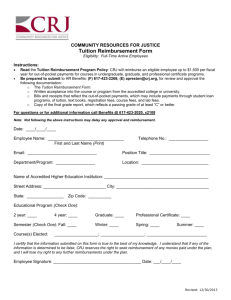

reimbursement account programs

advertisement

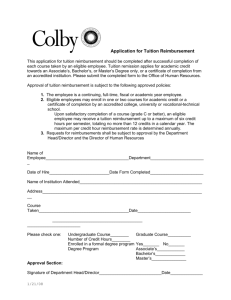

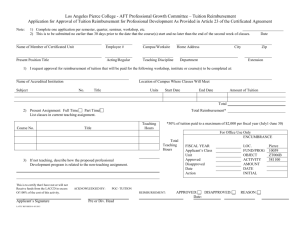

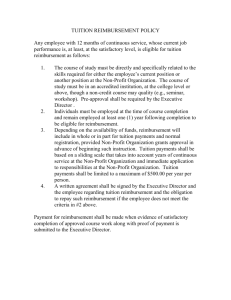

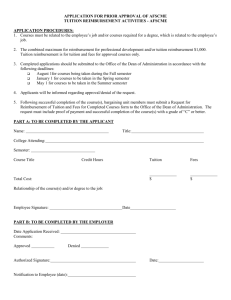

TABLE OF CONTENTS Benefits at a Glance 5 Oxford Freedom Medical Plans EPO Plan – Option #1 90/70 Plan – Option #2 100/70 Plan – Option #3 6 6 6 Cancer Resource Services (CRS) Emergency Room Services Gym Reimbursement Healthy Bonus® Precertification Prescription Drugs Vision 7 7 7 7 7 7 8,9 Health Plan Enrollment Considerations 10 Dental Plans DeltaCare Delta Dental PPO Plus Premier 11 11,12 Domestic Partners 13 The Tax-Free Advantage 14 Changes in Your Family Status 14,15 Income Protection Short Term Disability Workers’ Compensation Long Term Disability 15 15 16 Long Term Care 16 Life and AD&D Insurance Enrollment Considerations 17 MEDEX Travel Assist 18 Dependent Life Insurance 19 Employee Assistance Program (EAP) 19 Reimbursement Account Programs Health Care Flexible Spending Account Dependent and Child Care Flexible Spending Account PayFlex Debit Card FSA Grace Period FSA Enrollment Considerations Commuter Reimbursement Programs eTRAC Commute Debit Card 20,21 21 22 22 22,23 23 23 Retirement Plans Basic Retirement Plan Supplemental Retirement Plan Enrollment Considerations 24 24 25 Educational On-Campus Tuition Remission Off-Campus Tuition Remission Off-Campus Dependent Child Tuition Remission 26 26, 27 27 2 TABLE OF CONTENTS Tuition Exchange Program 28, 29 New York College Savings Program 30 Human Resources Web Page 31 Oxford Freedom Medical Plan Summaries EPO Plan – Option #1 90/70 Plan – Option #2 100/70 Plan – Option #3 32 3 IMPORTANT INFORMATION This publication is intended only as a general overview. Additional coverage information about each plan and/or benefit program is available by contacting the University Benefits office. This publication does not state all of the plans and/or benefit programs’ terms and conditions. In all cases, the plan documents and not this publication will govern the benefits paid. Pace University and its sponsored plan administrators/insurance carriers reserve the right to update this publication as needed. 4 BENEFITS AT A GLANCE Pace University provides you with a very competitive benefit program. The Univerisity is committed to providing a variety of programs and services to include your spouse or domestic partner and dependents. Your benefits at Pace University are designed to provide: Medical and dental insurance for preventive care or diagnostic and surgical procedures Income protection in the event you are not actively at work, due to illness Programs and services that assist you in balancing your work and personal life Financial security upon retirement Educational opportunities for you and your family to pursue a degree at Pace or another higher education institution Your benefits package includes: HEALTH Medical Plan Dental Plan FINANCIAL SECURITY Basic Retirement Plan Supplemental Retirement Plan Post Retirement Benefits (if eligible) INCOME PROTECTION Short Term Disability Salary and Benefit Continuation Long Term Disability Insurance Worker’s Compensation Long-Term Care Life Insurance Dependent Life Insurance EDUCATION On-Campus Tuition Remission Off-Campus Graduate Tuition Reimbursement Off-Campus Dependent Tuition Reimbursement Tuition Exchange Programs New York College Savings Program (529 Plan) WORK/LIFE Employee Assistance Program Health Care Flexible Spending Account Dependent Care Flexible Spending Account Commuter Reimbursement Accounts Academic Federal Credit Union Paid University Holidays Paid Vacation/Personal Days Leaves of Absence Some benefits are fully paid by the University, some are partially subsidized, while some are paid only by the employee. 5 OXFORD HEALTH PLANS, A UNITED HEALTHCARE COMPANY Pace University has consolidated its medical plans under Oxford Health Plans, a United Healthcare Company. The plan design offers Pace full-time faculty and staff the opportunity to select from among three options, all are open access and do not require the selection of a primary care physician (gatekeeper) and permits members to self refer to specialists and services. Oxford Freedom EPO Plan – Option #1 (Oxford Exclusive Plan), which is modeled after the HMO plans, offers access to Oxford’s Freedom network (tri-state area) as well as United Healthcare Choice Plus (nationally), an excellent selection of providers and facilities, but restricts all services to the network. This plan includes coverage for preventative services and wellness programming, including an annual $400 allowance for a health club membership for the employee. Oxford Freedom 90/70 Plan – Option #2 (Freedom Plan Direct) introduces a deductible and coinsurance limit for hospitalization (inpatient and outpatient) and other services (e.g., outpatient procedures) but maintains a reasonable co-pay for office, specialist, and pharmacy services by In-Network providers. The In-Network deductible is $250 per member (up to a maximum of $500 for family contracts). This option has a 10% coinsurance, for In-Network services, but is capped at an annout out-of-pocket maximum of $750 per individual and $1,500 for family contracts. The coinsurance for In-Network will always be based on the significantly discounted and negotiated rates established between Oxford Health Plans and the provider/facility. The savings are passed on to the member immediately. There is also a deductible ($500 individual, $1,000 family) and coinsurance (30%) for Out-of-Network services. Oxford Freedom 100/70 Plan – Option #3 (Freedom Plan Access) offers, in most cases, a reasonable co-pay for office and specialist visits. In general, there is no deductible or coinsurance for In-Network services. There is a deductible ($300 individual, $600 family) and coinsurance (30%) for Out-of-Network services. In all cases, the emergency room co-pay is introduced to discourage unnecessary use and is waived if hospital admission is required. Oxford Freedom 90/70 Plan – Option #2 and Oxford Freedom 100/70 Plan – Option #3 are Point of Service (POS) plans that offer access to Oxford’s Freedom network (tri-state) area as well as United Healthcare Choice Plus (nationally) and offer coverage for services performed outside of these networks. The member decides where he/she will receive care. In-Network benefits include coverage for preventative services and wellness programming, including an annual $400 allowance for a health club membership for the employee. It should be noted that for all three plans, students who are covered under the employee’s plan are covered until the end of the calendar year in which they lose their student status up to the age of 25. For example, if a student graduates in May at age 23, he/she is covered for the remainder of that calendar year. This benefit affords additional coverage for the dependent student before the dependent needs to obtain his/her own coverage or enroll in COBRA coverage. 6 OXFORD HEALTH PLANS, A UNITED HEALTHCARE COMPANY All of the plans listed above offer the following features: Cancer Resource Services (CRS) If a member has been diagnosed with cancer and is interested in receiving care from a CRS participating facility, he/she must register with Cancer Resource Services in advance of treatment. Members may call 1-866-936-6002 to register. Registration will ensure that services performed at centers such as Memorial SloanKettering will be treated as In-Network. Please visit www.urncrs.com for general information. Emergency Room Services The member is responsible for a $75 Emergency Room co-payment. The co-payment is waived if the member is admitted to the hospital through the Emergency Room. If the Emergency Room visit results in a hospital admission, the member must notify Oxford’s Customer Service Department, at 1-800-444-6222, within 48 hours of the admission. Gym Reimbursement Members are eligible for up to $200 per 6-month period; $100 reimbursement for enrolled spouse/domestic partner; Must complete a minimum of 50 visits per 6-month period; Reimbursement form is available on the Human Resources web page (www.pace.edu/hr) under Forms > Medical. Healthy Bonus® A preventative program offering members access to discounts and special offers on health-related products and services. Offers include weight loss, nutrition, wellness and important health issues such as pediatric nutrition and condition management (diabetes and asthma). Precertification Precertification is required for all planned in-patient hospitalizations and professional services