Chapter 23 Futures, Swaps, and Risk Management

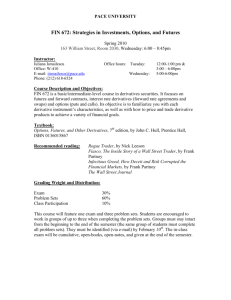

advertisement

Chapter 23 - Futures, Swaps, and Risk Management Chapter 23 Futures, Swaps, and Risk Management Multiple Choice Questions 1. Which one of the following stock index futures has a multiplier of $250 times the index value? A. Russell 2000 B. S&P 500 Index C. Nikkei D. DAX-30 E. NASDAQ 100 2. Which one of the following stock index futures has a multiplier of $10 times the index value? A. Russell 2000 B. Dow Jones Industrial Average C. Nikkei D. DAX-30 E. NASDAQ 100 3. Which one of the following stock index futures has a multiplier of $100 times the index value? A. Russell 2000 B. FTSE 100 C. Nikkei D. NASDAQ 100 E. Russell 2000 and NASDAQ 100 4. Which one of the following stock index futures has a multiplier of $100 times the index value? A. Russell 2000 B. FTSE 100 C. S&P Mid-Cap D. DAX-30 E. Russell 2000 and S&P Mid-Cap 23-1 Chapter 23 - Futures, Swaps, and Risk Management 5. Which one of the following stock index futures has a multiplier of $100 times the index value? A. CAC 40 B. S&P 500 Index C. Nikkei D. DAX-30 E. NASDAQ 100 6. Which one of the following stock index futures has a multiplier of 10 euros times the index? A. CAC 40 B. DJ Euro Stoxx - 50 C. Nikkei D. DAX-30 E. CAC 40 and DJ Euro Stoxx - 50 7. Which one of the following stock index futures has a multiplier of 10 euros times the index? A. FTSE 100 B. DJ Euro Stoxx - 50 C. Nikkei D. DAX-30 E. FTSE 100 and DJ Euro Stoxx - 50 8. Which one of the following stock index futures has a multiplier of 25 euros times the index? A. FTSE 100 B. DJ Euro Stoxx - 50 C. Nikkei D. DAX-30 E. FTSE 100 and DJ Euro Stoxx - 50 23-2 Chapter 23 - Futures, Swaps, and Risk Management 9. You purchased one S&P 500 Index futures contract at a price of 950 and closed your position when the index futures was 947, you incurred: A. a loss of $1,500. B. a gain of $1,500. C. a loss of $750. D. a gain of $750. E. None of these is correct. 10. You took a short position in two S&P 500 futures contracts at a price of 910 and closed the position when the index futures was 892, you incurred: A. a gain of $9,000. B. a loss of $9,000. C. a loss of $18,000. D. a gain of $18,000. E. None of these is correct. 11. If a stock index futures contract is overpriced, you would exploit this situation by: A. selling both the stock index futures and the stocks in the index. B. selling the stock index futures and simultaneously buying the stocks in the index. C. buying both the stock index futures and the stocks in the index. D. buying the stock index futures and selling the stocks in the index. E. None of these is correct. 12. Foreign Exchange Futures markets are __________ and the Foreign Exchange Forward markets are __________. A. informal; formal B. formal; formal C. formal; informal D. informal; informal E. organized; unorganized 23-3 Chapter 23 - Futures, Swaps, and Risk Management 13. Suppose that the risk-free rates in the United States and in the United Kingdom are 4% and 6%, respectively. The spot exchange rate between the dollar and the pound is $1.60/BP. What should the futures price of the pound for a one-year contract be to prevent arbitrage opportunities, ignoring transactions costs? A. $1.60/BP B. $1.70/BP C. $1.66/BP D. $1.63/BP E. $1.57/BP 14. Suppose that the risk-free rates in the United States and in the United Kingdom are 5% and 4%, respectively. The spot exchange rate between the dollar and the pound is $1.80/BP. What should the futures price of the pound for a one-year contract be to prevent arbitrage opportunities, ignoring transactions costs? A. $1.62/BP B. $1.72/BP C. $1.82/BP D. $1.92/BP E. None of these is correct. 15. Suppose that the risk-free rates in the United States and in Japan are 5.25% and 4.5%, respectively. The spot exchange rate between the dollar and the yen is $0.008828/yen. What should the futures price of the yen for a one-year contract be to prevent arbitrage opportunities, ignoring transactions costs? A. $0.009999/yen B. $0.009981/yen C. $0.008981/yen D. $0.008891/yen E. None of these is correct. 23-4 Chapter 23 - Futures, Swaps, and Risk Management 16. Let RUS be the annual risk free rate in the United States, RUK be the risk free rate in the United Kingdom, F be the futures price of $/BP for a 1-year contract, and E the spot exchange rate of $/BP. Which one of the following is true? A. if RUS > RUK, then E > F B. if RUS < RUK, then E < F C. if RUS > RUK, then E < F D. if RUS < RUK, then F = E E. There is no consistent relationship that can be predicted. 17. Let RUS be the annual risk free rate in the United States, RJ be the risk free rate in Japan, F be the futures price of $/yen for a 1-year contract, and E the spot exchange rate of $/yen. Which one of the following is true? A. if RUS > RJ, then E < F B. if RUS < RJ, then E < F C. if RUS > RJ, then E > F D. if RUS < RJ, then F = E E. There is no consistent relationship that can be predicted. Consider the following: 18. What should be the proper futures price for a 1-year contract? A. 1.703 A$/$ B. 1.654 A$/$ C. 1.638 A$/$ D. 1.778 A$/$ E. 1.686 A$/$ 23-5 Chapter 23 - Futures, Swaps, and Risk Management 19. If the futures market price is 1.63 A$/$, how could you arbitrage? A. Borrow Australian Dollars in Australia, convert them to dollars, lend the proceeds in the United States and enter futures positions to purchase Australian Dollars at the current futures price. B. Borrow U. S dollars in the United States, convert them to Australian Dollars, lend the proceeds in Australia and enter futures positions to sell Australian Dollars at the current futures price. C. Borrow U. S. dollars in the United States and invest them in the U. S. and enter futures positions to purchase Australian Dollars at the current futures price. D. Borrow Australian Dollars in Australia and invest them there, then convert back to U. S. dollars at the spot price. E. There is no arbitrage opportunity. 20. If the market futures price is 1.69 A$/$, how could you arbitrage? A. Borrow Australian Dollars in Australia, convert them to dollars, lend the proceeds in the United States and enter futures positions to purchase Australian Dollars at the current futures price. B. Borrow U. S. dollars in the United States, convert them to Australian Dollars, lend the proceeds in Australia and enter futures positions to sell Australian Dollars at the current futures price. C. Borrow U. S. dollars in the United States and invest them in the U. S. and enter futures positions to purchase Australian Dollars at the current futures price. D. Borrow Australian Dollars in Australia and invest them there, then convert back to U. S. dollars at the spot price. E. There is no arbitrage opportunity. 