2009BenefitsRe-EnrollmentDetails

advertisement

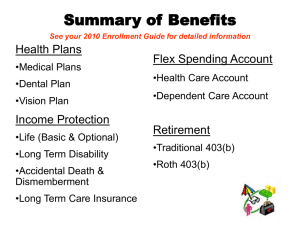

Augsburg College Human Resources Department 612-330-1052 612-330-1058 October 6, 2008 TO: FROM: RE: All Insurance Benefits-Eligible Staff and Faculty Sandra Hokanson, Director of Human Resources 2009 Insurance Benefits Renewal The next benefit plan year will begin January 1, 2009. October 10-November 30, 2008 is our annual enrollment period and certain changes in your benefits may only be made during this time. Please plan to attend one of the following meetings and/or read this memo carefully for information regarding benefits and changes. Friday, October 10, 2008 from 3:00 – 4:00 p.m. in Oren C. Gateway Room 100 Tuesday, October 21, 2008 from 9:30 – 10:30 a.m. in Oren C. Gateway Room 100 Thursday, October 23, 2008 from – 1:30 – 2:30 p.m. in Oren C. Gateway Room 100 Wednesday, October 29, 2008 from – 10:30 – 11:30 a.m. in Oren C. Gateway Room 100 Wednesday, October 29, 2008 from – 8:15 – 9:15 p.m. in Oren C. Gateway Room 100 Tuesday November 4, 2008 from 3:00 – 4:00 p.m. in Oren C. Gateway Room 100 IMPORTANT: Forms and Deadlines: Enrollment forms, election forms, and change forms are due on or before November 30, 2008. Employees who turn in their completed forms early by November 11, 2008 will have their names placed in a drawing for a $25 gift certificate. FOUR LUCKY WINNERS will be selected! Please send or drop off completed forms to: Human Resources Memorial Hall, Room 19 Campus Box 79 Contact Lor Yang, Benefits/Payroll Assistant, at x1052 or yangl@augsburg.edu for questions regarding benefits coverage, enrollment, changes, and forms. 2009 Insurance Benefits Renewal Page 1 of 10 2009 Insurance Re-enrollment Overview As we enter the insurance benefits re-enrollment period for 2009, Human Resources would like to take the opportunity to provide you with an overview of Augsburg College’s goals and 2009 changes. With regard to medical and dental insurance, the College has two primary goals: 1) to keep balance between a) changing participant’s behavior by placing “first dollar cost” with the employee, and b) providing a plan that is rich enough to protect employees from financial distress if there is a large claim; and 2) to promote the health and wellbeing of our College community rather than only addressing increasing costs of coverage annually, year after year. Many changes have been implemented over time to mitigate increases, including plan design and network changes, varying structure of prescription drug copays, and use of both self insured and fully insured plans. In the current medical insurance market, we have influenced positive changes in our medical insurance premiums by: Utilizing deductibles and prescription drug copays Adding a High Deductible Health Plan (HDHP) Adding a Healthcare Savings Account (HSA) The College began movement forward on this path three years ago: moving the medical plan from a ‘sick plan’ (meaning one only uses it when one is sick) to a ‘wellness plan’ --where the focus is on prevention so that in future years, potential premium incentives/savings could be offered and plan cost could be more predictable. Since 2005, we have provided two levels of deductible with a copayment structure for prescription drugs. The Benefits Advisory Committee (comprised of participants and users of our medical and dental plans) was initiated in 2007 and was consulted throughout this past year with specific attention given to the addition of a HDHP and HSA. This committee’s primary purpose is to advise management and: help employees gain better understanding of the issues facing the insurance market and Augsburg specifically, help both management and employees to better understand each other’s needs and Augsburg’s philosophy around insurance and other employee benefits, and advise how best to communicate changes to employees. For 2009, we are pleased to announce there has been no change in plan structure for either the medical or dental insurance products. The medical benefits and prescription drug copayment plan structure will stay the same as in 2008. We will continue to offer the $600 and $1200 deductibles. While we anticipated as much as a 25% market increase, our prior changes and utilization allowed Augsburg to hold the overall 2009 plan increase to just under 15%. For 2009 we again are taking another step on this path by adding a HDHP option and HSA. For 2009, the dental plan received a 3.7% increase. Please take time to review the attached materials on http://web.augsburg.edu/hr/2009_Benefits/2009BenefitsRe-EnrollmentDetails.pdf for instructions about re-enrollment for 2009, and please join us at group sessions for more information, questions and answers. 