and all out-patient procedures performed at hospital out-patient departments, ambulatory surgical facilities, and freestanding facilities. Precertification is also required for major diagnostic tests, such as CT Scans, Magnetic Resonance Imaging (MRI), Magnetic Resonance Angiography (MRA), Positron Emission Tomography (PET), and nuclear medicine studies. For In-Network covered services, the member’s participating provider must obtain the necessary precertification directly from Oxford Health Plans. When a member seeks care Out-of-Network, he/she is responsible for obtaining any necessary precertification. Members who do not receive precertification for services received Outof-Network will be obligated to pay for all charges, or may be subject to a reduction in coverage, depending on their plan. Self-referrals and pre-authorizations are not the same. Prescription Drugs Oxford Health Plans contracts with a pharmacy benefit manager, Medco Health Solutions, to help administer retail and mail-order pharmacy services. There is a three-tier structure for prescription drug coverage under all Oxford Health Plans. When members visit a participating pharmacy for covered prescriptions, they will be responsible for a co-pay of $10, $25, or $50 for Tier 1 (generic), Tier 2 (preferred brand), and Tier 3 (non-preferred brand) drugs respectively. Effective July 1, 2008, members will be utilizing Oxford’s Traditional Formulary. They may visit the Oxford Health Plan web site, at www.oxhp.com, to view, by tier, the current prescription drug list by selecting “Traditional Prescription Drug List”. Members are able to purchase prescriptions through the mail-order program, Medco by Mail. If a prescription is eligible for mail-order purchase, a member will pay only 2 co-payments (e.g., 2X) for a 90-day supply. For futher information, please contact Medco Health Solutions at 1-800-905-0201. 7 OXFORD HEALTH PLANS, A UNITED HEALTHCARE COMPANY Effective July 1, 2008 Pace University will be offering a comprehensive vision plan through United HealthCare Specialty Benefits (formerly known as Spectera) . Vision services will no longer be covered under the Oxford medical plans. All employees enrolled in the Oxford medical plans will be enrolled into the United HealthCare Vision program according to your Oxford medical plan election. Employees and their dependents are entitled to the following vision services: Eye Examination: Includes a comprehensive eye exam, covered in full (after $10 co-payment). Spectacle Lenses: Includes a pair of clear, single vision, lined bifocal or lined trifocal lenses, covered in full (after $20 copayment), as well as standard scratch-resistant coating. Frame Benefit: Applies to most frames on the market today, many of which are covered in full, (after $20 co-payment). Contact Lens Benefit: Includes contact fitting/evaluation fee and contact lenses (including many of the most popular brands on the market), as well as disposables (depending on prescription and plan) and up to two follow up visits – covered in full (Note: When electing contact lenses outside of covered-in-full selection, such as toric, gas permeable and bifocal contacts, an allowance is provided and material co-pay does not apply). Access to Discounted Laser Vision Correction Procedures: Partner with the Laser Vision Network of America (LVNA) for discounted laser vision correction procedures. Enables members to access a NCQA-credentialed surgeon from a national network of 400 laser vision correction providers. Out-of-Network Reimbursement: Reimburse services rendered outside our network, up to the plan maximum allowance schedule National Network: Access to more than 27,000 providers in private practice or retail chains Partner with more than 75 national retail chains through the country Provide access to a diverse network of providers with day, evening and weekend appointments Able to perform targeted provider recruiting, if needed, to ensure adequate access Require participating providers to meet or exceed established quality and licensing standards. For a full list of participating providers, visit their website at www.uhcspecialtybenefits.com For further information, please contact the Oxford Member Services department at 1-800-444-6222. 8 OXFORD HEALTH PLANS, A UNITED HEALTHCARE COMPANY Vision Plan Summary Benefit Type UnitedHealthCare Specialty Benefits Plan Frequency Examination Lenses Frames Contacts (In lieu of eyeglass lenses & frame Member Provider Coverage once every 12 months once every 12 months once every 24 months once every 12 months Exam Copay (eyeglass exam) Lenses (uncoated plastics) Single Bifocal Trifocal Lenticular Material Copay (lens and/or frame) Frame wholesale allowance $10 copay Paid in full after copay Paid in full after copay Paid in full after copay Paid in full after copay $20 copay Up to $50 wholesale Up to $130 retail value Elective Contact Lenses (contacts in lieu of eyeglass lenses & frame) Medically Necessary Contacts Non-Member Provider Coverage Exam Lenses Single Bifocal Trifocal Lenticular Frames Elective Contact Lenses Medically Necessary Contacts Retail Chains included in network? Fully Covered Frames? Fully Covered Contacts? Provider Locations Centralized or Independent Lab Discount Services Through Company Providers (least expensive option within respective category) Oversize Lenses (For Lenses > 61MM) Fashion and gradient tinting Glass-Grey #3 Prescription Sunglasses Laser Vision Correction Standard Progressive lens Premium Progressive lens Photochromatic lens Scratch Resistant Coating Standard Anti-Reflective Coating Premium Anti-Reflective Coating Hi-Index lenses (1.60 spherical) Polarized lenses Polycarbonate lenses Plastic Photo-Sensitive Lenses Ultraviolet Coating Up to $125 reimbursement Up to $210 reimbursement Up to $40 reimbursement Up to $40 reimbursement Up to $60 reimbursement Up to $80 reimbursement Up to $80 reimbursement Up to $90 reimbursement Up to $125 reimbursement Up to $210 reimbursement Major Retail Chain Network Providers include EyeMasters, Wal-Mart, Sterling Optical, and Sam's Club Up to Allowance Up to Allowance National Centralized Up to $10 reimbursement Up to $15 reimbursement Up to $30 reimbursement Discount of 15% Up to $70 reimbursement Up to $110 reimbursement Up to $65 reimbursement Included Up to $40 reimbursement Up to $80 reimbursement Up to $40 Single Vision/$60 Multi-focal reimbursement Up to $45 Single Vision/$69 Multi-focal reimbursement Up to $25 Single Vision/$30 Multi-focal reimbursement Up to $50 Single Vision/ $65 Multi-focal reimbursement Up to $18 reimbursement 9 HEALTH PLAN ENROLLMENT CONSIDERATIONS Your elections for your medical plan will remain in effect until June 30, 2009, unless there is a qualifying change in your family status. See “Changes in Family Status” in this publication for further information. You can select from three coverage levels: ‘individual’, ‘employee + one’ or ‘family’ for your medical and/or dental plans. Domestic partners and the partner’s natural or legally adopted children can be enrolled in the medical and/or dental plans once the “Statement of Domestic Partnership” is completed and approved. All contributions for additional medical and dental coverage for a domestic partner and the partner’s dependent children will be deducted on an after-tax basis. See “Domestic Partners” in this publication for further information. You can add dependents to or drop dependents from your coverage whenever you have a qualifying change in your family status. See “Changes in Family Status” in this publication for further information. If your spouse or domestic partner has medical or dental coverage under his or her employer's plan, you should consider that coverage as you decide on your medical and/or dental coverage through Pace University. For the medical or dental plan, dependent children are covered through age 19. For medical coverage only, students who are covered under the employee’s plan are covered until the end of the calendar year in which they lose their student status up to the age of 25. For dental, coverage will continue for dependent children with full time student status at a higher education institution until the end of the month in which they turn age 23. 