Revised Per June 30, 2011 FHA Guide (05555341

advertisement

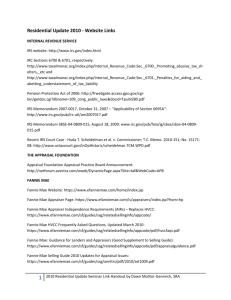

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Ineligible Projects

Criteria

FHA

1. Condominium Hotel or

“Condotels”.

2. Timeshares or segmented

ownership projects.

3. Houseboat projects.

4. Multi-dwelling unit

condominiums (i.e. more

than one dwelling per

condominium unit).

5. All projects not deemed to

be used primarily as

residential

6. Projects where more than

25% of total space is used

for nonresidential purposes

(live-work units where more

than 25% of the total project

or unit square footage is used

for nonresidential purposes).

7. Projects located within

designated coastal barriers of

the Atlantic Ocean, Gulf of

Mexico, or the Great Lakes.

8. Assisted living facilities.

9. Developer owned common

area or amenities once

transfer of control has been

turned over to the HOA.

FNMA (Fannie Mae)

1. Projects that include registration

services and offer rentals of

units on a daily basis.

2. Projects in which individual

units are operated as a

commercial hotel or motel.

3. Projects with names that include

the words “hotel” or “motel”.

4. Projects that restrict the owner’s

ability to occupy the unit.

5. Projects with mandatory rental

pooling agreements that require

unit owners to either rent their

unit or give a management firm

control over the occupancy of

the units.

6. Projects with non-incidental

business operations owned or

operated by the homeowners’

association such as, but not

limited to, a restaurant, a spa, a

health club, etc.

7. Investment securities (i.e.,

projects that have documents on

file with the Securities and

Exchange Commission, or

projects where unit ownership is

characterized or promoted as an

investment opportunity.)

{05555341.DOC;2}

1 of 49

FHLMC (Freddie Mac)

1.

Projects subject to federal

or State securities

regulations.

2. Hotel/Resort projects.

3. Projects with multidwelling units.

4. Projects with nonincidental commercial

space (over 20% of total

square footage in project).

5. Projects with nonincidental commercial

income (over 20% of

income from sources other

than dues/assessments).

6. Common-interest

apartment projects.

7. Projects with fragmented

or segmented ownership.

8. Timeshare projects.

9. Houseboat projects.

10. Attached Condominium

Projects that are legal

nonconforming.

11. Projects in litigation,

arbitration, mediation or

other dispute and the

reason for the dispute

Source/Date

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 1.4 of

Guide (Dated

June 30, 2011

and effective

June 30, 2011).

2. Fannie Mae

Single

Family/2009

Selling

Guide/Part

B/Subpart

B4/Chapter B42/Section B42.1-02 (Dated

October 30,

2009).

3. Freddie Mac

Single-Family

Seller/Servicer

Guide/Volume

1/Chapter

42/Section 42.3

(Dated October

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Ineligible Projects

Criteria

FHA

FNMA (Fannie Mae)

8. Common interest apartments or

community apartment projects

or buildings that are owned by

several owners as tenants-incommon or by a homeowners’

association in which individuals

have an undivided interest in a

residential apartment building

and land, and have the right of

exclusive occupancy of a

specific apartment in the

building.

9. Timeshare or segmented

ownership projects.

10. Houseboat projects.

11. New projects where the seller is

offering sale/financing structures

in excess of Fannie Mae’s

eligibility policies for individual

mortgage loans, including but

not limited to: builder/developer

contributions, sales concessions,

HOA or principal and interest

payment abatements, and/or

contributions not disclosed on

the HUD-1 Settlement

Statement.

{05555341.DOC;2}

2 of 49

FHLMC (Freddie Mac)

12.

13.

14.

15.

16.

involves safety, structural

soundness or habitability

of the project.

Project sold with

excessive Seller

contributions.

Project with excessive

single investor

concentration.

Project with fractured

interest.

Continuing Care

Retirement Communities.

Any Condominium

Project that Fannie Mae

has rejected.

Source/Date

9, 2009).

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Ineligible Projects

Criteria

FHA

FNMA (Fannie Mae)

12. Projects where more than 20%

of the total space is used for

nonresidential purposes.

13. Projects where a single entity

(the same individual, investor

group, partnership, or

corporation) owns more than

10% of the total units in the

project.

14. Multi-dwelling unit condos or

co-ops – projects that permit an

owner to hold title (or stock

ownership and the

accompanying occupancy rights)

to more than one dwelling unit,

with ownership of all of his or

her owned units (or shares)

evidenced by a single deed and

financed by a single mortgage

(or share loan).

15. Condo or co-op projects that

represent a legal, but nonconforming, use of the land, if

zoning regulations prohibit

rebuilding the improvement to

current density in the event of

their partial or full destruction.

{05555341.DOC;2}

3 of 49

FHLMC (Freddie Mac)

Source/Date

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Ineligible Projects

Criteria

FHA

FNMA (Fannie Mae)

16. A tax-sheltered syndicate’s

leasing to a co-op or “leasing”

co-ops – projects that involve

the leasing of the land and the

improvements to the co-op

corporation, even if the co-op

corporation owns part of the

building.

17. Co-op projects that are subject to

leasehold estates.

18. Limited equity co-ops – projects

in which the co-op corporation

places a limit on the amount of

return that can be received when

stock or shares are sold.

19. Co-op projects with units that

are subject to resale restrictions

or located on land owned by

community land trusts.

20. Co-op projects in which the

developer or sponsor has an

ownership interest or other rights

in the project real estate or

facilities other than the interest

or rights it has in relation to

unsold units.

21. Any project for which the

homeowners’ association or coop corporation is named as a

{05555341.DOC;2}

4 of 49

FHLMC (Freddie Mac)

Source/Date

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

FHLMC (Freddie Mac)

Source/Date

1. All units and common

elements are not fully

completed, or are subject

to additional phasing or

annexation;

2. The project or subject

legal phase and any prior

legal phases in which

units have been offered

for sale are substantially

complete. “Substantially

complete” indicates that

the applicable jurisdiction

has issued a certificate of

occupancy or its

equivalent for the legal

phase, and that all units in

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 201122, Sections

1.4 and 1.5 of

Guide (Dated

June 30, 2011

and effective

June 30, 2011).

2. Fannie Mae

Single

Family/2009

Selling

Guide/Part

party to current litigation or, any

project for which the project

sponsor or developer is named

as a party to current litigation

that relates to the project, if the

project has not been turned over

to the association or corporation

(excluding foreclosure and

collection actions).

