Chapter 3 – Receipt of a Partnership Interest for Services

advertisement

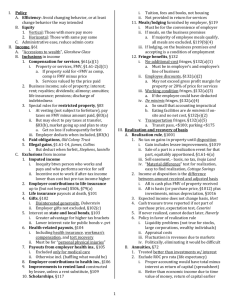

Chapter 13 – Basis Adjustments to Partnership Property—Code Secs. 743(b), 734(b) 1. The equal XYZ Partnership has the following balance sheets: Property A Property B Inventory A Inventory B Capital, X Capital, Y Capital, Z Basis $39,000 $60,000 $3,000 $15,000 $117,000 FMV $54,000 $42,000 $15,000 $12,000 $123,000 $35,000 $41,000 $41,000 $117,000 $41,000 $41,000 $41,000 $123,000 XYZ has a Code Section 754 election in effect, and X sells her interest to W for $41,000 cash. The two Properties are both capital assets. Inventory A was contributed by X at a time when its unrealized appreciation was $6,000. At the time of the transfer, X’s share of the partnership’s basis in partnership assets is $35,000. i. How much is the Code Sec. 743(b) adjustment to each asset? ii. How much income would be allocated to each partner if, one year later, Property A is sold for $60,000? 2. The equal XYZ Partnership has the following balance sheet: Property A Property B Inventory A Inventory B Capital, X Capital, Y Capital, Z Basis $39,000 $60,000 $3,000 $15,000 $117,000 FMV $54,000 $42,000 $15,000 $12,000 $123,000 $35,000 $41,000 $41,000 $117,000 $41,000 $41,000 $41,000 $123,000 XYZ has a Code Section 754 election in effect, and X sells her interest to W for $39,000 cash. The two Properties are both capital assets. Inventory A was contributed by X at a time when its unrealized appreciation was $6,000. At the time of the transfer, X’s share of the partnership’s basis in partnership assets is $35,000. How much is the Code Sec. 743(b) adjustment to each asset? What will each partner’s gain or loss be if Property B is later sold for $45,000? 3. Partner X is distributed the following in complete liquidation of her partnership interest: Cash Inventory Land A Basis $30,000 $30,000 $35,000 $95,000 FMV $30,000 $40,000 $20,000 $90,000 X had a basis in her partnership interest of $75,000, so the land’s basis was reduced $20,000 and had only a $15,000 basis in X’s hands. The remaining YZ partnership (which did have a Code Sec. 754 election in effect) had the following remaining assets: Cash Inventory Unrealized Receiv. Land B Building Basis $40,000 $30,000 $50,000 $25,000 $45,000 FMV $40,000 $45,000 $45,000 $40,000 $10,000 i. How much of an adjustment to basis would each of the partnership assets have? ii. How much of an adjustment to basis would each of the partnership assets have if X’s basis in her partnership interest had been $140,000? 4. As of the end of the current tax year, Valerie Fleming’s tax basis in her partnership interest was $45,000. At that time she received a $60,000 nonliquidating cash distribution. Assume that all other partners also received proportionate cash distributions, so that the provisions of §751(b) do not apply to the distribution. Immediately following the distribution, the partnership had the following assets: Basis FMV Cash $ 10,000 $ 10,000 Accounts Receivable 0 45,000 Depreciable Equipment 50,000 80,000 Land (§1231 Asset) 25,000 145,000 Building 65,000 105,000 $140,000 $385,000 Assume that the partnership originally purchased the depreciable equipment for $100,000. The original purchase price of the building was $80,000. The equipment is being depreciated using accelerated depreciation, while the straight-line method is used for the building. The partnership had a §754 election in effect at the date of the distribution. i. By how much will the partnership be required to adjust its tax basis in its remaining assets under §734(b) in connection with the distribution to Valerie? ii. To which class(es) of assets will the adjustment be allocated? iii. How will the adjustment be allocated among the partnership’s remaining assets?