10 DENTAL PLANS Pace University offers dental coverage with our provider Delta Dental. You will have a choice between two (2) plans for dental coverage, DeltaCare USA or Delta Dental PPO Plus Premier. DeltaCare USA The DeltaCare USA plan works very much like a Health Maintenance Organization in that you must select a primary care dentist from a list of participating network dentists in order to be enrolled and receive coverage. If you see your primary care dentist (or a network dental specialist referred by your primary care dentist), no deductible is required. Co-payments will generally apply only to major services provided and no claim forms need to be filed by you. The co-payment schedule(s) are available at our website, www.pace.edu/hr or at the Human Resources/Benefits office. DeltaCare USA is offered in the states of New York and New Jersey only. SUMMARY OF COVERAGE Preventive 100% Basic Restorative 100% Major Restorative Fixed co-pay Orthodontia (one course of treatment per Fixed co-pay individual) Annual Maximum Unlimited (excluding orthodontia) For an updated list of participating providers, please review their website at www.deltadentalins.com. You can contact DeltaCare USA in New York at 1-800-422-4234 or in New Jersey at 1-800-722-3524. Please refer to the plan document for more specific details about the benefits provided. DeltaCare USA will issue members an identification card. Delta Dental PPO Plus Premier Employees may choose a participating dentist from the Delta Dental Premier or Delta Dental PPO programs. The Delta Dental Premier program has Delta Dental’s largest dentist network, paying the higher amount per procedure of the two programs. The Delta Dental PPO network is smaller and the dentists agree to accept less per dental service. Your participation in the Delta Dental PPO Plus Premier program provides you with the flexibility to choose dentists within the network (Delta Dental PPO) or out-of-network (Delta Dental Premier and Non-Participating). Your choice of dentist can determine your cost savings. Here is an example of how the Delta Dental PPO Plus Premier works: PPO Premier Non-Participating Example Fee Charged $120 $120 $120 Sample MPA Allowance $80 $90 $100 % of Allowance Paid by Delta Dental 90% 80% 80% Delta Dental Pays $72 $72 $80 Patient Pays $8 $18 $40 *Assumes dental service is Basic Restorative. As you can see from this example, your out of pocket expenses can be reduced by your choice of dentist. 11 DENTAL PLANS Delta Dental PPO Plus Premier Brochure (pdf) Annual Benefit Maximum There is a $2,000 annual benefit maximum per person for in-network (Delta Dental PPO only) or $1,500 for outof-network (Delta Dental Premier and Non-Participating). For example, if you use an out-of-network dentist and meet the $1,500 annual benefit maximum, you can then switch to an in-network provider and receive an additional $500 toward your annual benefit maximum. At no time does the annual benefit maximum exceed $2,000. Dental Plan Summary Benefit DIAGNOSTIC PREVENTIVE BASIC RESTORATIVE ORAL SURGERY ENDODONTICS Delta Dental PPO Paid by Delta Paid by Patient 100% 0% 100% 0% 90% 10% 90% 10% 90% 10% Delta Premier and Non-Participating Paid by Delta Paid by Patient 100% 0% 100% 0% 80% 20% 80% 20% 80% 20% PERIODONTICS 90% 10% 80% 20% MAJOR RESTORATIVE PROSTHODONTICS ORTHODONTICS TEMPOROMANDIBULAR JOINT DYSFUNCTION 60% 60% 60% 40% 40% 40% 50% 50% 50% 50% 50% 50% 50% 50% 50% 50% For an updated list of participating providers, please review their website at www.deltadentalins.com. In addition, you can contact Delta Dental at 1- 800-932-0783. Please refer to the plan document for more specific details about the benefits provided. Identification Card An ID card is included in the Delta Dental brochure that is provided during the Benefits orientation. Please contact the University Benefits office if you would like a copy of the brochure. 12 DOMESTIC PARTNERS Pace University’s benefits coverage will be extended to same sex and opposite sex domestic partners of our faculty and staff. Benefits for domestic partners will be administered in the same manner, as possible, to the benefits for legally married couples. The following details the procedure and eligibility criteria for enrollment of domestic partners in the University’s benefit programs. Registration: To establish the eligibility for University benefits of a same sex or opposite sex domestic partner, an affidavit titled “Statement of Domestic Partnership,”must be completed by the employee and domestic partner, accompanied with supporting documentation of financial interdependence and common residence for the past two calendar years. Copies of this affidavit are available at the Human Resources website, www.pace.edu/hr or at your campus Human Resources office. Benefits Eligibility: Once the “Statement of Domestic Partnership” is completed and approved, the employee’s domestic partner and the partner’s natural or legally adopted dependent children become eligible to apply for University benefits. You have 31 days from the date of registration to enroll the domestic partner and the domestic partner’s dependent children in the medical and/or dental plans. If you choose not to enroll during these 31 days, you will need to wait until the next open enrollment period. Please see “Changes in Family Status” for other benefit enrollment considerations outside the open enrollment period. Medical/Dental Plan: As a full-time employee, you may elect to add a domestic partner and/or dependent children of a domestic partner under the “employee plus one” or “family” coverage option of our medical and dental plans. Tuition Remission: The same eligibility rules that apply to all employees’ spouses and children will apply to registered domestic partners and their natural and adopted children. Applications for on-campus or off-campus tuition remission benefits may be made as soon as the “Statement of Domestic Partnership” is completed and approved for benefit coverage. Other Benefits: Employees who are not married may name anyone as a beneficiary on life insurance or retirement plans. It is not necessary to register a domestic partner to name that person as beneficiary. Eligible employees who retire and have sufficient age and years of service, according to policy, to retain medical coverage in retirement, may also retain medical coverage for a registered domestic partner, in the same manner that such coverage is made available to spouses of retiring employees. Pace University policy language regarding leaves of absence to care for newborn and/or adopted Children or ill family members, or for purposes of death in a family will be extended to include domestic partners and children of domestic partners. Tax Implications: The Internal Revenue Code does not recognize the tax exemption of benefits extended to domestic partners, as such, there will be certain tax consequences to the employee who enrolls a domestic partner. An employee’s contributions for medical and/or dental coverage of a domestic partner and that person’s dependent children will be deducted from pay on an after-tax basis. In the case of tuition remission for domestic partners and their children, the value of the tuition will be treated as ‘imputed’ or direct income to the employee and taxes will be withheld based on that additional income. Medical and dependent care expenses for a domestic partner and/or children of a domestic partner cannot be reimbursed through an FSA. 13 THE TAX-FREE ADVANTAGE Your share of the cost of medical coverage and dental coverage is withheld from your paycheck with pre-tax dollars before federal, state and social security taxes are taken out. Your contributions to the Flexible Spending and Commuter Reimbursement Accounts are also made on a tax-free basis. Here is an example to show how pre-tax contributions and enrolling in a Flexible Spending and Commuter Reimbursement Account can help you save on taxes. Let us assume the following: Employee Elections Oxford 90/70 Plan, Family Delta PPO, Family Total Medical and Dental Premiums Annual Employee Cost * $6,924.00 1,650.00 $8,574.00 Employee Expenses Annual Medical Expenses Annual Child Care Expenses Annual Metro Card Expenses Total Employee Expenses 2,000.00 1,500.00 1,008.00 $4,508.00 Annual Salary: $55,000 Tax Bracket**: 25% Tax-Free Tax Free With FSA Without FSA Annual Pay $55,000 $55,000 Total Medical and Dental Premiums 8,574 8,574 Medical and Dependent Care FSA 3,500 0 Commuter Reimbursement 1,008 0 Taxable Income 41,918 46,426 Federal Income Tax 10,480 11,607 Social Security Tax 3,206 3,552 After-tax Expense 0 4,508 Take-Home Pay $28,232 $26,759 Tax Free Savings from FSA $1,473 Total Tax Free Savings $4,272 After-Tax $55,000 0 0 0 55,000 13,750 4,208 13,082 $23,960 * Based upon Medical plan and dental plan premium rates effective July 1, 2008. ** If state taxes were included in this example, your tax savings would be even greater. CHANGES IN YOUR FAMILY STATUS Once you enroll in our medical and/or dental plans, the IRS does not allow you to make a change to the plan and coverage level during the calendar year, except during open enrollment. The IRS will only allow you to make a change to your coverage level during a calendar year if there is a qualifying change in your family status. The following are acceptable changes: Gaining or losing a dependent through marriage, divorce, birth, adoption or death; Ineligibility of a dependent child for coverage due to age restrictions (19 or 25 with full time student status); Change in spousal/domestic partner employment status. 