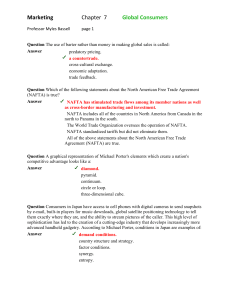

NAFTA: A Guide to Customs Procedures

advertisement