21. Assume the current market futures price is 1.66 A$/$. You borrow 167,000 A$ and convert the proceeds to U. S. dollars and invest them in the U. S at the risk-free rate. You simultaneously enter a contract to purchase 170,340 A$ at the current futures prices (maturity of 1 year). What would be your profit (loss)? A. Profit of 630 A$ B. Loss of 2300 A$ C. Profit of 2300 A$ D. Loss of 630 A$ E. None of these is correct. 23-6 Chapter 23 - Futures, Swaps, and Risk Management 22. Which of the following is/are example(s) of interest rate futures contracts? A. Corporate bonds B. Treasury bonds C. Eurodollars D. Treasury bonds and Eurodollars E. Corporate bonds and Treasury bonds 23. You hold a $50 million portfolio of par value bonds with a coupon rate of 10 percent paid annually and 15 years to maturity. How many T-bond futures contracts do you need to hedge the portfolio against an unanticipated change in the interest rate of 0.18%? Assume the market interest rate is 10 percent and that T-bond futures contracts call for delivery of an 8 percent coupon (paid annually), 20-year maturity T-bond. A. 398 contracts long B. 524 contracts short C. 1048 contracts short D. 398 contracts short E. None of these is correct. 24. A swap A. obligates two counterparties to exchange cash flows at one or more future dates. B. allows participants to restructure their balance sheets. C. allows a firm to convert outstanding fixed rate debt to floating rate debt. D. obligates two counterparties to exchange cash flows at one or more future dates and allows participants to restructure their balance sheets. E. obligates two counterparties to exchange cash flows at one or more future dates, allows participants to restructure their balance sheets, and allows a firm to convert outstanding fixed rate debt to floating rate debt. 23-7 Chapter 23 - Futures, Swaps, and Risk Management 25. Credit risk in the swap market A. is extensive. B. is limited to the difference between the values of the fixed rate and floating rate obligations. C. is equal to the total value of the payments that the floating rate payer was obligated to make. D. is extensive and is equal to the total value of the payments that the floating rate payer was obligated to make. E. None of these is correct. 26. Trading in stock index futures A. now exceeds buying and selling of shares in most markets. B. reduces transactions costs as compared to trading in stocks. C. increases leverage as compared to trading in stocks. D. generally results in faster execution than trading in stocks. E. All of these are correct. 27. Commodity futures pricing A. must be related to spot prices. B. includes cost of carry. C. converges to spot prices at maturity. D. All of these are correct. E. None of these is correct. 28. Arbitrage proofs in futures market pricing relationships A. rely on the CAPM. B. demonstrate how investors can exploit misalignments. C. incorporate transactions costs. D. All of these are correct. E. None of these is correct. 23-8 Chapter 23 - Futures, Swaps, and Risk Management 29. One reason swaps are desirable is that A. they are free of credit risk. B. they have no transactions costs. C. they increase interest rate volatility. D. they increase interest rate risk. E. they offer participants easy ways to restructure their balance sheets. 30. Which two indices had the lowest correlation between them during the 2001–2006 period? A. S&P and DJIA; the correlation was 0.957 B. S&P and NASDAQ; the correlation was 0.899 C. DJIA and Russell 2000 the correlation was 0.758 D. S&P and NYSE; the correlation was 0.973 E. NYSE and DJIA; the correlation was 0.931 31. Which two indices had the highest correlation between them during the 2001–2006 period? A. S&P and DJIA; the correlation was 0.957 B. S&P and Russell 2000; the correlation was 0.899 C. DJIA and Russell 2000; the correlation was 0.758 D. S&P and NYSE; the correlation was 0.973 E. NYSE and DJIA; the correlation was 0.931 32. The value of a futures contract for storable commodities can be determined by the _______ and the model __________ consistent with parity relationships. A. CAPM; will be B. CAPM; will not be C. APT; will not be D. APT; will be E. CAPM and APT; will be 23-9 Chapter 23 - Futures, Swaps, and Risk Management 33. In the equation Profits = a + b*($/₤ exchange rate), b is a measure of A. the firm's beta when measured in terms of the foreign currency. B. the ratio of the firm's beta in terms of dollars to the firm's beta in terms of pounds. C. the sensitivity of profits to the exchange rate. D. the sensitivity of the exchange rate to profits. E. the frequency with which the exchange rate changes. 34. Hedging one commodity by using a futures contract on another commodity is called A. surrogate hedging. B. cross hedging. C. alternative hedging. D. correlative hedging. E. proxy hedging. You are given the following information about a portfolio you are to manage. For the longterm you are bullish, but you think the market may fall over the next month. 35. If the anticipated market value materializes, what will be your expected loss on the portfolio? A. 14.29% B. 16.67% C. 15.43% D. 8.57% E. 6.42% 23-10 Chapter 23 - Futures, Swaps, and Risk Management 36. What is the dollar value of your expected loss? A. $142,900 B. $16,670 C. $85,700 D. $30,000 E. $64,200 37. For a 200-point drop in the S&P500, by how much does the value of the futures position change? A. $200,000 B. $50,000 C. $250,000 D. $500,000 E. $100,000 38. How many contracts should you buy or sell to hedge your position? Allow fractions of contracts in your answer. A. sell 1.714 B. buy 1.714 C. sell 4.236 D. buy 4.236 E. sell 11.235 39. You sold S&P 500 Index futures contract at a price of 950 and closed your position when the index futures was 947, you incurred: A. a loss of $1,500. B. a gain of $1,500. C. a loss of $750. D. a gain of $750. E. None of these is correct. 23-11 Chapter 23 - Futures, Swaps, and Risk Management 40. You took a short position in three S&P 500 futures contracts at a price of 900 and closed the position when the index futures was 885, you incurred: A. a gain of $11,250. B. a loss of $11,250. C. a loss of $8,000. D. a gain of $8,000. E. None of these is correct. 