2009 Insurance Benefits Renewal Page 2 of 10 Augsburg College 2009 Insurance Benefits Renewal MEDICAL INSURANCE Blue Cross and Blue Shield of Minnesota (BCBS) (www.bluecrossmn.com) will continue as Augsburg’s health insurance provider for 2009. The plan has not changed from last year. The BCBS network continues to be one of the most extensive in the country and provides coverage for those traveling outside the U.S. Preventative care for adults and children is covered at 100%, including routine physicals, vision/hearing screenings, immunizations and vaccinations, many laboratory services, cancer screening, and prenatal and well child visits. We will continue to offer 2 levels of annual deductible, $600 and $1200 and have added a high deductible health plan (HDHP) with an annual deductible of $2300. The medical Summary of Benefits provides information about each of these three plans - $600, $1200, and $2300. You can log onto www.bluecrossmn.com and use their cost comparison tools (under Quick Links – Health Care Cost Calculator) to help estimate potential costs for 2009 or you can access the Plan Advisor Tool, another calculator. This tool allows you to enter information relevant to your situation and will generate an estimate of costs for the three deductible plans in order to help you make a selection between the three options. Deductibles: If you are currently enrolled in the $600 deductible plan and want to continue it, you will automatically be enrolled in the $600 deductible plan with no action required. o If you would like to switch to the $1200 or $2300 deductible plan, you must complete a BCBS Change Form and an Augsburg pre-tax election form for insurance programs. If you are currently enrolled in the $1200 deductible plan and you want to continue it, you will automatically be enrolled in the $1200 deductible plan with no action required. o If you would like to switch to either the $600 or $2300 deductible plan, you must complete a BCBS Change Form and an Augsburg pre-tax election form for insurance programs. The HDHP/HSA option is limited to those Augsburg College plan participants who have been covered under the College’s medical plan during the previous benefit year. Prescription Drug Copayments: For the $600 and $1200 deductible plans, the prescription drug copay remains a $10/35/60 model: o Generic drugs require a $10 copay per prescription o Brand Name drugs on the formulary list require a $35 copay per prescription o Brand Name drugs not on the formulary list require a $60 copay per prescription o The separate deductible specific to prescription drugs of $750 for single and $1,000 for family after which coverage is provided at 100% remain the same o NOTE: NO PRESCRIPTION DRUGS ARE COVERED UNDER THE HDHP o You can log onto www.bluecrossmn.com under Quick Links – Prescription Drugs for more information. 2009 Insurance Benefits Renewal Page 3 of 10 Out of Pocket Maximum: $600 and $1200 Deductible The “Out of Pocket Maximum” exposure has not changed from last year -- this means that once the deductible is met, co-insurance becomes 80% paid by BCBS and 20% paid by the participant, and: o the $600 deductible plan has an out of pocket maximum of $1,500 for single and $3,000 for family coverage o the $1200 deductible plan has an out of pocket maximum of $2,000 for single and $4,000 for family coverage o reminder: preventative care is covered at 100% High Deductible Health Plan The “Out of Pocket Maximum” exposure for the HDHP plan is $2300 for single, and is $4600 for both “Single Plus One” or “Family” coverage. The HDHP offers 100% coinsurance upon meeting the deductible. o no prescription drug coverage is provided under the HDHP. o Reminder: preventative care is covered at 100% 2009 Medical Premiums: Please carefully review premiums, deductibles compared to your medical needs, tax benefits, and cash needs as you consider the three deductible options. For 2009, the premium increased 14.9%, shared equally by both participants and the College. When reviewing these choices, you may wish to consider which of the three deductible plans may be more advantageous to you. Considerations for participating in the HDHP and HSA are complex; please review your personal carefully. The following tables provides employee premiums for those at .750 FTE or higher, effective January 1, 2009: For more information or for other FTEs, please refer to the 2009 Insurance Premium Grid. Participant $600 Deductible Single Single +1 Family Monthly $58.20 $267.88 $409.33 Annual $698.40 $3214.56 $4911.96 2009 Medical Insurance Premiums Participant Participant $1200 Deductible $2300 Deductible Monthly $20.20 $189.88 $289.33 Annual $242.40 $2278.56 $3471.96 Monthly $1.20 $148.38 $227.33 Augsburg College Contribution Annual $14.40 $1780.56 $2727.96 Monthly $361.30 $612.12 $932.67 Annual* $1,122,931 $514,182 $1,074,434 TOTAL $2,711,547 *Estimate: Total annual employer contribution fluctuates based on actual enrollment. The above estimate was based on enrollment as of July 2008. Actual employer contribution for 2009 may be higher. 2009 Insurance Benefits Renewal Page 4 of 10 Options at Re-Enrollment: If you are currently enrolled and wish to discontinue your coverage, this is the only time of year you may cancel without a qualifying change in family status. To cancel, complete the BCBS Change Form and an Augsburg pre-tax election form for insurance programs. If you are not enrolled and would like to enter the plan, this is the only time of year you may enroll without a qualifying change in family status. To enroll, complete the new BCBS Enrollment Form for Group Coverage and Augsburg pre-tax election form for insurance programs. To avoid an 18month pre-existing condition limitation, you must also provide proof of prior continuous coverage. The HDHP/HSA option is limited to those Augsburg College plan participants who have been covered under the College’s medical plan during the previous benefit year. BCBS will continue to provide the following: Whole Person Health Support: Offers a wide array of information and services designed to improve your overall health or to manage