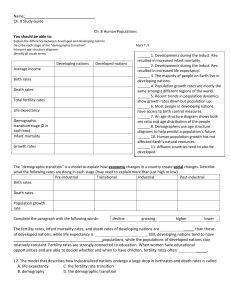

Demographic transition in Sub Saharan Africa

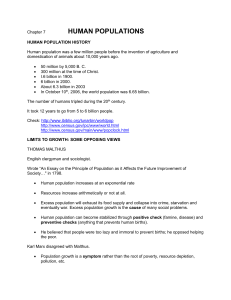

advertisement