41. Suppose that the risk-free rates in the United States and in the Canada are 3% and 5%, respectively. The spot exchange rate between the dollar and the Canadian dollar (C$) is $0.80/C$. What should the futures price of the C$ for a one-year contract be to prevent arbitrage opportunities, ignoring transactions costs. A. $1.00/ C$ B. $1.70/ C$ C. $0.88/ C$ D. $0.78/ C$ E. $1.22/ C$ 42. Suppose that the risk-free rates in the United States and in the Canada are 5% and 3%, respectively. The spot exchange rate between the dollar and the Canadian dollar (C$) is $0.80/C$. What should the futures price of the C$ for a one-year contract be to prevent arbitrage opportunities, ignoring transactions costs. A. $1.00/ C$ B. $0.82/ C$ C. $0.88/ C$ D. $0.78/ C$ E. $1.22/ C$ 23-12 Chapter 23 - Futures, Swaps, and Risk Management 43. Suppose that the risk-free rates in the United States and in the United Kingdom are 6% and 4%, respectively. The spot exchange rate between the dollar and the pound is $1.60/BP. What should the futures price of the pound for a one-year contract be to prevent arbitrage opportunities, ignoring transactions costs. A. $1.60/BP B. $1.70/BP C. $1.66/Bp D. $1.63/BP E. $1.57/BP You are given the following information about a portfolio you are to manage. For the longterm you are bullish, but you think the market may fall over the next month. 44. If the anticipated market value materializes, what will be your expected loss on the portfolio? A. 7.58% B. 6.52% C. 15.43% D. 8.57% E. 6.42% 45. What is the dollar value of your expected loss? A. $142,900 B. $65,200 C. $85,700 D. $30,000 E. $64,200 23-13 Chapter 23 - Futures, Swaps, and Risk Management 46. For a 75-point drop in the S&P500, by how much does the futures position change? A. $200,000 B. $50,000 C. $250,000 D. $500,000 E. $18,750 47. How many contracts should you buy or sell to hedge your position? Allow fractions of contracts in your answer. A. sell 3.477 B. buy 3.477 C. sell 4.236 D. buy 4.236 E. sell 11.235 48. Covered interest arbitrage ____________. A. ensures that currency futures prices are set correctly B. ensures that commodity futures prices are set correctly C. ensures that interest rate futures prices are set correctly D. ensures that currency futures prices are set correctly and ensures that commodity futures prices are set correctly E. None of these is correct. 49. A hedge ratio can be computed as ____________. A. profit derived from one futures position for a given change in the exchange rate divided by the change in value of the unprotected position for the same exchange rate B. the change in value of the unprotected position for a given change in the exchange rate divided by the profit derived from one futures position for the same exchange rate C. profit derived from one futures position for a given change in the exchange rate plus the change in value of the unprotected position for the same exchange rate D. the change in value of the unprotected position for a given change in the exchange rate plus by the profit derived from one futures position for the same exchange rate E. None of these is correct. 23-14 Chapter 23 - Futures, Swaps, and Risk Management 50. E-Minis typically have a value of ____________ percent of the standard contract and exist for ____________. A. 50; individual stocks and commodities B. 50; stock indexes and foreign currencies C. 40; stock indexes and commodities D. 20; individual stocks and commodities E. 20; stock indexes and foreign currencies 51. The most common short term interest rate used in the swap market is A. the U.S. discount rate. B. the U.S. prime rate. C. the U.S. fed funds rate. D. LIBOR. E. None of these is correct. 52. If interest rate parity holds, A. covered interest arbitrage opportunities will exist. B. covered interest arbitrage opportunities will not exist. C. arbitragers will be able to make risk-free profits. D. covered interest arbitrage opportunities will exist and arbitragers will be able to make riskfree profits. E. covered interest arbitrage opportunities will not exist and arbitragers will be able to make risk-free profits. 53. If interest rate parity does not hold, A. covered interest arbitrage opportunities will exist. B. covered interest arbitrage opportunities will not exist. C. arbitragers will be able to make risk-free profits. D. covered interest arbitrage opportunities will exist and arbitragers will be able to make riskfree profits. E. covered interest arbitrage opportunities will not exist and arbitragers will be able to make risk-free profits. 23-15 Chapter 23 - Futures, Swaps, and Risk Management 54. If covered interest arbitrage opportunities do not exist, A. interest rate parity does not hold. B. interest rate parity holds. C. arbitragers will be able to make risk-free profits. D. interest rate parity does not hold and arbitragers will be able to make risk-free profits. E. interest rate parity holds and arbitragers will be able to make risk-free profits. 55. If covered interest arbitrage opportunities exist, A. interest rate parity does not hold. B. interest rate parity holds. C. arbitragers will be able to make risk-free profits. D. interest rate parity does not hold and arbitragers will be able to make risk-free profits. E. interest rate parity holds and arbitragers will be able to make risk-free profits. Short Answer Questions 56. Why are commodity futures prices different from other futures prices? Explain the difference and give an example of a commodity and the factors involved. 23-16 Chapter 23 - Futures, Swaps, and Risk Management 57. Suppose that the risk-free rate is 4% and the market risk premium is 6%. You are interested in a cocoa futures contract. The beta of cocoa is −0.291. - What is the required annual rate of return on the cocoa contract? - You plan to hold the contract for three months, then take delivery of the cocoa. At that time, you expect the spot price of cocoa to be $900 per ton. What is the present value of this threemonth deferred claim? What would the proper price be for this contract? 58. Explain how a firm that has issued $1 million of long-term bonds with a fixed 6% interest rate can convert its fixed-rate debt into floating-rate debt. Give two numerical examples that show the possible outcomes, one favorable and one unfavorable. 