WHO:

advertisement

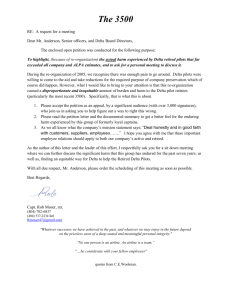

WHO: WHEN: WHERE: ATTENDEES: THIS EVENT: Ed Bastian Thursday, 21 March 2013 Institute of Directors, London Aviation Stakeholders UK Aviation Club Lunch Speech Thank you Jane. Good afternoon ladies and gentlemen, it’s a real pleasure to be here in London, one of my favorite cities; I’m the first person from Delta to speak at the Aviation Club for which I’m very honored. I’m delighted to see so many of you here today. Delta’s founder CE Woolman ran our company for over forty years. He was a very down-to-earth charismatic man known for his great insights. When he was asked about getting Delta started, he said: “Running an airline is like having a baby: fun to conceive, but hell to deliver.” His passion and faith in aviation never waivered and his core values of honesty, integrity and perseverance have made Delta the airline it is today. I think all of us here today would also agree with Woolman that the “The only monotonous thing about aviation is the constant change.” But I’m glad our business has changed and since our merger, which heralded a wave of consolidation in the U.S., Delta has become a leader in the global aviation landscape. Despite difficult economic challenges, we just posted solid profits for a third year running that together total over $4billion. In fact, Delta delivered a full 50% of the entire US industry's 2012 profits, and that's quite a statement. And we continue to look forward to 2013 with great expectations. 1 And while there are uncertainties for our business, we focus on the things that we can control and which we know will make a difference to continuously improve our business. We see these as: o Striving to always do better; to make Delta the airline of choice against some formidable competition o Investing in our business and services o Looking after our people and creating a great place to work o Thinking about things differently to further improve our airline Critical to our investment program is building our capacity at both Heathrow and in New York. Heathrow is hugely important to us: of the top 10 transatlantic markets, 85 percent of customers fly to Heathrow and it’s the number one destination for corporate travelers between the US and UK. But our options at the airport were limited. We all know that capacity is a problem and the dominance of BA-AA who hold 60 percent of slots. This left us, the preferred airline in the US and with a global brand and network, unable to compete effectively for the critical US-UK business customer. The same applied to Virgin Atlantic – a leading brand in the UK – its options were also limited when it came to expanding its offering. That’s why we were excited when the opportunity came along to tie up a deal with Virgin – a partnership that we believe will drive great value for our customers, employees and our shareholders. 2 We are a marriage of two award-winning airlines, with great services and great brands. And let’s be clear that the Delta and Virgin brands are here to stay. We complement one another well. Virgin’s reach will expand with access to our U.S. domestic network. For Delta, the deal is a game-changer transforming our ability to compete on transatlantic routes. o We will jointly operate 31 daily flights from the UK and North America o 21 of these are from Heathrow Our partnership is great news too for competition and the customer. Business customers on the most important route in the world will finally get a real choice of service resulting in improved schedule flexibility and better services. It will also allow us to profitably grow in this critical business sector. Heathrow is not an investment in isolation. We have established New York as a lead hub which will improve our transatlantic service to corporate customers. We now operate 415 flights daily from the city that feels as much like home turf as our Atlanta base. At La Guardia and New York JFK combined, we offer twice as many departures than any other airline. JFK is the busiest US airport for international passengers – with over 22 million passengers using this US gateway last year. And in May we will unveil our new $1.4 billion Terminal 4 at the airport, making the travel experience even better. I hope you get the chance to pass through it: I think you’ll find the sense of space, the dining and shopping options and improvements really impressive. The decision to tie up the deal with Virgin and, build our New York business, shows I believe our drive to be innovative and do things differently. 3 That ethos was also behind our investment in the Trainer oil refinery in Pennsylvania. This move is a first for our industry and I know is of keen interest to many of you. The refinery protects us from volatile jet fuel prices and it’s well positioned to serve our US hubs – it should produce around 80 percent of the fuel for our US fleet. It’s early days yet but we have high hopes that we will secure significant cost savings. We also moved first when it came to mergers and alliances. Our merger with Northwest paved the way for US consolidation and our transatlantic joint venture with Air France, KLM and Alitalia, provided the template for similar agreements. And our investment in Virgin Atlantic follows the investments we have already made in two leading Latin American airlines: Aeromexico, the leading carrier in Mexico as well as GOL the top domestic airline in Brazil. Both of which have given us an important foothold in growing markets. Consolidation continues to change the competitive landscape and we believe it’s a cause for good for the industry. It has helped shape the business model of US airlines with tough decisions made, that ultimately, have provided greater scope to improve financial stability. 4 Good evidence for this comes from our recent Quarter 1 investor guidance that points to a small profit. As you know, the early part of the year is traditionally tough but our changed business structure is driving our best first quarter results since 2000 – and this is with a fuel bill that’s $2billion higher. We are also in a stronger position to invest in our business and we’re in the process of spending $3 billion to deliver a range of improvements. Some of these include: o Introduced full-flat beds on all flights from London and we are extending our upgraded BusinessElite to all long-haul services and will be completed by this time next year o We’ve rolled out Wi-Fi across our domestic fleet and we will be extending Wi-Fi to our transatlantic flights o We’ve introduced premium economy across our entire network o We are improving our airport facilities, including New York JFK which I mentioned Of course, our employees are at the heart of delivering our services; and they make the real difference to how customers perceive our brand as well as make a positive difference to our business. Woolman said it best: “If you take care of your people, they will take care of our customers.” And this is a core value that shapes Delta today. With this in mind, we work hard every day to provide the best environment for our 80,000 people to make Delta a great place to work. And it is thanks to our employees that improvements to our services are being recognized. In 2012 we won over 30 business awards and a little over three weeks ago, Fortune named Delta its most admired global airline for the year. 5 Before I wrap up I want to return to where I started today – with Heathrow and more accurately, its future. The airport has played a pivotal role in the success of the aviation market between the UK and North America – around 30% of passengers fly to and from Heathrow on North Atlantic routes. It’s the preferred airport for corporate travelers and 68 percent of FTSE 100 chairmen are in favor of the third runway solution. While there are numerous schemes on the table to extend capacity in the SouthEast, in our mind, there is no effective substitute to Heathrow. Along with Heathrow, APD is another critical issue that’s important not just for aviation but the entire health of the UK economy. As an American businessman looking at the UK’s approach to taxation of the aviation sector, I recognize the negative impact APD has on the UK and it strikes me that it is a true barrier to tourism and investment here. I do hope that the arguments relating to the benefits of scraping or reducing APD – especially for long-haul passengers – will gain traction. We want to invest more in our UK business. And it’s my sincere hope that the UK will remain a key driving force for global aviation and that the right decisions will be made quickly to ensure a vibrant future for Heathrow. While governments have to make the hard decisions to grow the aviation sector, we remain focused on the priorities that we can control and which are critical to our success. And, I’m positive about the future. 6 There is of course continued economic uncertainty ahead and we live in a volatile industry. But the US economy is emerging from recession and opportunities are strong in the world’s growing markets. IATA is estimating that airline profits will be in excess of $10 billion for the year. I would like to end with a thought from Woolman that I believe has real resonance today. He said: "I'm optimistic about the future of air transportation. This industry grew up on problems – and it grew because it solved them." Thank you for your time today and I’m hoping to welcome many of you on Delta in the near future. 7