14 CHANGES IN YOUR FAMILY STATUS For example, if you do not initially enroll your 5-year-old child in the medical plan, you would not be able to enroll this 5-year-old child upon the birth of another child. An employee has 31 days, from the date of the event, to complete enrollment forms to change his/her coverage level relevant to the qualifying event. Please contact your Human Resources/Benefits office within 31 days of the qualifying event in order to complete the appropriate change forms. If an employee waits longer than 31 days, he/she will need to make the changes at the next annual Open Enrollment. INCOME PROTECTION Pace University hopes our employees will stay healthy. It is important to know what benefits Pace University provides to protect your income and your family in the event that you are not actively at work due to illness or injury or you become deceased. Short Term Disability The University provides you with short-term disability insurance and supplements New York State disability to provide salary and benefit continuation in the event you are unable to perform the duties of your job because of illness, injury or pregnancy. Your short-term disability begins on the eighth calendar day, including weekends and holidays, following the onset of illness or injury. Pace University’s short term disability insurance and process is managed by UNUM. The carrier is responsible for administering claims, and managing the medical case with a focus on expediting your successful and healthy return to work. Pace University not only pays for the full cost of this coverage but also provides salary and benefits continuation to our full time employees as indicated below: Length of full time service at time of disability Less than 3 months 3-12 months 12 months and over Salary and Benefits continuation No salary or benefits continuation First two (2) months – full base salary Up to four (4) additional months – one-half salary Full base salary and benefits up to 26 weeks If you are ill or injured for eight or more consecutive days, you, someone representing you, or your supervisor, may contact UNUM at 1-888-673-9940 to initiate your claim and ensure salary and benefits continuation, during your disability leave. Pace’s STD Policy # is 903560. Workers’ Compensation Workers’ compensation is insurance that provides cash benefits and/or medical care for workers who are injured or become ill as a direct result of their job. Pace University contributes fully towards this benefit. Weekly cash benefits and medical care are paid by Pace’s University’s insurance carrier, the State Insurance Fund, as directed by the New York State Workers’ Compensation Board. The Workers’ Compensation Board is a state agency that processes the claims and determines, through a judicial proceeding, whether the claim is justified and how much will be awarded. Pace University provides salary and benefit continuation according to the same schedule noted under Short Term Disability. It is important that you or someone else report any injury on the job within 24 hours to your campus Security Office. It is equally important that your supervisor or department head be advised of the incident. Responsibility for claiming compensation is on the injured employee. All incidents are to be reported no matter how minor they appear to be. The Security Office then must immediately complete an Incident Report and investigate the incident. The University can refuse to compensate an employee if the incident is not reported in a timely manner. 15 INCOME PROTECTION Long Term Disability The University also provides an insurance benefit to assist employees who are disabled more than 26 weeks. UNUM also administers our long-term disability benefit. As a result of a combined managed disability program with one carrier, the transition from short-term disability to long-term disability will be seamless to the employee. If approved for long-term disability, employees are entitled to the following benefits covered by this insurance: Income of up to 60% of your current base salary, not to exceed $7,500.00 per month. This replacement income will be offset by income provided by Social Security Disability, Worker’s Compensation and/or any other income source available to you. Continued retirement contributions on your behalf, for the duration of your disability. Continued life insurance coverage if approved by the life insurance carrier Pace University provides the following additional benefits to supplement this insurance: Continued medical coverage while on Long Term Disability On-campus tuition remission for you, your spouse and dependent children up to age 30, if you have been employed full time for at least 5 years as of your date of disability. Ability to participate in the group dental plan for a maximum of 42 months. Continued Pace University e-mail account. LONG TERM CARE Pace University offers a group long term care plan to all full time faculty and staff. Some benefits of this group long term plan include: Flexibility to purchase a plan that is tailored to best fit your needs and the needs of eligible family members including spouses/domestic partners, parents, children, siblings and grandparents; Lower group-rated premiums as compared to premiums for individual long term care policies; Convenient payroll deductions for employee and spousal coverage; Full portability upon separation or retirement from Pace University. Enrollment in the Long Term Care insurance program continues on a rolling basis. However, if you enroll during the first 31 days of employment, the medical questionnaire that is required to be completed will be waived for most Long Term Care Plans. If you would like an enrollment package for the long term care program at any time during the year, please visit the website at http://w3.unumprovident.com/enroll/pace . 16 LIFE AND AD&D INSURANCE The University provides you with basic life and accidental death and dismemberment (AD&D) insurance coverage equal to one times your base salary (up to $100,000), at no cost to you. . You may choose additional life insurance and AD&D coverage equal to another one, two or three time your base salary. The combined life insurance maximum for basic and supplemental coverage is $750,000. Evidence of health is required when increasing your life insurance by more than one level. The Standard Life Insurance Company of New York is the carrier for this coverage. The cost of supplemental life and AD&D insurance coverage will be based on age-related rates, according to the following schedule effective through June 30, 2010: Age Under 30 30 to 34 35 to 39 40 to 44 45 to 49 50 to 54 55 to 59 60 to 64 65 to 69 70 to 74 75 to 79 80 to 84 85 to 99 $0.10 $0.11 $0.12 $0.17 $0.29 $0.48 $0.73 $0.83 $1.45 $2.43 $4.10 $6.28 $9.92 1. Evidence of insurability is required for anyone who increases more than one level; 2. Supplemental insurance only is subject to the following age reduction schedule: a. Total supplemental life insurance value decreases to 67% for an employee who is ages 70-74.9. b. Total supplemental life insurance value decreases to 50% for an employee who is age 75 and over. Example: Base Salary: $50,000 Age: 34 Elect: 1X Life Insurance Monthly Cost: $11.00 Total Life Insurance: $100,000 ($50,000 basic and $50,000 supplemental) Enrollment Considerations You should consider other sources of income your beneficiary would have at your death. These may include other life insurance policies, the retirement plan and any other assets you have. Please keep in mind that the cost of group term life insurance, inclusive of basic and supplemental life insurance, in excess of $50,000 is includable as income and subject to Social Security and Medicare taxes. The IRS defines an age-related table to impute the value of this benefit. Contact the Payroll Office (x22898) for additional details or refer to IRS Pub. 525, Taxable and Non-Taxable Income. Evidence of good health is needed to choose one or more additional levels of life. Please contact the Human Resources/Benefits Office for the necessary forms. Any increase in your life insurance will be effective on the first day of the month following the approval from the carrier, The Standard Life Insurance Company of New York. You may name one or more beneficiaries to your life insurance. If you do not name a beneficiary, benefits will be paid to your estate. You should review your beneficiary designations from time to time to make sure they are current. 