Board Meeting Minutes: Wednesday, February 10

advertisement

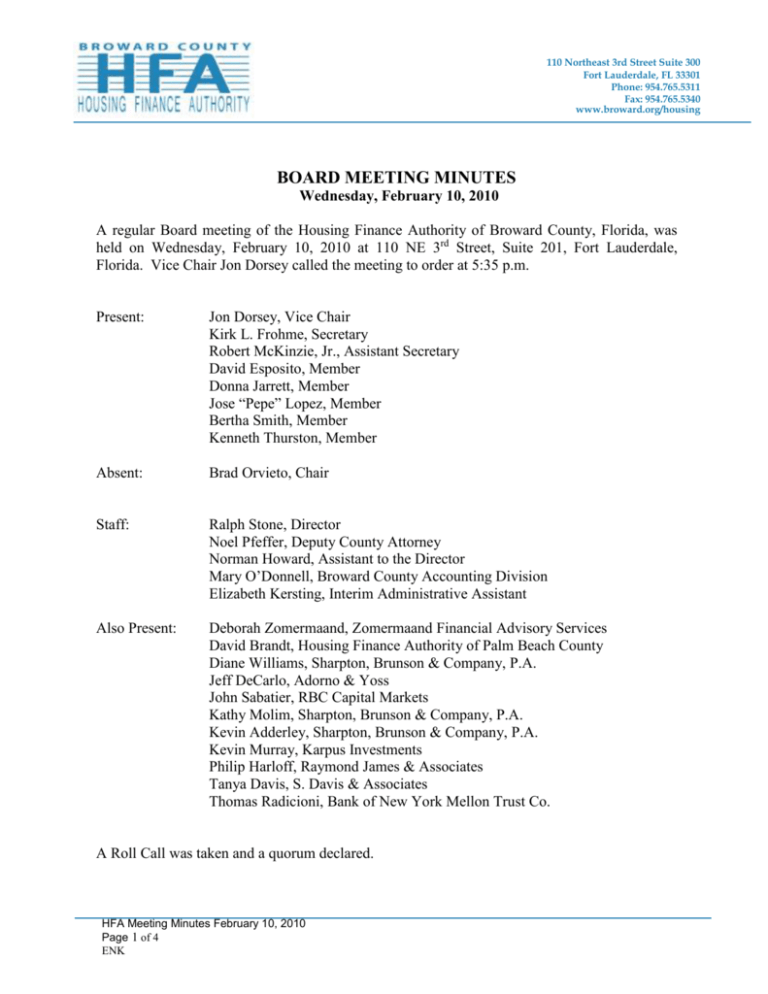

110 Northeast 3rd Street Suite 300 Fort Lauderdale, FL 33301 Phone: 954.765.5311 Fax: 954.765.5340 www.broward.org/housing BOARD MEETING MINUTES Wednesday, February 10, 2010 A regular Board meeting of the Housing Finance Authority of Broward County, Florida, was held on Wednesday, February 10, 2010 at 110 NE 3rd Street, Suite 201, Fort Lauderdale, Florida. Vice Chair Jon Dorsey called the meeting to order at 5:35 p.m. Present: Jon Dorsey, Vice Chair Kirk L. Frohme, Secretary Robert McKinzie, Jr., Assistant Secretary David Esposito, Member Donna Jarrett, Member Jose “Pepe” Lopez, Member Bertha Smith, Member Kenneth Thurston, Member Absent: Brad Orvieto, Chair Staff: Ralph Stone, Director Noel Pfeffer, Deputy County Attorney Norman Howard, Assistant to the Director Mary O’Donnell, Broward County Accounting Division Elizabeth Kersting, Interim Administrative Assistant Also Present: Deborah Zomermaand, Zomermaand Financial Advisory Services David Brandt, Housing Finance Authority of Palm Beach County Diane Williams, Sharpton, Brunson & Company, P.A. Jeff DeCarlo, Adorno & Yoss John Sabatier, RBC Capital Markets Kathy Molim, Sharpton, Brunson & Company, P.A. Kevin Adderley, Sharpton, Brunson & Company, P.A. Kevin Murray, Karpus Investments Philip Harloff, Raymond James & Associates Tanya Davis, S. Davis & Associates Thomas Radicioni, Bank of New York Mellon Trust Co. A Roll Call was taken and a quorum declared. HFA Meeting Minutes February 10, 2010 Page 1 of 4 ENK CONSENT AGENDA 1. Approval of January 13, 2010 Regular Meeting Minutes 2. Executive Report 3. Finance Reports 4. 2010 National Housing Finance Association (NALHFA) Policy Conference at the Washington Court Hotel in Washington DC. MOTION TO APPROVE staff and board members to attend the NALHFA Policy Conference in Washington, DC from March 25-27, 2010. MOTION TO APPROVE the Consent Agenda for February 10, 2010 was made by Mr. David Esposito, seconded by Mr. Kenneth Thurston and was unanimously approved. PRESENTATIONS 5. S. Davis & Associates – HFA 2009 Audited Financial Statements (Year Ended September 30th) Review by Tanya Davis, Partner Vice Chair, Jon E. Dorsey introduced Ms. Tanya Davis of S. Davis & Associates who presented the FY2009 Audited Financial Statements for the HFA for the Year Ended September 30, 2009. Ms. Davis made reference to the Board Presentation package distributed to the members and gave an overview of its contents which included audited financial statements, Net Assets, Activities, Balance Sheet, comparison analysis review together with bar graphs with explanation of significant variances. Ms. Davis stated that they found no non compliance to laws, rules and regulations and agreements. There were no deficiencies found in HFA’s internal control. After the presentation Ms. Davis thanked Mr. Howard and Ms. O’Donnell for all the help extended to her office during this auditing process. Ms. Bertha Smith joined the meeting at 5:45 p.m. 6. Karpus Investment Management – HFA Investment Portfolio Review by Kevin Murray, Vice President Mr. Ralph Stone introduced Mr. Kevin Murray, Vice President of Karpus Investment Management, who, upon the recommendation of staff, gave an overview presentation of the Investment Portfolio performance to the Board with reference to the US Treasury Notes/Bonds market, interest rates and the impact on the HFA Portfolio as of January 28, 2010. A review was given in terms of measurement and benchmarks over a ten (10) year performance period with comparison returns made between the HFA gaining 51.16%, 90 Day Treasury Bill 34.21% and Federal Fund receiving an average rate of 33.59%. During discussion there were inquiries made by the members regarding the last two years in terms of variance in dollar weight and time weight. Mr. Murray responded noting that the HFA received the highest returns in 2008 due to a tremendous rush for quality as opposed to performance of the other two entities but in 2009 the trend was in the reverse. In conclusion to his presentation, Mr. Murray said that given the economic situation at this time, overall the HFA did very well both in terms of the ten years and annualized yield performance. Mr. Murray thanked the Board for the opportunity of doing business with the HFA. Mr. Jose “Pepe” Lopez joined the meeting at 6:00 