HM Portfolios Newsletter May 31, 2015

advertisement

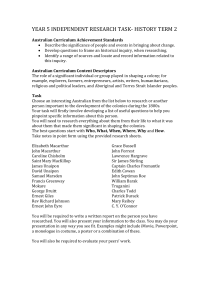

Investment Report - For Month Ending 31 May 2015 Asset Class Performance to 31 May 2015 Index* 1 Mth 3 Mths 6 Mths 1 Yr p.a. 2 Yrs p.a. 3 Yrs p.a. 5 Yrs p.a. 10 Yrs p.a. Australian Shares 0.43% -1.28% 11.18% 9.93% 12.98% 17.03% 10.06% 8.03% International Shares 4.60% 2.95% 14.69% 29.18% 26.20% 27.07% 15.33% 6.56% Australian Property Securities 2.92% -0.32% 16.35% 29.66% 17.55% 21.81% 15.07% 3.43% Australian Fixed Interest International Fixed Interest Australian Cash 0.04% -0.32% 3.28% 7.47% 5.79% 5.09% 6.93% 6.41% -0.47% -0.02% 2.71% 7.96% 6.78% 6.28% 7.53% 7.32% 0.20% 0.59% 1.28% 2.65% 2.67% 2.89% 3.69% 4.73% Indices* International Shares MSCI World Ex Australia in $A - Net Dividends Reinvested Index Australian Shares S&P/ASX 300 Accumulation Index Australian Property Securities S&P/ASX 200 A-REIT (Property Trusts) Accumulation Index Australian Fixed Interest Bloomberg AusBond Composite Bond Index - All Maturities International Fixed Interest Barclays Capital Global Treasury Index Hedged in $A Australian Cash Bloomberg AusBond Bank Bill Index Highest Performing Asset Class for that Period Lowest Performing Asset Class for that Period Month in Review World markets experienced another volatile month in April on mixed economic data out of the US, better than expected US earnings results and the Federal Reserve reiterating its next move on rates is data dependent. Increased fears about a Greek default, weaker Chinese data and Chinese regulatory changes also weighed on negative investor sentiment despite commodity and oil prices rebounding over the month. US GDP grew by only 0.2% in Q1, below forecasts of 1% and job numbers disappointed where the US economy added the fewest jobs since December 2013 easing fears the Fed will raise rates soon. The US Federal Reserve indicated that there is no pre-determined timeline for the Fed rate lift-off and that the Fed is totally data dependent in considering when next to change policy. Chinese growth slowed to 7% for Q1 while trade data, industrial production and retail sales also weakened prompting the Chinese government to provide further stimulus. Oil prices rose 25% back towards $US60 a barrel as US oil production slowed while iron ore rallied 21% from a low of $47 after both BHP and Vale stated they will slow iron ore expansion and Chinese steel mills restocked on increased steel production. All asset classes returned negative returns except for Cash which returned 0.18% with International Shares the worst performing asset class with -2.07% in Australian dollar terms after the currency gained 4.5%. The Australian share market closed out the month in negative territory to be down -1.65% after missing out on breaking through the 6,000 level on the All Ordinaries index by about 50 points. Talk of the banks needing to raise more capital, uncertainty of an RBA rate cut, worries about Australia losing its AAA credit rating and a weaker USD following signs a US rate hike is farther way than expected saw financials, yield plays and USD exposed healthcare stocks decline. In contrast, the rise in commodity prices saw the energy and material sectors outperform. In company news, BHP reported better than expected production and sales of iron ore for the quarter at 64.4m tonnes and confirmed it will slow the pace of its iron ore expansion by deferring an infrastructure upgrade at its Port Hedland facility in WA. Fortescue Metals (FMG) successfully raised $US2.3bn in a bond issue to ensure it will meet debts due in 2017 & 2018 by issuing a 9.75% senior secured 7 year bond as its shares bounced as much as 50% from its lows. Resmed (RMD) reported a slight decline in profit for the March quarter to $251.4m as margins fell due to lower prices, currency movements and increased costs which saw its shares decline by 13% for the month. In Australian economic news, as expected the RBA cut the cash rate for the 2nd time this year by 0.25% to a record low 2% in early May but provided no guidance as to the future path of monetary policy which sent the AUD higher. The RBA cited ongoing economic weakness for its decision saying “Looking ahead the key drag on private demand is likely to be weakness in business capital expenditure in both the mining and non-mining sectors over the coming year” and “the inflation outlook provided the opportunity for monetary policy to be eased further, so as to reinforce recent encouraging trends in household demand.” The RBA also appeared to move away from its easing bias, suggesting this might be the last cut in the current cycle which could cause Sydney property prices to head into bubble territory. Inflation for Q1 grew at just 0.2%, above 0.1% forecast as headline inflation eased to an annual rate of 1.3%, below 1.7% estimated to a 3 year low as fuel prices dropped 12% and fruit and vegetable prices declined 8% in the March quarter. Underlying CPI came in at 2.4% for the year, well within the RBA’s 