Ineligible Projects

New Communities or

Conversions

Eligibility Criteria

The project must consist of two or

more units.

Type of Community:

1. Proposed;

2. Under Construction (not

completed or is under 1 year

of completion)

3. Conversions (Non-Gut

Rehabilitation or Gut

Rehabilitation)

Converted, Gut and Non-Gut

Rehabilitation Project:

Must be processed under

DELRAP.

1. Fewer than 90% of the total

units in the project have been

conveyed to the unit purchasers.

2. Project is not fully completed,

such as proposed construction,

new construction, or the

proposed or incomplete

conversion of an existing

building to a condo.

3. Project is newly converted.

4. Project is subject to additional

phasing.

5. Project, or subject legal phase,

must be “substantially

complete”. This means that:

A certificate of

occupancy or other

{05555341.DOC;2}

5 of 49

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

New

Communities/Projects

Conversion must be

complete, as evidenced by

engineering or architectural

inspection (within 12 mos. of

completion).

Current reserve study (no

more than 24 months old)

must be provided.

Budget, balance sheet and

income/expense statement of

less than 90 days old must all

be provided and demonstrate

sufficient maintenance,

reserves, deductibles and

reserve study items

adequately funded.

Detailed description of work

proposed and/or completed

required.

51% units must be conveyed

or under contract for

purchase to owner

occupants.

No more than 49% of total

units can be owned by

developer (exempt from 10%

investor limit).

FNMA (Fannie Mae)

substantially similar

document has been

issued by the applicable

governmental agency for

the project or subject

phase, and

All the units in the

building in which the

unit securing the

mortgage is located are

complete, subject to the

installation of buyer

select items, such as

appliances.

6. Project complies with all legal

requirements set forth in Section

B4-2.2-13, Condo Project

Review and Legal Document

Requirements (10/30/09)

{05555341.DOC;2}

6 of 49

FHLMC (Freddie Mac)

Source/Date

the building in which the

subject unit is located are

complete.

3. Fewer than 90% of the

total number of units in

the project have been

conveyed to the unit

purchasers other than the

developer; or

4. The developer has not

turned control of the

homeowners association

over to the unit owners.

B/Subpart

B4/Chapter

B4-2.2-01 and

Chapter B42.2-09 and B42.2-05 (dated

October 30,

2009).

3. Freddie Mac

Single-Family

Seller/Servicer

Guide/Volume

1/Glossary

and Volume

1/Chapter

42/Section

42.6(Dated

October 9,

2009).

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

Comprehensive sale and

marketing and transition

summary must be provided

by developer.

For Gut Rehabilitation – the entire

community and common facilities

must be 100% built (except for

interior buyer’s preference items)

and a building permit or its

equivalent is required.

The Condominium Project must be

declared and exist in full compliance

with applicable State law

requirements of the jurisdiction in

which the condominium project is

located and with all other applicable

laws and regulations.

FHA will require the completion

and retention of the following

documents:

Phase I Environmental

Site Assessment (see

Environmental Review

Requirements in Section

1.7 of Guide effective

{05555341.DOC;2}

7 of 49

FHLMC (Freddie Mac)

Source/Date

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

New

Communities/Projects

Insurance

Requirements

FNMA (Fannie Mae)

FHLMC (Freddie Mac)

Source/Date

August 30, 2011)

Builder’s Certification

of Plans, Specifications

and Site, Form HUD92541

Builder’s Warranty,

Form HUD-92544

Building Permit

Final C/O

10 year warranty

Inspection report

1. Hazard-Replacement cost

coverage (100% current

replacement cost of

condominium exclusive of

land, foundation, excavation,

and other typical exclusions)

2. Liability

3. Fidelity Insurance for HOA

(for new and established

condominium projects with

20 or more units)-3x

monthly aggregate HOA

dues plus reserve funds

unless State law requires a

maximum amount of

required coverage.

1. Hazard-Replacement cost

coverage

2. Liability-min of $1,000,000

3. Fidelity Bond insurance is

required for communities over

20 units-3 x monthly HOA dues

4. Flood (when applicable)$250,000 per unit

5. If master policy does not include

“All In” coverage including

improvements and betterments,

an HO6 policy is required with

coverage equal to 20% of the

value of the unit

“All In” = insure fixtures,

{05555341.DOC;2}

8 of 49

1. Hazard-Replacement cost

coverage

2. Liability-min $1,000,000

3. Fidelity Bond(required for

projects with 20 or more

units)-3 x monthly HOA

dues

4. Flood (when applicable)$250,000/unit

5. Earthquake (when

applicable in California)

6. If master policy does not

include “All In” coverage

including improvements

and betterments, an HO6

policy is required with

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 2.1.9 of

Guide (Dated

June 30, 2011

and effective

June 30, 2011).

2. Fannie Mae

Single

Family/2009

Selling

Guide/Part

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

improvements, alterations and

If community engages

equipment within the individual

management company,

condominium unit

must provide proof of

fidelity insurance/bond

for the management

company naming

association as oblige in

amount not less than

estimated maximum

funds in custody of

association or

management company.

In no event shall the

amount of coverage be

less than a sum equal to 3

months aggregate

assessments on all units

plus reserve funds unless

State law requires a

maximum amount of

required coverage.

4. Flood (when applicable)

5. Owner is required to obtain

HO-6 policy if the master or

blanket policy does not

include interior unit

coverage, including

replacement of interior

improvements and

{05555341.DOC;2}

9 of 49

FHLMC (Freddie Mac)

coverage equal to 20% of

the value of the unit

“All In” = insure fixtures,

improvements, alterations and

equipment within the individual

condominium unit

Source/Date

B/Subpart

B4/Chapter B42, Section B42.1-05 (dated

October 30,

2009).

3. Fannie Mae

Single

Family/2009

Selling

Guide/Part

B/Subpart

7/Chapter B7-4

(dated October

9, 2009).

4. Freddie Mac

Seller/Service

Guide Chapter

42.2(c) and

58.1 (dated

October 9,

2009).

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

FHLMC (Freddie Mac)

Permitted unless it adversely impacts

the rights of a mortgagee or its assignee

to:

1. Foreclose or take title to a

Condominium Unit pursuant to

the remedies in the Mortgage; or

2. Accept a deed or assignment in

lieu of foreclosure in the event

of default by a mortgagor; or

3. Sell or lease a unit acquired by

the mortgagee or its assignee.

