Short Risk-Free

advertisement

MGMT 365: Investments

Solution to Final Exam Practice Problems

1) For each of the following options, calculate the missing variable:

Option

C

X

S

Rf

A

?

$30.00 $30.00 6% 25%

B

$2.00 $30.00

?

7% 30%

C

$9.00 $25.00 $30.00 6%

?

T

0.25

0.5

1

Answer: Use the Black-Scholes formula. To solve for S and , you must use trial and error (or

Excel’s solver tool). B&C would not be fair game on the final, but they do help you understand

the formula better.

Option

C

X

S

Rf

T

A

25%

0.25

$1.72 $30.00 $30.00 6%

B

$2.00 $30.00 $28.10 7%

30%

0.5

C

$9.00 $25.00 $30.00 6% 48.8%

1

2) For each of the following situations, calculate the missing variable:

Scenario

C

P

X

S

A

?

$1.00 $30.00 $30.00

B

$2.00 $0.50 $30.00

?

C

$9.00

?

$25.00 $30.00

Answer: Use put-call parity.

Scenario

C

A

$1.45

B

$2.00

C

$9.00

P

$1.00

$0.50

$2.54

X

$30.00

$30.00

$25.00

S

$30.00

$30.47

$30.00

Rf

6%

7%

6%

T

0.25

0.5

1

Rf

6%

7%

6%

T

0.25

0.5

1

3) You have decided to start a company that provides insurance on individual portfolios. Clients simply

provide a description of their portfolio to you and you guarantee that the portfolio will be worth at least a

pre-specified amount. For example, a client may hold 300 shares of IBM, 200 shares of GM, and 100

shares of Ford. The client asks you to guarantee that the portfolio will be worth $50,000 in one year (if it

is worth only $40,000, you would have to pay $10,000 in one year). Explain how you would determine

the price of the insurance.

Answer: You are essentially offering to sell put options on individual portfolios. The client would

receive a payoff in the amount of max{X-VT,0}, where VT is the value of the portfolio at the

expiration of the guarantee and X is the guaranteed amount. To determine a fair price, you would

need to estimate the volatility of the portfolio by looking at historical prices and estimate the riskfree rate by looking at Treasury securities. The strike price is the guaranteed amount. You can

then use Black-Scholes in conjunction with put-call parity to determine a fair price for the

insurance.

4) Why do farmers find forward contracts to be useful?

Answer: Forward contracts allow farmers to lock in crop prices and therefore reduce price

uncertainty.

5) Suppose a commodity forward contract sells for $100 and matures in 6 months. The risk-free rate is

7% and the cost of storing and insuring the commodity is $3.00 for six months, paid in advance. What

must the current commodity price be so that there is no arbitrage opportunity?

Answer: If you purchase the stock today and store it for a year, you will spend Ps+$3.00.

Alternatively, you might invest $100/e0.50.07 = $96.56 in the risk-free asset and purchase a 6month forward contract. The risk-free pays $100 in 6 months. That $100 can be used to meet

the forward obligation. In both cases, you end up with the commodity in 6 months without risk.

Therefore, the current commodity price must be $93.56 in order to eliminate the possibility of

arbitrage.

6) A stock does not pay dividends, but reported earnings-per-share of $4 this past year. The expected

earnings growth is 7% per year for the next 4 years. The average historical P/E ratio in the industry is 18.

The stock has an adjusted beta of 1.0, the risk-free rate is 5%, and the expected return on the market

portfolio is 11%. What is your best estimate of the stock's value today?

Answer: Since there are no dividends, we might use the Malkiel Model. The expected earnings per

share in four years is $4 1.074 = $5.243. The expected price in four years is $5.243 18 = $94.38.

The expected return on the stock is 11% (since the beta is 1.0). So, P0 = $94.38 / 1.114 = $62.17

7) A stock maintains a dividend payout ratio of 40% and has expected earnings-per-share of $3 this

coming year. The expected earnings growth is 6% per year for each of the following 3 years (after this

year). The average historical P/E ratio in the industry is 20. The stock has a beta of 1.4, the risk-free rate

is 5%, and the expected return on the market portfolio is 12%. What is the stock worth today?

Answer: Since the growth rate is good only for a few years, we cannot use the Gordon Model. We

can instead use the Malkiel Model. The expected dividend this year is D1 = 40%$3 = $1.20.

