Residents Benefit Presentation - Massachusetts General Hospital

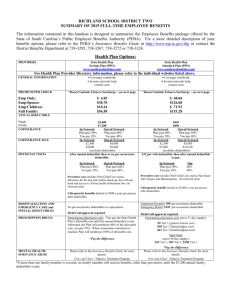

advertisement

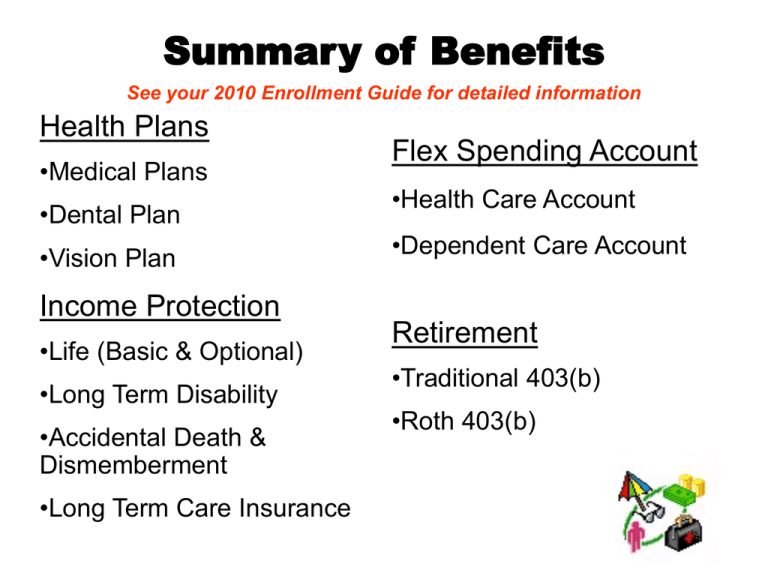

Summary of Benefits See your 2010 Enrollment Guide for detailed information Health Plans •Medical Plans •Dental Plan •Vision Plan Income Protection •Life (Basic & Optional) •Long Term Disability •Accidental Death & Dismemberment •Long Term Care Insurance Flex Spending Account •Health Care Account •Dependent Care Account Retirement •Traditional 403(b) •Roth 403(b) Partners Medical Insurance Policy All Partners eligible employees MUST maintain health insurance coverage through Partners or an alternative source. This policy was created to ensure compliance with respect to the new Health Care laws in Massachusetts. Without coverage you may incur a tax penalty when you file your MA state taxes. When will my benefits begin? DATE OF HIRE Your benefits will begin on your date of hire, unless you take action to designate another date . If you have medical coverage elsewhere, you can “opt out” of coverage through Partners. Opting out MUST be done within 30 days of your hire date OTHERWISE You will automatically be enrolled in BCBS Partners Value – Individual • If you elect to “opt out” of coverage, you will receive a HIRD* form to complete and return to benefits. (* Health Insurance Responsibility Disclosure) Other times benefit changes can be made? • During Open Enrollment for 2011 (Fall 2010) Benefit changes effective January 1, 2011 • If a “Qualified Life Event” occurs (e.g. marriage, birth of child, opportunity for insurance through your spouse, end of coverage through school, etc.) Changes must be made within 30 days of the status change. How much will this cost? We have done the math for you! See the enclosed Rate Sheet PARTNERS BENEFITS FOR RESIDENTS 2010 RATE SHEET - MONTHLY CHOICE PAY AND PRICES Everyone Receives BASIC CHOICE PAY: $277.00 Employee Only MEDICAL CHOICE PAY $256.16 Added to $277.00 MEDICAL INSURANCE Price Employee & Spouse Total $533.16 $768.49 Your Cost Total $1,045.49 Price Employee & Children $691.61 Your Cost Price Total $968.61 Your Cost Family $1,203.94 Total $1,480.94 Price Your Cost Partners Plus $569.25 $36.09 $1,138.50 $93.01 $1,053.08 $84.47 $1,622.33 Master Health Plus $1,055.00 $521.84 $2,110.00 $1,064.51 $1,951.75 $983.14 $3,006.75 $1,525.81 $511.08 ($22.08) $1,022.17 ($23.32) $945.50 ($23.11) $1,456.58 ($24.36) Partners Value Neighborhood Health Plan Harvard Pilgrim HealthCare Tufts Health Plan DENTAL CHOICE PAY DENTAL INSURANCE Major Dental Basic Dental VISION INSURANCE $664.67 $131.51 $676.58 $143.42 $671.75 $138.59 Employee Only $16.80 Price Your Cost $38.67 $21.87 $28.00 $11.20 Employee Only $7.08 LONG TERM DISABILITY LIFE INSURANCE Optional Age on 1/1/09 60% of Pay * $1,329.33 $283.84 $1,353.17 $307.68 $1,343.50 $298.01 Employee & Spouse $33.65 Price Your Cost $77.33 $43.68 $56.08 $22.43 Employee & Spouse $14.15 $ 13.32 80% of Pay * $19.99 Basic Life = Annual Salary No cost to Employee Employee Age Under 30 30-34 35-39 40-44 45-49 Monthly Cost Per $1,000 $0.050 $0.072 $0.081 $0.090 $0.135 Spouse Age Under 30 30-34 35-39 40-44 45-49 AD&D INSURANCE $1.40 for $100,000 of coverage CHILD LIFE INSURANCE $2.10 for $10,000 of coverage for all eligible children $1,229.67 $261.06 $1,251.67 $283.06 $1,242.75 $274.14 Employee & Children $33.65 Price Your Cost $96.67 $63.02 $56.08 $22.43 Employee & Children $12.38 Monthly Cost Per $1,000 0.080 0.088 0.099 0.110 0.165 $1,894.33 $1,928.25 $1,914.50 Family $50.45 Price $135.33 $84.08 Family $141.39 $413.39 $447.31 $433.56 Your Cost $84.88 $33.63 $19.46 *If no election is made, coverage defaults to 60% Medical Plan Options Details of each plan outlined in Medical Comparison Chart BCBS Partners Plus BCBS Partners Value Harvard Pilgrim Health Care Neighborhood Health Plan Tufts Health Plan BCBS Master Health Plus Majority choose Partners Plus or Partners Value! Blue Cross Blue Shield Partners Plus/Value • In-network coverage: – Designated Primary Care Physician (PCP) – Referral from PCP needed to see Specialists The “Network” is – Low out of pocket costs Blue Cross Blue Shield HMO Blue and Blue Choice • Out-of-network coverage: – Self-referral to Specialists – Out-of-state care (non-emergency) – Higher out of pocket costs Prescription Drug Program Medco In addition to your Health Insurance Card you will receive a Medco ID card Retail Purchase 30 day supply $10 Generic $20 Preferred brand $35 Other approved brands Mail Order 90 day supply $20 Generic $40 Preferred brand $70 Other approved brands Delta Dental Plan You will receive separate ID card 1. Basic Dental - $1,000 per person annual maximum 100% Diagnostic & Preventive (No Deductible) 50% Minor Restorative ($50/$100 Deductible) 50% Major Restorative ($50/$100 Deductible) No Orthodontia 2. Major Dental - $2,000 per person annual maximum 100% Diagnostic & Preventive (No Deductible) 80% Minor Restorative ($25/$50 Deductible) 50% Major Restorative ($25/$50 Deductible) Orthodontia - 50% covered up to $2000 lifetime maximum Davis Vision Plan 100% coverage by Davis providers Every 12 months • Eye exam w/ participating optometrist ($10 co-pay) • 1 pair of Davis Vision eye glasses or contact lenses see brochure • Out-of-network care available at a higher cost Long Term Disability (LTD) • Continues portion of salary, if unable to work due to illness or injury for longer than 90 days. • Payments may continue to age 65. • Annual cost of living adjustment, if applicable. • Automatically enrolled @ 60%*, unless declined at enrollment. TWO OPTIONS *60% of base pay @ $13.32 per month 80% of base pay @ $19.99 per month Life Insurance Partners provides coverage of 1 x salary (no cost to employee) Need more Life Insurance? Employee Employees can elect up to 3x annual salary without Evidence of good health, 5x salary is available with Evidence of Health and insurance company’s approval Spouse Coverage amounts: $10K, $25K, $50K, $75K, $100K Child $10k for each child Accidental Death & Dismemberment (AD&D) Insurance is also available (p 21) Flex Spending Accts (FSA) USE IT OR LOSE IT BENEFIT For eligible expenses incurred from Hire Date to 3/15/2010 CALENDAR YEAR BENEFIT – RE-ELECT EVERY YEAR! Health Care Dependent Care $3,000 pre-tax (max) $5,000 pre-tax (max) •Out-of-pocket medical, dental and vision expenses • Expenses