Permitted unless it adversely

impacts the rights of a mortgagee

or its assignee to:

1. Foreclose or take title to a

Condominium Unit

pursuant to the remedies in

the Mortgage; or

2. Accept a deed or

assignment in lieu of

foreclosure in the event of

default by a mortgagor; or

3. Sell or lease a unit

acquired by the mortgagee

or its assignee.

Source/Date

betterment coverage to

insure improvements that the

borrower may have made to

unit.

New

Communities/Projects

Right of First

Refusal

Permitted unless it violates

discriminatory conduct under the

Fair Housing Act regulation in 24

CFR 100.

{05555341.DOC;2}

10 of 49

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 2.2.2 of

Guide (Dated

June 30, 2011

and effective

June 30, 2011).

2. Fannie Mae

Single

Family/2009

Selling

Guide/Part

B/Subpart

B4/Chapter Bf2.2-13 (dated

October 9,

2009).

3. Freddie Mac

Seller/Service

Guide Chapter

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

FHLMC (Freddie Mac)

Source/Date

42.2(e) (dated

October 9,

2009).

New

Communities/Projects

Commercial

Limitations

1. No more than 25% of

property’s total floor area in

the project or in the unit can

be used for commercial

purposes (no exception

exists for proposed, under

construction, newly

converted, or existing

projects under 1 year old).

2. The commercial portion of

the project must be of a

nature that is homogenous

with residential use, which is

free of adverse conditions to

the occupants of the

individual condominium

units.

No more than 20% of the square footage

of the project can be used for

commercial purposes.

{05555341.DOC;2}

11 of 49

No more than 20% of the total

square footage of the project can

be used for non-residential

purposes. No more than 20% of

the income is from sources other

than dues and assessments.

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 2.1.3 of

Guide (Dated

June 30, 2011

and effective

June 30, 2011).

2. Fannie Mae

Single

Family/2009

Selling

Guide/Part

B/Subpart

B4/Section B42.2-04 (dated

October 30,

2009).

3. Freddie Mac

Seller/Service

Guide Chapter

42.3(d) and (e)

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

FHLMC (Freddie Mac)

Source/Date

(dated October

9, 2009).

New

Communities/Projects

Ownership

Limitations

1. Over 10 Units: No more than

10% of the units may be

owned by one investor,

including all units rented and

leased that a

developers/builder owns.

Unoccupied and

unsold units owned

by builder/developer

are not considered

investor owned and

are not subject to

above requirement.

The investor/single

entity individual

owner-occupied unit

is not considered

investor owned and is

not subject to the

above requirement.

Eligible non-profit

and/or eligible

governmental

housing programs

1. Over 10 Units: No

single entity – the same

individual, investor

group, partnership, or

corporation other than

the developer during the

initial marketing period –

may own more than 10%

of the total units in the

project.

2. Under 10 units: No

single entity can own

more than one unit.

{05555341.DOC;2}

12 of 49

1. Over 10 Units: No more

than 10% of the total

number of units can be

owned by a single entity.

2. Under 10 Units: No single

entity can own more than

one unit.

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 2.1.4 of

Guide (Dated

June 30, 2011

and effective

June 30, 2011).

2. Fannie Mae

Single

Family/2009

Selling

Guide/Part

B/Subpart

B4/Section B42.2-04 (dated

October 30,

2009.

3. Freddie Mac

Seller/Service

Guide Chapter

42.3(m) (dated

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

New

Communities/Projects

Criteria

Delinquency Rates

FHA

and units in projects

subject to legally

mandated rent

regulations are not

subject to 10%

ownership interest

limitation.

2. Under 10 Units: No single

entity may own more than

one unit within the project.

All units, common elements

and facilities within the

project must be 100%

complete. Only one unit can

be conveyed to non-owner

occupants.

No more than 15% of the total units

can be more than 30 days past due

on the payment of their assessments.

The 15% includes all units

(occupied, investor, bank owned,

vacant).

FNMA (Fannie Mae)

Source/Date

October 9,

2009).

No more than 15% of the total units can

be more than 30 days past due.

An exception to the 15% may be

considered on a case-by-case basis

increasing up to 20% provided the

following requirements are met:

FHLMC (Freddie Mac)

The HOA provides a report

{05555341.DOC;2}

13 of 49

No more than 15% of the total

units can be more than 30 days

past due on the payment of their

assessments.

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 2.1.5 of

Guidelines

(Dated June 30,

2011 and

effective June

30, 2011).

2. Fannie Mae

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

for the past six months that

reflects the history of unpaid

assessments.

The HOA current reserve

fund balance and current

operating results

(documented HOA Balance

Sheet and Income/Expense

financial statements dated

less than 90 days at the time

of submission) evidences

excess available funds in the

amount of the outstanding

arrearage.

A review of the HOA

financial statements and

verification of the reserve

account balance reveals that

the HOA has sufficiently

accounted for bad debt and

arrearages.

A current reserve study that

is no greater than 24 months

old supports the sufficiency

of the current HOA

assessments to meet the

project component

replacement needs.

FHLMC (Freddie Mac)

Source/Date

Single

Family/2009

Selling

Guide/Part

B/Subpart

B4/Section B42.2-04 (dated

October 30,

2009.

3. Freddie Mac

Seller/Service

Guide Chapter

42.6(d) (dated

October 9,

2009).

{05555341.DOC;2}

14 of 49

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

FHLMC (Freddie Mac)

If Lender Full Review: At least 70% of

the total units in the project or subject

legal phase must have been conveyed or

be under a bona fide contract for

purchase to owner-occupant principal

residence or second home purchasers.

At least 70% of the total units in

the project (or of a legal phase if

development is in phases) must be

sold or under a bona fide contract

for sale as a principal residence or

second home.

Presale requirement is not applicable For a specific legal phase or phases in a

for existing or Non-Gut

new project, at least 70% of the total

Rehabilitations.

units in the subject legal phase(s),

considered together with all prior legal

The pre-sale percentage must be

phases, must have been conveyed or be

documented as follows:

under contract to be sold to owneroccupant principal or second home

1. Copies of sales

purchasers.

For a specific legal phase or

phases in a new project, at least

70% of the total units in the

subject legal phase must be

conveyed and or under agreement

to owner-occupied principal or

second home purchasers. In

addition, at least 70% of the

Source/Date

The HOA provides evidence

of actions to collect the

unpaid arrearages, including

legal action, execution of

payment plans, or other

similar efforts.

The exception terminates with

the expiration of the current

condominium project approval.