17 MEDEX TRAVEL ASSIST MEDEX Travel Assist is a comprehensive program of information, referral, assistance, transportation and evacuation services designed to help you respond to medical care situations and many other emergencies that may arise during travel. MEDEX Travel Assist also offers pre-travel assistance, which gives you access to information on things like passport and visa requirements, foreign currency and worldwide weather. Covered Services These worldwide assistance services are available to you and eligible family members whenever you travel 100 miles or more from home or internationally for trips of up to 90 days. Pre-trip Assistance Medical Assistance Services • Consulate and embassy locations • Currency exchange information • Health hazards advice and inoculation requirements • Passport and visa information • Weather information • Travel locator service • Locating medical care • Case communications • Translation/interpreter services • Hotel convalescence arrangements • Medical insurance assistance • Prescription drug assistance Emergency Transportation Services • Emergency credit card/ticket replacement • Emergency passport/document replacement • Emergency message service • Missing baggage assistance • Locating legal services • Bail bond services • Emergency evacuation • Medically necessary repatriation • Family/friend travel arrangements • Return of dependent children • Vehicle return Travel Assistance Services MEDEX Travel Assist also provides real-time security intelligence and security evacuation services in the event of a threatening situation. For MEDEX Travel Assist emergency medical, legal and travel assistance information and referral service 24hours a day, 365 days a year, call (800) 527-0218 in the U.S., Canada, Puerto Rico, U.S. Virgin Islands, and Bermuda. In other locations worldwide, call collect (410)453-6330 Worldwide: All covered services must be arranged by MEDEX Assistance Corporation. 18 DEPENDENT LIFE INSURANCE Pace University offers a voluntary life insurance benefit to cover a spouse/domestic partner and dependent children for the following coverage: 1. Spouse - $10,000 2. Children ages 14 days to 1 year old - $500 3. Children ages 1 to 19 (23 if full time student) - $5,000. The monthly cost for this coverage would be $3.26/family unit or $1.63/paycheck. The rate is the same if there is only one spouse/domestic partner or there is a spouse/domestic partner plus eligible children. Medical evidence of insurability is waived if you enroll in this benefit during the first 31 days of your full-time employment. It is required thereafter if you elect this coverage during subsequent Open Enrollments. The enrollment form for this benefit can be found at our website, www.pace.edu/hr , by following the link to Forms. EMPLOYEE ASSISTANCE PROGRAM (EAP) The Employee Assistance Program (EAP), with United Behavioral Health, provides confidential support for everyday challenges and for more serious problems. The University absorbs the entire cost of this program. An employee may be struggling with stress at work, seeking financial or legal advice, or coping with the death of a loved one. The EAP offers assistance and support for these concerns and more: Depression, anxiety, and stress Substance abuse Workplace problems or conflicts Parenting and family issues Child and elder care There is no charge for referrals or for seeing a clinician in the United Behavioral Health network. There is no cost for the initial consultation with financial/legal experts or mediators. Subsequent legal assistance is available at a 25% discount. Any member of your household may access these online services, including dependents living away from home. You can reach United Behavioral Health 24 hours a day 365 days a year at 1-866-248-4096. You can also get information on-line at www.liveandworkwell.com . Our access code is 61530. 19 REIMBURSEMENT ACCOUNT PROGRAMS The Pace University Reimbursement Account programs provide you with the opportunity to set aside, on a pretax basis, a pre-determined dollar amount to reimburse yourself for eligible expenses. There are two types of Reimbursement Accounts: 1. Flexible Spending Accounts for medical/dental and/or dependent daycare expenses 2. Commuter Reimbursement Accounts for mass transit and/or parking expenses Flexible Spending Accounts (FSA) Effective July 1, 2008, PayFlex will be Pace University’s new administrator for Health and Child/ Dependent Care FSA. This change comes as a result of service issues during the transition of our prior vendor’s (BeniSource) acquisition by CBIZ. This change in administration will allow for many enhancements to provide you with more convenient access to managing your flexible spending accounts. Some of these enhancements include online claims submission, personalized customer service and a fully integrated website offering, accessed through www.mypayflex.com . The Health Care FSA will reimburse you with ‘tax-free dollars” savings for unreimbursed medical and dental expenses (i.e., medical co-payments, prescription co-payments) and you may contribute up to a maximum of $8,000 for this plan year from July 1, 2008 through June 30, 2009. Through the Child and Dependent Care FSA you can set aside savings with the same ‘tax-free’ advantage to reimburse yourself for day care expenses incurred for your dependent children under age 13 or other qualified dependents. You can contribute a maximum of $5,000 to the Child and Dependent Care FSA ($2,500 if you and your spouse enroll in separate FSAs) for this plan year from July 1, 2008 through June 30, 2009. You will actually save 25% to 40% on qualified purchases when you use your flex account dollars. This is because the money in your flex account goes in as pre-tax dollars, and this money is never taxed. Your savings are based upon the amount of tax you would have paid on those dollars had you not put them into a Flexible Spending Account. We have included the Tax Free Advantage to illustrate the tax savings by enrolling in a Flexible Spending Account. The minimum contribution for each FSA is $200 for this plan year. If you choose not to enroll in the FSA for this plan year, you will not have another opportunity to enroll in the Flexible Spending Account program until the following plan year beginning July 1, 2009. Health Care Flexible Spending Account This account will reimburse you with “tax-free dollars” for unreimbursed medical and dental expenses (i.e. medical co-payments, prescription co-payments) incurred by you, your spouse or your dependent. You may elect to contribute up to a maximum of $8,000 to the Health Care FSA for this plan year from July 1, 2008 through June 30, 2009. The minimum annual contribution is $200. Examples of Eligible Medical and Dental Expenses: Copayments, deductibles and coinsurance Expenses that exceed usual, reasonable and customary (UCR) limits Vision or hearing expenses not covered by your plan Unreimbursed expenses for mental health care Unreimbursed chiropractic expenses Over the counter medicines and drugs Any other expense that would qualify as a medical expense deduction for federal income tax purposes Examples of Expenses that do NOT Qualify for Reimbursement: Health or Dental plan premiums (including COBRA) 20 REIMBURSEMENT ACCOUNT PROGRAMS Health club dues Cosmetic surgery that is not medically necessary Long-Term Care insurance premiums Expenses for domestic partner or children of domestic partner Any other expense that would NOT qualify as a medical expense deduction for federal income tax purposes You can obtain a complete list of eligible expenses in IRS Publication 502-Medical and Dental Expenses. This publication is available at your local IRS office or on the IRS website, www.irs.ustreas.gov/. Dependent and Child Care Flexible Spending Account This account will reimburse you with “tax-free dollars” for day care expenses incurred for your dependent child under age 13 while you and your spouse (if married) are at work. Day care expenses incurred for dependents age 13 or over are considered eligible only if the dependent is physically or mentally disabled, spends at least eight hours a day in your home and depends