,000 EXERCISE 6-8 Beginning inventory (200 X $5) ......................................... $1,000 Purchases: June 12 (300 X $6) ........................................... $1,800 June 23 (500 X $7)........................................... 03,500 5,300 Cost of goods available for sale (1,000 units) .................. 6,300 Less: Ending inventory (180 units) Cost of goods sold (820 units) (a) (1) FIFO Cost of Goods Sold: Date Units Unit Cost 6/1 6/12 6/23 200 300 320 820 $5 6 7 Date Units Unit Cost 6/23 180 $7 Total Cost $1,000 1,800 2,240 $5,040 Ending Inventory: Total Cost $1,260 Proof: CGS + EI = GAS $5,040 + $1,260 = $6,300 (2) LIFO Cost of Goods Sold: Date Units 6/23 6/12 6/1 Unit Cost 500 300 20 820 $7 6 5 Total Cost $3,500 1,800 100 $5,400 Ending Inventory: Date 6/1 Proof: CGS + EI Units Unit Cost 180 $5 = GAS 6-5 Total Cost $900 $5,400 + $900 = $6,300 6-6 EXERCISE 6-8 (Continued) (b) The FIFO method will produce the higher ending inventory because costs have been rising. Under this method, the earliest costs are assigned to cost of goods sold, and the latest costs remain in ending inventory. For Dene Company, the ending inventory under FIFO is $1,260 compared to $900 under LIFO. (c) The LIFO method will produce the higher cost of goods sold for Dene Company. Under LIFO, the most recent costs are charged to cost of goods sold, and the earliest costs are included in the ending inventory. The cost of goods sold is $5,400 compared to $5,040 under FIFO. 6-7 EXERCISE 6-9 (a) Cost of Goods Available for Sale $6,300 ÷ Total Units Available for Sale 1,000 = Weighted Average Unit Cost $6.30 Ending Inventory: 180 X $6.30 = $1,134 Cost of Goods Sold: 820 X $6.30 = $5,166 Proof: CGS + EI = GAS $5,166 + $1,134 = $6,300 (b) Ending inventory is lower than FIFO ($1,260) and higher than LIFO ($900). In contrast, cost of goods sold is higher than FIFO ($5,040) and lower than LIFO ($5,400). When prices are changing, the average cost method will always produce this type of result. That is, average results will fall somewhere between those of FIFO and LIFO. (c) The average cost method uses a weighted average unit cost, not a simple average of unit costs ($5 + $6 + $7 = $18 ÷ 3 = $6). 6-8 EXERCISE 6-10 (a) Periodic Inventory Method Purchases (100 x $10) ........................................ Accounts Payable ...................................... 1,000 Accounts Receivable (70 x $15)......................... Sales ........................................................... 1,050 1,000 1,050 Perpetual Inventory Method (b) Merchandise Inventory (100 x $10) .................... Accounts Payable ...................................... 1,000 Accounts Receivable (70 x $15)......................... Sales ........................................................... 1,050 Cost of Goods Sold (70 x $10) ........................... Merchandise Inventory.............................. 700 1. FIFO 2. LIFO 3. Specific Identification 4. LIFO 6-9 1,000 1,050 700 EXERCISE 6-13 Cameras Minolta Canon Total Light Meters Vivitar Kodak Total Total inventory Cost Market $ 875 1,050 1,925 $ 800 1,064 1,864 1,500 1,150 2,650 1,428 1,350 2,778 $4,575 $4,642 LCM $4,575 Since the market value of the total inventory is higher than its cost, the lower of cost and market value is the inventory’s cost, $4,575. 6-10 *EXERCISE 6-14 (1) Date FIFO Sold Purchased Balance Jan. 1 8 10 (2 X $600) $1,200 (6 X $700) $4,200 15 (2 X $600) (2 X $700) $2,600 (4 X $600) $2,400 (2 X $600) 1,200 (2 X $600) (6 X $700) 5,400 (4 X $700) 2,800 Cost of goods sold: $1,200 + $2,600 = $3,800 Ending inventory: $2,800 Proof: CGS + EI = GAS $3,800 + $2,800 = $6,600 (2) MOVING AVERAGE COST Purchased Date Sold Jan. 1 8 10 15 (2 X $600) $1,200 (6 X $700) $4,200 (4 X $675) $2,700 *Average unit cost = $5,400 ÷ 8 = $675 Cost of goods sold: $1,200 + $2,700 = $3,900 Ending inventory: $2,700 Proof: CGS + EI = GAS $3,900 + $2,700 = $6,600 6-11 Balance (4 X $600) $2,400 (2 X $600) 1,200 (8 X $675)* 5,400 (4 X $675) 2,700 *EXERCISE 6-15 Net sales ($51,000 – $1,000) .............................................................. Less: Estimated gross profit (30% X $50,000) ................................ Estimated cost of goods sold ........................................................... $50,000 015,000 $35,000 Beginning inventory .......................................................................... Cost of goods purchased ($28,200 – $1,400 + $1,200) .................... Cost of goods available for sale ....................................................... Less: Estimated cost of goods sold ................................................ Estimated cost of merchandise lost ................................................. $25,000 028,000 53,000 035,000 $18,000 *EXERCISE 6-16 Women's Department Cost Retail Cost $032,000 0148,000 $180,000 Cost to retail ratio $180,000 = 80% $225,000 $183,750 = 75% $245,000 $40,000 X 80% = $32,000 $50,000 X 75% = $37,500 6-12 $046,450 0137,300 $183,750 Retail Beginning inventory Goods purchased Goods available for sale Net sales Ending inventory at retail Estimated cost of ending inventory $045,000 0 180,000 225,000 0 185,000 $ 40,000 Men's Department $060,000 185,000 245,000 195,000 $ 50,000 PROBLEM 6-2A (a) GENERAL JOURNAL Account Titles and Explanation Date Apr. 5 7 9 10 12 14 17 20 21 27 30 30 Debit Purchases ......................................................... Accounts Payable ..................................... 1,600 Freight In........................................................... Cash ........................................................... 80 Accounts Payable ............................................ Purchase Returns and Allowances.......... 100 Accounts Receivable ....................................... Sales .......................................................... 900 Purchases ......................................................... Accounts Payable ..................................... 660 Accounts Payable ($1,600 $100) .................. Cash ........................................................... 1,500 Accounts Payable ............................................ Purchase Returns and Allowances.......... 60 Accounts Receivable ....................................... Sales .......................................................... 700 Accounts Payable ($660 $60) ....................... Cash ........................................................... 600 Sales Returns and Allowances ....................... Accounts Receivable ................................ 30 Cash .................................................................. Sales .......................................................... 600 Cash .................................................................. Accounts Receivable ................................ 1,100 6-13 J1 Credit 1,600 80 100 900 660 1,500 60 700 600 30 600 1,100 PROBLEM 6-2A (Continued) (b) Cash Date Apr. 1 7 14 21 30 30 Explanation Ref. Balance J1 J1 J1 J1 J1 Debit Credit 80 1,500 600 600 1,100 Balance 2,500 2,420 920 320 920 2,020 Accounts Receivable Date Explanation Apr. 10 20 27 30 Ref. Debit J1 J1 J1 J1 Credit 900 700 30 1,100 Balance 900 1,600 1,570 470 Merchandise Inventory Date Apr. Explanation 1 Balance Ref. Debit Credit Balance 3,500 Accounts Payable Date Apr. Explanation 5 9 12 14 Ref. J1 J1 J1 J1 6-14 Debit Credit 1,600 100 660 1,500 Balance 1,600 1,500 2,160 660 17 21 J1 J1 6-15 60 600 600 0 PROBLEM 6-2A (Continued) (b) (Continued) Kane, Capital Date Apr. 1 Explanation Ref. Balance Debit Credit Balance 6,000 Sales Date Explanation Apr. 10 20 30 Ref. Debit J1 J1 J1 Credit 900 700 600 Balance 900 1,600 2,200 Sales Returns and Allowances Date Explanation Apr. 27 Ref. J1 Debit Credit 30 Balance 30 Purchases Date Apr. Explanation 5 12 Ref. J1 J1 Debit Credit 1,600 660 Balance 1,600 2,260 Purchase Returns and Allowances Date Apr. Explanation 9 17 Ref. J1 J1 Freight In 6-16 Debit Credit 100 60 Balance 100 160 Date Apr. Explanation 7 Ref. J1 6-17 Debit 80 Credit Balance 80 PROBLEM 6-2A (Continued) (c) KANE’S PRO SHOP Trial Balance April 30, 2003 Cash .............................................................................. Accounts Receivable ................................................... Merchandise Inventory ................................................ Kane, Capital ................................................................ Sales ............................................................................. Sales Returns and Allowances ................................... Purchases .................................................................... Purchase Returns and Allowances ............................ Freight In ...................................................................... Totals ..................................................................... (d) Debit $2,020 470 3,500 Credit $6,000 2,200 30 2,260 160 80 $8,360 $8,360 KANE’S PRO SHOP Income Statement (Partial) For the Month Ended April 30, 2003 Sales revenues Sales ......................................................... Less: Sales returns and allowances .... Net sales .................................................. Cost of goods sold Inventory, April 1 ..................................... Purchases ................................................ Less: Purchase returns and allowances Net purchases.......................................... Add: Freight in ..................................... Cost of goods purchased ....................... Cost of goods available for sale ............. Inventory, April 30 ................................... Cost of goods sold............................. Gross profit ................................................... 