2019-05-07 -- CL PDDs

advertisement

FL-140

ATTORNEY C» PARTY WITHOUT ATTORNEY INtmt. »•<»

««I SlMlOSS):

Phong H. Nguyen(SUN 280611)

Nguyen & l.imon, 1.1.P

1625 't he Aliimeda. Suite 200. San Jose. CA 95126

TELEPHONENO (408)4 13-(l8()()

FAX NO : (408)419-1862

E-MAIL ADDRESS

ATTORNEY FOR W.m.) |<()C Pjj-j'LRINI

SUPERIOR COURT OF CALIFORNIA, COUNTY OF Santa Clara

STREETAOORESS 201 N. I'irsl SlFecl

MAUNGAOORESS. 191 N. I'lrsl SlTCCt

CITY ANO ZIP CODE Son JllSC. CA 95113

BRAHCHNAME I'amilv Justice Center

PETITIONERJOANNA PIFf-iiRINI

RESPONDENTiROC Pil l liRINI

OTHER PARENT/PARTY:

CASE NUMBER

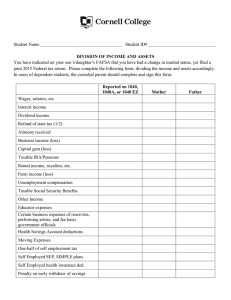

DECLARATION OF DISCLOSURE

1

1 Petitioner's

1 X 1 Respondent's

I81T.003353

j X j Preliminary

[

j Final

DO NOT RLE DECLARATIONS OF DISCLOSURE OR FINANCIAL ATTACHMENTS WITH THE COURT

In a dissolulion, legal separation, or nullity eclion, both a preliminary and a final declaration of disclosure must be served on the other

party with certain exceptions. Neither disclosure is filed with the court. Instead, a declaration staling that service of disclosure

documents was completed or waived must be filed with the court(see form FL-141).

• In summary dissolution cases, each spouse or domestic partner must exchange preliminary disclosures as described in Summary

Dissolution Information (form FL-810). Final disclosures are not required(see Family Code section 2109).

• In a defaultjudgment case that is not a stipulatedjudgment or a Judgment based on a marital settlement agreement, only the

petitioner is required to complete end serve a preliminary declaration of disclosure. A final disclosure is not required of eitherparly

(see Family Code section 2110).

• Samoa ofpreliminary declarations of disclosure may not be waived by an agreement between the parties.

• Parties who agree to waive final declarations of disclosure must file their written agreement with the court(see form FL-144).

The petitioner must serve a preliminary declaration of disclosure at the same lime as the Petition or within 60 days offiling the Petition.

The respondent must serve a preliminary declaration of disclosure at the same time as the Response or within 60 days offiling the

Response. The lime periods may be extended by written agreement of the parties or by court order(see Family Code section 2104(f)).

Attached are the following:

1, I X I A completed Schedule of Assets and Debts(form FL-142) or I

I

2, I

I Community and Quasi-Community Property

j

I A Properly Declaration (form FL-160}for (specify):

j Separate Property.

IA completed Income and Expense Declaration (form FL-150).

3, I X I All tax returns filed by the party in the two years before the date that the party served the disclosure documents.

4.[n A statement of all material facts and information regarding valuation of all assets that are community property or in which the

community has an Interest (not a form).

Respondent is not yet fully aware of valuation of all assets that are community properly.

5. 1X1 A statement of all material facts and information regarding obligations for which the community is liable (not a form).

Respondent is not yet fully aware of alt obligations for which the community is liable.

6. I X I An accurate and complete written disclosure of any investment opportunity, business opportunity, or other income-producing

opportunity presented since the date of separation that results from any investment, significant business, or other incomeproducing opportunity from the dale of marriage to the date of separation {not a form).

Respondent is not yet fully aware of any investment, business, or other income-producing opportunities,

I declare under penalty of perjury under the laws of the State of Califor^pldmat th

ing is true and correct.

Dale; S

ROC PIFFERINI

SIGNATURE

(TYPE OR PRINT NAUE)

Pagel of 1

Form Adopted(c Wondotory Um

Judool Counol of Cotifomn

a-140[Rey July t,20l9)

DECLARATION OF DISCLOSURE

(Family Law)

r«mlrC(>4e.$f2102.21O4.

2105.2106.2112

rtWW COJTfS CS POV

FL-iSO

AnOfWEVra PARTY WIIHOWr AnOflNEY ptiai*.SMSanuater.tnfMttntf-

fORCOCMrtlMONlY

_ Phong H.Nguyen(SBN:280611)

Nguyen & Limon,LLP

1625 The Alameda,Suite 200

San Jose,CA 95126

TcupfeNcin:(408)4I3>0800

Electronically filed

by Superior Court of CA,

Counfy of Santa Clara,

eAtwiAccReaswptoKiQ

ATTOANEYroRiwuKT ROC PIFFERINI

suPEiuoR COURT OF CAUFORNtA.COUNTY OF Santa Clara

STREET AMMESS; 201 N. FlTSt SttCCt

HMUNaAOIWESS: 191 N. FifSt StTCCt

on 5/8/2019 10:09 AM

Reviewed By:J. Viramontes

cfTYANoapcooE: San Josc,CA 95113

aRAwcMHAiiE. Family Justlcc Ccntcr

Case #18FL003353

Env #2857242

PETITIONEnPLAlNTIFF: JOANNA PIFFERINI

RESPONOENT/OEFENOANT: ROC PIFFERINI

OTHER PARENT/CIAIMANT:

CASEKUiaeR

INCOME AND EXPENSE DECIARATION

I8FL003353

1. Employment(Ghre InUtrmaUon on yourcumnlfiA or.ifyouVo unemployed, your most recentJott.f

a.

b.

a

d.

e.

Attach copies

of your pay

stubs for last

tiMO months

(blade cut

social

Employer Ci^ ofSan Jose

Employer's address:201 West Mission Street,San Jose, CA 95110

Employer's phone number (408)277-4631

Occupation; Police Oflicer

Date|ob started: 7/1/2006

f. if unemployed,date Job ended: N/A

secuiity

numbers).

g. Iwoiltabout

40 hours per week.

h. i gel paid S 10,625 gross(before taxes) I " I pemTonth I

I perwook I

I per hour.

(If you have more than ono Jolr,attach an 8)Miy-114nch shoot of paper and Uat thesame infUrmatlon aa abovefor your other

Jobs. Writs"Question l-^XftorJotTS"atthe top.)

2. Age and education

a. My age Is fspudiyj: 50

b. i have comptatsdh^h school or the eguivalenl: LjU Yes I—I No

c Number of yeareolcoItegecompteledfApediyj.- 2

If no.higheslgreito completed (^Mcf(K).-

LU Degree(8)obtained ftpedftij: Multidisciplinaiy Stuti.

d. Number of years of graduate school completed(specify}:

l_J Oegreefs)obtained (speedy/-'

e. 1 have: \-i-l professlonaVoccupaHonai iloense(s)(spedljf): Police Officer

I

I vocational training(apecdyj:

3. Tax Information

a.

I last filed taxes for tax year(apecfly year): 2018

b. My tax(Hing status Is ' t single I 'head of household i

i marrted.filing separately

'^ t married. CBng jolnUywRh(speedy narrte): Joanna Pifierini

c. I file state tax returns In I

I California L—I other(spnciiystafe/.-

d. I claiffl the following number of exemptions(inctuding myselQ on my taxes fspeedy): 3

4. other party's Income. I esUmate the gross monthly Income(before taxes)of the ether party In this case at(speedy):S

This estimate Is based on (expfaen):

(If you nood more epaco to ansvrar any questions on thisform,attach an 8K-by-11*inch shootof paper and wrtto the

question number Irafore your answer.) Number of pages attached:

I dectare under penally of perjury underthe laws of the Slate of Can

any attachfflents to true and correct

the Infomiallon conlabiad on all pages of tids form and

Date: ^

ROC PIFFERINI

rcmiAifatreSbrWtiXiroiYU**

JtiOdW CoooftofCrVbrIb

rut90|Rw.Jmay tIMI)

V

INCOME AND EXPBISE DECLARATION

Btail^

F«ngYC0O>,HE0)0-in2,

]ieo4its.SS91:saioosM.

4S90-4tTA43SO-«aO

mMMoaeVbLCipsr

PETITtONEIVPlAINTIFF: JOANNA PIFFERINI

CASertUUBIR:

.RESPONDENTrOEFENOANT: ROC PIFFERINI

I8FL003353

OTHER RARENT/ClAtMANT:

Attach coplos of your pay stubs for tha lasttwo months and proof ofany othor Income. Take a copy of your latestfMeral

tax return to the court hoarino.(Blaek out yoursoelatseeari^mimbercn th9paystub and tax rafumj

Income(Forevaraga monthly, add up aB die Inoomo you moeived In each categoryIn tha last 12 months

and dMde tha total by 12.)

