Inventory Errors

advertisement

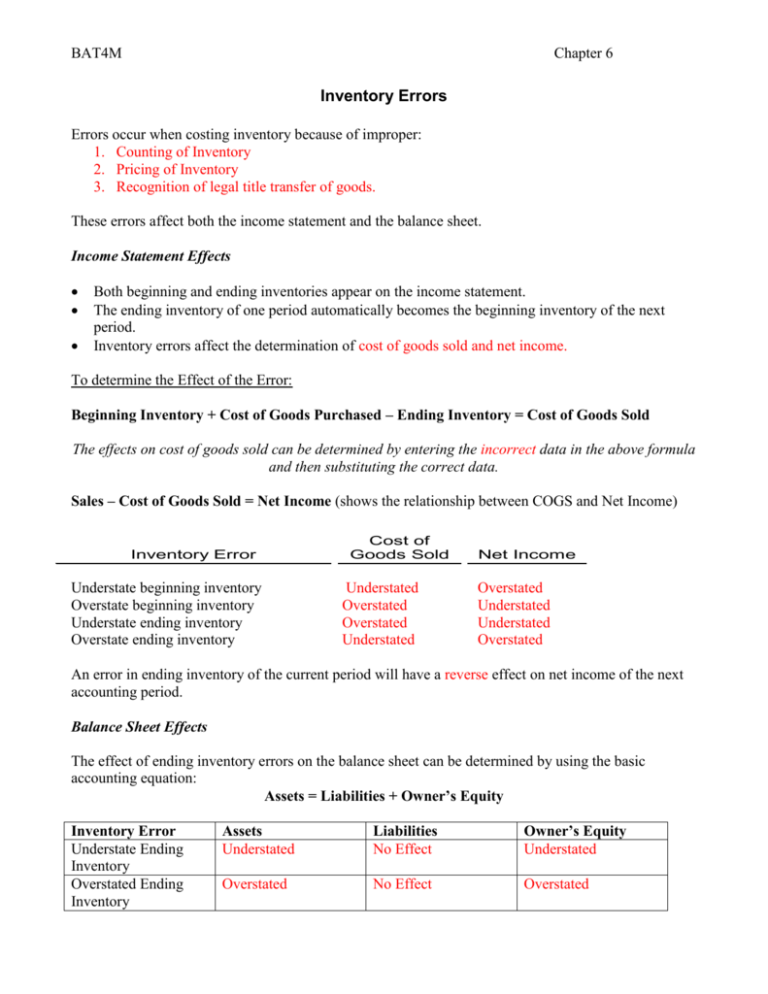

BAT4M Chapter 6 Inventory Errors Errors occur when costing inventory because of improper: 1. Counting of Inventory 2. Pricing of Inventory 3. Recognition of legal title transfer of goods. These errors affect both the income statement and the balance sheet. Income Statement Effects Both beginning and ending inventories appear on the income statement. The ending inventory of one period automatically becomes the beginning inventory of the next period. Inventory errors affect the determination of cost of goods sold and net income. To determine the Effect of the Error: Beginning Inventory + Cost of Goods Purchased – Ending Inventory = Cost of Goods Sold The effects on cost of goods sold can be determined by entering the incorrect data in the above formula and then substituting the correct data. Sales – Cost of Goods Sold = Net Income (shows the relationship between COGS and Net Income) Inventory Error Understate beginning inventory Overstate beginning inventory Understate ending inventory Overstate ending inventory Cost of Goods Sold Understated Overstated Overstated Understated Net Income Overstated Understated Understated Overstated An error in ending inventory of the current period will have a reverse effect on net income of the next accounting period. Balance Sheet Effects The effect of ending inventory errors on the balance sheet can be determined by using the basic accounting equation: Assets = Liabilities + Owner’s Equity Inventory Error Understate Ending Inventory Overstated Ending Inventory Assets Understated Liabilities No Effect Owner’s Equity Understated Overstated No Effect Overstated BAT4M Chapter 6