chronic conditions you may already have. Mail Service Pharmacy: Saves money on pharmacy co-payments for maintenance medications. With this service, you receive three refills at once, but pay only two co-payments. Refills can be requested by phone, mail, or internet. More information regarding the PrimeMail mail order pharmacy is available on the BCBS website at http://www.bluecrossmn.com. 90 day RX Program: Available on a national basis through Target, Walmart, Kmart and Kroger. Care Support Service: Identifies members who have been diagnosed with or may be at risk for certain chronic health conditions such as diabetes, heart disease, and asthma. You have access to features such as screenings and assessments, reminders for key preventive health services throughout the year, newsletters, and home monitoring. Fitness Center Discounts for members. Go to a participating fitness center to enroll. Each time you work out at the center, your visit is tracked. When you’ve worked out twelve days in a month, you’ll automatically receive a $20 credit toward your fitness center membership fees the next month. See the BCBS website to find more information about the program and a list of participating fitness centers. FirstHelp Nurseline: Provides 24-hour access to health advice from specially-trained nurses to help you make informed decisions about whether to see a doctor or care for an illness or injury at home. The number to call is 1-800-622-9524. You can also access 24-hour health advice from your computer with the FirstHelp online symptom advisor. Healthy Start: This program offers one-to-one individualized support prenatal care. By enrolling in the Healthy Start program, mothers-to-be are given confidential prenatal education and support. Babies who receive prenatal care are more likely to have a normal full-term delivery, so quality care and awareness is important to the child as well as the mother. Internet Service Center. This center provides claims information, year-to-date deductible information, explanations of benefits, ID card requests, and member health program information. Go to http://www.bluecrossmn.com/servicecenter for more information. 2009 Insurance Benefits Renewal Page 5 of 10 Changes Effective January 2008 by Minnesota State Law: Dependent Student Age Limit: Unmarried dependent children may remain on your medical and dental plans up to age 25, regardless of whether the dependent is a student. If you choose to add your dependent child back onto the plan(s) or continue to insure them beyond age 18, you are responsible for determining any tax consequences for benefits provided to dependents that do not meet Internal Revenue Code requirements for dependent status. You can access this IRC guideline at www.irs.gov/publications/p501/ar02.html#d0e3591. New Changes Effective January 2009 by Blue Cross Blue Shield Clarifications and Benefit Changes: Blue Print for Health was replaced by Whole Person Health Support Program Preadmission notification penalty is being removed. Amino acid based elemental formulas subject to drug benefits and not durable medical equipment and supplies benefit. Newborn claims for inpatient facility services are subject to separate deductible, copayment and coinsurance. Reproductive treatments will have $10,000 per person lifetime maximum benefit, including injectables, prescriptions, and other charges related to the treatment. Additional treatment options will be covered, but subject to the $10,000 max. Applies to both male and female treatments. The max does not apply to diagnostic testing needed to determine infertility diagnosis. For additional information, go to www.bluecrossmn.com. Women’s Health and Cancer Rights Act Under the Federal Women’s Health and Cancer Rights Act of 1998, you are entitled to the following services: 1. Reconstruction of the breast on which the mastectomy was performed; 2. Surgery and reconstruction of the other breast to produce a symmetrical appearance; and 3. Prostheses and treatment for physical complications during all stages of mastectomy, including swelling of the lymph glands (lymphedema). Services are provided in a manner determined in consultation with the physician and patient. Coverage is provided on the same basis as any other illness. 2009 Insurance Benefits Renewal Page 6 of 10 Dental Insurance Delta Dental will continue as Augsburg’s dental insurance provider. The Delta Dental Summary of Benefits provides a snapshot of your dental coverage. For more information, go to (www.deltadentalmn.org). The following is effective January 1, 2009: Single Family 2009 Dental Insurance Premiums Participant Monthly $40.32 $113.32 Annual $483.84 $1359.84 There are no changes to the dental plan from last year. The annual deductible remains $25 per person/$75 per family on in-network services. Participants will experience an increase in dental premium of 3.7% over 2008. If you are currently enrolled, your coverage will continue at the premiums listed above unless you make an active election to change by completing a Delta Membership Maintenance Form If you are not currently enrolled, you may enroll now on a voluntary basis with no preexisting condition limitations. Coverage would be effective January 1, 2009. If you wish to enroll, please complete a new Delta Dental Enrollment Form and an Augsburg pre-tax election form for insurance programs. 