New

Communities/Projects

Pre-Sale

Requirements

At least 30% of the total units must

be sold prior to endorsement of a

mortgage on any unit. Valid presales

include an executed sales agreement

and evidence that a lender is willing

to make the loan.

{05555341.DOC;2}

15 of 49

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 3.4 of

Guide (Dated

June 30, 2011

and effective

June 30, 2011).

2. Fannie Mae

Single

Family/2009

Selling

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

agreements and

evidence that a

mortgagee is willing

to make the loan;

2. Evidence that units

have closed and are

occupied; OR

3. Information from a

developer/builder

that lists all of the

units already sold,

under contract, or

closed (e.g. a

spreadsheet, chart, or

listing used for the

company’s own

tracking purposes)

that is accompanied

by a signed

certification from the

developer.

FNMA (Fannie Mae)

A project of one building cannot have

more than one legal phase.

If Condo Project Manager (CPM) At

least 51% of the total units in the project

or subject legal phase must have been

conveyed or be under a bona fide

contract for purchase to owner-occupant

principal residence or second home

purchasers.

For a specific legal phase or phases in a

new project, at least 51% of the total

units in the subject legal phase(s),

considered together with all prior legal

phases, must have been conveyed or be

under contract to be sold to owneroccupant principal or second home

purchasers.

A project of one building cannot have

more than one legal phase.

Secondary residences can only be

included if it meets the requirements

of 24 CFR 203.18(f)(2). (Effective

8/30/11)

{05555341.DOC;2}

16 of 49

FHLMC (Freddie Mac)

number of units within the phase,

considered together with all prior

legal phases, must have been

conveyed or be under contract to

be sold to owner-occupant

principal or second home

purchasers.

A project of one building cannot

have more than one legal phase.

Source/Date

Guide/Part

B/Subpart

B4/Section B42.2-04 and B42.2-05 (dated

October 30,

2009).

3. Freddie Mac

Seller/Service

Guide Chapter

42/Section

42.6(b) (dated

October 9,

2009).

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

New

Communities/Projects

Criteria

FHA

FNMA (Fannie Mae)

Owner Occupancy

Requirements

At least 30% of the declared units of

a project must be owner occupied or

sold to owners who intend to occupy

the units. One year after the first

unit conveyance, the project

requirement is at least 50% owneroccupancy of the declared units.

If Lender Full Review:

1. At least 70% of the units in the

project have been conveyed or

are under contract to purchasers

(other than the developer or

successor to the developer) who

will occupy their unit as a

Primary Residence or second

home.

2. At least 70% of the sum of the

total number of units in the

subject legal phase plus the total

number of units in all prior legal

phases in which units have been

offered for sale must have been

conveyed or are under contract

to purchasers (other than the

developer or successor to the

developer) who will occupy their

unit as a Primary Residence or

second home).

3. 2-4 Unit Condominium: All but

one unit must be conveyed to

owner-occupant principal

residence or second home

*Secondary residences can only be

considered “owner occupied” if it

meets the requirements of 24 CFR

203.18(f)(2).

*Units sold to owners who intend to

occupy the units may only be

considered “owner-occupant” if it

was a valid presale.

If Condo Project Manager (CPM):

1. At least 51% of the units in the

project have been conveyed or

{05555341.DOC;2}

17 of 49

FHLMC (Freddie Mac)

1. At least 70% of the units in

the project have been

conveyed or are under

contract to purchasers

(other than the developer

or successor to the

developer) who will

occupy their unit as a

Primary Residence or

second home.

2. At least 70% of the sum of

the total number of units in

the subject legal phase plus

the total number of units in

all prior legal phases in

which units have been

offered for sale must have

been conveyed or are

under contract to

purchasers (other than the

developer or successor to

the developer) who will

occupy their unit as a

Primary Residence or

second home).

Source/Date

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 3.5 of

Guide (Dated

June 30, 2011

and effective

June 30, 2011).

2. Fannie Mae

Single

Family/2009

Selling

Guide/Part

B/Subpart

B4/Chapter B42.2-05 (Dated

October 30,

2009).

3. Freddie Mac

Seller/Service

Guide Chapter

42.6(b) (dated

October 9,

2009).

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

FHLMC (Freddie Mac)

Source/Date

are under contract to purchasers

(other than the developer or

successor to the developer) who

will occupy their unit as a

Primary Residence or second

home.

New

Communities/Projects

Limitations on

Legal Phasing

Legal Phasing is permitted for

condominium processing as follows.

For Vertical Buildings, legal

phasing is acceptable if:

2. At least 51% of the sum of the

total number of units in the

subject legal phase plus the total

number of units in all prior legal

phases in which units have been

offered for sale must have been

conveyed or are under contract

to purchasers (other than the

developer or successor to the

developer) who will occupy their

unit as a Primary Residence or

second home).

3. 2-4 Unit Condominium: All but

one unit must be conveyed to

owner-occupant principal

residence or second home

Single buildings can have no more than N/A

one legal phase. Owner

occupancy/presale is based on the entire

project or subject legal phase.

{05555341.DOC;2}

18 of 49

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

1. The floors are legally

phased in groupings

of no less than five

consecutive

residential floors;

except where the

owner provides

documentation that a

group of less than

five floors is

required, e.g. vertical

building contains

seven floors; and

2. At least a temporary

certificate of

occupancy has been

obtained and all

common areas and

amenities have been

completed; and

3. A third party

completion bond has

been obtained.

FHLMC (Freddie Mac)

Source/Date

Section 2.1.13

of Guide (Dated

June 30, 2011

and effective

June 30, 2011).

2. Fannie Mae

Single

Family/2009

Selling

Guide/Part

B/Subpart

B4/Section B42.2-04 and B42.2-05 (dated

October 30,

2009).

For purposes of calculating the

owner-occupancy percentage and

FHA concentration:

1. On multi-phased projects the

{05555341.DOC;2}

19 of 49

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

FHLMC (Freddie Mac)

Source/Date

owner-occupancy percentage

is calculated on the first

declared phase and

cumulatively on subsequent

phases if the ownership of

the condominium project

remains the same.

2. If multi-phasing includes

separate ownership per

phase, each phase is

calculated individually.

3. In single-phase

condominium project

approval requests, all units

are used in the denominator

when calculating the 50%

owner-occupancy

percentage.

New

Communities/Projects

Concentration of

Loans

1. Projects With 3 or Less

Units. No more than one

unit can be encumbered with

FHA insurance.

NA

N/A

2. Projects With 4 or More

Units. No more than 50% of

the total units can be

encumbered with FHA

insurance.

