question 1 - Hatem Masri

advertisement

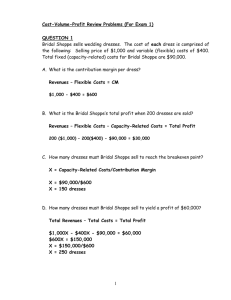

QUESTION 1 Bridal Shoppe sells wedding dresses. The cost of each dress is comprised of the following: Selling price of $1,000 and variable (flexible) costs of $400. Total fixed (capacity-related) costs for Bridal Shoppe are $90,000. A. What is the Bridal Shoppe’s total profit when 200 dresses are sold? Revenues – Flexible Costs – Capacity-Related Costs = Total Profit 200 ($1,000) – 200($400) - $90,000 = $30,000 B. How many dresses must Bridal Shoppe sell to reach the breakeven point? X = Capacity-Related Costs/Contribution Margin X = $90,000/$600 X = 150 dresses C. How many dresses must Bridal Shoppe sell to yield a profit of $60,000? Total Revenues – Total Costs = Total Profit $1,000X - $400X - $90,000 = $60,000 $600X = $150,000 X = $150,000/$600 X = 250 dresses QUESTION 2 Northenscold Company sells several products. Information of average revenue and costs are as follows: Selling price per unit Variable costs per unit: Direct materials Direct manufacturing labor Manufacturing overhead Selling costs Annual fixed costs $20.00 $4.00 $1.60 $0.40 $2.00 $96,000 1. Calculate the number of units Northenscold’s must sell each year to break even. 20X - 8X - 96,000 = 0; X = 8,000 units 1 2. Calculate the number of units Northenscold’s must sell to yield a profit of $144,000. 20X – 8X – 96,000 = $144,000; X = 20,000 units QUESTION 3 Berhannan’s Cellular sells phones for $100. The unit variable cost per phone is $50 plus a selling commission of 10%. Fixed manufacturing costs total $1,250 per month, while fixed selling and administrative costs total $2,500. A. What is the breakeven point in phones? N = Breakeven in phones $100N - $50N - $10N - $1,250 - $2,500 = 0 $40N - $3,750 = 0 N = $3,750 / $40 = 93.75 phones Breakeven Point = 94 phones c. How many phones must be sold to earn a targeted profit of $7,500? N = Phones to be sold $100N - $50N - $10N - $1,250 - $2,500 = $7,500 $40N = $11,250 N = $11,250 / $40 = 281.25 phones To achieve target profit: Must sell 282 phones THE FOLLOWING INFORMATION APPLIES TO QUESTIONS 1 THROUGH 2: Kaiser’s Kraft Korner sells a single product. 7,000 units were sold resulting in $70,000 of sales revenue, $28,000 of variable costs, and $12,000 of fixed costs. 1. Breakeven point in units is: a. 2,000 units b. 3,000 units c. 5,000 units d. None of these answers are correct. $10X – $4X – $12,000 = 0; X = 2,000 units 2. At the breakeven point of 200 units, variable costs total $400 and fixed costs total $600. The 201st unit sold will contribute ___________ to profits. a. $1 b. $2 c. $3 d. $5 $1,000 – $400 – $600 = 0; Sales ($1,000 / 200) – Variable costs ($400 / 200) = $3 CM 2 3. Sales total $200,000 when variable costs total $150,000 and fixed costs total $30,000. The breakeven point in sales dollars is: a. $200,000 b. $120,000 c. $ 40,000 d. $ 30,000 ($200,000 – $150,000) / $200,000 = 25% CM%; $30,000 / 0.25 = $120,000 BE sales 4. What is the breakeven point in units, assuming a product's selling price is $100, fixed costs are $8,000, unit variable costs are $20, and operating income is $32,000? a. 100 units b. 300 units c. 400 units d. 500 units $100N – $20N – $8,000 = 0; $80N = $8,000; N = 100 units 5. If breakeven point is 100 units, each unit sells for $30, and fixed costs are $1,000, then on a graph the: a. total revenue line and the total cost line will intersect at $3,000 of revenue b. total cost line will be zero at zero units sold c. revenue line will start at $1,000 d. All of these answers are correct. 3 Beta Company sells blouses in Washington, USA. Blouses are imported from Pakistan and are sold to customers in Washington at a profit. Salespersons are paid basic salary plus a decent commission on sales made by them. Sales and expense data is given below: Selling price per blouse Variable expenses per blouse: Invoice cost Sales commission Total Annual fixed expenses: Rent Marketing Salaries Total $80.00 ——— $36.00 $14.00 ——— $50.00 ——— $160,000 $300,000 $140,000 ——— $600,000 ——— Required: Compute the number of units to be sold to break-even. Prepare a CVP graph (break-even chart) and show the break-even point on the graph. If the manage is paid a commission of $6 blouse (in addition to the salesperson’s commission), what will be the effect on company’s break-even point? 4. As an alternative to (3) above, company is thinking to pay $6 commission to manager on each blouse sold in excess of break-even point. What will be the effect of these changes on the net operating income or loss of the Beta company if 23,500 blouses are sold in a year? 5. Refer to the original data. What will be the break-even point of the company if commission is entirely eliminated and salaries are increased by $214,000? Should the company make this change? 1. 2. 3. Solution: (1) Calculation of break-even point: Fixed expenses / Contribution margin per unit $600,000 / $30 20,000 units or 20,000 units × $80 = $1,600,000 (2) CVP graph or break-even chart: 4 (3) Break-even point if manager is also paid a commission of $6 per blouse sold: The payment of a commission of $6 to manager will decrease the unit contribution margin and increase the number of units required to sell to break-even. $600,000 / $24 25,000 Units Now the company requires 25000 units or $2,000,000 in sales just to break-even. (4) Effect on net operating income or loss if manager is paid a commission of $6 on each blouse sold after break-even point: Sales (23,500 × $80) $ 1,880,000 Less variable expenses (23,500 × 1,175,000 $50) ———— 705,000 Less manager’s commission 21,000 [(23,500 - 20,000) × 6] ———— 684,000 Fixed expenses 600,000 ———— Net operating income 84,000 ———— (5) Break-even point after elimination of commission and increase in salaries: $814,000 /$44 18,500 units or 18,500 × $80 = $14,80,000 Fixed cost after change: $600,000 + 214,000 = 814,000 Unit contribution margin after change: $80 – $36 = $44 With the new system, Beta company will start making profits after selling $18,500 units but with the old system company needs to sell 20,000 units before making any profit. The change should, therefore, be implemented. 5