p.m. HFA Meeting Minutes February 10, 2010 Page 2 of 4 ENK ACTION ITEM 7. Single Family Bond Program – Mortgage Credit Certificate (MCC) Ms. Debbie Zomermaand requested a motion to authorize staff to publish a Mortgage Credit Certificate Public Notice, hold any required public hearings, assign Counsel for the preparation of the Public Notice and TEFRA Hearing and authorize expenditures not to exceed $2,500. For the benefit of new Board members, Ms. Zomermaand explained the process of the Mortgage Credit Certificate (MCC). She stated that the MCCs provide a method for qualifying families of low and moderate income to receive assistance in the form of a tax credit when purchasing a home and meeting the federal guidelines. She stated that MCCs can be used with most loan types except Mortgage Revenue Bonds. In having this tax credit homeowners would be eligible to receive up to $2,500 for the life of the mortgage. Ms. Zomermaand indicated that the MCC program that was done in 2005 was not very successful due to the fact that there were a variety of mortgage products that are no longer available. Since that time, underwriting guidelines have become more stringent and the homebuyers are more aware of the benefits available via a tax credit due to the publicity surrounding the $8,000 first time homebuyer’s tax credit. Ms. Zomermaand felt this would be a great opportunity since the HFA has $50,000,000 in Bond allocations which could be utilized for the MCC program. She noted that this Bond allocation will expire on December 31, 2010. She said that based on research done, the MCC program was very successful in other parts of the country. She spoke about the program and its success in Texas who implemented the program for 5 consecutive years. She said that since the Broward County Community Development Division is presently working with BAND with regard to the Neighborhood Stabilization Program (NSP), staff and HFA professionals are hopeful that the MCC program will provide additional opportunities for households purchasing homes that become available as a result of the NSP program. She also stated that Broward County income levels and housing costs are such that a MCC program should work well and be an effective tool in increasing homeownership opportunities for qualifying households. There was some discussion among the members and Mr. Stone regarding the NSP Program and criteria of 500 potential home buyers, marketing strategy and fees incurred. Ms. Zomermaand stated that their goal is to start this program in another four months. To the extent the Board is receptive to pursuing an MCC program, specific program recommendations from staff will be presented at the March meeting. Motion was made by Mr. Thurston seconded by Mr. Esposito and unanimously approved to authorize staff to proceed as follows: (1) publish a Mortgage Credit Certificate Public Notice; (2) hold any required public hearings; (3) assign Counsel for the preparation of the Public Notice and TEFRA Hearing (4) authorize expenditures not to exceed $2,500. HFA Meeting Minutes February 10, 2010 Page 3 of 4 ENK INFORMATION ITEM 8. Single Family Bond Programs – Update Ms. Zomermaand gave an update from Citibank on the Single Family Bond Programs, Series 2006 A,B & C, 2007 A,B,C & D and Series 2007 E&F. She said that the information received from Citibank Program Data – January 2, 2010 indicated the three issues referenced generated $39,421,370 in first mortgage loans and $1,628,317 in second mortgage loans. These three issues generated 258 first mortgage loans and 39 second mortgage loans. Since the programs were originated in 2006 the real estate market in South Florida has deteriorated and the area is facing a high number of foreclosures. This trend is consistent with the performance of the loans within the HFA’s portfolio which originated since 2006. There was a lengthy discussion among the members on what strategies and counseling methods could be used in solving the foreclosure situation. 9. MATTERS OF HFA MEMBERS 10. MATTERS FROM THE FLOOR 11. NEXT BOARD MEETING March 10, 2010 12. ADJOURNMENT Meeting was adjourned at 6:30pm Disclosure: The above captioned Minutes are transcribed in a summary format. To hear the full meeting, a compact disk of the meeting can be provided after 24 hour notice to the administrative office at 954-765-5323. HFA Meeting Minutes February 10, 2010 Page 4 of 4 ENK