Last month

Aver

menu

a. Salary or wages(gross, before taxes)

5 I0.62S

\0.6i

b. Overtime(gross, before taxes)

^ Varies

Varies

Commissions or bonuses

siL

Public assistance(for example:TANF,SSI,6A/GR) I—I ounently receiving

$2.

Spousal support I •r i from Oils marriage 1

$0_

i from a different marriage

Partner support I I from Oils domestic partnership I i from a differentdomeslic partnership $2PensionfreUrement fiind payments

$2Sodal security retlremenl(not SSI)

—

s2_

Oisebaity: l_J Sodal security(not SSI) I I State dlsabiiay(SDI) I 1 Private Insurance.s2J. Unemployment compensation

6.

$2.

k.

Workers'compensation

$2-

I.

OOier(military BAG,royally payments,etc.)

S:

Investmont Income(AHach a schedula ahowbtg gross receiptstoss cash expensestor each place otproparto.)

a. OlvidendsfinteiesL

$2

b. Rental property income

$2—

c. Tnnllneome

s2—

d. Other(spec/fy):

$2

7. Income from self-ompleyment,after business expanses for all tMislnesses

I am the 1 1 ownerfSole proprietor I I business partner I

Number of years In this business(tpeciiy):

0

JT

22

I other(fpecayj;

Name of buslnass(specfy):

Type of business(to>aeOy):

Attach a prolK and loss statemontfor the last two years ora Schedule C from your last federal lax return. Black out your

social security number. If you have more than one buslrtess, provide the Information above for each of your businesses.

8. I

I Addlttonal Income.I received one^e money(lolletyrmnrrings.inhetilanoe.etc)In the last 12 months

source and

anrnunt):

9. I

I Change In Income. My financial situation has changed ^nUieanlly over the last 12 months because(speetiy);

I.ast month

10. Oeductlons

a. Reriuired union dues.

b. Required rotiremenl payments(not social security,PICA.401(k),orIRA)

$2

c. Medical, hospital,dental,and other health insurance premiums(total monthly amount).

d. Child support that I pay(or children from other relationshbis

$203

e. Spousal support that I pay by court order from a diflerentmamage

sfi

S;

f. Parltter support that I pay by court order from a different domestic partnership

$!

g. Necessary JotMalated expenses not reimbursed by my employer(altscfi explanation lattetod "Question lOgT).

11. Assets

Total

a. Cash and checking accounts,savings,credit union,money maricei and other deposit accounts

$^4:22-

b. Stocks,bonds,and other assets t could easily seP

S' ^|_

c. All other property, 1 *' 1 real and 1

FUiaO(lUv.JMMiy 1.2C01)

1 persrmal (esSmato tat matlmt value minus the detds you owe).... 8

INCOME AND E}(PENSE DECLARATION

^

FL-lfiO

PETinONER/PUINTIfF: JOANNA PIFFBRINl

-RESPONOENT/OEFENDANT: ROC PIFFERINI

CASBNUUOSft

18FL0033S3

OTHER PARENT/CLAIMANT;

12. The following people live wtlh me:

How the person Is

That person's gross

r^ed to me?(ax:son) monthly Income

Age

Name

□

□

!!□

□

□□

a.

b.

c.

d.

e.

13. Average monlhly expenses

a.

I * I Estimated expenses I

Home:

(1) I

h.

I Rent Of CZZl

S

522

I Actual expenses I

Yes

Yes

Yes

Yes

Yes

□

□

CZl

CD

CD

No

No

No

No

No

I Proposed needs

30

Laundiy and cleaning

Clothes...

$.

Education

Ifmoitoaga;

(a) average pfintipal: $.203

Entertainment, gifts, and vacation

(b) average Interest: $ 318

(2) Real property taxes

Auto expenses and transportation

(4) Malnlenanoe and repair

m.

100

s TBD

b. Health care costs not paid by Insurance... $ 9.

S ^92

e. Ealing out

Ullfilles (gas, electric, water, trash)

$ 50

s 750

g. Telephone, ceil phone, and e-man

$ 250

n 737

Insurance (life, accidenL etc; do not

Include auto, home, or health insurance)... S 260

a

Savings and Investments

s0

o.

CharHabte contributions

$ 175

P-

Monthly payments listed In Item 14

c. Chadcare

d. Groceries and household supplies

—

finsurance, gas, repairs, bus, etc.)

$68

(3) Honwownei^ or rentei's Insurance

01 not Included above)

f.

Pays some of the

household expenses?

(Sembe batowtnJ4 aitd ^sfulfolalhep).. $ Varies

TOTAL EXPENSES (a-g) (do not odd In

the emounts In a(1)(B} and (b))

s.

4.277

Amount of exponsos paid by others

14. Installment payments and debts not Bsted strove

Paid to

For

Amount

Be la TOG

Date of test payment

AAdvantage Mastercard 9120

Credit Card

$700

$4,076

4/2019

$

$

$

$

$

$

$

$

$

$

15. Attomoy foes (This Is mquliod If eitherparty is requasdng Bttvmey fees.);

a. To date, I have paid my attorney this amount for fees and costs (spedfy): $

b. The source of this money was (i^pecfly);

& I slill owe the following fees and costs to my attorney (apedfy total awed): S

d. My attoms/s hourly rate Is (ppecfiy).' S

I confinn this fee arrangement.

istoNATune or ATTommi)

(nrre on FKMT NAME OF ATIOfWeV)

ruiUISM. JUMiy t.Moq

INCOME AND EXPENSE DECLARATION

ng»lof4

FL.1fiO

CASfiNUUfiCfl

PETITtONEiVPLAlNTIFF: JOANNA PIPPERINI

-RESPONDENTrOEFENOANT ROC PIPPERINI

I8FL0033S3

OTHER PARENTrClAIMANT:

CHILD SUPPORTINFORMATION

(NOTE:Fin outthis pase only If your case Involvas cliDd support.)

16. Number of chlldran

& tham(sfiedfynmAei):

ddtdren under the «ge of18 Mitt)iheelhsrparenMnUds case,

b. The diSdren spend

percenloflhelrtimewilhnieand

percent ofthelrlbnewilh the other parent

ff/youVe ffofsure atourpercsiilape or A hesnotbean egmed on,pfease doseribe yourpatenting selteduie tiem.)

17. Chtldren's heatth-care expenses

a. I

I I do

I

I i do not

have health insurance avaOabte to me for the children through my Job.

b. Name ofInsurance company;

c. Address of insurance company:

d. The monthly coal fra the children's health Insurance is or would be fapectty/'S

(Do not bttbtde On anwunl yourenfployerpaiys.}

16. Additional expenses for the chltdron In this case

0. Child core so t can v/oik or gel Job training

Amount per month

S

b. Chtldren'B health care not covered by Insurance

R

c. Travel expenses for vtsUatton

d. Chttdrenls educational or other spectel needs(apeedybeftiwj;

$

$

19. Special hardships. I ask the court to considerIhe following special financial tircumslsnoes

(attach doeumentaOott ofanyItam Sitedlnm,tttelatSogeomtoidets):

Amount per month

For how many monUis?

a. Extraordinary hesllh expenses not biciuded In IS).

sO

0

b. Major losses not covered by Insurance(examptes:lire, theft, other

Insured loss)

^

6^2

6 (1) Expenses(or my minor Children who are from other relationships and

are living with me

.

Sz

(2) Names and ages ofthose children (speeSir):

(3) Child support I receive(orthose children

The expenses listed In a.b,and ccreate an extreme financial hardship because(explain):

20. Other Information I wantthe courtto know concerning supportIn my case(ipacOy):

Fl'iseIRW.j«a«r 1.MO)]

INCOME AND EXPENSE DECLARATION

ngtotro

SCHEDULE SE

c^i*

(Form 1040)

T^v

OUB No. 1545-0074

ombno.isas-oota

Self-Employment Tax

Oepartmer,of.he Treasury

@0)17

!®17

m^Jrs.gov/ScheduleSE for instntctions and the latest information.

Attachment

►Attach to Form 1040 or Form 1040NR.

internal Revenue SeivBO (9?)

Sequence

Sequence No.

No. 17

17

Name of person with seif-em^oyment income (as shown on Form 1040 orFonn toaONR)

Social securjty number of person

ROC M PIFFERINI

with self-employment income ►

551-53-5651

Before you begin: To determine if you must file Schedule SE, see the instructions.

May I Use Short Schedule SE or Must 1 Use Long Schedule SE?

Note: Use this flowchart only If you must file Schedule SE. If unsure, see Who Must File Schedule SB In the Instructions.

!

' ' "

Did you racelve wages or tips in 2017?

j

Are you a minister, member of a religious order, or Christian

Science practilioner who received IRS approval not to be taxed

Was the total of your wages and tips subject to social security yes

on earnings from these sources, but you owe self-employment

self-employment more than SI 27,2007

or railroad retirement (tier 1j tax plus your net earnings from

tax on other earnings?

Are you using one of the optional meOiods to figure your net

Did you receive tips subject to social security or Medicare tax

that you didn't report to your employer?

y^,

earnings ftee instructions)?

Old you receive church employee Income (see Instructions) [Ves

reported en Form W-2 of $108.28 or more?

