Bangor University MIP-Template–ACE-102-ThreeWeeks[1]

advertisement

![Bangor University MIP-Template–ACE-102-ThreeWeeks[1]](http://s3.studylib.net/store/data/008610893_1-9bccc2ecb8354944fa8b87394c195f42-768x994.png)

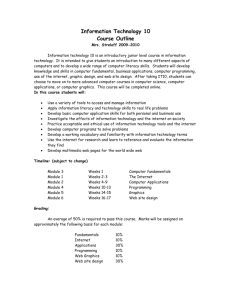

Bangor University Transfer Abroad Undergraduate Programme Module Implementation Plan MODULE: INTAKE: ACTIVITY TYPES: ACE-102 Introduction to Banking and Finance 2010 Lecture, presentation, quiz, exam, workshop LECTURER: SEMESTER: 3 Start Date: Nov 28, 2011 End Date: Dec 16, 2011 Year II Semester Academic weeks Fall Week 13 ~ 15 2011/11/28~2011/12/16 Module Code Module Name Credits ACE-102 Introduction to Banking and Finance 10 Lecture hrs/week 11.25 for each session Mon ~Thu Session I: 0830~1100 Session II: 1430~1700 Fri 0830~ 0930 1000~ 1100 Tutorial Hrs/week (Local Tutor) Weeks 5 3 Course Detail: The module aims to offer insights into the nature of the financial instruments, financial markets and financial intermediaries, with particular focus on the banking business. On completing the module, students are expected to be able to : Understand the role of financial markets and financial intermediaries; Understand the importance of regulation in the financial sector; Develop a sound understanding of the banking business; Understand the crucial role of central banks in the financial sector. Assessment Mid-term assignment, comprising an essay of about 2,500 words (40%); 2-hour written examination (60%). Assessment ( Variable based on individual module ) Class Participation Attendance Quiz I Quiz II Individual Assignment Group Paper Final Exam Date Value 12/12/11 40% 16/12/11 60% Paper Assignment: An essay of 2,500 words maximum on the following title: Describe the process of financial intermediation and how the deposit-taking and non-deposit-taking financial intermediaries facilitate the transfer of liquidity from surplus to deficit units in the economy. Indicative reading for essay: Buckle & Thompson: Chap. 2 Casu, Girondone & Molyneux: Chap. 1 Fell: Chap. 2 Goodhart: Chap. 5 Howells & Bain: Chaps. 1, 3, 4. Piesse, Peasnell & Ward: Chap.3. Pilbeam, Chaps. 2, 3. Week Activity Type Scheduled Contact Hours Lecture 2.5hr Activity Details Core Reading + Additional Reading + Practice Material Learning Outcomes Week 01 Monday Nov 28 Tutorial 1hr Pilbeam. Chapter 1 Lecture: Introduction to the financial system. Mallon: Unit 1. Distinguish between financial institutions and financial markets Self assessment questions (SAQs). Distinguish between banking and nonbanking financial intermediaries Discuss the importance of the financial system in the economy. Discuss the structure of the system. Explain diagram of the financial system structure and financial instruments. Explain what is meant by and provide examples of “financial claims” Distinguish between marketable and non-marketable financial claims Student Preparation for Tutorial Distinguish between deposit-taking and non-deposit-taking financial intermediaries Explain the importance of liquidity in the markets for the operation of the economy Describe the characteristics of the main financial instruments in the money markets Describe the characteristics of the main financial instruments in the capital markets Tuesday Nov 29 Lecture 2.5hr Lecture: Financial instruments: functions and characteristics. their Pilbeam. Chapters 1 Understand the distinction between Tutorial & 5. marketable and non-marketable questions Mallon: Unit 1. financial instruments. for unit 1 Self assessment questions (SAQs). Wednesday Nov 30 Tutorial 1hr Lecture 2.5hr Discuss the important terms in Unit 1: Financial assets & liabilities; Financial claims; Surplus & Deficit units.. Tutorial questions in study guide for unit 1 Lecture: The activities of banks. Understand the distinction between surplus and deficit units. Casu, Girondone Understand the structure of modern Tutorial question & Molyneux: banking and banking business. Describe the main services offered by sheet for Chapters 2, 3, 4 Tutorial 1hr Tutorial: banks. unit 1 Understand the importance of the Mallon: Cover general and specific questions relating Unit 1 and Unit 5 on payment system to financial markets and financial commercial Understand the forces of change in instruments. banking and the main trends deriving banking. from these. Appreciate the range of retail banking Tutorial questions in study guide for unit 1 & 12. services in the UK Describe the services provided by the wholesale banks and the international banks Thursday Dec 01 Lecture 2.5hr Lecture: Regulation of the financial system. Self assessment questions (SAQs). Casu, Girondone & Molyneux: Chapter 7. Mallon: Unit 2. Tutorial 1hr Tutorial: Cover the credit creation multiplier. Distinction between traditional and modern banking; retail and wholesale banking; corporate