2-3% target. The unemployment rate for March dropped to 6.1% from 6.2% in February which was revised down from 6.3%, below estimates of 6.3% as 37,700 jobs were created versus 15,000 forecast. In further positive news, business confidence and conditions improved in March, rebounding from near 2 year lows as confidence rose 3 points from the zero level and conditions gained 4 points to 6, above the long run average of zero as both trading and profitability improved. Building approvals rose 1.8% in March, above a -2% estimated fall to record its 10th straight monthly gain as new unit approvals increased 3.6% with overall approvals up 23.6% on year. US markets increased slightly in April with the Dow Jones up 0.36% and the S&P 500 gaining 0.85% in another volatile month on uncertainty over when the US Fed will raise rates, mixed economic data and a better than expected earnings season. Of the S&P 500 companies already having reported, 73% have beat profit forecasts and 49% beat sales estimates with Q1 profits projected to now be down -0.4% on year against previous estimates of a deeper decline of up to -4%. Companies which exceeded earnings expectations included the likes of Apple, Google, Microsoft, Coca-Cola, Morgan Stanley and Goldman Sachs while Bank of America, General Motors, Twitter and American Express disappointed. Weak data releases included Q1 GDP of 0.2%, a sharp decline from the 2.2% growth seen in Q4 2014 as bad weather, falling exports and a drop in business investment impacted. The US economy added only 126,000 jobs in March, well below 250,000 forecast with the unemployment rate unchanged at 5.5% as the participation rate fell 0.1% to 62.7%. Consumer confidence fell in April to a 4 month low of 95.2 from 101.4, below estimates of 102.5. Positive data included retail sales up 0.9% in March for the first increase in 3 months led by auto sales which rose 2.7% while weekly jobless claims fell to a 15 year low of 262,000. US Fed minutes revealed officials are split on the timing of raising interest rates with Fed Chair Yellen reiterating the rate move is data dependent with markets now seeing a September move more likely. Europe saw Greek default fears increase again with the country’s negotiations with its creditors stalling as they struggle to reach agreement on the required Greek reforms. The Greek finance minister was removed by PM Tsipras from the debt negotiations ahead of IMF payments totaling $US1bn due in May where missing an IMF payment could mean default and an exit from the Euro. However, German Chancellor Merkel is willing to find a solution for Greece and that Greek default would represent a failure for Europe. German bond yields declined to a record low of 0.08% mid-April on the Greek fears and due to the ECB QE program. ECB President Draghi reiterated the bond buying program will remain in place as planned and “must be fully implemented to work.” Draghi also said there’s “clear evidence that the monetary policy measures that we’ve put in place are effective” and “we expect the economic recovery to broaden and strengthen gradually.” In further signs of continuing low interest rates, Switzerland has become the first government in history to sell benchmark 10 year debt at a negative interest rate of -0.055% to raise SFr 232.5m ($315.3m). Over the past year, Germany, Austria, Finland and Spain have all sold shorter-term debt at sub-zero yields. The Eurozone core CPI held at 0.6% on year to April as expected which allayed concerns of deflation and a sign the ECB QE program was having an impact. China’s economy continued to slow with weaker growth, industrial production, retail sales and soft trade data leading to the central bank providing further stimulus during April. GDP for Q1 grew at 7% on year as expected, slowing from 7.3% growth in Q4 2014 to record its weakest reading since the GFC. Industrial production rose 5.6% on year to March versus 7% forecast and its lowest level since the GFC low of 5.4%. Retail sales growth came in at 10.2% on year to March, below estimates of 10.9%. The monthly trade surplus fell to $US3.1bn for March, well down from $US60.6bn in February and below $US40.1bn forecast as the Chinese New Year impacted. This was led by a sharp fall in exports which were down 14.6% from a year ago against expectations of an 8.2% gain while imports fell more than expected, down 12.3% from a year ago versus an estimated 11.3% fall. The People’s Bank of China responded by cutting the banks’ Reserve Requirement Ratio by 1% to 18.5%, double the size of the cut in February which is expected to release about 1 trillion Yuan ($208bn) of capital into the economy. In further stimulus, the government halved the rate of tax it charges domestic iron ore miners to alleviate the dominance of overseas producers. China’s securities regulator warned investors not to borrow money or sell real estate to buy shares and banned trusts using margin accounts and allowing fund managers to lend shares for short-selling. The official PMI