Yes

No I Old you report any wages on Form 8916, Uncollecied Social Yes

r~

You must use LJing Schedule SE on page 2

You may use Short Schedule SE below

Section A—Short Schedule SE. Caution: Read above to see If you can use Short Schedule SE,

la

Net farm profit or (loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form

1065), box 14, code A

b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve

Program payments included on St^edule F. line 4b, or listed on Schedule K-1 (Form 1055), box 20, code Z

2

Net profit or (loss) from Schedule C, line 31; Schedule C-E2, line 3; Schedule K-1 (Form 1065),

box 14. code A (other than farming); and Schedule K-1 (Foim 1065-B), box 9, code J1.

Ministers and members of religious orders, see instructions for types of income to report on

3

4

21.120

21.120

this line. See Instructions for other Income to report

Combine lines la, lb, and 2

Multiply line 3 by 92.35% (0.9235). If less than $400, you don't owe self-employment tax; don't

19,504

file this schedule unless you have an amount on line 1b

^

Note; If line 4 is less than $400 due to Conservation Reserve Program payments on line lb.

see instructions.

5

Self-employment tax. If the amount on line 4 Is;

• $127,200 or less, multiply line 4 by 15.3% (0.153). Enter the result here and on form 1040, line

57. or Form1040NR, line 55

• More than $127,200, multiply llne-1 by 2.9% (0.029). TTien, add $15,772.80 to the result.

Enter the total here and on Form 1040, line 57, or Form 1040NR, line 55

6

Deduction for one-half of seff-employment tax.

Multiply line 5 by 50% (0.50). Enter the result here and on Form

1040, line 27, or Form 1040NR, line 27

For Paperwork Reduction Act Notice, see your tax retum instructions.

I

E

6

1, 4 92^

Cat. No. 11353Z

Schedule SE ^orm 1040) 2017

0MB No. 154&-O074

Employee Business Expenses

Oepartmsnl ot e Treasury

imemal Revenue Service |9S)

1017

^ Attach to Form 1040 or Form 1040NR.

Attachment

^ Qo to www.lrs.gev/Fom2l06 tor instructions and the latest Information.

I

Sequence No. 129

Occupation in which you incurred expenses Social security numtier

Your name

ROC M PIFFERINI

POLICE OFFICER

551-|53-56|51

Employee Business Expenses and Reimbursements

Column B

Column A

Step 1 Enter Your Expenses

Other Than Meals

Meals and

and Entertainment

Entertainment

Vehicle expense from tine 22 or line 29. fRural mail carriers; See

instructions.)

1,198

Parking fees, tolis, and transportation, including train, bus, etc.. that

didn't involve overnight travel or commuting to and from work . .

Travel expense while away from home overnight, including lodging,

airplane, car rental, etc. Don't include meals and entertanment. .

Business expenses not included on lines 1 through 3. Don't include

meals and entertainment

5 Meals and entertainment expenses(see instructions)

6 Total expenses. In Column A, add lines 1 through 4 and enter the

result. In Column B, enter the amount from line 5

6

1,198

Note: If you weren't reimbursed for any expenses in Step 1. skip line 7 and enter the amount from line 6 on line 8.

step 2 Enter Reimbursements Received From Your Employer for Expenses Listed in Step 1

7 Enter reimbursements received from your employer that weren't

reported to you in box 1 of Form W-2. Include any reimbursements

reported under code "L" In box 12 of your Form W-2(see

instructions)

Step 3 Rgure Expenses To Deduct on Schedule A(Form 1040 or Form 1040NR)

8 Subtract line 7 from line 6. If zero or less, enter -0-. However, if line 7

is greater than line 6 in Column A. report the excess as income on

Form 1040, line 7(or on Form 1040NR, line 8)

0

1,198

Note: If both columns of line 8 are zero, you can't deduct

employee business expenses. Stop here and attach Form 2106 to

your return.

9 In Column A. enter the amount from line 8. In Column B, multiply line

8 by 50% (0.50).(Employees subject to Department of Transportation

(DOT)hours of service limits: MuKlply meal expenses incurred while

away from home on business by 80% (0.80) instead of 50%. For

details, see instructions.)

_9

^

10 Add the amounts on line 9 of both columns and enter the total here. AJso, enter the total on

Schedule A (Form 1040), line 21 (or on Schedule A (Form 1040NR), line 7).(Armed Forces

reservists, qualified performing artists, foe-basis state or local government officials, and

Individuals with disabilities; See the Instructions for special rules on where to enter the total.) .

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. Nu. 11 7oon

1,198

Fomi2106(2017)

Page 2

Form?106(?017)

Vehicle Expenses

Section A—General {nformation (You must complete this section if you

are claiming vehicle expenses.)

11

12

13

14

15

(b) Vehicle 2

(a) Vehicle 1

Enter the date the vehicle was placed in service

Totai miles the vehicle was driven during 2017

Business miies inciuded on line 12

Percent of business use. Divide line 13 by line 12

Average daiiy roundtrip commuting distance

11 01 ^01 /2017

_12

15, OOOmiles

_13

2.24 0mlles

J[4

14.93 %

_16

miies

>

/

16

Commuting miles included on line 12

_16

miles

17

Other miles. Add lines 13 and 16 and subtract the total from line 12 . .

_17

12,760miles

18

Was your vehicle available for personal use during off-duty hours?

□ Yes

IX No

19

20

Do you (or your spouse) have another vehicle available for persona! use?

Do you have evidence to support your deduction?

□ Yes

X Yes

X No

□ No

"""Uss

nilles

%

niiles

niiles

miles

21

If "Yes," is the evidence written?

X Yes □ No

Section 8—Standard Mileage Rate (See the instructions for Part II to find out whether to complete this section or Section C.)

1.198

a) Vehide 1

Section C—Actual Expenses

Vehicle 2

Gasoline, oil, repairs, vehicle

insurance, etc

Vehicle rentals

Inclusion amount (see Inslructicns)

.

Subtract line 24b from line 24a

Value of employer-provided

vehicle (applies only if 100% of

annual lease value was included

on Form W-2—see instructions)

Add lines 23, 24c, and 25.

.

.

Multiply line 26 by the percentage

on line 14

Depreciation (see instructions) .

Add lines 27 and 2B. Enter total

here and on line 1

Section D—Depreciation of Vehicies (Use this section only if you owned the vehicle and are completing Section C for the vehicle,

1

WVehicie 1

I

(b) Vdiicle 2

30

Enter cost or other basis (see

instructions)

31

Enter section 179 deduction and

special allowance (see instructions) I 31

Multiply line 30 by line 14 (see

Instructions if you claimed the

section 179 deduction or special

allowance)

Enter depreciation method and

percentage (see instructions)

.

Multiply line 32 by the percentage

on line 33 (see instructions) . .

Add lines 31 and 34

.

.

.

.

Enter the applicable limit explained

in the line 36 instructions .

.

.

Multiply line 36 by the percentage

on line 14

Enter the smaller of line 35 or line

37. If you skipped lines 36 and 37,

enter the amount from line 35.

Also enter this amount on line 26

above

4562

inigna Rgvenuo S(i«v« (99) [

&

Attachment

► Go to www.irs.gov/Form4Se2 for instructions and the latest information.

Name(a) shown on return

M

i§i7

►Attach to your tax return,

Depe™.«.,oMh«T,^

ROC

OUB No. 1545-0172

Depreciation and Amortization

(Including Information on Listed Property)

Sequence No. 179

Business or activity to wnich this form relates

JOANNA

L

Identifying number

PIFFERINI

551-53-5651

Eieirtion To Expense Certain Property Under Section 179

Note: If you have any listed property, complete Part V before you complete Part i.

1

J_l

Maximum amount (see instructions)

2 Total cost of section 179 property placed in service (see instructions)

3 Threshold cost of section 179 property before reduction in limitation (see instructions)

510.000

2

3 I 2,030.000

4 Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter -0-

5 Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less, enter -0-. If married filing

separately, see instructions

6

(a) Description ot property

I (b) Cost (l>uslnea» use only) I

7 Listed property. Enter the amount from line 29

510.000

(o) 0sctecl cost

| 7 |

8 Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7

9 Tentative deduction. Enter the smaller of line 5 or line 8

10 Carryover of disallowed deduction from line 13 of your 2016 Form 4562

11 Business income limitation. Enter the smaller of business Income (not less than zero) or line 5 (see instructions)

12 Section 179 expense deduction. Add lines 9 and 10, but don't enter more than line 11

13 Carryover of disallowed deduction to 2018. Add linesSand 10, less line 12 ►

510.000

| 13 I

Note: Don't use Part II or Part ill below for listed property. Instead, use Part V.

Special Depreciation Allowance and Other Depreciation (Don't include listed property.) (See Instructions.

14 Special depreciation allowance for qualified property (other than listed property) placed in service

during the tax year (see instructions)

15 Property subject to section I68(f)(1j election

_

16 Other depreciation (includinq ACRS)

Part lil

MACRS Depreciation (Don't include listed property.) (See instructions.