6-18 $2,200 30 $2,170 $3,500 $2,260 160 2,100 80 2,180 5,680 4,200 1,480 $ 690 PROBLEM 6-4A (a) COST OF GOODS AVAILABLE FOR SALE Date Cost Jan. 1 Mar. 15 July 20 Sept. 4 Dec. 2 Explanation Units Beginning inventory Purchase Purchase Purchase Purchase Total 100 300 200 300 100 1,000 (b) FIFO (1) Date Sept. Dec. Ending Inventory Unit Total Units Cost Cost 4 150 $ 28 $4,200 2 100 30 3,000 250* $7,200 *1,000 – 750 = 250 (2) Cost of Goods Sold Unit Total Date Units Cost Cost Jan. 1 100 $ 20 $ 2,000 Mar. 15 300 24 7,200 July 20 200 25 5,000 Sept. 4 150 28 4,200 750 $18,400 Check: EI + CGS = GAS $7,200 + $18,400 = $25,600 6-19 Unit Cost $20 24 25 28 30 Total $ 2,000 7,200 5,000 8,400 3,000 $25,600 PROBLEM 6-4A (Continued) (b) (Continued) WEIGHTED AVERAGE COST Weighted average unit cost: $25,600 1,000 = $25.60 (1) Units 250 Ending Inventory Unit Total Cost Cost $25.60 $6,400 (2) Cost of Goods Sold Unit Total Units Cost Cost 750 $25.60 $19,200 Check: EI + CGS = GAS $6,400 + $19,200 = $25,600 LIFO (1) Date Jan. Mar. (2) Date Mar. July Sept. Dec. Ending Inventory Unit Total Units Cost Cost 1 100 $ 20 $2,000 15 150 24 3,600 250 $5,600 Cost of Goods Sold Unit Total Units Cost Cost 15 150 $ 24 $ 3,600 20 200 25 5,000 4 300 28 8,400 2 100 30 3,000 750 $20,000 Check: EI + CGS = GAS $5,600 + $20,000 = $25,600 6-20 PROBLEM 6-4A (Continued) (c) FIFO produces the highest inventory cost for the balance sheet, $7,200. LIFO produces the highest cost of goods sold for the income statement, $20,000. (d) The choice of inventory cost method does not affect cash flow. It is an allocation of costs between inventory and cost of goods sold. 6-21 PROBLEM 6-5A (a) RÉAL NOVELTY Condensed Income Statements For the Year Ended December 31, 2003 FIFO Sales ........................................................ $865,000 Cost of goods sold Beginning inventory ........................ 34,000 Cost of goods purchased................ 591,500 Cost of goods available for sale ..... 625,500 Ending inventory ............................. 55,000a Cost of goods sold .......................... 570,500 Gross profit ............................................. 294,500 Operating expenses................................ 147,000 Net income .............................................. $147,500 a 20,000 x $2.75 = $55,000 b [($34,000 + $591,500) ÷ (15,000 + 230,000) = $2.55] 20,000 x $2.55 = $51,000 6-22 Weighted Average $865,000 34,000 591,500 625,500 51,000b 574,500 290,500 147,000 $143,500 PROBLEM 6-5A (Continued) (b) Dear Sir/Madame: I would like to bring the following inventory related points to your attention to assist you in making a choice between the FIFO and weighted average cost flow assumptions: 1. Gross profit under the weighted average cost flow assumption will be lower than the gross profit reported under the FIFO cost flow assumption. Costs are rising, and in such instances, FIFO will always result in the higher gross profit. 2. The choice of inventory cost flow assumption will impact the balance sheet (through inventory) and income statement (through cost of goods sold) of the company. It will not impact the company’s cash flow. While purchases and sales have a cash effect, the choice of cost flow assumption does not affect cash as it only allocates costs between inventory and cost of goods sold. 3. In selecting a cost flow assumption management should consider their circumstances—the type of inventory and the flow of costs throughout the period. Management should select the method that will best match their costs with their revenues. The FIFO cost flow assumption produces the more meaningful inventory amount for the balance sheet because the units are costed at the most recent purchases. The FIFO method is most likely to approximate actual physical flow because the oldest goods are usually sold first to minimize spoilage and obsolescence. The weighted average cost flow assumption produces the more meaningful gross profit / net income because the cost of more recent purchases are matched against sales. At least, more so than occurs with FIFO, which matches the cost of the earliest purchases against sales revenue. Average also smoothes these costs, using an average of all costs during 6-23 the period rather than matching the cost of any specific time period. Sincerely, 6-24 PROBLEM 6-8A (a) Amelia Company—Purchaser GENERAL JOURNAL Account Titles and Explanation Date July 5 8 10 15 16 20 25 Debit Purchases ......................................................... Cash ........................................................... 540 Cash .................................................................. Sales .......................................................... 