on you for at least half of his or her support. To be eligible, the child, spouse or parent must be a dependent you claim on your federal tax return. You may elect to contribute up to a maximum of $5,000 to the Dependent Care FSA for for this plan year from July 1, 2008 through June 30, 2009. The maximum is $2,500 if you and your spouse each establish a Dependent and Child Care flexible spending account. The minimum annual contribution is $200. Examples of Eligible Dependent Care Expenses: Payments for dependent care services provided in the home. The services cannot be provided by someone you also claim as a dependent, or by your child under age 19, whether or not a dependent. Pre-school or nursery school tuition (below first grade) Day camp After-school programs Child care centers Examples of Dependent Care Expenses that are NOT Eligible: Education expenses for the first grade or higher Payments to a care giver while at home sick from work Round-the-clock nursing home care Overnight camp Transportation to and from a care site If you use the services of a dependent care center that provides care for at least six individuals, the center must be in compliance with state and local laws. You can obtain a complete list of eligible expenses in IRS Publication 503-Child and Dependent Care Expenses. This publication is available at your local IRS office or on the IRS website, www.irs.ustreas.gov/. 21 REIMBURSEMENT ACCOUNT PROGRAMS PAYFLEX FSA DEBIT CARD Pace University is offering the PayFlex debit card to help you save time and money. PayFlex, Pace University’s new FSA vendor, issues their own proprietary branded MasterCard debit card which has the capability for its payment processing system to work with participating IIAS (i.e., Inventory Information Approval System) merchants to electronically substantiate over-the-counter flexible spending account (FSA) eligible items. This service has already been implemented at many of the nation’s leading drugstore chains. When purchasing prescriptions and/or over-the-counter (OTC) FSA-eligible items, new special coding along with PayFlex’s proprietary payment technology, will only allow eligible FSA items to be purchased at the point of sale. This new technology should reduce the need for substantiation. Non-eligible items are not allowed to be purchased using the PayFlex Card. Although the merchant will be paid directly from the funds in your FSA, YOU STILL MUST KEEP ITEMIZED MERCHANT RECEIPTS AND PayFlex Debit card receipts for purchases made using your debit card. PayFlex may audit, as required by the IRS, and notify you directly via your Pace e-mail account if these receipts are requested. You have 31 days in order to submit receipts to substantiate the charges that are in question and to avoid suspension of your PayFlex Debit card privileges. It is customary for PayFlex to request receipts that do not match our current medical co-payment design, or for purchases that are made at retailers that offer convenience products or services other than pharmaceutical. FSA GRACE PERIOD Pace University has implemented a 2 ½ month grace period to allow participants who enroll in the HealthCare Flexible Spending Program for the July 1, 2008 - June 30, 2009 plan year to incur eligible expenses following the end of the plan year (i.e., June 30, 2009). This means that participants may continue to incur expenses through September 15, 2009. All reimbursements must be submitted by September 30, 2009. We have provided an example to explain how this change will impact you: John Smith has $100 remaining in his health care FSA as of June 30, 2008. He incurs $120 expense for medical procedures on August 12, 2008. Prior to the Grace Period: John would have forfeited the $100. Implementation of Grace Period through September 15, 2008: John can submit a claim for the $100 which will be reimbursed vs. his $100 remaining account balance for the current plan year, ending on June 30, 2008 and apply the $20 toward the new 2008-2009 balance. FSA Enrollment Considerations If you do not incur enough eligible expenses by year-end or the end of the grace period (i.e., September 15th) to receive all the money back from your account, the balance is forfeited as stipulated by Section 125 of the Internal Revenue Code. The unused balance cannot be carried forward to the next plan year. In addition, you cannot use money in your Dependent Care FSA to pay health care expenses or vice versa. It is important that you estimate your expenses carefully, so as not to lose the money you have elected to set aside. You can be reimbursed for eligible health care expenses, up to the total of your yearly contributions, even before your contributions to the Health Care FSA have been made. For instance, if you authorize $1,000 in Health Care FSA contributions, $83.33 would be withheld, from your paycheck each month. If you have $250 in eligible expenses in February, you would be reimbursed the full $250, even though your contributions to date were only $166.66. 22 REIMBURSEMENT ACCOUNT PROGRAMS Your dependent care expenses can be reimbursed only up to the current balance in your Dependent Care FSA. In addition, if you are reimbursed for dependent care expenses through your FSA, the same expenses cannot be applied toward a tax credit on your federal income tax return. You may want to compare your tax savings for dependent care under the FSA plan with the tax credit you could receive at year-end when you file your federal income tax return. You can claim the tax credit only for expenses that were not reimbursed through your Dependent Care FSA. You should speak with a tax advisor to determine which option is best for you. Your current FSA election will not roll over in 2008-2009. You must make an annual election during each Open Enrollment period to participate in this option. COMMUTER REIMBURSEMENT PROGRAMS Pace University has also selected a new vendor, Benefit Resource, Inc., to administer our commuter reimbursement programs. This change will provide employees with the capabilities of choosing both pre- and post-tax payroll deductions and the flexibility for employees to change their elections monthly online at www.benefitresource.com . The Commuter Reimbursement Accounts provide employees with maximum pre-tax reimbursements for out-ofpocket mass transit and parking expenses. If you participate, you will reduce your federal, state and local income tax liability because your elected contributions are not subject to these taxes. In 2008 the Transportation Reimbursement Account will allow you to continue to set aside up to $115/month from your paycheck on a tax-free basis to cover mass transit expenses. The Parking Reimbursement Account will allow you set aside up to $220/month from your paycheck on a pre-tax basis to cover parking expenses incurred near your place of employment while at work. Employees will also be able to make post-tax payroll contributions to cover the total cost of commuting expenses over the IRS pre-tax limit. With the new enhancement to allow pre- and post-tax contributions, employees will now have the ability to use one card for their commuter reimbursements rather than utilizing two forms of payment. eTRAC COMMUTE DEBIT CARD Benefit Resource Inc. offers the eTRAC debit card. The eTRAC card is a MasterCard “stored value” card. If an employee loses a card, it can be reported lost and his/her funds are guaranteed. The pre- and post-tax payroll deductions are automatically loaded onto the card each month, and the card can be used to purchase the choice of fare; from a single fare to a month’s worth. Employees can purchase exactly the amount they need, and any unused amount rolls over to the next month. This encourages greater usage and tax savings. eTRAC Commute can be used for both workplace parking and mass transit fees. 23 RETIREMENT PLANS Pace University offers a retirement program to assist you in building financial security. The retirement plan provides you with an opportunity to make contributions to tax sheltered investments for the purpose of accumulating retirement income. The University’s retirement program is made up of two separate plans, Basic and Supplemental. Participation in the plans is voluntary and contributions made by either the University and/or the employee are immediately vested. Employees may direct either their own contributions and the University contributions to either one of all of the following funding vehicles. Each of the funding vehicles allow you to invest in equities, bonds, fixed income and mixed funds. Investment Carrier TIAA-CREF Fidelity Investments T.Rowe Price Website