Acknowledgements

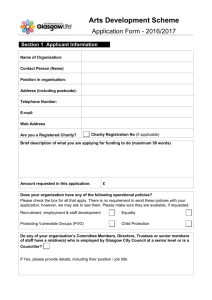

advertisement