Section A

17 MACRS deductions for assets placed in service in tax years beginning before 2017

18 If you are electing to group any assets placed in service during the tax year into one or more general

asset accounts, check here

^ □

Section B—Assets Placed in Service During 2017 Tax Year Using the General Depreciation System

Id) Bscovery

(«) Classification ot property

b

3-vear propei

S-year propei

c

7-year propei

19a

m Method

Convention

period

(s) OwreciaCondeduetlon

f 20-year pro

25-vear pro

25 vrs.

h Residential rental 06/2017

property

07/2017

189.008 27.5 vrs.

MM

14.

14. 904

9041 27.5

27.5 yrs.

vrs.

i Nonresidential real

I

MM

S/L

S/L

^

3.723

1

248"

39 vrs.

property

Section C—Assets Placed in Service During 2017 Tax Year Using the Alternative Depreciation System

20a Class life

b 12-vear

c 40-vear

Summary (See instructions.)

I

1

12 yrs.

40 yrs.

I

1

I

I

MM

S/L

S/L

S/L

21 Listed property. Enter amount from line 28

22 Total. Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g), and line 21. Enter

here and on the appropriate lines of your return. Partnerships and 3 corporations—see instructions

23 For assets shown above and placed in service during the current year, enter the

portion of the basis attributable to section 263A costs

For Paperwork Reduction Act Notice, see separate instructions.

21

22

IWy

23

Cat. No. 12906N

3, 971

-• V;.-

1 '

Form-ase? gOlT]

Page 2

QSQ Listed Property (Include automobiles, certain other vehicles, certain aircraft, certain computers, and property

used for entertainment, recreation, or amusement.)

Note: For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24a,

24b. columns(a)through (c) of S^tion A. all of Section S, and Section C if applicable.

Section A—Depreciation and Other information (Caution: See the instructions for limits for passenger automobiles.

24a Do you have evidence to support the business/investment use claimed? G Yes Si No 24b IfYes," is the evidence written? G Yes □ No

M

(b)

Type of property (i>sl Date placeO

vehicles first)

(g)

Method/

Convention

in service

(h)

□epraciaticn

Elected section 179

deduction

cost

25 Special depreciation allowance for qualified listed property placed in service during

the tax year and used more than 50% in a qualified business use (see instructions) .

26

Prooerty used more than 50% in a Qualified business use:

27

Property used 50% or less In a qualified business use:

5/LS/L-

!ss»g3Sf

5/L-

28 Add amounts in column (h), lines 25 through 27. Enter here and on line 21, page 1

| 28 |

29 Add amounts in column (1), line 26, Enter here and on line 7, page t

29

Section B—Information on Use of Vehicles

Complete this section f(»' vehicles used by a sole proprietor, partner, or other "more than 5% owner.' or related person, If you provided vehicles

to your employees, first answer the questions in Section C to see if you meet an exception to completing this section for those vehicles.

30 Total business/investment miles driven during

(a|

(b)

|c>

Id}

(e)

(fi

Vehiclsl

Vehicles

Vehicles

Vehicle 4

Vehicles

Vehicle 6

vehicle i

the year (don't include commuting miles)

31 Total commuting miles driven during the year

32 Total other personal

(noncommuting)

miles driven

33 Total miles driven during the year. Add

lines 30 through 32

34 Was the vehicle available for persona!

use during off-duty hours?

35 Was the vehicle used primarily by a more

than 5% owner or related person? . .

36

Yes

Is another vehicle available for personal use?

Section C—Questions for Employers Who Provide Vehicles for Use by Their Employees

Answer these questions to determine if you meet an exception to completing Section B for vehicles used by employees who aren't

more than 5% owners or related persons (see instructions).

37 Do you maintain a written poiicy statement that prohibits aii personal use of vehicles, including commuting, by

Yes

your employees?

38 Do you maintain a written policy statement that prohibits personal use of vehicles, except commuting, by your

employees? See the instructions for vehicles used by corporate officers, directors, or 1 % or more ownere .

.

39 Do you treat aii use of vehicles by employees as personal use?

40 Do you provide more than five vehicles to your employees, obtain information from your employees about the

use of the vehicles, and ret^n the information received?

41

Do you meet the requirements concerning qualified automobile demonstration use? (See instructions.)

Note: If your answer to 37.38, 39. 40. or 41 is "Yes," don't complete Section B for the covered vehicles.

Part VI

.

.

.

SSfH

Amortization

M

Oescriplion of costs

(b)

Dale amonizalion

begins

(•)

ic)

(d)

Amortizable amount

Code section

AmoftizaUon

period or

Amortization for this year

percentage

42 Amortization of costs that m ins during vour 2017 tax year (see instructions

VA

FEE

106-01-20171

8,712 r

43 Amortization of costs that began before your 2017 tax year

44 Total. Add amounts in column (f). See the instructions for where to report

339

Form 4562 (2017)

8283

Noncash Charitable Contributions

iRev Decen-cef 2014)

0MB No. 1S45-0908

Attach to your tax return H you claimed a total deduction

Depertmeni of the Treasury I

Anachmenl

^'O'' con^birted property.

Internal Revenue Service | ► infonnation about Form 8283 and Its separate instructions Is at www.lrs.gov/form8283.

Name(s) shown on your income tax return

ROC

K

&

JOANNA

L

Sequence No. 155

IdentHylng number

551535651

PIFFERINI

Note. Figure the amount of your contribution deduction before completing this form. See your tax return instructions.

Section A. Donated Property of $5,000 or Less and Publicly Traded Securities—List in this section only Items (or

groups of similar items) for which you claimed a deduction of $5,000 or less. Also list publicly traded

Part I

securities even if the deduction is more than $5,000 (see instructions).

Information on Donated Property—If you need more space, attach a statement.

(b) if donated property is a vehicle (see instructions),

(a) Name and address of trte

donea organization

check the box. Aiso enter the vehicle identificetion

number (unless Form tOS8-C is attached).

(c) Description of Oonaled property

(For a vehicle, enter the year, maice. rrtodel, std

mileage. For securities, enter the company name and

the number of sharee.)

QODWILL

125 SOUTH GRANT

Note. If the amount you claimed as a deduction for an Item is $500 or less, you do not have to complete columns (e), (f), and (g).

Id) Dale of the

contribution

(a) Date acqured

by donor (mo., yr.]

(f) How acquired

tjy donor

(q) Donor'ecosl

or adjusted basis

Qi) Fair market viJue

(see inshuctiofts)

(i) Metixid used to determine

the fair market value

eSObARAGE GALE VALUE

9-24-2017

Partial Interests and Restricted Use Property—Complete lines 2a through 2e if you gave less than an

entire interest in a property listed in Part I. Complete lines 3a through 3c if conditions were placed on a

2a

contribution listed in Part 1; also attach the required statement (see instructions).

Enter the letter from Part I that Identifies the property for which you gave less than an entire interest ►

If Part II applies to more than one property, attach a separate statement.

b Total amount claimed as a deduction for the property listed in Part I; (1)

(2)

c

For this tax year

►

For any prior tax years

►

Name and address of each organization to which any such contribution was made in a prior year (complete only if di^erent

from the donee organization atjcve):

Name of charltabis crganlzation (donee)

AdOresa (number, street, and room or eulio no.)

Crtyor town, state, and ZIP code

d

e

3a

For tangible property, enter the place where the property is located or kept ►

Name of any person, other than the donee organization, having actual possession of the property ►

Is there a restfictlon, either temporary or permanent, on the donee's right to use or dispose of the donated

Yes I No

property?

b

Did you give to anyone (other than the donee organization or another organization participating with the donee

organization In cooperative fundraistng) the right to the income from the donated property or to the possession of sS

the property, including the right to vote donated securities, to acquire the property by purchase or otherwise, or to

designate the person having such Income, possession, or right to acquire?

c

Is there a restriction limiting the donated property for a particular use?

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. &2299J

Form 8283 (Rev. 12-2014)

02g'|

Department of the Treasury

Internal Revenue Service (99)

Alternative Minimum Tax—Individuals

^

0MB No. 1545-0074

www.lrs.gov/Forni62S1 for InstrucUons and the latest information.

Altachm«fit

► Attach to Form 1040 or Form 1040N R.

Saguence No.32

Nama(s) shown on Form 1040 or Form 104ONR

Your social BBCurlty number

ROC M & JOANNA L PIFFERINI

551-53-5651

Alternative Minimum Taxable Income (See instructions for how to complete each line.)

1 If filing Schedule A (Form 1040), enter the amount from Form 1040, line 41, and go to line 2. Otherwise,

enter the amount from Form 1040, line 38, and go to line 7. pf less than zero, enter as a negative amount.)