Dividends for the subsequent years are expected to be D2=D1(1+g) = $1.20 1.06 = $1.272,

D3=D1(1+g)2 = $1.20 1.062 = $1.348, and D4=D1(1+g)3 = $1.20 1.063 = $1.429. The expected

earning per share in four years is E4 = E1(1+g)3 = $31.063 = $3.573. The expected price in four

years is 20$3.573=$71.46. The expected return on the stock is 5%+1.4(12%-5%) = 14.8%. So,

the current value of the stock is P0 = $1.20/1.148 + $1.272/1.1482 + $1.348/1.1483 + $1.429/1.1484 +

$71.46/1.1484 = $44.87.

8) Calculate the value of a company’s stock given the following information:

Last year:

sales: $5.0 million

variable costs: $2.2 million

fixed costs: $0.6 million

depreciation: $0.5 million

Expectations:

sales growth: 10% per year for the next two years, followed by 6% per year thereafter.

variable costs: grow at the same rates as sales

fixed costs: 2.5% inflation rate

depreciation: relatively constant over time

Other information:

The company has no debt or preferred stock. Furthermore, no capital expenditures are planned.

= 1.2

rf = 6%

rm = 13%

average tax rate = 40%

Answer: k =6%+1.27% = 14.4%.

Year

1

2

3

4

Sales

$5.500

$6.050

$6.413

$6.798

Var. Costs

$2.420

$2.662

$2.822

$2.991

Fixed Costs

$0.615

$0.630

$0.646

$0.662

Depreciation

$0.500

$0.500

$0.500

$0.500

Taxable Income

$1.965

$2.258

$2.445

$2.644

Taxes

$0.786

$0.903

$0.978

$1.058

Net Income

$1.179

$1.355

$1.467

$1.587

Free Cash Flow

$1.679

$1.855

$1.967

$2.087

The cash flow growth is 6.08% between years 3 and 4. Assuming that this is likely to continue,

we can estimate the terminal value at year 4 of the remaining cash flows.

TV4=$2.0871.0608/(0.144-0.0608) = $26.605. The value of the company today is then V0 =

$1.679/1.144+$1.855/1.1442+$1.967/1.1443+$2.087/1.1444 + $26.605/1.1444 = $20.95M

9) A put option has a $60 strike price and an expiration of one year. The risk-free rate is 8%. Suppose

that the underlying asset currently trades for $55. You expect that price to increase by 15% or decrease

by 5% over the next year. Describe the portfolio of the underlying asset and the risk-free asset that

replicates the option payoffs. What is the option worth today?

Answer:

$63.25: put payoff = $0

$55

$52.25: put payoff = $7.75

Suppose we buy h shares of stock and invest B in the risk-free asset. The payoff would be as

follows.

Stock Price

Stock Payoff

Risk-Free Payoff

Total

0.08

$63.25

$63.25h

Be

$63.25h + Be0.08

0.08

$52.25

$52.25h

Be

$52.25h + Be0.08

Setting the payoffs equal to the put payoffs gives

$0 = $63.25h + Be0.08

$7.75 = $52.25h + Be0.08

Solving these simultaneously gives h = -0.7045 and B = $41.14. That is, we should short 0.7045

shares of stock and invest $41.14 in the risk-free asset. The cost of doing that must be what the

option is worth today: $41.14 – 0.7045$55 = $2.39

10) Briefly discuss the intuition behind put-call parity and then demonstrate it using payoff diagrams.

Answer: Put-call parity is based on the idea that the payoff on a put option can be perfectly

replicated using a call option (with the same strike price and expiration date), the stock, and the

risk-free asset. In fact, any of the four assets can be replicated using the other three.

Graphically, this occurs as follows:

short

stock

call

=

+

invest in

risk-free

put

=

+

11) A stock current sells for $50. The standard deviation of the stock price is estimated to be 30% per

year. A call option on the stock expires in three months and has a strike price of $45. The risk-free rate is

6%. Assuming no dividends or other capital distributions to shareholders, what is the value of the call

option today? What is the value of a put option on the stock with the same strike price and expiration?

Answer: Using Black-Scholes:

d1 =0.8774

d2 = 0.7274

S = $50

X = $45

T = 0.25

Rf = 6%

= 0.30

N(d1) = 0.8099 and N(d2) = 0.7665

C = $6.51

12) Gold currently trades for $270 per ounce. The cost of storing an ounce of gold is $2 per year (paid in

advance). The risk-free rate is 6%. A one-year forward contract on gold is available at $295. Is there an

arbitrage opportunity available? If so, what portfolio would you form to take advantage of the situation?

Answer: You can arrange to have gold in one year (risk-free) using two different methods.

Buy the gold now and store it. Cost today = $270+$2 = $272.

