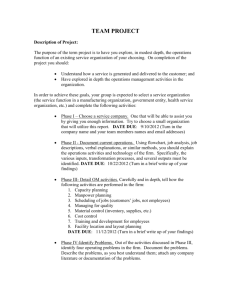

Questions and Answers

advertisement

Questions and Answers Please note: While all questions are reviewed, only representative Q&A will be posted on the Web site. Specific questions cannot be addressed in this forum. The information in this Q&A document is intended to be informative and as accurate as possible. If there is any conflict between information in this document and anything in the Tentative Agreement with CWA and the Company, the agreement prevails. Questions and answers added December 13, 2010 Q1: A1: Q2: A2: Could you please define what an "eligible employee" is under the National Transfer Plan (NTP) as proposed under this Tentative Agreement? Bargained-for employees in the National Internet Contract may indicate their interest in other bargained-for positions in other participating companies. To be an “eligible employee” under the NTP for a position in the receiving or participating company, an employee must meet all qualifications (which may include interviewing, testing, driving or security checks, etc.) and selection criteria required by the participating company. I need to send in my ballot. Could you provide me the district and local number for the Birmingham call center chapter of the CWA and confirm where it should be sent? Certain locals, including Birmingham (District 3, Local 3902), provided preaddressed envelopes to have ballots forwarded to the CWA National Office located at 501 3rd Street NW, Washington, D.C., 20001. Members mailing in their ballots should include their district number and union local number on the envelope. Questions and answers added December 7, 2010 Q1: A1: Q2: A2: What are the catch-up contributions for the AT&T Retirement Savings Plan (ARSP)? Under the ARSP, if you are or will be 50 years of age or older before the end of a calendar year, you may save more on a before-tax basis to “catch-up” your savings to help meet your retirement needs. You may contribute an additional Before-Tax Supplementary Contribution that exceeds the otherwise applicable ARSP or statutory limits (a “Catch-up Contribution”). Is the Calculator using wages before or after taxes? As taxes and other deductions vary from employee to employee, the calculator is using wages before taxes. Q3: A3: I set the calculator to the “Family and Hospitalization” scenario and it said my medical costs would only go up $4,100 over 3 years. How is that possible if the Family Deductable will be $11,550? How are you arriving at these medical cost numbers in your calculator? The amount of $11,550 represents the Network/Out-of-Network Area (ONA) outof-pocket maximum for 2012, not the Family Deductible. The Family Deductible for 2012 is $1,300. The Change in Health Care Cost shown represents the estimated difference between out-of-pocket health care expenses under the tentative agreement and your out-of-pocket health care expenses under the current plan. All expenses are assumed to be in-network. Out-of-pocket health care expenses include monthly premium contributions, deductibles, coinsurance, copayments and any other eligible expenses. Questions and answers added December 6, 2010 Q1: A1: Do non-union members qualify for the ratification bonus if the agreement is ratified? If ratification of the tentative agreement occurs by December 21, 2010, all employees who are in the job titles covered in this agreement and who are on payroll on the date of ratification will receive a ratification bonus of $500. Q2: A2: When will Customer Assistants be eligible for Tuition Assistance? The Company and Union agreed that Customer Assistants will be eligible for Tuition Assistance effective with ratification. More information about the eligibility guidelines is available here on HROneStop. If the tentative agreement is ratified, the AT&T Non-Management Tuition Aid Policy application form, which can be found at www.acclaris.net should be completed and submitted online. Applications may be submitted online as early as 45 calendar days prior to the start of the course but no later than the last day of the course. Q3: Is tuition assistance on a pre- or post-paid basis? What does this assistance cover? Tuition assistance is pre-paid to the employee, subject to submission of acceptable final grades and proof of payment following completion of the course. Tuition assistance covers a maximum of $3,500 in a calendar year and can be used towards tuition and required course-specific fees. Courses must be in one of the approved degree programs listed in the policy, which can be found here on HROneStop. A3: Q4: A4: Are the lump sum payments for Customer Assistants and non-Customer Assistants included in the ratification bonus of $500? No, the $500 ratification bonus would be in addition to the lump sum payments for Customer Assistants and non-Customer Assistants outlined in the highlights document, if ratification of the tentative agreement occurs by December 21, 2010. Questions and answers added December 4, 2010 Q1: A1: When does the Success Sharing Plan (SSP) begin? See Q1 and Q2 under the questions