2 Reserved for future use

1 ____^201^4^

2

3 Taxes from Schedule A(FoiTn 1040), line S

_3

4 Enter the home mortgage interest adjustment, If any, from line 6 of the worksheet in the instaictions for this Ijne

5 Miscellaneous deductions from Schedule A (Form 1040), line 27

_4

_5

6 If Form 1040, line 38, is SI 56,900 or less, enter -0-. Otherwise, see instructions

7 Tax refund from Form 1040, line 10 or line 21

6 (

7 (

8 Investment interest expense (difference between regular tax and AMT)

9 Depletion (difference between regular tax and AMT)

10 Net operating loss deduction from Form 1040, line 21. Enter as a positive amount

^

1 > 671

_§

_9

_10

11 Alternative tax net operating loss deduction

12

13

14

16

16

17

18

19

20

21

22

22 , 582

11 (

Interest from specified private activity bonds exempt from the regular tax

Qualified small business stock, see Instructions

Exercise of incentive stock options (excess of AMT Income over regular tax income)

Estates and trusts (amount from Schedule K-1 (Form 1041), box 12, code A)

Electing large partnerships (amount from Schedule K-1 (Form 1065-B), box 6)

Disposition of property (difference between AMT and regular tax gain or loss)

Depreciation on assets placed In service after 1986 (difference between regular tax and AMT)

Passive activities (difference between AMT and regular tax Income or loss)

Loss limitations (difference between AMT and regular tax income or loss)

Circulation costs (difference between regular tax and AMTj

Long-term contracts (difference between AMT and regulartax income)

.

.

.

.

)_

_12

_13

_14

Jl5

_16

17 __________

_Jfi

_1j!

_20

_21

_22

23 Mining costs (difference between regular tax and AMT)

24 Research and experimental costs (difference between regular tax and AMT)

_24

25 Income from certain installment sales before January 1.1967

26 (

26 Intangible drilling costs preference

27 Other adjustments, including income-based related adjustments

^

)_

_26

_27

28 Alternative minimum taxable income. Combine lines 1 through 27. (If married filing separately and line

28 Is more than $249,450, see instructions.)

28

222 > 404

. . I 29

69.124

Alternative Minimum Tax (AMT)

29 Exemption. (If you were under age 24 at the end of 2017, see Instructions.)

IF your filing status is...

AND line 28 is not over... THEN enter on line 29...

Single or head of household . . . .

Married filing jointly or qualifying widow(er)

$120,700

160,900

$54,300

84,500

60,450

42,250

Married filing separately

If line 28 Is over the amount shown above for your filing status, see instructions.

30 Subtract line 29 from line 28. if more tha-n zero, go to line 31. If zero or less, enter -0- here and on lines 31, 33,

and 35. and go to line 34

153,280

31 • If you are filing Form 2556 or 2555-EZ, see instmctions for the amount to enter.

• If you reported capital gain disthbutions directly on Form 1040, line 13; you reported qualified dividends

on Fot-m 1040. line 9b; or you had a gain on both lines 15 and 16 of Schedule D (Form 1040) (as

39,853

refigured for the AMT, if necessary), complete Part lit on the back and enter the amount from line 64 here.

• All others; It line 30 Is $187,800 or less ($93,900 or less if married filing separately), multiply lino

30 by 26% (0.26). Otherwise, multiply line 30 by 28% (0.28) and subtract $3,756 ($1,878 U

married filing separately) from the result.

32 /yiemative minimum tax foreign tax credit (see instructions)

32

33 Tentative minimum tax. Subtract line 32 from line 31

33

39r 853

34

39,901

34 Add Form 1040, line 44 (minus any tax from Form 4972), and Form 1040. line 46. Subtract from the result any

foreign tax credit from Form 1Q40, line 49, If you used Schedule J to figure your lax on Form 1040, line 44,

refigure that tax without using Schedule J before completing this line (see instructions)

35 AMT. Subtract line 34 from line 33. If zero or lass, enter -0-. Enter here and on Form 1040, line 45

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 13600G

Form 8251 (2017)

Form

ORIIO

OMB No. 154S-1D08

Passive Activity Loss Limitations

►See separate instructions.

Department of the Treasury

1017

►Attach to Form 1040 or Form 1041.

Internal Revenue Service (99)

M

&

JOANNA

Sequence No. 88

Id

'< entHylng number

Nama(s| shown on return

ROC

Attachment

► Go to www./fs.gov/Form858g for Instructions and the latest Information.

Internal Revenue Service (OT)

L

551-53-5651

PIFFERINI

2017 Passive Activity Loss

Caution: Complete Worksheets 1.2, and 3 before completing Part I.

Rental Real Estate Activities With Active Participation (For the definition of active participation, see

Special Allowance for Rental Real Estate Activities in the instructions.)

la Activities with net income (enter the amount from Worksheet 1,

column (a))

_1a

b

Activities with net loss (enter the amount from Worksheet 1. column

(b))

c

_1^(

1

1c |(

]

2a (

)

Prior years' unallowed losses (enter the amount from Woritsheet 1,

column (c))

d Combine lines la. lb, and 1c

Commercial Revltallzadon Deductions From Rental Real Estate Activities

2a Commercial revitalization deductions from Worksheet 2, column (a).

b

Prior year unallowed commercial revitalization deductions from

Worksheet 2, column (b)

c

2b (

Add lines 2a and 2b

All Other Passive Activities

3a

Activities with net income (enter the amount from Worksheet 3,

*

column (a)}

b

Activities with net loss (enter the amount from Worksheet 3, column

(b))

c

3b 1(

12, 017 )

Prior years' unallowed losses (enter the amount from Worksheet 3,

t'l-r

column (c))

iJi'

d Combine lines 3a, 3b, and 3c

4

. •

I 3d I

-12, 017

4 |

-12, 017

Combine lines id, 2c, and 3d. If this line is zero or more, stop here and include this form with

your return; ait losses are allowed, Including any prior year unallowed losses entered on line 1c,

2b, or 3c. Report the tosses on the forms and schedules normally used

If line 4 is a loss and;

• Line 1 d is a loss, go to Part II.

• Line 2c is a loss (and line Id is zero or more), skip Part 11 and goto Part ill.

• Line 3d is a loss (and lines 1d and 2c are zero or more), skip Parts ii and ill and go to line 15.

Caution: If your filing status is married filing separately and you lived with your spouse at any time during the year, do not complete

Part Ii or Part 111. Instead, go to line 15.

Special Allowance for Rental Real Estate Activities With Active Participation

5

6

7

Note: Enter all numbers in Part il as positive amounts. See instructions for an example.

Enter the smaller of the loss on line Id or the loss on line 4

Enter $150,000. If married filing separately, see insttuctions . .

_6

Enter modified adjusted gross income, but not less than zero (see instructions)

7

Note: If line 7 is greater than or equal to line 6, skip lines 8 and 9,

I 5

■m

enter -0- on line 10. Otherwise, go to line 6.

8

Subtract line 7 from line 6

9

Multiply line 8 by 50% (0.50). Do not enter more than $25,000. If married filing separately, see instructions |_9

10

I 8

■a i

Enter the smaller of line 5 orline 9

If line 2c is a loss, go to Part lil. Otherwise, go to line 15.

Special Allowance for Commercial Revitalization Deductions From Rental Real Estate Activities

Note: Enter all numbers in Part III as positive amounts. See the example for Part II in the instructions.

11

Enter $25,000 reduced by the amount, if any, on line 10. If married filing separately, see instructions

11 I

12

Enter the loss from line 4

12

13

Reduce line 12 by the amount on line 10

13

14

Enlerthe smallest of line 2c (treated as a positive amount), line 11, or line 13

Part IVI Total Losses Allowed

15

Add the income, if any, on lines la and 3a and enlerthe total

16 Total losses allowed from all passive activities for 2017. Add lines 10. 14, and 15. See

instructions to find out how to raoorl the tosses on your fax return

For Paperwork Reduction Act Notice, see Instructions.

14

16

Cat. No. a37D4F

Form 8582 (2017)

0MB No. 1545-0074

Additional Medicare Tax

8959

^ tr any line does not apply to you, leave It blank. See separate instructions.

► Attach to Form 1040,1040NR, 1040-PR, or 1040-SS.

^ Go to Mww.lrs.govlFom8X9 for instructions and the latest information.

D^H/tment of ine Treasury

Internal Revenue Service

Part \

1

JOANNA L

PIFFERINI

5!

551-53-5651

Additional Medicare Tax on Medicare Wages

Medicare wages and tips from Form W-2, box 5. If you have

more than one Form W-2, enter the total of the amounts

from box 5

_1

2

Unreported tips from Form 4137, line 6

_2

3

Wages from Form 8919, line 6

_3

5

Enter the following amount for your filing status:

4 Add lines 1 through 3

Married filing jointly

Manied filing separately

_4

ra|

256. 575 ^

256.

256, 575

575{!^

$250,000

$125,000

M

H

Single, Head of household, or Qualifying widow(er) $200,000 __5

250.0001

250.