Buy a forward contract and invest enough in the risk-free today so that your obligation in one year

will be met. Cost today = $295/e0.06 = $277.82

The two methods cost different amounts, so there is an arbitrage opportunity. To take

advantage of it, you would

Buy the gold now and store it

Sell the gold forward

Short enough of the risk-free asset so that the payment you receive in one year exactly offsets your

short position (i.e., short $295/e0.06 = $277.82).

Cash flows:

Date

0

1

Gold Purchase + Storage

-$272

$0

Forward

$0

+$295

Short Risk-Free

+$277.82

-$295

Total

$5.82

$0

13) You own a house valued at $200,000, but still owe money on it. The loan is to be repaid in one lump

sum of $175,000 in one year. Prices of similar houses have a historical standard deviation of 35%. The

risk-free rate is 7%. The house is the only collateral on the loan, so you can simply turn it over to the

lender in one year rather than make the payment. What is the current value of the equity in the house?

Answer: Since you can simply turn in the house if its value is below $175,000, you actually own

a call option on the house. To see this, consider the payoff to you in one year. If the house is

worth less than $175,000, you get nothing (and you have no obligation). If the house is worth

$225,000, you could sell the house and net $50,000. If $275,000, you would net $100,000. The

payoffs are identical to a call option on the house. We can therefore use Black-Scholes to

estimate the value of equity in the house.

d1 =0.7565

d2 = 0.4605

= 0.35

S = $200,000

N(d1) = 0.7753 and N(d2) = 0.6578

C = $47,722

T=1

X = $175,000

Rf = 7%

14) A 4-year, $1,000 face value bond has a coupon rate of 12% (paid annually) and sells for

$1,097.19. What is the yield-to-maturity of the bond? Hint: The answer is an integer

percentage.

Answer: Since the price is above $1,000, we know that the interest rate must be below

12%. Trial and error, a financial calculator, or Excel will show that

PV = $120 PVIFA9%,4 + $1,000/1.094 = $1,097.19. So, the yield-to-maturity is 9%.

15) A bond with an 8.6% coupon rate sells at par. What is the yield-to-maturity of the bond?

Suppose that the yield-to-maturity is still the same after one year. What would the capital gains

yield be over that year? What would the coupon yield be over that year?

Answer: Since the bond sells at par, the yield-to-maturity must be equal to the coupon

rate. So, the yield-to-maturity is 8.6%. If the yield-to-maturity is still equal to the coupon

rate in a year, then the bond will still sell for $1,000. This implies that the capital gains

yield will be zero. The coupon yield will be $86/$1000 = 8.6%.

16) A bond has a face value of $1,000, a coupon rate of 10% with the coupons paid semiannually, and four years to maturity. If the yield-to-maturity is 9%, what is the value of the bond

today? Is the bond a discount bond, a par bond, or a premium bond?

Answer: PV = $50 PVIFA4.5%,8 + $1,000/1.0458 = $1,032.98. Notice that we use the semiannual interest rate (which is half the yield-to-maturity) because we have semi-annual cash

flows. The bond is a premium bonds because it sells for more than $1,000.

17) What is the duration of a 4-year 5% semi-annual coupon bond that has a yield-to-maturity of

6%? What is the significance of duration?

Answer:

Date

Cash Flow

PV(Cash Flow) tPV(Cash Flow)

0.5

$25

$24.27

$12.14

1

$25

$23.56

$23.56

1.5

$25

$22.88

$34.32

2

$25

$22.21

$44.42

2.5

$25

$21.57

$53.93

3

$25

$20.94

$62.82

3.5

$25

$20.33

$71.16

4

$1025

$809.14

$3,236.56

Total

$964.90

$3,538.90

D = $3538.90/$964.90 = 3.67 years. Duration measures the bond price’s sensitivity to

changes in interest rates.

18) One bond has a duration of 4 years and another has a duration of 7 years. Suppose that you

want to invest for 6 years and that you want an immunized portfolio. If you have $50,000 to

invest, how much should you invest in each bond?

Answer: w4 + (1-w)7 = 6 w=0.3333. So, you would invest $16,667 in the shortduration bond and $33,333 in the long-duration bond.

19) Explain the relationship between bond prices, duration, and convexity.

Answer: Bond prices are convex in interest rates. Duration essentially measures the slope

of the price-rate curve. When estimating the impact of interest rate changes, the linear

duration model gives small errors because of the convexity (non-linear relationship).

