Student Taxes Directions Use this set of directions to fill out your Tax

advertisement

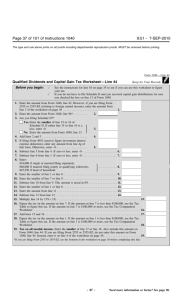

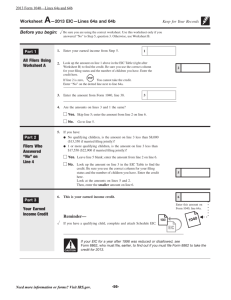

Student Taxes Directions Use this set of directions to fill out your Tax Form 1040 for the Game of Real Life project. This set of directions is no good for filing real taxes! (Because it ignores a number of things you would really need to take into consideration.) Directions 1. Get out your family portfolio. Specifically, get out your paycheck stub and your checkbook register. 2. We are going to be estimating values that normally would be given to you by your employer. The tax form will ask for information found on your “W-2” form. You don’t have one, so we’ll come up with as close an estimate as we can for these values. 3. Under “Filing Status” on your 1040 form, check “Married Filing Jointly” (line 2) 4. For “Exemptions”, check the box for “You” for “Your Spouse” and fill in the names of your two children (it’s ok to leave the Social Security Numbers blank). Check that they do qualify for the child tax credit. Fill in the appropriate boxes to the right. You should have a total of “4” when you add the numbers up. 5. For line 7, you are going to need to look at the “Presentation of Your Family” Worksheet. On there, you should find your “Gross Annual Income”. That goes in line 7. 6. Look through your check register and your “Situation Cards”. If you ever earned any more money (had an extra job, did some “moonlighting”, etc.), you should total that up and enter it on line 21. Do not include gifts or refunds – those don’t count as income! Leave all the lines between line 7 and line 21 blank. 7. Put a 0 in line 36, and rewrite the amount from line 21 on line 37. 8. Rewrite the amount from line 37 on line 38. 9. In line 40a, write the deduction for “Married, Filing Jointly” – it should be $11,400. 10. For line 41, subtract line 40a from line 38. 11. For line 42, look at line 6d (should be “4”). Multiply this by $3,650 and enter the amount on line 42. 12. Subtract line 42 from line 41. This is your taxable income. If the answer would be negative, write 0. 13. Follow the link for the “Tax Table” in your directions OR get a copy of the Tax Table from your teacher. Find where your taxable income falls, and pick the number under the Married Filing Jointly * column. Enter that number in line 44. This is the amount of tax you owe the federal government. 14. Rewrite the number from line 44 in line 46. 15. Leave lines 47 – 50 blank. For line 51, follow these directions: If your line 38 is more than $110,000, put “0” If your line 38 is less than $110,000 put “2,000” 16. Put the amount of line 51 in line 54. 17. Subtract what you have in line 54 from line 46. If it’s a negative number, put “0”. Put this number in line 55. 18. Do not fill out lines 56 – 60. 19. For line 61, you need to get out your paycheck stub. Look at the entry under “Federal Withholding”. Multiply that number by 12 and enter it into line 61. This represents the amount of money that has already been kept from your paycheck and paid to the federal government. Hopefully, it will actually be higher than the amount you owe. If that’s the case, you’ll get a “Tax Refund” – that is, you’ll get back the money that you’ve already earned but paid the government in case you owed it in taxes. If your withholding was smaller than your taxes, that’s because you earned a lot of extra money over the course of the year that you weren’t “pre-paying” your taxes on. In that case, you’ll need to write a check to the IRS! 20. Put the amount from line 61 into line 71. 21. You need to look: which is bigger, line 71 or line 60? If line 71 is bigger, then you overpaid and you are due a refund (yeah!). If that’s the case, you need to subtract line 60 from line 71 and put the amount in line 72. If on the other hand line 60 is bigger than line 71, then you underpaid and are going to need to write a check to the IRS to cover the difference (boo!). If that’s the case, you need to subtract line 71 from line 60 and put the amount in line 75. If this were your real taxes, you’d then be writing a check to Uncle Sam! 22. Don’t forget to sign your taxes, fill out the date, and your occupation (you can sign for your spouse, too, since s/he doesn’t really exist). Way to go! You’ve filed your first taxes!