{05555341.DOC;2}

20 of 49

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 3.6 of

Guide (Dated

June 30, 2011

and effective

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

FHLMC (Freddie Mac)

Source/Date

June 30, 2011).

*The jurisdictional HOC may

grant an exception to allow

insurance of a mortgage in a

project with an FHA

concentration FOR EXISTING

AND NON-GUT

REHABILITIATIONS ONLY

greater than 50% for up to 100%

if the project meets all of the

requirements for project

approval and the following

additional requirements:

The project has at

least 4 units.

The project is 100%

complete and

construction has been

completed for at least

one year.

100% units have

been sold and no

entity owns more

than 10% of the units

in project (or more

than one unit if

project is fewer than

10 units).

{05555341.DOC;2}

21 of 49

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

FHLMC (Freddie Mac)

Source/Date

The project’s budget

provides for the

funding of

replacement reserves

for capital

expenditures and

deferred maintenance

in an account

representing at least

10% of the budget;

Control of the HOA

has been transferred

to owners;

Owner occupancy

ratio is at least 50%;

The exception terminates

with the expiration of the

current project approval.

New

Communities/Projects

Reserve Study

1. In cases where the budget

documents do not meet

FHA’s budget standards, the

mortgagee may request a

reserve study to assess the

financial stability of the

N/A

{05555341.DOC;2}

22 of 49

N/A

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

FHLMC (Freddie Mac)

project. The reserve study

cannot be more than 24

months old.

New

Communities/Projects

Transfer of Control

New

Communities/Projects

Budget

Must occur no later than the latest of

the following: (1) 120 days after the

date by which 75% of the units have

been conveyed to the unit

purchasers; (2) Three years after

completion of the project evidenced

by the first conveyance to a unit

purchaser; or (3) the time frame

established under state or local

condominium laws if specific

provisions regarding transfer of

control exist.

Mortgagees must review the

homeowners’ association proposed

budget. The review must determine

that the budget is adequate and:

1. Includes allocations/line

items to ensure sufficient

funds are available to

maintain and preserve all

amenities and features

Source/Date

Section 2.1.6 of

Guide (Dated

June 30, 2011

and effective

June 30, 2011).

N/A

The budget must:

1. be “adequate” (i.e., it includes

allocations for line items

pertinent to the type of condo);

2. provide for the funding of

replacement reserves for capital

expenditures and deferred

maintenance at least 10% of the

budget; and

3. provide adequate funding for

{05555341.DOC;2}

23 of 49

N/A

1. At least 10% of the budget

must provide funding for

replacement reserves for

capital expenditures and

deferred maintenance

based on the project’s age

and remaining life, and on

the quality and

replacement cost of major

items comprising the

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 1.9 of

Guide (Dated

June 30, 2011

and effective

June 30, 2011).

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 2.1.6 of

Guide (Dated

June 30, 2011

and effective

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

unique to the condominium

project;

2. Provides for the funding of

replacement reserves for

capital expenditures and

deferred maintenance in an

account representing at least

10% of the budget; and

3. Provides adequate funding

for insurance coverage and

deductibles.

FNMA (Fannie Mae)

insurance deductibles.

In cases where the budget

documents do not meet these

standards, a reserve study (not more

than 24 month old) may be

requested to assess the financial

stability of the project.

New

Communities/Projects

Special

Assessments

Project submittals must contain a

signed and dated explanation for any

special assessment from the builder,

developer, sponsor, HOA or

management company answering

the following:

What is the purpose of the

assessment;

Does the assessment impact

the marketability of any of

{05555341.DOC;2}

24 of 49

FHLMC (Freddie Mac)

common elements

including the heating

system, elevators and roof.

There must be adequate

funding for insurance

deductibles.

2. There must be appropriate

allocations for line items

pertinent to the type and

status of the condominium

project.

3. If the project was recently

converted, the developer

must have initially funding

a working capital fund in

an amount consistent with

the estimated remaining

life of the individual

common elements

1. U.S. Department of

Housing and Development

Mortgagee Letter 2011-22,

Section 2.1.7 of the Guide

(Dated June 30, 2011 and

effective June 30, 2011).

Source/Date

June 30, 2011).

2. Fannie Mae

Single

Family/2009

Selling

Guide/Part

B/Subpart

B4/Section B42.2-04 (dated

October 30,

2009).

3. Freddie Mac

Seller/Service

Guide Chapter

42.6(c) (dated

October 9,

2009).

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

New

Communities/Projects

Criteria

Pending Litigation

FHA

FNMA (Fannie Mae)

the units;

Have other special

assessments been required (if

yes, explanation);

When is the assessment to be

paid;

How is overall financial

stability of the project

impacted by the assessment;

and

What impact will the

assessment have on the

future value and

marketability of the property.

Project submittals must include a

N/A

signed and dated explanation

regarding pending litigation (does

not include routine foreclosure)

from the attorney representing the

builder, developer, sponsor, HOA or

management company addressing

the following:

Reason for pending

litigation;

Anticipated

settlement/judgment date, if

any;

Is there sufficient insurance

{05555341.DOC;2}

25 of 49

FHLMC (Freddie Mac)

N/A

Source/Date

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 2.1.8 of

the Guide

(Dated June 30,

2011 and

effective June

30, 2011).

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

New

Communities/Projects

Criteria

FHA

FNMA (Fannie Mae)

coverage to pay out a

settlement/judgment without

affecting financial stability

of project;

Impact of action on future

solvency of the HOA;

Ability for owners to transfer

title affected;

Impact on owners rights.

Affordable Housing Condominium projects containing

N/A

affordable housing programs

operated through governmental

agencies and/or eligible nonprofits is

eligible for FHA approval if:

The government or eligible

nonprofit program restriction

meets the exceptions defined

in 24 CFR 203.41(c) and (d);

or

The recorded condominium

declarations contain the

affordable housing program

requirements, including

defining the specific units

that are covered under the

program. If no such

provision exists, the

{05555341.DOC;2}

26 of 49

FHLMC (Freddie Mac)

N/A

Source/Date

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 1.8.7 of

the Guide

(Dated June 30,

2011 and

effective June

30, 2011).

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

FHLMC (Freddie Mac)

Source/Date

declaration must be amended

to reflect the specific units.

New

Communities/Projects

Project

Certification

Project Certifications (Appendix A

of Guide) are required with each

submittal for project approval,

including annexation requests. The

certification must be submitted on

company letterhead and must be

signed by an association

representative, or its authorized

representative (i.e. management

company, project consultant, or

attorney).