495 Sales Returns ................................................... Cash ........................................................... 110 Purchases ......................................................... Cash ........................................................... 200 Accounts Payable ............................................ Purchase Returns and Allowances.......... 40 Cash .................................................................. Sales .......................................................... 540 Purchases ......................................................... Cash ........................................................... 65 6-25 Credit 540 495 110 200 40 540 65 PROBLEM 6-8A (Continued) (b) Karina Company—Seller GENERAL JOURNAL Account Titles and Explanation Date July 5 15 16 25 Debit Cash .................................................................. Sales .......................................................... 540 Cash .................................................................. Sales .......................................................... 200 Sales Returns and Allowances ....................... Cash ........................................................... 40 Cash .................................................................. Sales .......................................................... 65 (c) COST OF GOODS AVAILABLE FOR SALE Date Cost July 1 July 5 July 15 July 16 July 25 Explanation Units Beginning inventory Purchase Purchase Purchase return Purchase Total 25 60 25 (5) 10 115 Unit Cost $10.00 9.00 8.00 8.00 6.50 Credit 540 200 40 65 Total $ 250 540 200 (40) 65 $1,015 Weighted average unit cost = $1,015 ÷ 115 = $8.83 Ending inventory = 201 x $8.83 = $176.60 1 115 – 45 + 10 - 60 = 20 (d) Ending inventory: Cost: 20 x $8.83 = $176.60 Market: 20 x $7 = $140 The ending inventory should be valued at $140, the lower of cost and market. 6-26 BYP 6-1 FINANCIAL REPORTING PROBLEM (a) The categories of inventory include merchandise held for resale, and supplies. (b) Inventory June 24, 2000 $107 thousand June 30, 1999 $103 thousand (1) 2000: $107 ÷ $5,416 = 2.0% 1999: $103 ÷ $24,990 = 0.4% (2) 2000: $107 ÷ $20,844 = 0.5% 1999: $103 ÷ $21,465 = 0.5% Inventory as a percentage of current assets was higher in 2000 than in 1999. Inventory as a percentage of total revenue was substantially unchanged between 1999 and 2000. The company had smaller inventories, in both absolute and relative terms, at the end of 1999 than it did in 2000. (c) Inventories are valued at the lower of cost or net realizable value, with cost being determined substantially on a first-in first-out basis. A different cost flow assumption would affect The Second Cup’s results, if the price of coffee increases or decreases greatly during the course of the year. Although given the low level of inventory in relation to total revenue, the effect may not be material. (d) The Second Cup does not disclose any information regarding its cost of goods sold, other than indirectly through its inventory valuation disclosure–as indicated in part (c) above. 6-27 BYP 6-2 INTERPRETING FINANCIAL STATEMENTS (a) Using a perpetual system will enable the coffee chain to keep its gross profit and inventory up-to-date in a time of changing prices. (b) In a period of changing prices, the cost flow assumption can have a significant impact on income and on evaluations based on income. By using an average cost flow assumption, variations in price will be smoothed and therefore net income will be smoothed as well. Using the average cost flow assumption allows the coffee chain to average its changing inventory prices and avoid a distortion of net income in any one period. 6-28 BYP 6-3 INTERPRETING FINANCIAL STATEMENTS (a) General Motors’ inventories are reported in the balance sheet at their cost, which is less than their market value (replacement cost or net realizable value). If their market value was less than their cost, generally accepted accounting principles would require that the inventories be reported at the lower of cost and market value. (b) GM presents their inventory information using both LIFO and FIFO for several reasons: U.S. accounting standards require companies to disclose the current (or replacement) cost of ending inventory because of their concerns that inventory under LIFO may be substantially undervalued; converting the information into FIFO shows the inventory at a figure closer to its replacement cost, which may be more meaningful to some decision makers. It also allows more meaningful analysis, including calculations of the current and inventory turnover ratios; and because GM reports throughout the world, presenting inventories using both FIFO and LIFO makes comparisons easier for its users. (c) The LIFO cost flow assumption means that the oldest costs are assigned to ending inventory. If its inventory under LIFO is less than under FIFO, prices must be rising. 