OOP BS

6

Subtract line 5 from line 4. If zero or less, enter -0-

7

Additional Medicare Tax on Medicare wages. Multiply line 6 by 0.9% (0.009). Enter here and

go to Part II

PartJI

8

Sequence No. 71

Yourcoclal Mcurity number

Narne{s) shown on relum

ROC M &

1®17

Anachment

7

Additional Medicare Tax on Setf-Empioyment income

Self-employment income from Schedule SE (Form 1040),

Section A, line 4, or Section B, line 6. If you had a loss, enter

-0- (Form 1040-PR and Form 1040-SS filers, see instructions.) _8

9

Enter the following amount for your filing status:

Married filing jointly

Married filing separately

19, 504

$250,000

$125,000

10

Single, Head of household, or Qualifying widow(er) $200,000 _9

Enter the amount from line 4

_10

11

Subtract line 10 from line 9. If zero or less, enter-0- .

12

Subtract line 11 from line 8. If zero or less, enter -0-

13

Additional Medicare Tax on self-employment Income. Multiply line 12 by 0.9% (0.009). Enter

.

.

250. OOP

250.000

256. 575

256,575

_11

19,504

here and go to Part III

Part III

14

13

Additional Medicare Tax on Railroad Retirement Tax Act (RRTA) Compensation

Railroad retirement (RRTA) compensation and tips from

Form(s) W-2, box 14 (see instructions)

15

_14

Enter the following amount for your filing status:

Married filing jointly

Manied filing separately

$250,000

$125,000

Single. Head of household, or Qualifying widow(er) $200,000

_15

16

Subtract line 15 from line 14. If zero or less, enter -0-

17

Additional Medicare Tax on railroad retirement (RRTA) compensation. Multiply line 16 by

0.9% (0.009). Enter here and go to Part IV

^ .

iPartlVl

Total Additional Medicare Tax

18

Add lines 7, 13, and 17. Also include this amount on Fotm 1040, line 62, (Form 1040NR.

1040-PR, and 1040-SS filers, see instructions) and go to Part V

PartV

Withholding Reconoiliation

19

Medicare tax withheld from Form W-2, box 6. If you have

more than one Form W-2, enter the total of the amounts

from box 6

20 Enter the amount from line 1

P|H

_19

BB

4.23 0|B

20

2 5 6 . 5 / bjffP

_21

3,72 0^^

21

Multiply line 20 by 1.45% (0.0145). This is your regular

22

Subtract line 21 from line 19. If zero or less, enter -0-. This is your Additional Medicare Tax sm

withholding on Medicare wages

Additional Medicare Tax withholding on railroad retirement (RRTA) compensation from Form

23

Medicare tax withholding on Medicare wages

W-2, box 14 (see Instructions)

24

Total Additional Medicare Tax withholding. Add lines 22 and 23. Also include this amount

with federal Income tax withholding on Form 1040, line 64 (Form 1040NR. 1040-PR, and

1040-SS filers, see instructions)

For Paperwork Reduction Act Notice, see your tax return instructions.

24

Cat. No. SS47SX

510

Form 8959 (2017)

Schedule A Supporting Statements

GIFTS TO CHARITY BY CASH OR CHECK

ELKS

PAAF

375

130

FEDERAL TOTAL

505

STATE TOTAL

505

MISCELLANEOUS DEDUCTIONS SUBJECT TO 2% AGI LIMIT - JOB RELATED (Line 21)

Form 2106

1,198

All other union dues

900

Job supplies

425

UNIFORMS

450

CELL BUS USE 50

200

UNIFORM CLEANING

240

LINE 21 TOTAL

3.413

551-53-5651

ROC M & JOANNA L PIFFERINI

SCHEDULE E - OTHER RENTAL EXPENSES STATEMENT # 1

RENTAL 13506 27TH AVE NE Seattle WA 98125

A

Air Travel

375

TOTAL OTHER EXPENSES

375

□ CORRECTED (if checked)

PAYER'S tume, street address, dty or town, state or province, country, ZIP

or foreign postal code, and telepfione no.

1 Rents

First Alarm Security & Patrol, Inc

0MB Mo. 1545K)US

$

1731 Technology Drive

Miscellaneous

Income

2017

2 Royalties

Suite 800

San lose, CA 95110

Form 1099-MlSC

$

4 Federal Income tax withheld

3 Ottier oicome

Phone:

PAYSfS federal Identincadon number

(408) 364-1110

$

REaPlENTS Identificatian number

77-0237870

Copy B

FOr Recipient

$

5 Hsfiing boat proceeds

6 Medical and heaSti care payments

$

$

7 Nonempioyee compensation

BSubstitute payments In lieu of

551-53-5651

REdPlENTS name

This is important tax

dividends or interest

Roc Miller Ptfferlnl

information and is

being furnished to

Street address (Indudtng apt na)

$

21,120.00

9 Payer made direct sales of

201W. Mission Street

(recbjient) fOr resale P LJ

$

12

11

San lose, CA 95110

Service. If you are

required to file a

return, a negligence

penalty or other

sanction may be

imposed on you If

10 Crop insurance proceeds

$5,000 or more of consumer

products to a buyer .

•

City or town, state or province, country, and ZIP or foreign postal code

the Internal Revenue

$

this income is

taxable and the IRS

Account number (see Instructions}

13 Excess golden parachute

FATCA filing

requirement

3152

lSaSeetian<«»Aderenals

payments

□

ISb Section 409A Income

$

$

Fbmi 1099-MlSC

(keep for your records.)

1 i=(i 111=1111 in 11 n=! M n

III

16 State tax withheld

17 State/Payer's state no.

$

$

$

DepaitmentaftheTreasuiy-Jntenial Revalue Service

n I M=iii 11=11 n 1=111 i 1=11 M 1=11111 =11111=11111 =11111=11111 mill

'

im

' < ngn. iijiT'

>11111—11111

i^n=nzns:r

:n=nCn=nZn=n^n=n

ii:n=nZn=n:rn = n~n=p

nii=niit=ti

f=n—nrn-nzn-nzn-nrr

ni-nil

I-It

I"

~ 11

in-nin-nni-tfiif

siiTrrsri 111 i =1

in=iiin=itin=iiiii=ii

=n=n

"SFG n-■ n z n-? I

111II =111II-tII11 =1IIII =1

5w55t55Si5ilSrrrr5rTTi naS^SaSf!

elWFVBHrtWIi1 111=11111

=n;=n=ni:

11=11111=11111=11111=1111

= Sli'?s1ii£i£ii9iri

n=n—n=n—n=n—n=n—n=r

n=n=n=n=n=n=n=nS

M=|lllt=l]lllSIIIII=lll|

rri n=n—nzn—n=n~n=n—r

It 111-11111-11111=11111=1

' E* *1*' -n-'"

:n=nzn=n=n=n=n=n=r

nil faU., U

=I_WJ^

11=11111=11111=11111=1111

—n!BW»!>npv»—ri~i v«i«_

•n=n—nzn—n=n—n=n—r

It I i 81111 -111II -i IIM =1111 f =1

•11111=11 III=11111-11111-11111=11111=11111=11111=1111 -11111 -I llTi I ^iTi I -Iiiti

:n=nzn=n=n=nzn=nm=nzn=n=n=n=n=n=n=r UiiSi ignfai iL.1 lai lai ig IT ;n=n=n=nzn=n=n=nzi1

.

i

- !IMaUin^aninrIliSLLm=ijm=inn=f

—n=n—

- i=n=n—

:Si4U&liH=ai#.^tiili=UlU=

• SUCn SnZM=B Ol9QEK=Cl«. n—n •»

n 1=1 ifi I =1II ft =111II =1 If 11 =1III

gicsmsiGiiii

S=riSnsnsn=nSn2n

=f

iluiiriUMTM-i

i=rizn=nr:n=n:rn=nzn=nzn=nr:n=n=n=ni:n=r = PT =

11=1 II 11=1 III in 1111=11111=11111=11111=11111 =11 n 1=1 t (I

" V=!4iii£' 'i*'

n

nr

(Eiilli=iiiM=niii=iiiii=i

liJJ?LlU

n'^nrnnn

. If WlUHWamWHTii 11 =i

r r«nffe-.nre-n-elT.r-o7I.TrTrie-iir,Tf-rfTf?TXJ^^

f -1 1 I It ^ I Ml 1 -1 ■

3 W5Tlf*Mw^iWHfn®2fWE Pr®n c n—n • n—n ~ nn z n-• n • r

-I ilM^iiiii~iiiii^iiiii=niiiZii(t 1-11111=11111=1111-' -11111—11111=11111=11111

:i

18 State income

$

wwwJrs.gov/fbrTnl09ftnisc

r 11

reported.