and answers added November 29, 2010. Q2: A2: Will we receive the ratification bonus and lump sum all in one paycheck? See Q3 under the questions and answers added November 29, 2010. Q3: Will the company still offer a 401(k) match of 80 percent up to 6 percent of your pay? Yes. All employees will remain in their current 401(k) plan through May 31, 2010. Effective June 1, 2011, all employees will become eligible to participate in the AT&T Retirement Savings Plan (ARSP). This 401(k) plan provides the same generous Company Match amount as under the prior savings plan, and includes the option to contribute to a Roth account as well as Catch-up Contributions. The ARSP provides a broad fund lineup that offers 10 core options, LifeCycle funds and a brokerage window option that allows thousands of other investment options. A3: Q4: A4: How do you find out what step of wage progression you are on now? Your supervisor should be able to help you determine where you are at on the wage table. Q5: Who is eligible to participate in the expanded National Transfer Plan? Also, could you elaborate more on what the plan entails? The National Transfer Plan (NTP) extends and enhances the current Intersubsidiary Movement process and the CWA Surplus Exchange process that allows eligible employees to move to other CWA-represented regional bargaining unit jobs before external hires. NTP will become effective once ratified by the Internet bargaining unit. Job offers made under the NTP will follow the order of consideration below after regional contract processes: 1. Surplus employees currently on the payroll and surplus employees involuntarily laid off within the last 12 months. 2. Current employees requesting transfer to other regions. A5: Under the NTP, eligible employees would have the opportunity to move to any of participating CWA-represented bargaining units. Questions and answers added November 30, 2010 Q1: A1: I'm confused by the National Internet contract Calculator. Can you explain how it works? The calculator was developed to allow bargained employees to look at the estimated financial impact of the tentative agreement. After entering some basic information, employees can view a comparison that shows their current pay and, if applicable, benefits compared to the pay and, if applicable, benefits under the tentative agreement. For wages, the "Increase in Pay" represents the cumulative effect of your proposed wage increases over the life of the tentative agreement. This includes the proposed annual wage increase, wage progression (if applicable) and lump sum payments. Below is an example of a Technical Support Representative II at top pay (Step 11) with no overtime. As of July 2010 $62,000 Year 1 Increase Year 2 Increase Year 3 Increase Lump Sum First Year of Contract $65,500 Second Year of Contract $65,200 Final Year of Contract $66,800 $1,800 $1,800 $1,800 $5,400 $1,400 $1,400 $2,800 $1,600 $1,600 $4,800 $11,500 $1,700 $3,500 $3,200 Total Remember, the comparison is based on your wages as of July 2010. Without wage increases, progression increases or lump sums over the next three years, you would receive $186,000 ($62,000 x three years) in wages. With the wage increases negotiated, you would receive $197,500 ($65,500 + $65,200 + $66,800) in wages. Therefore, the difference would be $11,500 ($197,500 $186,000) in increased wages over the life of the tentative agreement. For those in progression, step increases would also be considered in the increase in pay; an employee in wage progression would see a substantially greater wage increase. If benefit changes apply to you, the "Change in Health Care Cost" shown represents the estimated difference between out-of-pocket health care expenses under the tentative agreement, and out-of-pocket health care expenses under the current plan. All expenses are assumed to be in-network. Below is an example of an individual plus 1 dependent who is a medium user of healthcare. Change in Health Care Cost Contract Year 1 Contract Year 2 Contract Year 3 Total $100 $300 $1,300 $1,700 The $300 in the second year of the contract represents the estimated increase in out-of-pocket health care expenses over estimated current costs. This includes monthly premium contributions, deductibles, coinsurance, copayments and any other eligible expenses. The estimates are based on AT&T average claim data for an individual plus 1 dependent medium user. For participants who select "hospitalization" for the type of health care user, the change in health care cost is measured using a utilization of "hospitalization" in the first and second year and "high" in the final year of the tentative agreement. Subtracting the increased costs in healthcare from the total increase in pay results in “Net Gain to You.” In the above example, $11,500 total increase in pay minus $1,700 total increase in healthcare costs results in $9,800 net gain to you. When using the calculator, do not use the back and forward buttons on your browser as this will not store your results. Q2: Do all non-Customer Assistant titles also get the $500 bonus on top