6-29 BYP 6-3 (Continued) (d) LIFO is often used primarily because of income tax benefits in the U.S. (where it is permitted for tax purposes). In addition, it is used to better match current costs to current revenues. Many companies also use other cost flow assumptions, such as FIFO or average cost, for reasons such as: extensive record keeping costs may result under LIFO, where inventory turnover is very high in certain product lines; unwanted involuntary liquidations may result under LIFO in certain product lines, where inventory levels are unstable; and certain product lines can be more susceptible to deflation instead of inflation. (e) This may be due to income tax regulations, which differ between countries. For example, LIFO is acceptable for tax purposes in the U.S., but not in Canada. It may also be due to different economic situations (inflationary conditions, etc.) from country to country, which affect the appropriateness of alternative inventory cost flow assumptions. 6-30 (a) BYP 6-5 COLLABORATIVE LEARNING ACTIVITY (1) Sales ......................................................... Cash sales ($18,500 x 40%) .................... Acknowledged credit sales April 1 – 10 . Sales made but not acknowledged ........ Sales as of April 10 .................................. (2) Purchases ................................................ Cash purchases April 1-10...................... Credit purchases ..................................... Less: Items in transit ............................... Purchases as of April 10 ......................... (b) Gross profit margin ........................................ Average gross profit margin (34% + 30%) ÷ 2 (c) (d) $94,000 4,200 $12,400 1,800 2002 Net sales .......................................................... Cost of goods sold Inventory, January 1 ................................ Cost of goods purchased ....................... Cost of goods available for sale ............. Inventory, December 31 .......................... Cost of goods sold .................................. Gross profit ..................................................... $180,000 7,400 28,000 4,600 $220,000 10,600 $108,800 2001 $600,000 $480,000 60,000 40,000 416,000 356,000 476,000 396,000 80,000 60,000 396,000 336,000 $204,000 $144,000 34% 30% 32% Sales ................................................................. Less: Gross profit ($220,000 x 32%) .............. Cost of goods sold .......................................... $220,000 70,400 $149,600 Inventory, January 1 ........................................ Purchases ........................................................ Cost of goods available for sale ..................... Cost of goods sold (68% of $220,000)............ Estimated inventory at the time of fire ........... $ 80,000 108,800 188,800 149,600 $ 39,200 Estimated inventory at the time of the fire .... Less: Inventory salvaged ................................ Estimated inventory loss ................................ $39,200 19,000 $20,200 6-31 BYP 6-8 ETHICS CASE (a) 1. Maximize gross profit–select lowest cost inventory for cost of goods sold Sales [(500 x $650) + (180 x $600)] ................. Cost of goods sold [(150 x $300) + (200 x $350) + (330 x $375)] . Gross profit ..................................................... $433,000 238,750 $194,250 2. Minimize gross profit–select highest cost inventory for cost of goods sold (b) Sales [(500 x $650) + (180 x $600)] ................. Cost of goods sold [(130 x $300) + (200 x $350) + (350 x $375)] . Gross profit ..................................................... $433,000 Difference ........................................................ $1,500 Reconciliation of difference 20 x ($375 - $300) ........................................... $1,500 240,250 $192,750 Average cost flow assumption Sales [(500 x $650) + (180 x $600)] ................. Cost of goods sold [((150 x $300) + (200 x $350) + (350 x $375)) ÷ 700 x 680] ..... Gross profit ..................................................... $433,000 239,214 $193,786 (c) The stakeholders are the investors and creditors of Quality Diamonds. Choosing which diamonds to sell in a month is unethical because it is managing income–it is not based on fact as the diamonds are all identical. (d) Quality Diamonds should select the weighted average cost flow assumption. The specific identification method is not appropriate because all items are identical. Using the weighted average cost flow assumption in a time of rising prices will smooth out variations in prices and result in reasonable values for both the income statement and balance sheet. 6-32