$

1) tn 1111=( 111 i:=i 11 i 1=1

ij j -• H11 -Lijj I -»i.i 11

attomey

$

•nzn—nm—n=n—n^n—nr:n—n=n—

->

determines that it

has not been

14 Gross proceeds paid to an

HfftBigai^pwfcfficn;:n=f _

till—iiiiiniiii=Mii''

_

Ji;rt-n-ni;n-nj.n-n

n-niii-tit 11=11111=11

■i~rf=nr:nr:n:rnrn~n

TTTTSTTTTTarTTTT'—11III

:ri—rinn—nzn—nzn—n

ii=i|iii=ii.tii=i 1111=11

iigTfaiigiiai'ignBnai i

irngri 1111=11 III

sreSPisWmBSjwaegn

=n=n=nzn=nzn=r =n=n=n=n=n=n=n=n=n=n=n

=11111=11111=11111=1

gnsnignsnginsnmnsrTjnsngRmsngnsnMinsngin^ri

lll=||||l=ltlll=|llll =11111=11111=81111=1

nSn—nSningn

iii=iiiii=inii=itiy=uiii=(iiii

nsrrgnSrifgnsnrirTarl gnannn5rT";rtSr^a''SnBr'TSngn

Lijusi iui;j=i4,tu,=ixu.iJ=iijLU=ujLJUi.=uju.i=u.ui.=i.uj.i=naj izuxumj * u n.uj.i=uii i rn i iu=ujti=iiiii=iJuaj=£iX4Uin

• ai—11 n <

OMBNft. 154S0008

7 social naaay tr*

1 wagn, tpx. cow coarcnHMi

FatmW-2 Wage, and Tax Statement

e ERVMyai naiM. aMtns, CM ZIP oods

CITY OP SAN JOSE

FINANCE -PAYROLL

200 EAST SANTA CLARA. STREET

SAN JOSE CA 95113-1905

c fciripiiawx nsffw, wwm^ nd o^ooda

217841.59

a/wceaiodops

a scciii tdcuoiy mon

a vanncaiion codo

0 Moddtra vagaand Hp*

11 NonHuttOod plaia

0 EnpiaTW moietoon lutew (tnq

Mcnw

94-6000419

40375:35

4 8oclil*aaiitr ln«OMid'

'

256575.22

10 Oop^idom c*re_Mratia.

a rediiii wcomeiuxweniwd

.

e MMwata OK wniMid''

4229.52

S 1 13000.00

DD r 19^53.90

W-2

Type

T/S

4,230

19,065

19,065

SWT

4,230

Local

■ T/OCPAYER TOTALS'

MedWH

'SPOUSE TOTALS'

•• COMBINED TOTALS'

88 WH

19,065

SDI

40,375

40,375

40,375

FWT

217,842

217,842

217,842

GroBs

WAGE STATEMENT LISTING

4,230

CITY OF SAN JOSE

CA 94.6000419

Employer / State / EIN

ROC M & JOAMNA L PIFFERINI

Tips

256,575

256,575

256,575

88 Wages/ Med Wages Txbl 1099R

Txbl IRA

No

Pension

551.53.565

[17116]

FORM

TAXABLE YEAR

Caiifornia Resident

2017

540

Income Tax Return

ATTACH FEDERAL RETURN

APE

A

551-53-5651

ROC

JOANNA

17

PIFF

564-89-5273

M

PIFFERINI

L

PIFFERINI

R

RP

PO BOX 1495

TWAIN

11-30-1968

01

06

07

08

09

10

11

12

13

14

16

17

18

19

31

32

33

34

35

40

43

44

CA

HARTE

95383

09-12-1971

2

0

2

228

0

0

0

0

01

353

581

217842

239141

1671

0

237470

18583

218887

15070

581

14489

0

14489

0

0

0

45

46

47

48

61

62

63

64

71

72

73

74

75

76

91

92

93

94

95

96

97

400

401

403

0

0

0

14489

0

0

0

14489

19065

0

0

0

0

19065

0

19065

0

4576

0

4576

0

0

0

0

405

406

407

408

410

413

422

423

424

425

430

431

432

433

434

435

436

437

438

439

440

110

111

112

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

113

0

115

4576

116

4576

117

0

APE

0

3800

0

3803

0

SCHGl

0

5870A

0

5805 5805F

0

DESIGNEE

1

TPIDP 00073913

FN

CCF

3805P

NQDC

3540

3554

3805Z

3807

3808

3809

IRC453A

IRC1341

JOEPIFFER0HOTMAIL.COM

(480) 233-5857

ROC

PIFFERINI

524-97-2698 SON

CT

^B

:z. ^

^(73

0

0

0

0

0

0

0

0

0

0

0

DDRl

121137522

8000810591

1

4 I I Head of tiousehold (v/ith qualifying person). See instructions.

1 I I Single

2 I X I Married/RDP filing jointly. See inst

5 I I Qualifying widow(er) with dependent child. Enter year spouse/ROP died

3 I I Married/RDP filing separately. Enter spouse's/ROP's SSN or ITIN above and full name here

If your California filing status is different from your federal filing status, check the box here

6 If someone can claim you (or your spouse/RDP) as a dependent, check the box here. See inst..

090 I

3101176

O

6

□

□

Form 540 2017 Sidel

[17116]

Your name:

PIFFERINI

551-53-5651

YourSSN orlTlN:

k- For line 7, line 8, line 9, and line 10: Multiply the amount you enter In the box by the pre-printed dollar amount for that line.

7 Personal: If you checked box 1,3, or 4 above, enter 1 in the box. If you checked

box 2 or 5. enter 2, in the box. If you checked the box on line 6, see instructions, (i) 7

X S114 = ®S

8 Blind: If you (or your spouse/RDP)are \nsually impaired, enter 1;

if both are visually impaired, enter 2

®8

X S114 = ® $

9 Senior: If you (or your spouse/ROP) are 65 or older, enter 1;

if both are 65 or older, enter 2

</)

tr

o 9

228

X S114 = ® $

10 Dependents: Do not Include yourself or your spouse/RDP.

DapendenI1

D.

m

□

□

Whole dollars only

Dependent 2

Dependent 3

First Name

P

®

ROC

®

®

®

PIFFERINI

®

®

9

524-97-2698

9

Last Name

UJ

SSN

Dependent't

relationship

to you

® SON

■

■—.I

1

—

1

..

■ — — —

®

9

®

9 10 Q

I ±J X $353= ® $

Total dependent exemptions

11 Exemption amount: Add line 7 through line 10. Transfer this amount to line 32

12 State wages from your Form(s)W-2, box 16

9 12

® 11

S

353

581

217, 842 IJoq

® 13

39,141

14 California adjustments - subtractions. Enter the amount from Schedule OA (540), line 37, column B . . . 9 14

1.671

13 Enter federal adjusted gross income from Form 1040, line 37; 1D40A, line 21; or 1040EZ, line 4

15 Subtract line 14 from line 13. If less than zero, enter the result in parentheses. See instructions

15

237.470

o

U

c

^

16 California adjustments - additions. Enter the amount from Schedule CA (540), line 37, column C

9 16

17 California adjusted gross income. Combine line 15 and line 16

9 17

237,470

. 9 18

18,583

® 19

218.887

18 Enter the

larger of:

Your California Itemized deductions from Schedule CA (540), line 44; DR

Your California standard deduction shown below for your filing status:

• Single or Married/RDP filing separately

$4,236

• Married/RDP filing jointly. Head of household, or Qualifying widow(er)

$8,472

If Married/RDP filing separately or the box on line 6 is checked, STOP. See instructions. .

19 Subtract line 18 from line 17. This is your taxable Income. If less than zero, enter -0-

31 Tax. Check the box if from:

□ Tax Table

[Kl Tax Rate Schedule

9 n FTB3800 9 D FrB3803

,y

,y

9 31

15.070 m

® 32

581

33 Subtract line 32 from line 31. If less than zero, enter -0-

® 33

14,489

34 Tax. See instructions. Check the box if from: 9 dl Schedule G-1 O CH FTB5870A

9 34

35 Add line 33 and line 34

® 35

32 Exemption credits. Enter the amount from line 11. If your federal AGI is more than Si 87,203

see instructions

Side 2 Form 540 2017

090 I

3102176

14,489

m

QQ

[17116]

Your name: IpIFFERINI

Your SSN or ITIN:

551-53-5651

40 Nonrefundable Child and Dependent Care Expenses Credit. See instructions

• 40

QQ

u

43 Enter credit name i

code•

and amount,

•43

44 Enter credit name

code•

and amount.

•44

ij")

O

"

45 To claim more than two credits, see instructions. Attach Schedule P (540)

•45

46 Nonrefundable renter's credit. See instructions

•46

47 Add line 40 and line 43 through line 46. These are your total credits

® 47

48 Subtract line 47 from line 35. If less than zero, enter -0-

® 48

61 Alternative minimum tax. Attach Schedule P (540)

•61

.b

® 62

.b

.2

O

o

a.

£/)

14.489

(/}

O

62 fWental Health Services Tax. See instructions

o

n

63 Other taxes and credit recapture. See Instructions

•63

64 Add line 48, line 61, line 62, and line 63. This is your total tax

•64

14.489 QQ

71 California income tax withheld. See instructions

• 71

19.065

72 2017 CA estimated tax and other payments. See instructions

• 72

73 Withholding (Form 592-B and/or 593). See Instructions

• 73

74 Excess SDI (or VPDI) withheld. See instructions

• 74

75 Earned Income Tax Credit (EITC)

.• 75

QQ

c

0)

£

(C

o.