to look after dependent child while parents are working •E.g. Deductibles, Coinsurance, Co-pays • E.g. Daycare for children through age 12 and disabled dependents Retirement Savings Programs 2 ways to save for your retirement through payroll deductions •Traditional 403(b) Program Your contributions are deducted before taxes are calculated and will reduce your taxable income every paycheck •Roth 403(b) Program Your contributions are deducted after taxes are calculated. Your contributions and investment earnings will be tax free when distributed. Combined maximum contribution $16,500 (CY2010) Investment Providers Fidelity Investments, TIAA-CREF, Vanguard Group . Tale of two savers VALUE AGE 65 $200K $167,832 $150K Maria Tom $125,025 Start Age 25 $1,000 contributed annually for 10 years $100K $50K $10,000 Contribution AGE Start Age 35 $1,000 contributed annually for 30 years $30,000 Contribution 25 35 45 55 65 This hypothetical example is based on monthly contributions made at the beginning of the month to a tax-deferred retirement plan and an 8% annual rate of return compounded monthly. Your own Plan account may earn more or less than this example, and income taxes will be due when you withdraw from your account.. Investing in this manner does not ensure a profit or guarantee against loss in declining markets. You need a Partners password How to create a Partners password https://myprofile.partners.org Myprofile.partners.org Step-by-step instructions WHAT IS ?? • Human Resources Information System which allows employees to perform transactions – Employee Self Service • Tasks • Views • eBenefits User Name: NT User ID Password: Partners Password Any problems: contact your Benefits Representative Accessing PeopleSoft eBenefits Home > Self Service > eBenefits Help is available Call the Benefits Office once you get here if you need help accessing the options available in eBenefits (617) 726-8133 eBenefits – Home Page Time to enroll Employee Name Employee Name To elect, edit each plan! Remember... • Submit your benefit elections online as soon as possible ! • Elections received after 30 days will NOT be processed and you will be automatically enrolled in BCBS Partners Value (individual coverage) • Benefits as well as DEDUCTIONS & CHOICE PAY are effective on your date of hire or eligibility date EMERGENCY CONTACT MBTA PASS ENROLLMENT • Employees have until the • 15th of every month to enroll • Parking & Commuter Services – • Wang Bldg.02-230 • call (726-8886) with questions or to purchase discounted T-passes after the deadline Don’t Forget! Designate Your Beneficiaries… Direct Deposit .. Suppress DDP Advice Print View pay advice before the 26th. Protect your identity! No more worries about pay advice being lost or misplaced. PRINT ON DEMAND- A complete history of your pay advices are printable at anytime. W-4 FEDERAL TAX FORM Questions? Contact Professional Staff Benefits BWH Angela Carter (617) 724-9357 acarter1@partners.org Questions? Professional Staff Benefits Office Mass General Hospital Bulfinch Bldg, Rm 126 Last Name Starts with A-G H-O P-Z Contact Jennifer R. Williams Linda Gulla Virginia Rosales (617) 726-9266 (617) 726-9266 (617) 724-9356