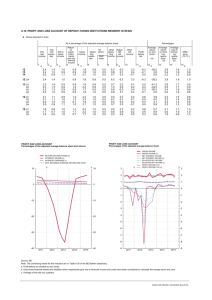

(I) Embedded Value (EV)

advertisement

Embedded Value European Embedded Value principles What are… Economic Value Added (EVA) Embedded Value (EV) Value Added Business Value Added (BVA) (I) Embedded Value (EV) The Embedded Value of a life company is the sum of the following parts: (a) Net assets adjusted to market value (allowing for any tax) (NAV) (b) Value of the in-force portfolio of life policies = Present value of future after tax profits on the local statutory basis (PVFP), on all in-force business, minus cost of holding the Risk Adjusted Capital (CRC) for the in-force business. (II) Embedded Value (EV) Net assets less Risk Adjusted Capital plus the value of future distributable profits. Required Capital / Risk Adjusted Capital The Required Capital is the capital required to ensure that the company has enough capital which is based on an economic viewpoint and which considers its business risk profile. Calculation of the cost of holding Risk Adjusted Capital The Cost of holding the Risk Adjusted Capital (CRC) can be calculated as: + Initial Risk Adjusted Capital - present value of investment income on Risk Adjusted Capital + present value of tax on investment income on Risk Adjusted Capital +/- present value of increases / releases of Risk Adjusted Capital (given the initial Risk Adjusted Capital position) Net Asset Value (NAV) The assets backing the technical reserves need to be defined. The remaining assets are the net assets. The net assets are shareholder assets. The value of the net assets should be determined as the realistic market value of the assets attributable to the shareholders. In determining their value allowance should be made for any contingent tax liabilities (e.g. arising on their sale) additional to those that have already been allowed for in determining the net assets. Present Value of Future Profits (PVFP) Determining the present value of future profits (PVFP) An actuarial projection system needs to be used to project on a calendar year basis and period by period (which could be monthly) into the future the income, expenditure and changes in reserves for each policy or model point. The projection system should determine the following cash flows on the assumptions set with allowance for profit-sharing. Present Value of Future Profits (PVFP) 1. Premium income 2. Investment return on mathematical reserves and cash flows 3. Expenses 4. Commissions 5. Death and morbidity claims 6. Surrender claims 7. Maturity claims 8. Increase in technical reserves 9. Taxation 10. Profits = 1+2-3-4-5-6-7-8-9 GLOSSARY Net Asset Value (NAV) The value of assets at market value allowing for tax held in the Company over and above those required to back technical provisions. Risk Adjusted Capital (RAC) (= Required Capital) The amount of capital required to be held by the business to ensure the company is sufficiently well capitalised to support its business risk profile. Also known as “Target Surplus”. Present Value of Risk Adjusted Capital (VRC ) Discounted present value of projected (investment income net of any tax on the projected amount of Risk Adjusted Capital plus releases (or minus increases) of the amount of Risk Adjusted Capital). Cost of holding Risk Adjusted Capital (CRC) The initial Risk Adjusted Capital minus the Present Value of Risk Adjusted Capital. GLOSSARY Profit That part of the local statutory profit attributable to the in-force business. Present Value of Future Profits (PVFP) Discounted present value of the projected future emergence of Profit. Distributable Profit Profit plus net investment return on Risk Adjusted Capital minus increase in Risk Adjusted Capital. Present Value of Distributable Profit Discounted present value of the projected future emergence of Distributable Profits. Embedded Value Net Assets plus Present Value of Future Profits minus Cost of holding Risk Adjusted Capital. Please note that the above definition is equivalent to: Net Assets minus Risk Adjusted Capital plus Present Value of Distributable Profits.