® 76

19,065 QQ

92 Payments balance. If line 76 is more than line 91, subtract line 91 from line 76

® 92

19,065

93 Use Tax balance. If line 91 is more than line 76, subtract line 76 from line 91.

® 93

76 Add lines 71 through 75. These are your total payments. See instructions

91 Use Tax. Do not leave blank. See instructions

X

1^

•91

If line 91 is zero, check if: I X I No use tax is owed.

o

0)

3

□ You paid your use tax obligation directly to CDTFA.

~ Q 94 Overpaid tax. If line 92 is more than line 64, subtract line 64 from line 92

k.

® 94

4,576

nj

O H

95 Amount of line 94 you want applied to your 2018 estimated tax

• 95

96 Overpaid tax available this year. Subtract line 95 from line 94

• 96

97 Tax due. If line 92 is less than line 64, subtract line 92 from line 64

® 97

•b

.b

O

090 1

3103176

4.576

Form 540 2017 Side 3

.b

.y

[17116;

Your name: IpIFFERINI

YourSSNorlTlN:

551-53-5651

Coda

California Seniors Special Fund. See instructions

•400

Alzheimer's Disease/Related Disorders Fund

•401

Rare and Endangered Species Preservation Voluntary Tax Contribution Program

*403

Calttornia Breast Cancer Research Voluntary Tax Contribution Fund

California Firefighters' Memorial Fund

Emergency Food for Families Voluntary Tax Contribution Fund

#407

California Peace Officer Memorial Foundation Fund

#408

California Sea Otter Fund

•410

California Cancer Research Voluntary Tax Contribution Fund

•413

School Supplies for Homeless Children Fund

•422

State Parks Protection Fund/Parks Pass Purchase.

.• 423

Protect Our Coast and Oceans Voluntary Tax Contribution Fund

,

•424

Keep Arts In Schools Voluntary Tax Contribution Fund.

State Children's Trust Fund for the Prevention of Child Abuse

*430

Prevention of Animal Homelessness and Cruelty Fund

*431

Revive the Salton Sea Fund

•432

California Domestic Violence Victims Fund

•433

Special Olympics Fund.

.• 434

Type 1 Diabetes Research Fund

California YMCA Youth and Government Voluntary Tax Contribution Fund.

Habitat for Humanity Voluntary Tax Contribution Fund.

CaliforniaSenior Citizen Advocacy Voluntary Tax Contribution Fund

Native California Wildlife Rehabilitation Voluntary Tax Contribution Fund

Rape Backlog Kit Voluntary Tax Contribution Fund.

110 Add code 400 through code 440. This is your total contribution

•ASS

Amount

[17116]

PIFFERINI

Your name:

YourSSN or iTIN:

551-53-5651

111 AMOUNT YOU OWE. It you do not Oave an amount on line 96, add line 93. line 97, and line 110. See instructions. Do not send cash.

Mail to: FRANCHISE TAX BOARD

PO BOX 942867

II

Ill

SACRAMENTO CA94267-D001

Pay online - Go to ttb.ca.gov/pay for more information.

^ v; 112 Interest, late return penalties, and late payment penalties

i:' n 113 Underpayment of estimated tax. Check the box:

M

112

FT6 5B05 attached •

□

FTB SBOSF attached. .*113

114 Total amount due. See instructions Enclose, but do not staple, any payment

114

QD

115 REFUND OR NO AMOUNT DUE. Subtract the sum of line 110, line 112 and line 113 from line 95. See instructions.

Mail to:

FRANCHISE TAX BOARD

POBOX 942840

SACRAMENTO CA 94240-0001

O

iT

D

4,576

• 115

.U

Fill In the Information to authorize direct deposit of your refund into oneor h.vo accounts. Do not attach a voided check or a deposit slip. See instructions.

Have you verllled the routing and account numbers? Use vrhcie dollars only.

All or the following amourrt of my refund (line 115) is authorized for direct deposit into the account shown below;

• Type

o

Zi

Routing number

5

S Checking ♦ Account number

• 116 Direct deposit amount

•c

o

□

121137522

"t5

c

Savings

4.576 J2Qi

8000310M1

The remaining amount of my refund (line 115) is authorized for direct deposit into the account shown below:

• Type

n Checking

• Routing number

117 Direct deposit amount

Account number

IMPORTANT: See the irstructiorrs to tmd out il you sbO'.ild aiiaeh a copy ot your compleie federal lax reiurn.

To learn aboul your pnvacy rights, how we may use your information, ar)d the consequences tor not providing the requested intormallon. go to

ftb.ca.gov/rorms and search (or 1131. To request this notice by mail, call 800.652.57i 1. Under penalties of perjury, i declare that 1 have examined this

tax return, including accompanying schedules and statements, artd to the best of my knowledge and belief, it Is true, correct, and complete.

Vbur signature

Spouto's/RDh 8 signaiuro (it a joint lax reiurn. both must sign)

Date

®Pfclorred phone number

(^Youi email address Enter only one email address.

Sign

Here

iigratuic [declaration of preparar is trased on all Intonation of which preparsr has any loiowledga)

It is unlawful

to forge a

spouse's/R tip's

signature.

Firm s name (or yo'rs, if self-employed)

DONALD

PTIN

■7^

P00073913

BYFIELD

Joint tax return?

(See Ihslruclions)

• FEIN

Rrm's addresa

1960

FRUITDALE AVE

JOSE

CA

95128

Oo you want to allow another person to discuss this tax reiurn with us? See ihslruclions.

□ No

Telephone Number

Print Third Party Dasigneo's Name

DONALD

Yes

408-295-0777

BYFIELD

090 I

3105175

Form 540 2017 Side 5

[17116]

SCHEDULE

TAXABLE YEAR

2017

California Adjustments — Residents

CA (5401

Important: Attach this schedule behind Form 540, Side 5 as a supportins California schedule.

SSN or ITIN

Names|s)as shown on lax relurn

551-53-5651

|o51-

ROC M & JOANNA L PIFFERINI

Partl Income Adiuslment Schedule

IB SuMftdlMi

See Hstiuclisns

A

Section A-Income

7

B

9

10

11

JUdllleai

B

See iisUuciiiiiii

Wages, salaries, tips. etc. See instructions betore making an entry In column B or C — 7 ® 217,8 42. ®

Taxable Interest(b)

— 8(8)®

®

Ordinary dividenfls. See instructions,(h)

9(3) ®

®

Taxable refunds, credits, offsets of state and focal Income taxes

10 ® 1,671.®

Alimony received

11®

il.

12®

®

13 Capital gain or (loss). See instructions

14 Other gains or (losses)

15 IRA distributions. See instructions,(a)

12 Business income or (loss)

13 ®

14 ®

15(b) ®

®

®

®

16

17

18

19

16(b) ®

®

^

®

®

Pensions and annuities. Sea Instructions.(a)__

Rental real estate, royalties, partnerships, S corporations, trusts, etc

Farm income or (loss)

Unemployment compensation

Social security benefits(a)(g

17 ®

18®

19 ®

.20(b)®

■

Other income.

e NOL from FTB 380SZ,

a California lottery winnings

b Disaster loss deduction from FTB 3805V

c Federal NOL (Form 1040. line 21)

d NOL deduction from FTB 3805V

3808,3807, or 3809

t Other (describe):

®

22 Total. Combine line 7 through line 21 in column A, Add line 7 through line 21f in

column B and column C. Go to Section B

1,671.1®

22 ® 240,633.1®

Section B -Adjustmenisto income

23 Educator expenses

23 ®

24 Certain business expanses of reservists, performing artists, and fee-basis

25

26

27

28

29

30

31a

government officials

24 ®

Health savings account deduction

Moving expenses

Deductible part ol self-employment tax

Sell-employed SEP, SIMPLE,and qualified plans

Self-employed health insurance deduction

Penalty on early v/ithdrawal of savings

Alimony paid,(b) Recipient's: SSN®

25 ®

26 ®

27 ®

28 ®

29 ®

30 ®

Last name ®

. • 31a ®

— 32®

32 IRA deduction

33 Student loan interest deduction

34 Tuition and lees

33 ®

34 ®

35 Domestic production activities deduction

35 ®

36 Add line 23 through line 3l3 and line 32 through line 35 in columns A, B, and 0.

See instructions

37 Total. Subtract line 36 from line 22 in columns A, B, ana C. See instructions

For Privacy Notlco.gM FTB 1131 ENC/SP.

36l®

®_

1,492.

.

1.492.1®

37l® 239,141.[®

1,671.1®

Schedule CA (540) 2D17fnEV02-l8) SIdel

[17116]

Part II Adjustments to Federal Itemized Deductions

Federal itemized deductions. Enter the amount from federal Schedule A (Form 1040), lines 4.9,15, 19,20,27, and 28

®38

Enter total of federal Schedule A (Form 1040), line 5(State Disability Insurance, and state and local Income tax. or

General Sales Tax) and line 8 (foreign Income taxes only). See Instructions

37,648.

19.065.

18.583.

40

41

18,583.

42

43 is your federal AG!(Form 540, line 13) more than the amount shown below for your filing status?