N/A

The certification requires the signing

party to certify the following:

They have reviewed the

project and it meets all state

and local condominium laws

and all FHA condominium

approval requirements.

To the best of his or her

knowledge and belief, the

information and statements

contained in the application

are true and correct.

The submitter has no

{05555341.DOC;2}

27 of 49

N/A

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 2.4 of

the Guide

(Dated June 30,

2011 and

effective

August 30,

2011).

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

knowledge of circumstances

or conditions that might have

an adverse effect on the

project or cause a mortgage

secured by a unit in the

project to become delinquent

including but not limited to:

o Defects in

construction;

o Substantial disputes

or dissatisfaction

among unit owners

about the operation

the project of the

owner’s association;

o Disputes concerning

unit owner’s right,

privileges, and

obligations.

The submitter must also

acknowledge and agree that the

submitter is under a continuing

obligation to inform HUD if any

material information compiled for

the review and acceptance of this

project is no longer true and correct.

{05555341.DOC;2}

28 of 49

FHLMC (Freddie Mac)

Source/Date

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Existing /Established

Communities/Projects

Existing /Established

Communities/Projects

Criteria

Eligibility

Requirements

FHA

FNMA (Fannie Mae)

The project must consist of two or

more units.

1. At least 90% of the total units

in the project have been

conveyed to the unit purchasers.

Project is fully completed and is

over one year old.

2. Project is 100% complete,

including all units and common

elements.

3. Project is not subject to

additional phasing or

annexation.

4. Control of the homeowners’

association has been turned

over to the unit owners.

5. All facilities related to the

project are owned by the unit

owners or the homeowners

association. The Developer

cannot retain any ownership

interest in any of the facilities

related to the project.

6. The amenities and facilities

(including parking and

recreational facilities) cannot be

subject to a lease between the

unit owners or the homeowners

association and another party.

In the case of legally phased project,

it is defined as date that the initial

phase has been completed and is

over one year old. This includes

multiple buildings within one phase

where the final building has been

completed and the certificate of

occupancy has been issued for over

one year.

The Condominium Project must be

declared and exist in full compliance

with applicable State law

requirements of the jurisdiction in

which the condominium project is

located and with all other applicable

laws and regulations.

Entire project including the common

{05555341.DOC;2}

29 of 49

FHLMC (Freddie Mac)

1. At least 90% of the total

units have been conveyed

to the unit purchasers other

than the developer

2. The unit owners control

the homeowners

Association.

3. All units and common

elements are complete and

not subject to any

additional phasing or

additions

Source/Date

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 1.5 of

the Guide

(Dated June 30,

2011 and

effective

August 30,

2011).

2. Fannie Mae

Single

Family/2009

Selling

Guide/Part

B/Subpart

B4/Chapter B42.2-01 and

Chapter B4-2.206 (dated

October 30,

2009).

3. Freddie Mac

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

facilities must be 100% complete

FNMA (Fannie Mae)

7. Separate metering of individual

units is recommended but not

generally required.

8. No single entity may own more

than 10% of the total units in

the project, or in the case of a

project under 10 units, no single

entity may own more than one

unit within the project.

9. The project must be

demonstrably well managed,

and if professionally managed,

the management contract shall

be for a reasonable term and

contain a termination provision

that does not require a penalty

payment or advance notice of

more than 90 days.

10. The project must be located on

one contiguous parcel of land

(but may be divided by a public

street).

11. Structures within the project

must be within a reasonable

distance from each other.

12. Common Elements and

facilities (such as recreational

facilities and parking) must be

consistent with the nature of the

{05555341.DOC;2}

30 of 49

FHLMC (Freddie Mac)

Source/Date

Single-Family

Seller/Servicer

Guide/Volume

1/Glossary and

Volume

1/Chapter

42/Section

42.5(Dated

October 9,

2009).

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

FHLMC (Freddie Mac)

Source/Date

project and competitive in the

marketplace.

13. 2-4 Unit Projects: All but one

unit in the project must have

been conveyed to owneroccupant principal residence or

second home purchasers

14. All units, common elements,

and facilities within the project

– including those that are

owned by any master

association – must be 100%

complete (if a two-to four-unit

project).

15. The units in the project must be

owned in fee simple or

leasehold, and the unit owners

must be the sole owners of, and

have the rights to the use of, the

project’s facilities, common

elements, and the limited

common elements

Existing /Established

Communities/Projects

Project Approval

Requirements

Existing /Established

Communities/Projects

Concentration of

Loans

1. Projects With 3 or Less

Units. No more than one

NA

N/A

{05555341.DOC;2}

31 of 49

1. U.S.

Department of

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

unit can be encumbered with

FHA insurance.

FHLMC (Freddie Mac)

Source/Date

Housing and

Development

Mortgagee

Letter 2011-22,

Section 3.6 of

Guide (Dated

June 30, 2011

and effective

June 30, 2011).

2. Projects With 4 or More

Units. No more than 50% of

the total units can be

encumbered with FHA

insurance.

Exceptions to 50% Concentration

Level. The FHA concentration level

may be increased up to 100% if the

project meets all of the basic

condominium standards plus the

additional items stated below:

1. The project is 100%

complete and construction

has been completed for at

least one year, as evidenced

by issuance of the final or

temporary/conditional

certificate of occupancy for

the last unit conveyed;

2. 100% of the units have been

sold and no entity owners

more than 10% of the units

in the project (for projects

with fewer than 10 units,

single entity may own no

{05555341.DOC;2}

32 of 49

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

FHLMC (Freddie Mac)

Source/Date

more than 1 unit);

3. The project’s budget

provides for funding of

replacement reserves for

capital expenditures and

deferred maintenance in an

amount representing at least

10% of the budget;

4. Control of the homeowners

association has transferred to

the owners; and

5. The owner-occupancy ratio

is at least 50%.

6. The exception terminates

with the expiration of the

current project approval.

Note: New construction and GutRehabilitation conversions are not

eligible for this exception.

Existing /Established

Communities/Projects

Commercial

Limitations

1. No more than 25% of

property’s total floor area in

the project or a Unit can be

used for commercial

purposes (exceptions can be

No more than 20% of the total square

footage in the project can be used for

nonresidential space.

{05555341.DOC;2}

33 of 49

1. No more than 20% of the

total square footage of the

project can be used for

non-residential purposes;

and.

1. U.S.

Department of

Housing and

Development

Mortgagee

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

requested on case-by-case

basis for up to 35% of

property’s or Units total

floor area).