2009 Insurance Benefits Renewal Page 7 of 10 Flexible Spending Account (FSA) for (Tax Shelter )Healthcare Reimbursement Plan and Dependent Care Reimbursement Plan These plans allow employees to set aside pre-tax dollars to pay for eligible health expenses and/or dependent care. Benesyst, our third-party administrator, continues to offer features such as on-line access to your claims and account balances and weekly payment of claims by check or by direct deposit. Since you send claims directly to Benesyst, you can be assured your information is be kept completely confidential. We will continue the BennyCard for 2009. This special debit card allows you to pay for qualifying health expenses (such as office visits, prescription copays at pharmacies, etc) without having to complete a claim form -- you may be requested to provide documentation of the expense. Continued Feature! If you go to the following listed vendors for prescription and over-thecounter drugs, you will not need to complete claim forms or provide documentation: Walgreens, Wal-Mart, Sam’s Club, AND Cub, Target, and Tom Thumb For a more comprehensive list, go to www.benesyst.net. If you are currently enrolled in the plan(s): Each year you must enroll to continue participation. If you do not re-enroll during November, your participation in the plan will end December 31, 2008. Complete a Flexible Spending Account Enrollment Form. You may not make any changes after November 30, 2008 unless you have a qualifying change in family status. If you are not currently enrolled in the plan(s): You may enroll effective January 1, 2009 during the November open enrollment period. Complete a Flexible Spending Account Enrollment Form. Click here to access a list of examples of eligible expenses for dependent and medical reimbursement accounts. 2009 Insurance Benefits Renewal Page 8 of 10 Unum Group Life Insurance All benefits-eligible employees at .500 full-time equivalency or greater are covered by a College-sponsored group life insurance policy through UnumProvident. There are no coverage changes for Life, Accidental Death or Dismemberment (AD&D), or Long-Term Disability coverage. It is important to update your beneficiary designation from time to time, as life circumstances change. If you wish to make a change in your beneficiary designation, please complete a Unum Group Life/AD&D Beneficiary Card. Unum Supplemental (Voluntary) Life Insurance If you are currently enrolled in the plan: If you will not make any changes, no action is required. If you wish increase life insurance, to exercise the guarantee issue provision you must do so by November 30. This provision allows you to increase your coverage up to the full guarantee issue amount without providing evidence of insurability. Complete a Voluntary Term Life and AD&D Enrollment Form. If you move from one age band to the next during 2009, the new deduction amount will appear on your January, 2009 paycheck. If you are not currently enrolled in the plan: You may apply now until November 30, 2008 for additional life insurance. Your application will be subject to underwriting approval. Complete a Voluntary Term Life and AD&D Enrollment Form and an Evidence of Insurability Form. Long Term Care Insurance: Augsburg College offers long term care insurance on a voluntary basis. Currently these polices are available through Prudential. For more information, call Lor at ext. 1052. 2009 Insurance Benefits Renewal Page 9 of 10 Employee Assistance Program Unum’s EAP, LifeBalance, allows you and your family to receive counseling, resources, and information on topics such as legal issues, education, chemical addiction, financial advice, parenting, and emotional well-being. The program is available 24 hours a day by phone at 1800-854-1446 or online at www.lifebalance.net (user ID ‘lifebalance’ and password ‘lifebalance’). In addition, a travel protection service called Assist America is available to you and your family. This service provides emergency medical and legal resources when traveling more than 100 miles from home. Brochures describing the resources are available in Human Resources. A video file describing the services is available for viewing on HR’s public folder on Augnet. Other Resources: Have you looked in HR’s public folder on Augnet lately? Click on the Benefits folder to find resources such as forms, Summary Plan Descriptions, informational articles from our vendors, and links to vendors’ websites. For example, Delta Dental supplies informative fact sheets about oral health. At the TIAA-CREF website, employees can view account information online and subscribe to electronic delivery of standard TIAA-CREF reports. TIAA-CREF has a local office in Bloomington. Representatives are available for individual consultation. Please call 952-8303100 if you wish to schedule time. How to contact our vendors: Benesyst 800-670-7131 Blue Cross/Blue Shield of Minnesota 651-662-5001 Delta Dental 651-406-5901 TIAA-CREF 800-842-2776 Unum EAP 800-854-1446 Unum Life & LTD 800-421-0344 www.benesyst.net www.bluecrossmn.com www.deltadentalmn.org www.tiaa-cref.org www.lifebalance.net www.unumprovident.com Questions? As always, please contact Human Resources if you have any questions about benefits eligibility, coverage, enrollment, costs, or plan details. Sandra Hokanson, Director Lor Yang, Payroll/Benefits Assistant General HR Assistance 2009 Insurance Benefits Renewal x1783 x1052 x1030 hokanson@augsburg.edu yangl@augsburg.edu Page 10 of 10