Course outline This course is designed to give to students who have

advertisement

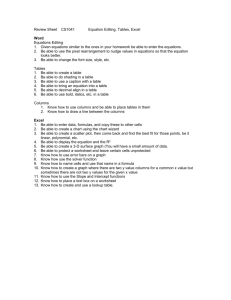

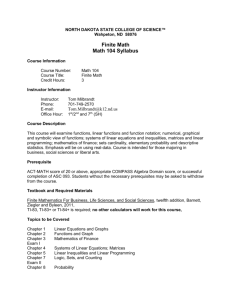

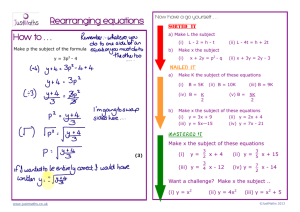

Course outline This course is designed to give to students who have a working knowledge of undergraduate mathematics an Understanding of Economics, Finance and Banking through 14 simplified equations. It gives a broad overview of how engineers and statisticians help compute solutions in a large number of applications of mathematics to banking, economics and market finance. * General overview of scope of course and tools used (Excel practice) * 5 equations in Macroeconomics ; * 4 equations on modern markets ; * 5 equations in Risk modelling * General summary, perspectives of Quantitative Finance and pending problems. Recommended readings General introductory books on business and finance, news in financial newspapers Teaching methods Each seance will successively present : - a general introduction to the theory and lead to the formulation of the core equation, and what should be expected in real life. - a mathematical refresher short mini course, that explains the nature of equations (linear, differential, maximizing, recurrent, ...) and how one can use IT tools present in Excel to solve the equations (Solver, statistics analysis, iterative calculation - an actual demonstration of the solution with Excel spreadsheet up to the final results * Powerpoint slides (most of them authored by the teacher himself) * Tutorials are done in MS Office Excel 2010. Exercises may be followed by students, who may if they have their own personal PCs , do hands-on exercises * 20 minutes will be reserved to discussions at the end of each of the 14 topics. Assessment methods One multiple choice test (10 questions) at the end of each of the Economics / Markets / Risk modelling sections The final grade will be the average of the 3 tests Class topics 1) Macroeconomics - the general national equilibrium (Leontieff) - consumer, producer and optimizations (static maximization) - monetary and budgetary government instruments (J-M Keynes), - inflation and shocks (Phillips, ARCH models), - dynamic models in Europe and USA (DSGE model) 2) Financial Markets and derivatives - Capital Asset Pricing Model and the securities line (linear regression) - Rating agencies and default risk (maximum likelihood) - Bank accounting, central bank and regulations (the Cooke ratio) - Migration risk of portfolios (correlations and markov process) 3) Risk modelling in banks - Derivative markets (Random walk and Black Scholes formula) - Strategies in option and hedging (for vanilla options) - Operational risks (convolution of frequency and severity) - Credit and counterparty risk (Merton's asymptotic single factor model) - Securitization (CDO, CDS) and financial crises (Basel supervisory formula) Special comment Each 3 hour seance is divided into 3 parts : - a general introduction to the theory and lead to the formulation of the core equation, and what should be expected in real life. - a mathematical refresher, short mini-course, that explains the nature of equations (linear, differential, maximizing, recurrent, ...) and how one can use IT tools present in Excel to solve the equations (Solver, statistics analysis, iterative calculatio - an actual demo and programming of the solution with Excel spreadsheet up to the final results. Sometimes Visual Basic for Application (Excel VBA) can be used, but only at introductory level, requiring no previous experience. Part I : Macroeconomics the general national equilibrium (Leontieff) 𝑌 + (𝑋 − 𝑀) = 𝐶 + 𝐼 + 𝐺 consumer, producer and optimizations (static maximization) monetary and budgetary government instruments (J-M Keynes), inflation and shocks (Phillips, ARCH models), dynamic models in Europe and USA (DSGE model) Part II :Financial Markets and derivatives - Capital Asset Pricing Model and the securities line (linear regression) - Rating agencies and default risk (maximum likelihood) - Bank accounting, central bank and regulations (the Cooke ratio) - Migration risk of portfolios (correlations and markov process) Part III : Risk modelling in banks - Derivative markets (Random walk and Black Scholes formula) - Strategies in option and hedging (for vanilla options) - Operational risks (convolution of frequency and severity) - Credit and counterparty risk (Merton's asymptotic single factor model) - Securitization (CDO, CDS) and financial crises (Basel supervisory formula)