www.tiaa-cref.org www.fidelity.com www.troweprice.com Telephone Number 800-842-2776 800-868-1023 800-492-7670 Basic Retirement Plan The Basic Retirement plan is a defined contribution plan in which specific contributions are made by the employee and the University once eligibility requirements are met. The requirements are based upon age and full time service criteria. Please review our website www.pace.edu/hr for eligibility requirements needed to join the basic retirement plan. Once you meet the eligiblity requirements and have completed the necessary enrollment forms, the University will contribute a percentage of your base salary, up to $230,000. You may also be required to make contributions, which will be on a tax-deferred basis. The percentages that the you and the University contribute will differ based upon your full time date of employment and years of service with the University. Please review our website, www.pace.edu/hr to see what percentage you and the University contribute to the retirement plan. Supplemental Retirement Plan The Supplemental Retirement Plan is a tax deferred contribution plan in which the employee makes additional voluntary contributions to supplement other retirement investments. There is no eligiblity and/or service requirements to join. Participation begins on the first of the following month upon completion of the necessary enrollment forms. You are not required to participate in the basic retirement plan to join the supplemental retirement plan. The maximum that you can contribute is subject to IRS statutory limitations. Effective January 1, 2008, employees will be able to contribute a maximum of $15,500 per year, which includes your contributions to the basic and supplemental plans. If you are over the age of 50, you may also be eligible to contribute an additional $5,000. You may also be eligible to contribute an additional $3,000 if you have 15 or more years of service at Pace University and have not met the lifetime maximum limit of $15,000. Please note that the IRS has identified that additional catch-up contributions must be elected each year. The total annual maximum for University and employee contributions is $46,000. Please contact the Human Resources/Benefits office to determine your annual maximum contribution. 24 RETIREMENT PLANS Tax Advantage Your contributions to the basic retirement or supplemental retirement plan are not subject to federal state and local income tax, as governed under section 403(b) of the Internal Revenue Code. University contributions are also not taxable to you as income as long as they remain in the retirement plan. Investment earnings that accumulate are tax deferred, until withdrawn. Your investment returns grow faster because they are not taxed each year. Enrollment Considerations You must complete the necessary enrollment and payroll authorization forms to participate in the retirement program. Any contributions that you make are tax deferred and are subject to a statutory IRS annual limit. Once you join the Supplemental Retirement Plan, your contributions except for the additional catch-up contributions will continue and roll-over from year to year. You are able to make 3 changes per calendar year which includes your initial enrollment. All changes and/or new enrollments must be completed no later than October 31st of each year. You decide how to allocate the investment of both your required contributions and those made on behalf of the University. Any changes to your investment strategies can be addressed directly with your investment carrier(s). Enrollment in the supplemental plan will not automatically enroll you in the Basic plan when you become eligible. You must complete the appropriate enrollment forms for the Basic plan upon reaching eligiblity. You may be eligible for a special tax credit of up to $2,000 based upon your adjusted gross income. You should speak with a tax advisor to determine your eligibility. For more information, contact your local IRS office or review their website at www.irs.ustreas.gov. 25 EDUCATIONAL On-Campus Tuition Remission On-Campus Tuition Remission is given to those who are attending classes for credit at Pace University. OnCampus Tuition Remission covers only the tuition. All other charges including lab fees, late charges or activities fees are not included. Attendance in classes will not be allowed during scheduled works hours including during one's lunch period. Graduate courses are subject to tax withholdings governed by the IRS. Spouse/Partner Eligible to receive 100% tuition for the duration of the employee's employment in all programs except for the Executive Business Program, the Ph.D. Psychology Program, and the Law School, and all doctoral programs. Those programs only receive a tuition benefit, not to exceed the greater of the total tuition to complete a Master's degree in Lubin or CSIS or 50% of the special graduate degree tuition. Children Are eligible to receive 100% tuition in all programs except for the Executive Business program, the Law School, and all doctoral programs. Those programs receive a tuition benefit, not to exceed the greater of the total tuition to complete a master's degree in Lubin or CSIS or 50% of the special graduate degree tuition. Dependent children receive 100% tuition up to age 24. After age 24 they receive 50% tuition benefit except for the Executive Business Program, the Ph.D. Psychology Program and the Law School, and all doctoral programs. Those programs receive 25% tuition benefit. All tuition remission benefits end at the end of the semester in which the child turns 30. Tuition Remission benefits available under the On-Campus Tuition Remission Program do not cover special arrangements such as tutorials, independent study, or courses conducted off-campus which are accepted for credit at Pace. Special course fees and all late fees are also not covered, and are the responsibility of the student. However, the General Institution Fee (GIF) is covered by the Tuition Remission Program. Non-Credit or Certificate Courses/Programs Covered for the employee only and when directly related to his/her job. Contact Human Resources for requirements and application procedures. Further information, regarding On-Campus Tuition Remission, can be found on the Human Resources web page under Benefits > Full Time Faculty & Staff > Educational. Off-Campus Tuition Remission Eligibility For full time faculty and staff enrolled in a job related graduate program not offered at Pace University. Remission Up to $1,500 per academic year – Private Institutions – ($750 per semester) Up to $1,000 per academic year – Public Institutions – ($500 per semester) Benefits provided for a maximum of three years 26 EDUCATIONAL Procedure Complete an Off-Campus Tuition Remission Application accompanied by current job description and statement from supervisor to justify relationship of program to current job responsibilities. In addition, must also provide a copy of paid statement and completion of courses for the given semester. Documents should be submitted directly to the University Benefits Office in Costello House, Pleasantville. Reimbursement Upon satisfactory completion of the required documents, reimbursement for courses will be made following the end of Pace’s semester schedule. For example, reimbursement for the Fall semester will be made in January, while reimbursement for the Spring semester will be made in June. Further information, regarding Off-Campus Tuition Remission, can be found on the Human Resources web page under Benefits > Full Time Faculty & Staff > Educational. Off-Campus Dependent Child Reimbursement Eligibility Dependent children of full-time faculty and staff members*, matriculated in full-time undergraduate studies at any institution other than Pace University. Dependent children already enrolled in the Tuition Exchange Programs will not be eligible for the Tuition Remission Program. Child must maintain a minimum GPA of 2.0 Definition of Dependent Natural born children, adopted children, step-children and foster children, up to age 24. Reimbursement $600 per child per year**, payable in two (2) installments of $300 per term (maximum $2400 per child). Each term grant ($300) will only be payable at end of the term. Procedures for Employee 1. An employee must complete an Off-Campus Dependent Child Tuition Remission Application and attach it to the Grade Report. 