2. No more than 20% of

income can be from

sources other than

dues/assessments.

Requirements for exceptions:

FHLMC (Freddie Mac)

Requests must be

submitted as part of

the approval, reapproval, or

recertification

process as an HRAP

application.

Proposed, under

construction, existing

projects less than one

year old and newly

converted projects

are ineligible.

Project must be

100% complete for at

least one year.

No exception will be

granted where the

nonresidential/commerci

al space use is more

{05555341.DOC;2}

34 of 49

Source/Date

Letter 2011-22,

Section 2.1.3

(Dated June 30,

2011 and

effective June

30, 2011).

2. Fannie Mae

Single

Family/2009

Selling

Guide/Part

B/Subpart

B4/Section B42.2-09 (dated

October 30,

2009).

3. Freddie Mac

Single-Family

Seller/Servicer

Guide/Volume

1/Chapter

42/Section 42.3

(Dated October

9, 2009).

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

than 35% of the

property’s total floor

area;

Control of the HOA

has been transferred

to the owners.

Granting an

exception does not

change the

requirement that the

project’s use remains

primarily residential,

homogenous with

residential use and is

free of adverse

conditions to the

occupants of the

units.

The exception

terminates with the

expiration of the

current project

approval.

2. The commercial portion of

the project must be of a

nature that is homogenous

with residential use, which is

{05555341.DOC;2}

35 of 49

FHLMC (Freddie Mac)

Source/Date

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Existing /Established

Communities/Projects

Criteria

Occupancy

Restrictions

FHA

free of adverse conditions to

the occupants of the

individual condominium

units.

3. Live/Work Projects must

meet the following

requirements:

Must be approved via

HRAP.

Condominium

Declaration must state

the work (nonresidential) space per

unit cannot exceed 25%

of the unit’s total floor

area.

The non-residential work

space may not exceed

25% of the project’s total

floor area; and

The work non-residential

use must be subordinate

to the unit’s residential

use and character.

At least 50% of the total units of a

project must be owner occupied or

sold to owners who intend to occupy

the units.

FNMA (Fannie Mae)

FHLMC (Freddie Mac)

2-4 Unit Projects:

2-4 Unit Projects:

All but one unit must be conveyed to

owner occupant principal residence or

All but one unit must be conveyed

to owner occupied principal

{05555341.DOC;2}

36 of 49

Source/Date

1. U.S.

Department of

Housing and

Development

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

second home

*A secondary residence can only be

considered “owner-occupied” if it

meets the requirements of 24 CFR

203.18(f)(2).

*Units sold to owners who intend to

occupy the units may only be

considered “owner-occupant” if it

was a valid presale.

*Restrictions on Leasing:

Condominium Declaration can

restrict owner’s ability to lease their

unit if the restrictions meet one or

more of the following criteria:

FHLMC (Freddie Mac)

residence or second home

Projects greater than 4 units

Projects greater than 4 units

Primary Residence or Second Home:

There is no limitation on number of

investor units if subject is a principal

residence or a second home.

Investment Property: At least 51% of

the total units in the project must be

conveyed to purchasers as principal

residences or second homes.

All leases must be in writing

and subject to the declaration

and by-laws of the

condominium project.

The condominium

association may request and

receive a copy of the

sublease or rental agreement.

The condominium

association may request the

name(s) of all tenants

{05555341.DOC;2}

37 of 49

Primary Residence or Second

Home : There is no limitation on

number of investor units if subject

is a principal residence or a second

home.

Investment Property: At least

51% of the total units in the

project must be conveyed to

purchasers as principal residences

or second homes.

Source/Date

Mortgagee

Letter 2011-22,

Sections 1.8.9

and 3.5 of

Guide (Dated

June 30, 2011

and effective

June 30, 2011).

2. Fannie Mae

Single

Family/2009

Selling

Guide/Part

B/Subpart

B4/Section B42.2-06 and B42.2-07 (dated

October 30,

2009).

3. Freddie Mac

Single-Family

Seller/Servicer

Guide/Volume

1/Chapter

42/Section

42.5(b) (Dated

October 9,

2009).

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

including the tenant’s family

members who will occupy

the unit.

Unit owners are prohibited

from leasing their units for

an initial term of less than 30

days.

The condominium

association may establish a

maximum allowable lease

term, e.g. six months, twelve

months, etc.

The condominium

association may establish a

maximum number of rental

units within the project;

however, the percentage of

rental units may not exceed

the current FHA

condominium project owneroccupancy requirement (i.e.

currently 50%).

The condominium

association may not require

that a prospective tenant be

approved by the

condominium association

and/or its agent(s), including

{05555341.DOC;2}

38 of 49

FHLMC (Freddie Mac)

Source/Date

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

FHLMC (Freddie Mac)

No more than 15% of the total units in

an attached condominium project can be

30 days or more past due on

assessments.

No more than 15% of the total

number of units in a project can be

30 days or more past due on

assessments.

Source/Date

but not limited to meeting

creditworthiness standards.

Existing /Established

Communities/Projects

Association

Requirements

Assessments/Delin

quency

No more than 15% of the total units

can be more than 30 days past due

on the payment of their assessments

(does NOT include late fees or

administration charges). ALL units

included in delinquency ratio

regardless of ownership.

*exception to 15% can be requested

for up to 20% delinquency on caseby-case basis. Additional

documentation may be required as

follows:

1. Report for past 6 months that

reflects history of unpaid

assessments.

2. The HOA current reserve

fund balance and balance

sheet/financial statements

evidences excess available

{05555341.DOC;2}

39 of 49

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 2.1.5 of

Guide (Dated

June 30, 2011

and effective

June 30, 2011).

2. Fannie Mae

Single

Family/2009

Selling

Guide/Part

B/Subpart

B4/Section B42.2-06 (dated

October 30,

2009).

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

FHLMC (Freddie Mac)

funds in the amount of the

outstanding arrearage.

3. HOA financial statements

demonstrate the HOA has

sufficiently accounted for

bad debt and arrearages.

4. A current reserve study that

is no greater than 24 months

old supports the sufficiency

of the current HOA

assessments to meet project

component replacement

needs.

5. HOA must provide evidence

of actions to collect unpaid

arrearages.

Source/Date

3. Freddie Mac

Seller/Service

Guide Chapter

42.5(d) (dated

October 9,

2009).

The exception terminates with

the expiration of the current

condo project approval.