and investment banking. describe thetheservices by the Understand reasons provided for regulation of Tutorial investment banks the financial system. questions Explain the objectives of government for unit 1A intervention. Describe the types of regulation in the UK financial sector. Tutorial questions in study guide for unit 1A Friday Dec 02 Lecture 1hr Revision session: Class exercise. Tutorial 1hr Go over the class exercise answers. Lecture 2.5hr Week 02 Monday Dec 05 Lecture: Money and the flow of funds in the Casu, Girondone Appreciate the origins and history of Tutorial economy. questions & Molyneux: money. Explain the functions and characteristics for unit 2. Chapter 5. Self assessment questions (SAQs). of money. Tutorial Tuesday Dec 06 1hr Lecture 2.5hr Tutorial 1hr Tutorial questions in study guide for unit 2 Lecture: Financial intermediation. Self assessment questions (SAQs). Tutorial: Money and the flow of funds. Tutorial questions in study guide for unit 3. Pilbeam, Chap. 4 Understand the circular flow of income, Mallon: Unit 3. expenditure and production. Identify and explain the flow of funds between sectors. Casu, Girondone & Molyneux: Chap. 1 Pilbeam, Chaps. 2, 3. Define and distinguish between surplus Tutorial and deficit units questions Mallon: Unit 4. Understand the contractual position for Unit 3 involved in financial intermediation Appreciate the problems and disparate needs of surplus and deficit units inherent in direct lending Explain how these disparate needs are reconciled by financial intermediation Understand the processes of maturity transformation, aggregation and risk transformation Appreciate the advantages of economies of scale and diversification, and Understand the problems of asymmetric information, adverse selection and moral hazard. Wednesday Dec 07 Lecture 2.5hr Lecture: Central Bank. Casu, Girondone & Molyneux: Chap. 5. Mallon: Unit 5. Understand the position and importance of Tutorial the Bank of England as the Central Bank questions in the UK financial system for unit 4 Appreciate how this has changed since 1997. Tutorial question Understand the central bank’s role in sheet for unit 4 controlling the money supply. Tutorial 1hr Tutorial: Financial intermediation. Tutorial question sheet for unit 4 Thursday Dec 08 Lecture 2.5hr Lecture: The Money Markets. Pilbeam, Chap. 5. Explain the role and nature of financial Tutorial Self assessment questions (SAQs). Mallon: Unit 6. markets in general question Understand what is meant by market sheet for unit 5. efficiency Understand the role of the money market Tutorial 1hr Tutorial: Central Bank. Tutorial questions in study guide for unit 5. Friday Dec 09 Lecture 1hr Revision session Q & A Tutorial 1hr Tutorial The money markets (1) Identify different instruments traded in the money market and describe their characteristics Calculate the yields on various money market instruments. Tutorial questions for unit 6 Tutorial questions in study guide for unit 6. Week 03 Monday Dec 12 Lecture 2.5hr Lecture: The Capital markets. Self assessment questions (SAQs). Tutorial 1hr Tutorial: The money markets (2) Tutorial questions in study guide for unit 6. Pilbeam, Chaps. Understand the difference between bonds and equities 6 & 9. Mallon: Unit 7 Distinguish between different types of long-term debt capital and risk capital and 8. Calculate the yields on various capital market securities Understand the presentation of relevant data on stocks and shares in the financial press. Tutorial question sheet for unit 6 Tuesday Dec 13 Lecture 2.5hr The derivatives market. Pilbeam, 13. Self assessment questions (SAQs). Chap. Distinguish between speculation, hedging Tutorial and arbitrage questions Describe some of the different types of for unit 7. Mallon: Unit 9. Tutorial 1hr Tutorial: The capital markets (1) derivative instruments, such as futures, options and swaps Tutorial question sheet for unit 7. Explain how, and on which markets, derivatives are traded Understand the risk and characteristics of derivatives Wednesday Dec 14 Lecture 2.5hr The foreign exchange market. Pilbeam, 11. Self assessment questions (SAQs). return Chap. Describe the structure and operation of the Tutorial Mallon: Unit 10. foreign exchange market questions Understand the press representations of for unit 7. the forex market Understand the determinants of exchange rates Understand basic risk in relation to exchange rates Tutorial 1hr The capital markets (2). Tutorial question sheet for unit 7. Thursday Dec 15 Lecture 1hr Revision. Tutorial 1hr Tutorial: Basic coverage of Derivatives and Foreign exchange. These are relatively short units and will Tutorial be covered partly in the revision time questions and partly in tutorial time. for units 8, 9 and 10. Tutorial question sheet for unit 8, 9 and 10. Friday Dec 16 Final Exam