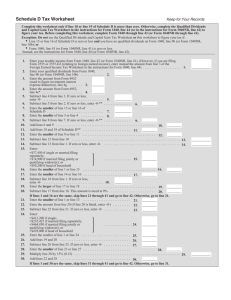

Student Loan Interest Deduction Worksheet—Line 33

advertisement

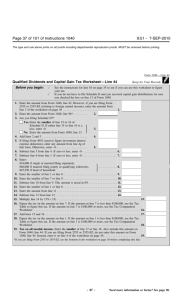

Student Loan Interest Deduction Worksheet—Line 33 Before you begin: ⻫ ⻫ Keep for Your Records Figure any write-in adjustments to be entered on the dotted line next to line 36 (see the instructions for line 36 on page 33). Be sure you have read the Exception above to see if you can use this worksheet instead of Pub. 970 to figure your deduction. 1. Enter the total interest you paid in 2010 on qualified student loans (see above). Do not enter more than $2,500 2. Enter the amount from Form 1040, line 22 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. 3. Enter the total of the amounts from Form 1040, lines 23 through 32, plus any write-in adjustments you entered on the dotted line next to line 36 . . . . . . . . . . . . . . . . . . . . . . . . . 3. 4. Subtract line 3 from line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. 5. Enter the amount shown below for your filing status. • Single, head of household, or qualifying widow(er) — $60,000 . . . . . . . . . . . 5. • Married filing jointly — $120,000 6. Is the amount on line 4 more than the amount on line 5? No. Skip lines 6 and 7, enter -0- on line 8, and go to line 9. Yes. Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. 7. Divide line 6 by $15,000 ($30,000 if married filing jointly). Enter the result as a decimal (rounded to at least three places). If the result is 1.000 or more, enter 1.000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. Multiply line 1 by line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. Student loan interest deduction. Subtract line 8 from line 1. Enter the result here and on Form 1040, line 33. Do not include this amount in figuring any other deduction on your return (such as on Schedule A, C, E, etc.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. } Need more information or forms? See page 96. - 32 - 7. 8. 9. . Standard Deduction Worksheet—Line 40 ! CAUTION Keep for Your Records Complete this worksheet only if Exception 1 on page 33 applies to you. Do not complete this worksheet if you checked the box on line 39b; your standard deduction is zero. Also, do not complete this worksheet if you must use Schedule L to figure your standard deduction (see Exception 2 on page 33). 1. Enter the amount shown below for your filing status. • Single or married filing separately—$5,700 • Married filing jointly or Qualifying widow(er)—$11,400 . . . . . . . . . . . . . . . 1. • Head of household—$8,400 2. Can you (or your spouse if filing jointly) be claimed as a dependent on someone else’s return? No. Enter the amount from line 1 on line 4, skip line 3, and go to line 5. Yes. Go to line 3. 3. Is your earned income* more than $650? Yes. Add $300 to your earned income. Enter the total . . . . . . . . . . . . . . . . 3. No. Enter $950 4. Enter the smaller of line 1 or line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. 5. If born before January 2, 1946, or blind, multiply the number on Form 1040, line 39a, by $1,100 ($1,400 if single or head of household). Otherwise, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. 6. Add lines 4 and 5. Enter the total here and on Form 1040, line 40 . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. *Earned income includes wages, salaries, tips, professional fees, and other compensation received for personal services you performed. It also includes any amount received as a scholarship that you must include in your income. Generally, your earned income is the total of the amount(s) you reported on Form 1040, lines 7, 12, and 18, minus the amount, if any, on line 27. } } Need more information or forms? See page 96. - 34 -