Existing /Established

Communities/Projects

Insurance

1. Hazard-Replacement cost

coverage (100% current

replacement cost of

condominium exclusive of

land, foundation, excavation,

and other typical exclusions)

2. Liability

1. Hazard-Replacement

cost coverage

2. Liability-min $1,000,000

3. Fidelity (20 units or

more)-3 x monthly HOA

dues

4. Flood-(if applicable) of

{05555341.DOC;2}

40 of 49

1. Hazard-Replacement cost

coverage

2. Liability-min $1,000,000

3. Fidelity (required for

projects with 20 or more

units)-3 x monthly HOA

dues

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 2.1.9

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

3. Fidelity Insurance by HOA

(for new and established

condominium projects with

20 or more units) - 3x

monthly aggregate HOA

dues plus reserve funds

unless State law mandates a

maximum dollar amount of

required coverage.

If community engages

management company,

must provide proof of

fidelity insurance

coverage/bond for the

management company

naming association as

obligee in amount not

less than estimated

maximum funds in

custody of association or

management company,

and in no event shall the

amount of coverage be

less than a sum equal to 3

months aggregate

assessments plus reserve

funds unless State law

requires a maximum

amount of required

FNMA (Fannie Mae)

$250,000 per unit

5. If master policy does not

include “All In”

coverage including

improvements and

betterments, an HO6

policy is required with

coverage equal to 20% of

the value of the unit

“All In” = insure fixtures,

improvements, alterations and

equipment within the individual

condominium unit

{05555341.DOC;2}

41 of 49

FHLMC (Freddie Mac)

4. Flood (when applicable)$250,000 per unit

5. Earthquake (when

applicable in California)

6. If master policy does not

include “All In” coverage

including improvements

and betterments, an HO6

policy is required with

coverage equal to 20% of

the value of the unit

“All In” = insure fixtures,

improvements, alterations and

equipment within the individual

condominium unit

Source/Date

and 3.7 of

Guide (Dated

June 30, 2011

and effective

June 30, 2011).

2. Fannie Mae

Single

Family/2009

Selling

Guide/Part

B/Subpart

B4/Chapter B42, Section B42.1-05 (dated

October 30,

2009).

3. Fannie Mae

Single

Family/2009

Selling

Guide/Part

B/Subpart

7/Chapter B7-4

(dated October

9, 2009).

4. Freddie Mac

Seller/Service

Guide Chapter

42.2(c) and

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

FHLMC (Freddie Mac)

coverage.

4. Flood (when applicable)

5. Owner is required to obtain

HO-6 policy if the master or

blanket policy does not

include interior unit

coverage, including

replacement of interior

improvements and

betterment coverage to

insure improvements that the

borrower may have made to

unit.

Existing /Established

Communities/Projects

Budget

Mortgagees must review the

homeowners’ association existing

budget. The review must determine

that the budget is adequate and:

1. Includes allocations/line

items to ensure sufficient

funds are available to

maintain and preserve all

amenities and features

unique to the condominium

project;

2. Provides for the funding of

replacement reserves for

capital expenditures and

Source/Date

58.1 (dated

October 9,

2009).

The budget must:

1. Be adequate (i.e. includes

allocations for line items

pertinent to the type of condo).

2. Provide for funding of

replacement reserves for capital

expenditures and deferred

maintenance equal to at least

10% of the budget.

{05555341.DOC;2}

42 of 49

1. The budget must contain

appropriate allocations for

line items pertinent to the

type and status of the

Condominium Project.

2. At least 10% of the

operating budget must

provide funding for

replacement reserves for

capital expenditures and

deferred maintenance

based on the project’s age

and remaining life, and the

quality and replacement

cost of major Common

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 2.1.6 of

Guide (Dated

June 30, 2011

and effective

June 30, 2011).

2. Fannie Mae

Single

Family/2009

Selling

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

FHA

FNMA (Fannie Mae)

deferred maintenance in an

account representing at least

10% of the budget; and

3. Provides adequate funding

for insurance coverage and

deductibles (pursuant to

Section VI, Insurance

Requirements).

Investor

Limitations

FHLMC (Freddie Mac)

Elements.

3. There must be adequate

funding for insurance

deductibles.

In cases where the budget

documents do not meet these

standards, a reserve study (no older

than 24 months) may be requested to

assess the financial stability of the

project.

No more than 10% of the Units can

be owned by one investor/entity

(single or multiple owner entities) –

including all rented and leased units

that a developer/builder owns. For

projects with 10 or fewer units, no

single investor/entity may own more

than one unit.

Source/Date

Guide/Part

B/Subpart

B4/Section B42.2-06 (dated

October 30,

2009).

3. Freddie Mac

Seller/Service

Guide Chapter

42.5(c) (dated

October 9,

2009).

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 2.1.4

(Dated June 30,

2011 and

effective June

30, 2011).

*If investor/single entity individual

unit is owner occupied, the unit not

considered investor owned.

*Unoccupied and unsold units

{05555341.DOC;2}

43 of 49

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Existing /Established

Communities/Projects

Criteria

FHA

FNMA (Fannie Mae)

owned by developer not considered

investor owned.

*Non-profit owned units and

eligible governmental housing

programs not subject to 10%

ownership limitation.

*Units in projects subject to legally

mandated rent regulations not

subject to investor requirements.

Affordable Housing Condominium projects containing

N/A

affordable housing programs

operated through governmental

agencies and/or eligible nonprofits is

eligible for FHA approval if:

The government or eligible

nonprofit program restriction

meets the exceptions defined

in 24 CFR 203.41(c) and (d);

or

The recorded condominium

declarations contain the

affordable housing program

requirements, including

defining the specific units

that are covered under the

program. If no such

provision exists, the

declaration must be amended

{05555341.DOC;2}

44 of 49

FHLMC (Freddie Mac)

N/A

Source/Date

1. U.S.

Department of

Housing and

Development

Mortgagee

Letter 2011-22,

Section 1.8.7 of

the Guide

(Dated June 30,

2011 and

effective June

30, 2011).

FHA, FANNIE MAE AND FREDDIE MAC GUIDELINES AND ELIGIBILITY REQUIREMENTS

As of March 8, 2016

Type of

Community/Project

Criteria

Existing /Established

Communities/Projects

Special

Assessments

Existing /Established

Communities/Projects

Pending Litigation

FHA

FNMA (Fannie Mae)

to reflect the specific units.

Project submittals must contain a

N/A

signed and dated explanation for any

special assessment from the builder,

developer, sponsor, HOA or

management company answering

the following:

What is the purpose of the

assessment;

Does the assessment impact

the marketability of any of