manufacturing data for April was unchanged at 50.1 while in contrast the HSBC PMI fell to 48.9 in April, below estimates of 49.4 as new orders declined, increasing the likelihood of more stimulus. Model Portfolio Performance 1 Mth 3 Mths 6 Mths 1 Yr p.a. 2 Yrs p.a. 3 Yrs p.a. 5 Yrs p.a. 10 Yrs p.a. HM Conservative Portfolio 0.26% 0.17% 4.38% 6.25% 7.97% 9.11% 6.68% - HM Balanced Portfolio 0.21% -0.33% 5.64% 7.38% 9.63% 11.02% 6.97% - HM Growth Portfolio 0.57% -0.16% 7.37% 9.34% 11.76% 13.48% 7.72% - -1.72% -3.96% 3.42% 0.95% 11.09% 15.13% 7.74% - HM Aust. Shares Portion of Growth Pfolio The Henderson Maxwell Model Portfolios registered positive returns in May while underperforming their benchmarks as the Australian and International Share underperformed their indices. The best performing Australian sectors for the month were Industrials (+5.6%), Information Technology (+5.49%) and AREITs (+2.92%) with the Consumer Staples (-2.2%), Financials (-1%) and Telecoms (-0.2%) the worst performing sectors. The best performing stocks within the portfolios included the BWP Trust (BWP) which gained 8.9% while both Brambles (BXB) and FlexiGroup (FXL) rose 5.6%. The next best performer was Woodside (WPL), up 4.5% as the oil price rebounded to over $US60 during May while the Vanguard All-World ex US Shares Index ETF (VEU) rose 3.7%. Asset Allocation changes in May saw a slight increase to Australian Shares as the All Ords pulled back to below 5,600. A new position was entered into for the SPDR S&P/ASX 200 Fund ETF (STW) while CBA was added to for the Growth portfolio. Rights were taken up for the National Australia Bank (NAB) across the models where 2 new shares have been issued for 25 held at $28.50, well below the recent market trades of $33 to 34. The BHP spin-off South 32 (S32) also occurred during the month where 1 new S32 share has been issued for each BHP share held. A sale was made in Resmed (RMD) after it announced poor clinical trial results where one of its sleep therapy products put the lives of heart attack victims at further risk. The portfolios are still holding high cash levels in order to take advantage of potential further market volatility in the seasonally weak June period. Henderson Maxwell Asset Allocation as at 31 May 2015 Asset Class Australian Shares HM Conservative Bench Portfolio Range mark 18.71% 20% 0% - 50% HM Balanced Bench Portfolio Range mark 32.59% 35% 0% - 70% HM Growth Bench Portfolio Range mark 39.84% 40% 0% - 80% International Shares Australian Property Securities 14.31% 15% 0% - 20% 19.11% 20% 0% - 30% 29.71% 30% 0% - 40% 3.81% 5% 0% - 20% 3.13% 5% 0% - 20% 2.44% 10% 0% - 20% Fixed Income 33.48% 40% 0% - 60% 24.24% 30% 0% - 40% 10.21% 15% 0% - 30% Australian Cash 29.69% 20% 2% - 100% 20.94% 10% 2% - 100% 17.80% 5% 2% - 100% Outlook Global markets have retreated since late April with Australian shares heavily sold off as the seasonal weak period normally seen during May/June appearing to be underway. Poor recent reports by the banks and Woolworths has seen the All Ords decline from 7 year highs reached in April as the market failed to break the 6,000 index level. The RBA failing to provide interest rate guidance in its latest announcement by removing reference to its easing bias indicated to markets that the latest rate cut may be the last in the cycle. This has resulted in the AUD rising back towards $US0.80 and bond yields also increasing sparking a further sell-off in banks, USD earners and the yield sensitive plays. Further headwinds the markets could face in the immediate term include rising fears about Greece, the uncertainty in the outcome of the British election and the potential need for additional capital raisings by banks. Other risks include Australia’s Budget due to be delivered on May 12 which could provide market moving announcements and the beginning of the “confession season” where Australian companies announce earnings downgrades ahead of profit results due in August. Offsetting these risks are the QE programs by Europe and Japan together with more evidence of a delay to US Fed rate hikes due to ongoing weak US data where the likely September move could be pushed out to 2016. With high cash weightings held across the models, these funds will be added to growth assets as equity markets continue to reach attractive levels. Economic Statistics and Forecasts Cash Rate % - RBA CPI headline % annual % change Unemployment Rate % GDP (qtr % rate) annual % change Aust - CPI headline % Aust - Unemployment Rate % Australia GDP % United States GDP % World GDP % Latest 5/6/15 2.00 Qtr 32014 0.5 2.3 6.1 0.4 2.7 2011 3.0 5.2 2.4 Jun-14 2.00 Qtr 42014 0.2 1.7 6.2 0.5 2.5 2012 2.2 5.3 3.6 Sep-15 2.00 Qtr 12015 0.2 1.3 6.2 0.9 2.3 2013 2.7 5.8 2.1 Dec-15 2.00 Qtr 22015 f 0.8 1.7 6.3 0.5 2.1 2014 1.7 6.2 2.7 Mar-16 2.00 Qtr 32015 f 0.8 2.0 6.5 0.6 2.3 2015f 2.3 6.5 2.2 Jun-16 2.00 Qtr 42015 f 0.5 2.3 6.5 0.7 2.5 2016f 2.5 6.5 3.0 1.8 4.1 2.8 3.4 2.2 3.3 2.4 3.2 2.6 3.5 3.2 3.8 Sources: Westpac, International Monetary Fund (IMF)