The basics of break-even

advertisement

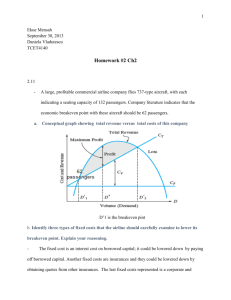

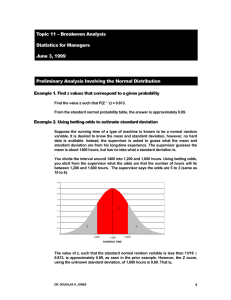

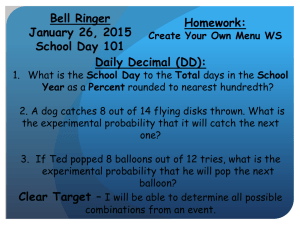

Starter: Fixed and Variable costs Write down 3 fixed and 3 variable costs you can remember Also define the term ‘breakeven’ The basics of break-even There are two types of costs: Variable costs increase by a step every time an extra product is sold (eg cost of ice cream cornets in ice cream shop) Fixed costs have to be paid even if no products are sold (eg rent of ice cream shop) Examples of variable costs Variable costs increase with the amount of production Raw materials Petrol Labour (paid by the hour) Packaging Example of Variable Costs Costs of production One product costs £1 to produce £4 £3 £2 £1 1 2 3 Production level 4 Examples of Fixed Costs Fixed costs remain the same no matter the production level Rent Business rates (tax on businesses) Salary based employee wages Insurance Costs of production Example of Fixed Costs £400 £300 £200 £100 1 2 3 4 Production level Breakeven The point at which a business neither makes a profit or a loss Formula: Fixed costs (Selling price per unit minus variable cost per unit) Why calculate break-even? Tom can hire an ice-cream van for an afternoon at a summer fete. The van hire will be £100 and the cost of cornets, ice cream etc will 50p per ice cream. Tom thinks a sensible selling price will be £1.50. At this price, how many ice-creams must he sell to cover his costs? Calculating this will help Tom to decide if the idea is worthwhile. Applying the formula Fixed costs (Selling price per unit minus variable cost per unit) Tom: £100 (£1.50 – 50p) = 100 Units Fruit Smoothie Breakeven Selling price - £1 Fixed Costs Variable Costs (per cup) Liquidiser - £15 Fruit– 19p Milk– 6p Yoghurt – 13p Cups – 2p Electricity – 5p 1. Complete the breakeven table 2. Draw breakeven chart Correct Answers Fixed costs = £15 Variable costs = 45p Selling price = £1 No. of units to breakeven = 27 cups 900 800 700 Revenue/Cost 600 500 Fixed Costs Variable Costs Margin of safety Total Cost 400 Sales Revenue 300 200 100 0 0 10 20 No. of Garm ents 30 40