Chapter 10 Update

advertisement

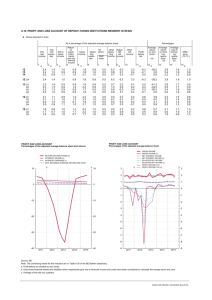

Chapter 10 Update Last Name: First Name: Team Number: Instructions: Do not delete any of the problems or instructions. Fill your answers in where you see boxes that are shaded yellow. Please keep all fonts at Times New Roman 12 point and do not increase the size of any equations produced by the equation editor. Don’t forget to sign the last page before you submit this. 1) Download your team’s historical stock data. When you are done, report the stock’s five most recent (by date) adjusted closing values. $ Adjusted Close #1 $ Adjusted Close #2 $ Adjusted Close #3 $ Adjusted Close #4 $ Adjusted Close #5 2) What is the average adjusted close for ALL weeks of your stock’s data? $ Average: 3) For the ten (10) most recent (by date) pairs of successive adjusted closes, compute the percent change from one week to the next to two (2) decimal places (for example, 2.35%). Only report your results below. Not your calculations. Weeks Percent Change Weeks 1 and 2 0.00% Weeks 2 and 3 0.00% Weeks 3 and 4 0.00% Weeks 4 and 5 0.00% Weeks 5 and 6 0.00% Weeks 6 and 7 0.00% Weeks 7 and 8 0.00% Weeks 8 and 9 0.00% Weeks 9 and 10 0.00% Weeks 10 and 11 0.00% *Week 1 is the most recent adjust close. Week 2 is the adjusted close the week before that. 4) Using the Equation Editor, clearly show all steps for the calculation of the Percent Change that you reported above for Weeks 1 and 2. Calculations: 5) Draw a graph of the all of your adjusted closing. Use the Chart Wizard and choose the XY (Scatter) option and then the graph that connects data points with no markers (last option). Your x axis should be dates, in ascending order, and the y axis should be the adjusted close of the stock price. Label and title the graph appropriately. (You may need to sort your data by date.) The background of the graph should be all white. Paste your graph in the space below and resize it so it fits, is readable, and looks good. Graph: Page 1 of 2 6) Add a column to your data spreadsheet and assign each adjusting closing price a week number, starting at 1. Hence, the first (oldest) adjusted close price is assigned 1, the second (oldest) price is assigned 2, etc. Then run a linear trendline in Excel using the week number as the x variable and the adjusted close price as the y variable. Report the equation below with the equation editor: Trendline Equation: 7) Use your trendline to predict the price of the stock (not the option) at the end of your team's option period. (You will have to be careful about what you let x be equal to…discuss this with your team first.) Show all calculations using the equation editor in the space provided. Prediction: Calculations: Note: this kind of prediction is dangerous (why?). We're doing it here just to get us into the mode of trying to predict the price of our stock at the end of the option period. * 8) Use your prediction in the previous problem to compute the value of the stock option (not the stock) at the end of the option period. Show all calculations using the equation editor in the space provided. Value: Calculations: 9) In no more than three (3) sentences, clearly explain if you believe the trendline prediction you got previously in (#7) is valid and why you believe the way you do. Explanation: Honor Code: With my signature below, I affirm that while I may have worked with other team members on this assignment, the final product is my own work. This means (a) I typed the work in this assignment myself and did not copy or allow another person to copy this file and (b) the work reflects my own understanding of the material. Violations of this code are subject to disciplinary action with the Vice President of Student Affairs. This assignment must be signed in order to be grades. Signature_________________________________________________________Date___________ Page 2 of 2