23-17 Chapter 23 - Futures, Swaps, and Risk Management Chapter 23 Futures, Swaps, and Risk Management Answer Key Multiple Choice Questions 1. Which one of the following stock index futures has a multiplier of $250 times the index value? A. Russell 2000 B. S&P 500 Index C. Nikkei D. DAX-30 E. NASDAQ 100 The multiplier is used to calculate contract settlements. See Table 23.1. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management 2. Which one of the following stock index futures has a multiplier of $10 times the index value? A. Russell 2000 B. Dow Jones Industrial Average C. Nikkei D. DAX-30 E. NASDAQ 100 The multiplier is used to calculate contract settlements. See Table 23.1. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management 23-18 Chapter 23 - Futures, Swaps, and Risk Management 3. Which one of the following stock index futures has a multiplier of $100 times the index value? A. Russell 2000 B. FTSE 100 C. Nikkei D. NASDAQ 100 E. Russell 2000 and NASDAQ 100 The multiplier is used to calculate contract settlements. See Table 23.1. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management 4. Which one of the following stock index futures has a multiplier of $100 times the index value? A. Russell 2000 B. FTSE 100 C. S&P Mid-Cap D. DAX-30 E. Russell 2000 and S&P Mid-Cap The multiplier is used to calculate contract settlements. See Table 23.1. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management 23-19 Chapter 23 - Futures, Swaps, and Risk Management 5. Which one of the following stock index futures has a multiplier of $100 times the index value? A. CAC 40 B. S&P 500 Index C. Nikkei D. DAX-30 E. NASDAQ 100 The multiplier is used to calculate contract settlements. See Table 23.1. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management 6. Which one of the following stock index futures has a multiplier of 10 euros times the index? A. CAC 40 B. DJ Euro Stoxx - 50 C. Nikkei D. DAX-30 E. CAC 40 and DJ Euro Stoxx - 50 The multiplier is used to calculate contract settlements. See Table 23.1. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management 23-20 Chapter 23 - Futures, Swaps, and Risk Management 7. Which one of the following stock index futures has a multiplier of 10 euros times the index? A. FTSE 100 B. DJ Euro Stoxx - 50 C. Nikkei D. DAX-30 E. FTSE 100 and DJ Euro Stoxx - 50 The multiplier is used to calculate contract settlements. See Table 23.1. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management 8. Which one of the following stock index futures has a multiplier of 25 euros times the index? A. FTSE 100 B. DJ Euro Stoxx - 50 C. Nikkei D. DAX-30 E. FTSE 100 and DJ Euro Stoxx - 50 The multiplier is used to calculate contract settlements. See Table 23.1. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management 23-21 Chapter 23 - Futures, Swaps, and Risk Management 9. You purchased one S&P 500 Index futures contract at a price of 950 and closed your position when the index futures was 947, you incurred: A. a loss of $1,500. B. a gain of $1,500. C. a loss of $750. D. a gain of $750. E. None of these is correct. (−$950 + $947) × 250 = −$750. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Risk management 10. You took a short position in two S&P 500 futures contracts at a price of 910 and closed the position when the index futures was 892, you incurred: A. a gain of $9,000. B. a loss of $9,000. C. a loss of $18,000. D. a gain of $18,000. E. None of these is correct. ($910 − $892) × 250 × 2 = $9,000. AACSB: Analytic Bloom's: Apply Difficulty: Basic Topic: Risk management 23-22 Chapter 23 - Futures, Swaps, and Risk Management 11. If a stock index futures contract is overpriced, you would exploit this situation by: A. selling both the stock index futures and the stocks in the index. B. selling the stock index futures and simultaneously buying the stocks in the index. C. buying both the stock index futures and the stocks in the index. D. buying the stock index futures and selling the stocks in the index. E. None of these is correct. If one perceives one asset to be overpriced relative to another asset, one sells the overpriced asset and buys the other one. AACSB: Analytic Bloom's: Understand Difficulty: Intermediate Topic: Risk management 12. Foreign Exchange Futures markets are __________ and the Foreign Exchange Forward markets are __________. A. informal; formal B. formal; formal C. formal; informal D. informal; informal E. organized; unorganized The forward market in foreign exchange is a network of banks and brokers allowing customers to enter forward contracts to purchase or sell currency in the future at a currently agreed upon rate of exchange. The currency futures markets are formal markets established by the Chicago Mercantile Exchange where contracts are standardized as to size and daily marking to market is observed. A clearinghouse is also involved. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management 23-23 Chapter 23 - Futures, Swaps, and Risk Management 13. Suppose that the risk-free rates in the United States and in the United Kingdom are 4% and 6%, respectively. The spot exchange rate between the dollar and the pound is $1.60/BP. What should the futures price of the pound for a one-year contract be to prevent arbitrage opportunities, ignoring transactions costs? A. $1.60/BP B. $1.70/BP C. $1.66/BP D. $1.63/BP E. $1.57/BP $1.60(1.04/1.06) = $1.57/BP. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Risk management 14. Suppose that the risk-free rates in the United States and in the United Kingdom are 5% and 4%, respectively. The spot exchange rate between the dollar and the pound is $1.80/BP. What should the futures price of the pound for a one-year contract be to prevent arbitrage opportunities, ignoring transactions costs? A. $1.62/BP B. $1.72/BP C. $1.82/BP D. $1.92/BP E. None of these is correct $1.80(1.05/1.04) = $1.82/BP. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Risk management 23-24 Chapter 23 - Futures, Swaps, and Risk Management 15. Suppose that the risk-free rates in the United States and in Japan are 5.25% and 4.5%, respectively. The spot exchange rate between the dollar and the yen is $0.008828/yen. What should the futures price of the yen for a one-year contract be to prevent arbitrage opportunities, ignoring transactions costs? A. $0.009999/yen B. $0.009981/yen C. $0.008981/yen D. $0.008891/yen E. None of these is correct $0.008828 (1.0525/1.045) = $0.008891/yen. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Risk management 16. Let RUS be the annual risk free rate in the United States, RUK be the risk free rate in the United Kingdom, F be the futures price of $/BP for a 1-year contract, and E the spot exchange rate of $/BP. Which one of the following is true? A. if RUS > RUK, then E > F B. if RUS < RUK, then E < F C. if RUS > RUK, then E < F D. if RUS < RUK, then F = E E. There is no consistent relationship that can be predicted. If RUS > RUK, then (1 + RUS)/(1 + RUK) > 1 and E < F. AACSB: Analytic Bloom's: Understand Difficulty: Challenge Topic: Risk management 23-25 Chapter 23 - Futures, Swaps, and Risk Management 17. Let RUS be the annual risk free rate in the United States, RJ be the risk free rate in Japan, F be the futures price of $/yen for a 1-year contract, and E the spot exchange rate of $/yen. Which one of the following is true? A. if RUS > RJ, then E < F B. if RUS < RJ, then E < F C. if RUS > RJ, then E > F D. if RUS < RJ, then F = E E. There is no consistent relationship that can be predicted. If RUS > RJ, then (1 + RUS)/(1 + RJ) > 1 and E < F. AACSB: Analytic Bloom's: Understand Difficulty: Challenge Topic: Risk management Consider the following: 18. What should be the proper futures price for a 1-year contract? A. 1.703 A$/$ B. 1.654 A$/$ C. 1.638 A$/$ D. 1.778 A$/$ E. 1.686 A$/$ 1.03/1.04(1.67 A$/$) = 1.654 A$/$. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Risk management 23-26 Chapter 23 - Futures, Swaps, and Risk Management 19. If the futures market price is 1.63 A$/$, how could you arbitrage? A. Borrow Australian Dollars in Australia, convert them to dollars, lend the proceeds in the United States and enter futures positions to purchase Australian Dollars at the current futures price. B. Borrow U. S dollars in the United States, convert them to Australian Dollars, lend the proceeds in Australia and enter futures positions to sell Australian Dollars at the current futures price. C. Borrow U. S. dollars in the United States and invest them in the U. S. and enter futures positions to purchase Australian Dollars at the current futures price. D. Borrow Australian Dollars in Australia and invest them there, then convert back to U. S. dollars at the spot price. E. There is no arbitrage opportunity. E0(1 + rUS) − FO(1 + rA); use the U. S. $values for the currency: 0.5988(1.04) − 0.6135(1.03) = −0.009153; when relationship is negative, action b will result in arbitrage profits. AACSB: Analytic Bloom's: Understand Difficulty: Challenge Topic: Risk management 23-27 Chapter 23 - Futures, Swaps, and Risk Management 20. If the market futures price is 1.69 A$/$, how could you arbitrage? A. Borrow Australian Dollars in Australia, convert them to dollars, lend the proceeds in the United States and enter futures positions to purchase Australian Dollars at the current futures price. B. Borrow U. S. dollars in the United States, convert them to Australian Dollars, lend the proceeds in Australia and enter futures positions to sell Australian Dollars at the current futures price. C. Borrow U. S. dollars in the United States and invest them in the U. S. and enter futures positions to purchase Australian Dollars at the current futures price. D. Borrow Australian Dollars in Australia and invest them there, then convert back to U. S. dollars at the spot price. E. There is no arbitrage opportunity. 0.5988(1.04) − 0.5917(1.03) = 0.013301; when this relationship is positive; action a will result in arbitrage profits. AACSB: Analytic Bloom's: Understand Difficulty: Challenge Topic: Risk management 23-28 Chapter 23 - Futures, Swaps, and Risk Management 21. Assume the current market futures price is 1.66 A$/$. You borrow 167,000 A$ and convert the proceeds to U. S. dollars and invest them in the U. S at the risk-free rate. You simultaneously enter a contract to purchase 170,340 A$ at the current futures prices (maturity of 1 year). What would be your profit (loss)? A. Profit of 630 A$ B. Loss of 2300 A$ C. Profit of 2300 A$ D. Loss of 630 A$ E. None of these is correct [A$167,000 / 1.67 × 1.04 × 1.66] − (A$167,000 × 1.03) = A$630. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Risk management 22. Which of the following is/are example(s) of interest rate futures contracts? A. Corporate bonds. B. Treasury bonds. C. Eurodollars. D. Treasury bonds and Eurodollars E. Corporate bonds and Treasury bonds Interest rate futures are traded on Treasury bonds and Eurodollars. Examples that use these contracts to hedge are given in the textbook. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management 23-29 Chapter 23 - Futures, Swaps, and Risk Management 23. You hold a $50 million portfolio of par value bonds with a coupon rate of 10 percent paid annually and 15 years to maturity. How many T-bond futures contracts do you need to hedge the portfolio against an unanticipated change in the interest rate of 0.18%? Assume the market interest rate is 10 percent and that T-bond futures contracts call for delivery of an 8 percent coupon (paid annually), 20-year maturity T-bond. A. 398 contracts long B. 524 contracts short C. 1048 contracts short D. 398 contracts short E. None of these is correct 0.9864485 × $50 M = $49,322,425; $50,000,000 − $49,322,425 = $677,575 loss on bonds; $100.00 − $82.97 = $17.03 × 100 = $1703 gain on futures; $677,575/$1,703 = 398 contracts short. AACSB: Analytic Bloom's: Apply Difficulty: Challenge Topic: Risk management 24. A swap A. obligates two counterparties to exchange cash flows at one or more future dates. B. allows participants to restructure their balance sheets. C. allows a firm to convert outstanding fixed rate debt to floating rate debt. D. obligates two counterparties to exchange cash flows at one or more future dates and allows participants to restructure their balance sheets. E. obligates two counterparties to exchange cash flows at one or more future dates, allows participants to restructure their balance sheets, and allows a firm to convert outstanding fixed rate debt to floating rate debt. A firm can enter into agreement to pay a floating rate and receive a fixed rate. Swaps involve an exchange of cash flows rather than securities. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management 23-30 Chapter 23 - Futures, Swaps, and Risk Management 25. Credit risk in the swap market A. is extensive. B. is limited to the difference between the values of the fixed rate and floating rate obligations. C. is equal to the total value of the payments that the floating rate payer was obligated to make. D. is extensive and is equal to the total value of the payments that the floating rate payer was obligated to make. E. None of these is correct. Swaps obligate two counterparties to exchange cash flows at one or more future dates. Swaps allow firms to restructure balance sheets, and the firm is obligated only for the difference between the fixed and floating rates. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management 26. Trading in stock index futures A. now exceeds buying and selling of shares in most markets. B. reduces transactions costs as compared to trading in stocks. C. increases leverage as compared to trading in stocks. D. generally results in faster execution than trading in stocks. E. All of these are correct. Trading in stock index futures now exceeds buying and selling of shares in most markets, reduces transactions costs as compared to trading in stocks, increases leverage as compared to trading in stocks, and generally results in faster execution than trading in stocks. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Risk management 23-31 Chapter 23 - Futures, Swaps, and Risk Management 27. Commodity futures pricing A. must be related to spot prices. B. includes cost of carry. C. converges to spot prices at maturity. D. All of these are correct. E. None of these is correct. Commodity futures are similar to other types of futures contracts but the cost of carrying must be considered. The cost of carrying includes interest costs, storage costs, and allowance for spoilage. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management 28. Arbitrage proofs in futures market pricing relationships A. rely on the CAPM. B. demonstrate how investors can exploit misalignments. C. incorporate transactions costs. D. All of these are correct. E. None of these is correct. No-arbitrage relationships are stronger than arguments such as the CAPM, but may be less precise if transactions or storage costs are not known. AACSB: Analytic Bloom's: Remember Difficulty: Challenge Topic: Risk management 23-32 Chapter 23 - Futures, Swaps, and Risk Management 29. One reason swaps are desirable is that A. they are free of credit risk. B. they have no transactions costs. C. they increase interest rate volatility. D. they increase interest rate risk. E. they offer participants easy ways to restructure their balance sheets. For example, a firm can change a floating-rate obligation into a fixed-rate obligation and vice versa. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Risk management 30. Which two indices had the lowest correlation between them during the 2001-2006 period? A. S&P and DJIA; the correlation was 0.957 B. S&P and NASDAQ; the correlation was 0.899 C. DJIA and Russell 2000 the correlation was 0.758 D. S&P and NYSE; the correlation was 0.973 E. NYSE and DJIA; the correlation was 0.931 The correlations are shown in Table 23.2. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management 23-33 Chapter 23 - Futures, Swaps, and Risk Management 31. Which two indices had the highest correlation between them during the 2001-2006 period? A. S&P and DJIA; the correlation was 0.957 B. S&P and Russell 2000 the correlation was 0.899 C. DJIA and Russell 2000 the correlation was 0.758 D. S&P and NYSE; the correlation was 0.973 E. NYSE and DJIA; the correlation was 0.931 The correlations are shown in Table 23.2. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management 32. The value of a futures contract for storable commodities can be determined by the _______ and the model __________ consistent with parity relationships. A. CAPM, will be B. CAPM, will not be C. APT, will not be D. APT, will be E. CAPM and APT; will be Both the CAPM and the APT can be used for this purpose and both will be consistent with parity relationships. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Risk management 23-34 Chapter 23 - Futures, Swaps, and Risk Management 33. In the equation Profits = a + b*($/₤ exchange rate), b is a measure of A. the firm's beta when measured in terms of the foreign currency. B. the ratio of the firm's beta in terms of dollars to the firm's beta in terms of pounds. C. the sensitivity of profits to the exchange rate. D. the sensitivity of the exchange rate to profits. E. the frequency with which the exchange rate changes. The slope of a line that plots profits vs. exchange rates gives the average amount by which profits will change for each unit change in the exchange rate. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Risk management 34. Hedging one commodity by using a futures contract on another commodity is called A. surrogate hedging. B. cross hedging. C. alternative hedging. D. correlative hedging. E. proxy hedging. Cross-hedging is used in some cases because no futures contract exists for the item you want to hedge. The two commodities should be highly correlated. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management You are given the following information about a portfolio you are to manage. For the longterm you are bullish, but you think the market may fall over the next month. 23-35 Chapter 23 - Futures, Swaps, and Risk Management 35. If the anticipated market value materializes, what will be your expected loss on the portfolio? A. 14.29% B. 16.67% C. 15.43% D. 8.57% E. 6.42% The change would represent a drop of (1200 − 1400)/1400 = 14.3% in the index. Given the portfolio's beta, your portfolio would be expected to lose 0.6*14.3% = 8.57% AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Risk management 36. What is the dollar value of your expected loss? A. $142,900 B. $16,670 C. $85,700 D. $30,000 E. $64,200 The dollar value equals the loss of 8.57% times the $1 million portfolio value = $85,700. AACSB: Analytic Bloom's: Apply Difficulty: Basic Topic: Risk management 23-36 Chapter 23 - Futures, Swaps, and Risk Management 37. For a 200-point drop in the S&P500, by how much does the value of the futures position change? A. $200,000 B. $50,000 C. $250,000 D. $500,000 E. $100,000 The change is 200 points times the $250 multiplier, which equals $50,000. AACSB: Analytic Bloom's: Apply Difficulty: Basic Topic: Risk management 38. How many contracts should you buy or sell to hedge your position? Allow fractions of contracts in your answer. A. sell 1.714 B. buy 1.714 C. sell 4.236 D. buy 4.236 E. sell 11.235 The number of contracts equals the hedge ratio = Change in portfolio value / Profit on one futures contract = $85,700/$50,000 = 1.714. You should sell the contract because as the market falls the value of the futures contract will rise and will offset the decline in the portfolio's value. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Risk management 23-37 Chapter 23 - Futures, Swaps, and Risk Management 39. You sold S&P 500 Index futures contract at a price of 950 and closed your position when the index futures was 947, you incurred: A. a loss of $1,500. B. a gain of $1,500. C. a loss of $750. D. a gain of $750. E. None of these is correct. ($950 − $947) = $3 × 250 = $750. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Risk management 40. You took a short position in three S&P 500 futures contracts at a price of 900 and closed the position when the index futures was 885, you incurred: A. a gain of $11,250. B. a loss of $11,250. C. a loss of $8,000. D. a gain of $8,000. E. None of these is correct. ($900 − $885) = $15 × 250 × 3 = $11,250. AACSB: Analytic Bloom's: Apply Difficulty: Basic Topic: Risk management 23-38 Chapter 23 - Futures, Swaps, and Risk Management 41. Suppose that the risk-free rates in the United States and in the Canada are 3% and 5%, respectively. The spot exchange rate between the dollar and the Canadian dollar (C$) is $0.80/C$. What should the futures price of the C$ for a one-year contract be to prevent arbitrage opportunities, ignoring transactions costs. A. $1.00/ C$ B. $1.70/ C$ C. $0.88/ C$ D. $0.78/ C$ E. $1.22/ C$ $0.80(1.03/1.05) = $0.78/ C$. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Risk management 42. Suppose that the risk-free rates in the United States and in the Canada are 5% and 3%, respectively. The spot exchange rate between the dollar and the Canadian dollar (C$) is $0.80/C$. What should the futures price of the C$ for a one-year contract be to prevent arbitrage opportunities, ignoring transactions costs. A. $1.00/ C$ B. $0.82/ C$ C. $0.88/ C$ D. $0.78/ C$ E. $1.22/ C$ $0.80(1.05/1.03) = $0.82/ C$. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Risk management 23-39 Chapter 23 - Futures, Swaps, and Risk Management 43. Suppose that the risk-free rates in the United States and in the United Kingdom are 6% and 4%, respectively. The spot exchange rate between the dollar and the pound is $1.60/BP. What should the futures price of the pound for a one-year contract be to prevent arbitrage opportunities, ignoring transactions costs. A. $1.60/BP B. $1.70/BP C. $1.66/Bp D. $1.63/BP E. $1.57/BP $1.60(1.06/1.04) = $1.63/BP. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Risk management You are given the following information about a portfolio you are to manage. For the longterm you are bullish, but you think the market may fall over the next month. 44. If the anticipated market value materializes, what will be your expected loss on the portfolio? A. 7.58% B. 6.52% C. 15.43% D. 8.57% E. 6.42% The change would represent a drop of (915-990)/990=7.58% in the index. Given the portfolio's beta, your portfolio would be expected to lose 0.86*7.58%=6.52% AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Risk management 23-40 Chapter 23 - Futures, Swaps, and Risk Management 45. What is the dollar value of your expected loss? A. $142,900 B. $65,200 C. $85,700 D. $30,000 E. $64,200 The dollar value equals the loss of 6.52% times the $1 million portfolio value = $65,200. AACSB: Analytic Bloom's: Apply Difficulty: Basic Topic: Risk management 46. For a 75-point drop in the S&P500, by how much does the futures position change? A. $200,000 B. $50,000 C. $250,000 D. $500,000 E. $18,750 The change is 75 points times the $250 multiplier, which equals $18,750. AACSB: Analytic Bloom's: Apply Difficulty: Basic Topic: Risk management 23-41 Chapter 23 - Futures, Swaps, and Risk Management 47. How many contracts should you buy or sell to hedge your position? Allow fractions of contracts in your answer. A. sell 3.477 B. buy 3.477 C. sell 4.236 D. buy 4.236 E. sell 11.235 The number of contracts equals the hedge ratio = Change in portfolio value / Profit on one futures contract = $65,200/$18,750 = 3.477. You should sell the contract because as the market falls the value of the futures contract will rise and will offset the decline in the portfolio's value. AACSB: Analytic Bloom's: Apply Difficulty: Intermediate Topic: Risk management 48. Covered interest arbitrage ____________. A. ensures that currency futures prices are set correctly B. ensures that commodity futures prices are set correctly C. ensures that interest rate futures prices are set correctly D. ensures that currency futures prices are set correctly and ensures that commodity futures prices are set correctly E. None of these is correct Covered interest arbitrage ensures that currency futures prices are set correctly. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management 23-42 Chapter 23 - Futures, Swaps, and Risk Management 49. A hedge ratio can be computed as ____________. A. profit derived from one futures position for a given change in the exchange rate divided by the change in value of the unprotected position for the same exchange rate B. the change in value of the unprotected position for a given change in the exchange rate divided by the profit derived from one futures position for the same exchange rate C. profit derived from one futures position for a given change in the exchange rate plus the change in value of the unprotected position for the same exchange rate D. the change in value of the unprotected position for a given change in the exchange rate plus by the profit derived from one futures position for the same exchange rate E. None of these is correct A hedge ratio can be computed as the change in value of the unprotected position for a given change in the exchange rate divided by the profit derived from one futures position for the same exchange rate. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Risk management 50. E-Minis typically have a value of ____________ percent of the standard contract and exist for ____________. A. 50; individual stocks and commodities B. 50; stock indexes and foreign currencies C. 40; stock indexes and commodities D. 20; individual stocks and commodities E. 20; stock indexes and foreign currencies E-Minis typically have a value of 20 percent of the standard contract and exist for stock indexes and foreign currencies. