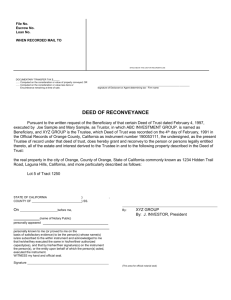

Trust deed - NSW Government

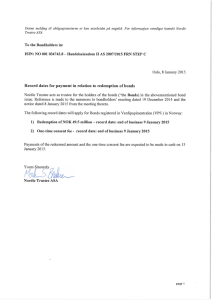

advertisement