20) You are considering an investment in one of three stocks in a given industry. Information on

those stocks is shown below. In addition, the risk-free rate is 4.4% and the expected return on

the market portfolio is 8.4%. Finally, you have noted that the historical average price-to-sales

ratio for the industry is 5. Based on this information, which of the three stocks is most likely

to be the best buy? Justify your answer.

Company

Current sales per share

Last Dividend (just paid)

Expected annual sales growth, next five years

Current share price

A

$2

$0

10%

1

$12

B

$3

$0

8%

0.8

$12

C

$4

$1

12%

1.2

$25

Answer: Using the Growth-Adjusted Comps technique, we have the following.

Company

A

B

C

Appropriate Discount Rate

8.40%

7.60%

9.20%

Dividend in 1 Year

Dividend in 2 Years

Dividend in 3 Years

Dividend in 4 Years

Dividend in 5 Years

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$1.12

$1.25

$1.40

$1.57

$1.76

Sales per Share in 5 Years

Expected Price in 5 Years

$3.22

$16.11

$4.41

$22.04

$7.05

$35.25

Estimated Stock Value Today

$10.76

$15.28

$28.10

% misvaluation

11.52% -21.47% -11.02%

From the table, we see that Stock B appears to be the most undervalued relative to its

peers. It is therefore most likely to be the best buy.

21) BRIEFLY discuss how each of the following affects the duration of a bond.

a) longer maturity, all else equal

Answer: Longer maturities are associated with higher durations because the cash

flows will tend to be paid farther into the future.

b) higher coupon rate, all else equal

Answer: Higher coupon rates are associated with lower durations because a greater

portion of the bond's value comes from cash flows early in the bond's life.

c) higher yield-to-maturity, all else equal

Answer: Higher yields are associated with lower durations because those high yields

have a bigger impact on later cash flows in terms of reducing their values.

Therefore, higher yields effectively give more weight to earlier cash flows in the

duration calculation.

22) A company borrows money using long-term bonds and invests that money in the short-term

bonds of selected companies.

a) Which poses more risk to the company, an unexpected increase in interest rates or an

unexpected decrease in interest rates? BRIEFLY explain your answer using the concept

of duration.

Answer: If interest rates decrease, the value of the company's debt will increase

more than the value of its assets. We know this because the long-term bonds will

have a higher duration than the short-term assets. It follows that the equity of the

company will tend to decrease when interest rates drop.

b) How might you hedge the risk you face using options on Treasury securities? BRIEFLY

explain your logic.

Answer: We want something that will pay us more money when interest rates drop.

Since bond prices increase when interest rates drop, we could hedge the risk by

buying call options on Treasury securities.

23) Two call options are identical except that one has a longer maturity. BRIEFLY explain your

answers. (Note: Feel free to condition your response on other variable(s))

a) If the options are European ones, which one will be worth more?

Answer: If the underlying asset does not pay dividends, the longer maturity call will

be worth more. This is true because the longer maturity gives the underlying asset a

greater chance to increase significantly. At the same time, the longer maturity gives

the underlying asset a greater chance to drop significantly, but remember that we

aren't penalized by such a drop because the call option payoff is bounded below at

zero.

b) If the options are American ones, which one will be worth more?

Answer: Since we can exercise at any point in time, there is no way that a longer

maturity can hurt the value of the call. Therefore, the longer maturity bond will

have a value at least as great as the shorter maturity call.

24) A company's stock is currently trading at $20 per share. An American call option on the

company's stock has a strike price of $15 and matures in two months. The company is about

to pay a dividend of $3 per share and no further dividends are expected prior to the expiration

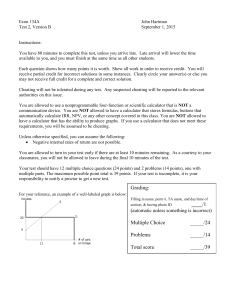

of the call option. Consider the following value chart, which depicts the Black-Scholes

valuation of the option along with the exercise value.

Call Option Value

Black-Scholes Valuation

$10.00

$9.00

$8.00

$7.00

$6.00

$5.00

$4.00

$3.00

$2.00

$1.00

$0.00

$0.00

$5.00

$10.00 $15.00 $20.00 $25.00

Stock Price

a) What is your best estimate of what the option will be worth immediately following the

dividend payment?

Answer: After the dividend payment, the stock price should be approximately $17 per

share. From the chart, we see that the option would be worth about $4.50

b) Should you exercise the option early? BRIEFLY justify your answer.

Answer: We can exercise now and receive $5 or hold on to the option (which will be worth

$4.50). So, we prefer to exercise the option early.