2. Completed application and attached documents are to be sent to the University Benefits Office within 90 days following the completion of the student's term. Reimbursement will not be made for applications filed after the 90-day period. *If both parents are employed by Pace University, an eligible child can only receive one grant. **Applicable only for Fall and Spring terms. Further information, regarding Off-Campus Dependent Child Reimbursement, can be found on the Human Resources web page under Benefits > Full Time Faculty & Staff > Educational. 27 EDUCATIONAL Tuition Exchange, Inc. The program, which is administered by the Tuition Exchange, Inc., Washington, D.C., provides for reciprocal undergraduate scholarships to children of faculty and staff employees of more than five hundred colleges and universities across the country. Under it, the child of a Pace employee would be awarded a scholarship to any of the institutions in the program. Duration Scholarships are awarded for four consecutive years. A student may retain a Tuition Exchange, Inc. scholarship if she or he continues to meet the academic standards of the school attended. Eligibility Parent must be employed at Pace full-time for a minimum of seven years prior to September 1st, of the scholarship year and also must be in active full-time service at that time. An employee's children by birth or adoption, under age 24, are eligible for this program. Stepchildren of an employee are not eligible. Once an employee's child has been awarded the Tuition Exchange, Inc. scholarship, the employee moves to the end of the line of those who are eligible for such scholarships, and will be eligible for a second scholarship only if no other employee who has priority, based on seniority, is applying for an available scholarship in a given year. Only one Tuition Exchange, Inc. scholarship will be awarded to an employee. Selection A limited number of scholarships may or may not be available in a given year. Available scholarships will be awarded in accordance with the parent's seniority (years of service) at Pace. Seniority will be measured from the parent's date of full-time employment at Pace University to September 1st, of the scholarship year. The number of awards to be granted is based on a review of the prior academic year's exchange activity and an estimate of the current year's final exchanges. Awards will be granted only after Pace's receipt of letters of acceptance and financial aid from the selected institution. Pace University's Tuition Exchange, Inc. Liaison is Michele Russo-Ramirez, Director of University Benefits, Human Resources. Visit www.tuitionexchange.org for more information about the schools participating in the Tuition Exchange, Inc. program. Further information, regarding Tuition Exchange, Inc., can be found on the Human Resources web page under Benefits > Full Time Faculty & Staff > Educational. Council of Independent Colleges (CIC) The Council of Independent Colleges Tuition Exchange Program (CIC-TEP) encourages dependent students and other immediate family members from employee families of private colleges and universities to attend similar institutions and assist these families in meeting the tuition costs of college attendance. Duration The award is granted for up to 4 consecutive years for full tuition only for undergraduate studies. * This award will continue dependent upon student’s academic record and employee’s full time status at the University. 28 EDUCATIONAL Eligibility The employee must be employed at Pace full-time for a minimum of three years prior to September 1st, of the scholarship year and also must be in active full-time service at that time. The employee, spouse/domestic partner and dependent children as defined by the IRS are eligible to participate in this program. An employee who is currently receiving a scholarship through the Tuition Exchange Program will not be eligible to apply for the CIC-TEP. Only one tuition exchange scholarship will be awarded to an employee. Employees are not eligible for off-campus dependent reimbursement if dependents are awarded a tuition exchange scholarship. Selection There are no limits on the number of students exported from Pace University to other institutions. The employee will complete a form to apply for this scholarship. The University Benefits Office will submit appropriate forms to participating institutions, which are responsible for determination of acceptance under the CIC-TEP. Participating Institutions For a current list of participating institutions, visit their website at www.cic.edu. Pace University’s Tuition Exchange Liaison Officer is Michele Russo-Ramirez, Director of University Benefits, Human Resources. *Participating institution may also offer graduate studies. Contact institution directly for more information. Further information, regarding the Council of Independent Colleges, can be found on the Human Resources web page under Benefits > Full Time Faculty & Staff > Educational. 29 NEW YORK COLLEGE SAVINGS PROGRAM Pace University is offering the New York College Savings Program, administered by Upromise Investments, Inc making saving for college convenient for full time and part time faculty and staff. Now more than ever, families need a college savings strategy that helps them reach their goals in the most efficient way possible. The best way to meet this challenge is to start planning and saving now. The New York College Savings Program is designed to help you and families save for college in the most convenient, flexible and affordable way possible. In addition, it also provides federal and state tax advantages as defined by Section 529 of the Internal Revenue Code and New York State tax regulations. The New York College Savings Program provides an opportunity for employees to save towards higher education expenses, including tuition, fees, supplies, books, and equipment required for enrollment at eligible undergraduate, graduate or professional institutions (including vocational, business, and trade schools) in the United States and around the world. Most room and board expenses are also covered for students enrolled at least half time. Some of the benefits of this program are: Minimum contribution of $15/paycheck Contributions and earnings grow tax free Choice of fifteen investment options by the Vanguard Group Qualified withdrawals are tax exempt from federal and New York State taxes Eligibility for a tax deduction ($10,000 married filing jointly; $5,000 filing single) Portability upon separation from the University Maximum contributions of $110,000/beneficiary; lifetime maximum of $235,000, inclusive of earnings Employees can set up as many accounts on behalf of beneficiaries, in which no familiar relationship is needed to exist and there is no age restriction Additional savings with the free Upromise Rewards Service For more information about the New York College Savings Program, please call toll free 1-877-NYSAVES or visit www.nysaves.org. in order to enroll on-line and complete the Payroll Authorization form which should be returned to the Benefits Office for processing at any time during the year. The best way to ensure that your children receive the college education they deserve is to start planning and saving today. 30 HUMAN RESOURCES WEB PAGE The Human Resources website, www.pace.edu/hr contains more information about the benefit programs that are outlined in this publication as well as programs that are not discussed including: On-Campus and Off-Campus Tuition Remission programs Leaves of Absences Academic Federal Credit Union You have accessability to 20+ forms that you can retrieve and print or save to your PC for future use. Some of the forms include: Oxford Claim form Oxford Gym Reimbursement form Oxford Medco By Mail Order form Dental Claim form Flexible Spending Account and Commuter Reimbursement forms On campus and off-campus tuition remission applications Payroll authorization forms for retirement contributions If you do not see a benefits form on our website, please contact the Human Resources/Benefits office to obtain one. In addition, you also have access to all of our benefit provider websites. We have included the links within our website in order for you to obtain information at the click of a mouse. Your needs may vary from reviewing the health plan provider directories to reviewing your financial portfolio with your retirement investment carrier. We encourage you to use this web site for your benefit needs and questions. University Benefits Office at Costello House in Pleasantville at X33810. 31 You can also contact the MEDICAL PLAN SUMMARIES PACE UNIVERSITY Oxford Freedom EPO Plan – Option #1 (Oxford Exclusive Plan) Oxford Freedom 90/70 Plan – Option #2 (Freedom Plan Direct) Oxford Freedom 100/70 Plan – Option #3 (Freedom Plan Access) 32