of the $1,200 lump sum? A2: If ratification of the tentative agreement occurs by December 21, 2010, all employees on payroll on the date of ratification will receive a ratification bonus of $500. Q3: Why do non-Customer Assistants get an increase each year and the Customer Assistants only get a 2 percent increase in 2010 and a 1 percent increase in 2012? The average Customer Assistant in progression will receive an approximately 37 percent wage increase over life of the agreement. This includes a 2 percent general wage increase retroactive to July 18, 2010 and a 1 percent general wage increase on Aug. 19, 2012, as well as progression increases. In addition, Customer Assistants will receive: A ratification bonus of $500, if ratification of the tentative agreement occurs by December 21, 2010. Two lump sum payments of $300, the first one payable as soon as practicable after ratification and the second one paid by August 26, 2011. Opportunity to receive up to $7,000 in additional cash payments during the term of the agreement under a the new quarterly Customer Assistant Pay Plan (CAPP) A3: Q4: A4: How much of an increase will I receive including everything – i.e. ratification, lump sum payments, etc.? In our continuing effort to provide accurate information on the tentative agreement between the CWA and AT&T for the National Internet contract, we are providing a calculator to help you understand how the proposed tentative agreement will affect you. The calculator can be found at www.att.com/internetbargaining, and a basic Q&A on how the calculator works can be found above. Questions and answers added November 29, 2010 Q1: A1: Since Team Award is going to be replaced by the Success Sharing Plan (SSP), is there anything special the employees will have to do in order to be eligible for payout in November? Employees who were in titles which were previously eligible for Team Award must be on the payroll on both the beginning and ending dates of each award year and during that award year work a minimum of three months. Customer Assistants, who were not previously eligible for Team Award, will be eligible for SSP in the 2013 award year with the same eligibility requirements. Q2: A2: What do you mean for award year? Is it years of service? No, the award year is not years of service – it is a 12-month period during which eligible employees will take part in the Success Sharing Plan (SSP). There are three award years for the SSP. Eligible employees will be awarded 150 success units at the beginning of each award year (Award Year 2011 – October 1, 2010, Award Year 2012 – October 3, 2011 and Award Year 2013 – October 1, 2012). Those success units will only be valid for that award year and will not carryover to the next award year. Q3: If the contract is ratified by December 21, when will we receive the bonus? When will we receive the retro pay and the $300 lump sum? Both payments will be included in your regular paycheck no later than the second pay cycle in February 2011, but could be as early as your second pay cycle in January 2011. A3: Q4: A4: Q5: A5: The tentative agreement mentions a wage increase. If you are already at top pay, what does that mean? The wage increases will be applied to the wage schedule. Therefore, those at top pay will have their wages increased as well. Do those who have not capped out of their pay grade still get hourly wage increases? The wage schedules will be increased and employees in progression will continue to receive increases every six months based on the new wage schedules. Q6: A6: Is the Sunday shift differential still in effect? Yes, the Sunday shift differential is still in effect. Q7: A7: Is everyone able to vote on the contract? If not, who is able to vote? The voting process is managed by the CWA and questions on this process should be directed to your local union. Q8: A8: What changes in the contract will apply to Internet Assistants? The details in the highlights document that apply to Non-Customer Assistant titles, as well as any noted as applying to all employees, are applicable to employees in the Internet Assistant title. Q9: A9: Is the pharmacy deductible still included with the medical deductible? Yes, the pharmacy deductible is still included with the medical deductible. Q10: Does the insurance deductible have to be met before the company will pay 100 percent of in-network preventive care costs? A10: In-network preventive care costs are 100 percent covered by the company; therefore, in this situation the insurance deductible does not have to be met. Q11: Do we still have seven paid holidays? A11: Yes, we still have seven paid holidays. Q12: How will this agreement affect a person in U-verse Tier 2? A12: The details in the highlights document that apply to Non-Customer Assistant titles, as well as any noted as applying to all employees, are applicable to employees in the in U-verse Tier 2 titles. Questions and answers added November 24, 2010 Q: A: When is the ratification vote? The vote is scheduled to be completed before and notice delivered to the company by December 21, 2010.