Task 1

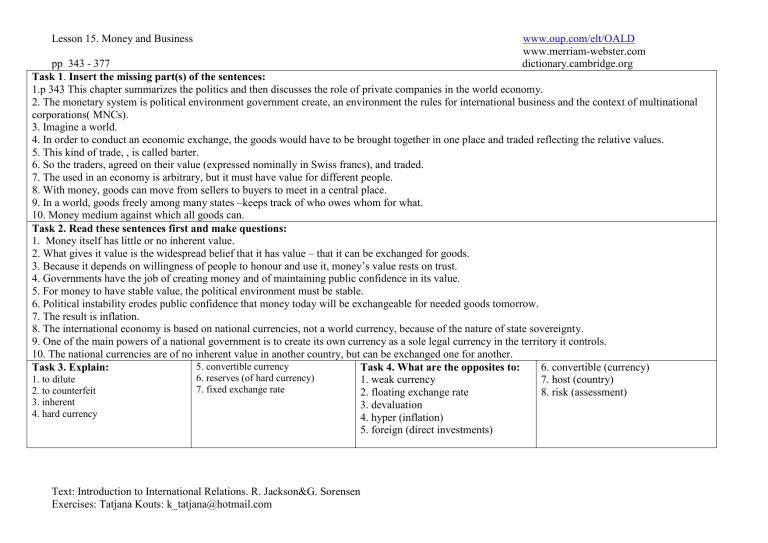

Lesson 15. Money and Business pp 343 - 377 www.oup.com/elt/OALD

www.merriam-webster.com

dictionary.cambridge.org

Task 1 . Insert the missing part(s) of the sentences:

1.p 343 This chapter summarizes the politics and then discusses the role of private companies in the world economy.

2. The monetary system is political environment government create, an environment the rules for international business and the context of multinational corporations( MNCs).

3. Imagine a world.

4. In order to conduct an economic exchange, the goods would have to be brought together in one place and traded reflecting the relative values.

5. This kind of trade, , is called barter.

6. So the traders, agreed on their value (expressed nominally in Swiss francs), and traded.

7. The used in an economy is arbitrary, but it must have value for different people.

8. With money, goods can move from sellers to buyers to meet in a central place.

9. In a world, goods freely among many states –keeps track of who owes whom for what.

10. Money medium against which all goods can.

Task 2. Read these sentences first and make questions:

1. Money itself has little or no inherent value.

2. What gives it value is the widespread belief that it has value – that it can be exchanged for goods.

3. Because it depends on willingness of people to honour and use it, money’s value rests on trust.

4. Governments have the job of creating money and of maintaining public confidence in its value.

5. For money to have stable value, the political environment must be stable.

6. Political instability erodes public confidence that money today will be exchangeable for needed goods tomorrow.

7. The result is inflation.

8. The international economy is based on national currencies, not a world currency, because of the nature of state sovereignty.

9. One of the main powers of a national government is to create its own currency as a sole legal currency in the territory it controls.

10. The national currencies are of no inherent value in another country, but can be exchanged one for another.

Task 3. Explain:

1. to dilute

2. to counterfeit

3. inherent

4. hard currency

5. convertible currency

6. reserves (of hard currency)

7. fixed exchange rate

Task 4. What are the opposites to:

1. weak currency

2. floating exchange rate

3. devaluation

4. hyper (inflation)

6. convertible (currency)

7. host (country)

8. risk (assessment)

5.

foreign (direct investments)

Text: Introduction to International Relations. R. Jackson&G. Sorensen

Exercises: Tatjana Kouts: k_tatjana@hotmail.com

Lesson 15. Money and Business pp 343 - 377 www.oup.com/elt/OALD

www.merriam-webster.com

dictionary.cambridge.org

Task 5. Answer the questions:

How can the value of goods or currencies be judged in a world lacking a central government and a world unit of money: a) traditionally b) over time c) in recent years ?

Task 6 . Match the parts of the sentences:

1. Today, national currencies are valued against each other,

…

.

2. These exchange rates are important because they

…

*only the changes in value over time are meaningful.*

*not against gold or silver.*

3. Thus, the rate for exchanging Danish kroner for Brazilian reals …

4. The relative values of currencies at a given point in time are arbitrary; …

5. However, when the value of yen rises (or falls) relative to dollars,

…

*because yen are considered more (or less) valuable than before, the yen is said to be strong

(or weak).*

*affect almost every international economic transaction – trade, investment, tourism, and so forth.*

*is called hyperinflation.*

6. Extremely high, uncontrolled inflation – more than 50 percent per month, or 13,000 percent per year-

…

*depends on the value of each relative to these world currencies.*

Task 7. Check yourself! Fill in the gaps with a suitable word or phrase without consulting the text:

1. The (1) … happens to be fairly close to the U.S. (2) … in value, whereas the Japanese

(3)

…

is dominated in units closer to the U.S…(4) .

.

*rapidly inflating*

*yen*

2. Some states do not have

…

.

3. The holder of such money has

…

to trade with another currency.

4. In practice, even … can often be sold, in black markets or by dealing directly with the government

…,

but the price may be extremely low.

5. Nobody wants to hold currency that is

…

– losing value relative to goods and services.

6. The

…

West has kept inflation relatively low – mostly below 5 percent annually –

*convertible currencies*

*penny*

*no guarantee of being able*

*issuing the currency*

*industrialized*

*nonconvertible currency* since 1980.

7. The … South has had less success with inflation, although the late 1990s were less

*dollar*

*global**euro* inflationary than previously.

Text: Introduction to International Relations. R. Jackson&G. Sorensen

Exercises: Tatjana Kouts: k_tatjana@hotmail.com

Lesson 15. Money and Business pp 343 - 377 www.oup.com/elt/OALD

www.merriam-webster.com

dictionary.cambridge.org

Task 8. Answer the questions:

1. Which are the major international currency markets? How are they linked?

2. What question are they driven in?

3. What’s the turn over of these international currency markets?

4. Who are these markets owned by?

5. What is a managed float system?

6. How does this system work?

7. What is the ERM?

HOME TASK: Read pages 348 - 350

Explain in written: Why currencies rise or fall?

Make detailed notes.

Text: Introduction to International Relations. R. Jackson&G. Sorensen

Exercises: Tatjana Kouts: k_tatjana@hotmail.com