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management 23-43 Chapter 23 - Futures, Swaps, and Risk Management 51. The most common short term interest rate used in the swap market is A. the U.S. discount rate B. the U.S. prime rate C. the U.S. fed funds rate D. LIBOR E. None of these is correct None of the listed answers are common short term interest rates used in the swap market. AACSB: Analytic Bloom's: Remember Difficulty: Basic Topic: Risk management 52. If interest rate parity holds A. covered interest arbitrage opportunities will exist B. covered interest arbitrage opportunities will not exist C. arbitragers will be able to make risk-free profits D. covered interest arbitrage opportunities will exist and arbitragers will be able to make riskfree profits E. covered interest arbitrage opportunities will not exist and arbitragers will be able to make risk-free profits If interest rate parity holds covered interest arbitrage opportunities will not exist. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Risk management 23-44 Chapter 23 - Futures, Swaps, and Risk Management 53. If interest rate parity does not hold A. covered interest arbitrage opportunities will exist B. covered interest arbitrage opportunities will not exist C. arbitragers will be able to make risk-free profits D. covered interest arbitrage opportunities will exist and arbitragers will be able to make riskfree profits E. covered interest arbitrage opportunities will not exist and arbitragers will be able to make risk-free profits If interest rate parity holds covered interest arbitrage opportunities will not exist. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Risk management 54. If covered interest arbitrage opportunities do not exist A. interest rate parity does not hold B. interest rate parity holds C. arbitragers will be able to make risk-free profits D. interest rate parity does not hold and arbitragers will be able to make risk-free profits E. interest rate parity holds and arbitragers will be able to make risk-free profits If interest rate parity holds covered interest arbitrage opportunities will not exist. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Risk management 23-45 Chapter 23 - Futures, Swaps, and Risk Management 55. If covered interest arbitrage opportunities exist A. interest rate parity does not hold B. interest rate parity holds C. arbitragers will be able to make risk-free profits D. interest rate parity does not hold and arbitragers will be able to make risk-free profits E. interest rate parity holds and arbitragers will be able to make risk-free profits If interest rate parity holds covered interest arbitrage opportunities will not exist. AACSB: Analytic Bloom's: Remember Difficulty: Intermediate Topic: Risk management Short Answer Questions 56. Why are commodity futures prices different from other futures prices? Explain the difference and give an example of a commodity and the factors involved. The price of a futures contract for a commodity that must be stored is given by F0 = P0*(1 + rf + c), where P0 is the spot price of the commodity, rf is the risk-free rate that applies to the opportunity cost of holding the commodity, and c is the carrying cost. Commodity futures have an extra cost integrated into their price—carrying costs can be significant. Carrying costs can include interest costs, storage costs, insurance costs, and an allowance for spoilage of goods in storage. These costs should be considered on a net basis: costs minus the benefits of carrying the commodity, such as protection against running out of stock. An example is a contract on corn. If the producer doesn't sell the corn now, it will need to be stored for future delivery. There will be explicit costs like insurance and the marginal cost of silo usage, including the resources used to keep the corn at its proper moisture level. There may be some spoilage of the corn. An implicit cost is the opportunity cost of not investing the funds that would have been earned if the corn had been sold in the spot market. Feedback: This question tests whether the student recognizes the important difference in commodities contracts due to carrying costs. AACSB: Reflective Thinking Bloom's: Understand Difficulty: Intermediate Topic: Risk management 23-46 Chapter 23 - Futures, Swaps, and Risk Management 57. Suppose that the risk-free rate is 4% and the market risk premium is 6%. You are interested in a cocoa futures contract. The beta of cocoa is −0.291. - What is the required annual rate of return on the cocoa contract? - You plan to hold the contract for three months, then take delivery of the cocoa. At that time you expect the spot price of cocoa to be $900 per ton. What is the present value of this threemonth deferred claim? What would the proper price be for this contract? The required rate of return is given by the CAPM. E(r) = 4%+ (−.291)*6% = 2.254%. The present value of the deferred claim is $900/(1.02254)0.25 = $895. The proper price for the contract would be determined by setting the present value of the commitment to pay F0 dollars in three months to $895. F0/(1.04)0.25 = $895. F0 = $903.82. Feedback: This question gives the student a chance to apply the CAPM to a storable commodity and to recognize the present value relationships that must hold. AACSB: Reflective Thinking Bloom's: Apply Difficulty: Challenge Topic: Risk management 58. Explain how a firm that has issued $1 million of long-term bonds with a fixed 6% interest rate can convert its fixed-rate debt into floating-rate debt. Give two numerical examples that show the possible outcomes, one favorable and one unfavorable. The firm can enter a swap arrangement, committing to pay .06*$1 million = $60,000 in exchange for receiving payments equal to $1 million times the LIBOR rate. If the LIBOR rate is 5, the cash inflow would be $1 million*.05 = $50,000. The net cash flow would be $10,000 in this case, which is unfavorable. If the LIBOR rate is 8%, the firm will have a cash inflow of $1 million*.08 = $80,000. The net cash flow in this case is $20,000, which is favorable. Feedback: This is a basic question about the mechanics of a swap agreement. AACSB: Reflective Thinking Bloom's: Understand Difficulty: Basic Topic: Risk management 23-47