Budgets and Taxes

advertisement

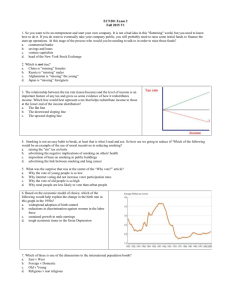

Budgets and Taxes Note: the less important slides are hidden Go to View | Slide Sorter to see them all Chapter 4 additional terms • Inflation\unemployment relationship • Monetary and fiscal policy • How Federal Reserve sets monetary policy • Demand side vs. Supply side (as in Lafer curve) • Line item veto\Balance Budget Amendment Revenues and Spending (Outlays) BUDGET CONTROL ACT OF 2011 • Raises the Debt Ceiling in exchange for long term budget cuts (900 Billion 1.2 Trillion) over ten years. • “Supercommittee must produce something better by November 23, 2011 (it didn’t) • Mandatory cuts now go into place, beginning January 2013-2021 • SEQUESTER: Cuts: across the board cuts, except Social Security, Medicare and Medicaid beneficiaries Total Government Surplus\ Deficit, % of GDP OECD Economic Outlook, Statistical Appendix, 2012 Total Government Debt, % of GDP OECD Economic Outlook, Statistical Appendix, 2012 Ten Largest Deficits and Debts, % of GDP, 2012 Deficits Japan United States Ireland Spain Greece United Kingdom Portugal Israel..... Slovak Republic France Debt -9.9% -8.5 -8.1 -8.1 -6.9 -6.6 -5.2 -4.7 -4.6 -4.5 Greece Japan Italy United States Portugal Belgium Ireland United Kingdom France Spain 146% 134 98 86 83 83 80 73 66 58 OECD Economic Outlook, Statistical Appendix, 2012 Health Care | Education | Higher Education | Poverty | Crime and Fiscal 2013 Budget Debt triples Interest Payments go down Taxation Fairness? • absolute equity – all benefit from government – all should pay equally (head tax) • Ability to pay -- justification for progressive taxation (graduated income tax) • Benefit principle -- tax in proportion to the benefit (gas tax, social security payroll tax) Economic Neutrality -Tax systems should exert minimal impact on the spending and business decisions of individuals and businesses. Violations of neutrality: (create positive and negative externalities) • tax subsidies for oil drilling, homeownership, health care • Tax incentives for positive social behavior • Sin taxes • Brick and Mortar Sales tax vs Internet sales Top 20 Biggest Tax Expenditure of US Govt. Efficiency and Simplicity • Cost of collecting taxes (toll roads vs. IPass) • Cost of compliance (tax lawyers and accoutnants) Visibility • Taxes should not be hidden – those who bear the burden should be aware (Hidden taxes: Gross Receipts Tax, Lottery?) Other principles • • • • Broad base (to allow lower rates) Predictable and stable supply of revenue Diverse sources (for stability and lower rates) Addresses geographic competition Tax Federal Income Tax Ill State Income Tax Social Security Medicare Collection User Sin Progressive? Costs Tax? Tax? Economic Effects Penalizes Rewards progressive medium Work tax exempted income flat medium Work tax exempted income very regressive very low Corporation tax flat low Sales Tax regressive low Gas tax even low Toll roads even high Property tax flat cigarette\ alcohol regressive business investment medium low work -- brick & mortar stores driving, large vehicles savings, Internet sales public transportation property improvmnt homeownership (exemption) drinking smoking healthy people Revenues The Laffer Curve O TAX RATE 100 FIGURE 3.1b Income Tax Revenues after Tax Changes, Cumulative % Change (constant$) 90% +82% --70% 50% +16% | +27% | -2% | 30% 10% 0 -10% '81 82 83 84 85 86 87 88 89 Reagan 1982 tax cut 92 93 94 95 96 97 98 99 00 Clinton 1993 tax increase