MBA 613 Financial Accounting

advertisement

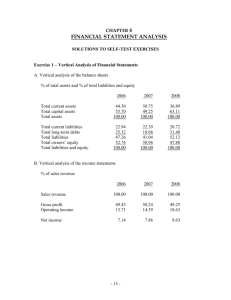

MBA 6101 Financial Accounting Prof. Larry Louie Key Concepts and Techniques These are the key concepts and techniques for this course. Chapter 1: Introduction Key Concepts Three primary business activities Operating – revenues, expenses and operating assets/liabilities Investing – long term operating assets vs. nonoperating assets Financing – creditor vs. equity Communications from management to shareholders Letters to shareholders Management Discussion and Analysis Auditor report – covers financial statements and notes only Regulatory filings and proxy statements (e.g. SEC 10-K, 8-Q) Accounting Equation Assets = Liabilities + Shareholders’ Equity 4 Basic Financial Statements and their relationships (see Exh 1.7) Balance Sheet (as of a specific date, permanent) Income Statement (for a period, temporary/gets reset) Statement of Equity (for a period, temporary/gets reset) Statement of Cash Flows (for a period, temporary/gets reset) Be familiar with accounts that are commonly found in those statements (e.g. cash, accounts receivable, accounts payable, common stock, dividends, revenues, cost of good sold, rent expense, etc.) Market Efficiency - Weak, Semi-strong, Strong form Competitive Analysis – Porter’s Five Forces Oversight of Financial Accounting SEC GAAP (FASB) Board of Directors (and its Audit Committee) Sarbanes – Oxley Act Accounting and Analytical Techniques ROA = Return on Assets = Net Income/Average Assets ROA = Net Income/Sales x Sales/Average Assets (or Profit Margin x Asset turnover) Chapter 2: Introducting Financial Statements and Transactional Analysis Key Concepts: Components of balance sheet – current and noncurrent assets, current and noncurrent liabilities, and shareholders equity (and typical accounts) Working capital Operating cycle Components of the Income Statement – sales, cost of goods sold, etc. Components of the Stateement of Stockholders’ Equity – common stock, retained earnings, etc. Components of the Statement of Cash flows – cash flow from operating, investing and financing activities Articulation of financial statements – linkage beween the 4 statements. Recording transactions (using the template approach, we will not use the T account approach in this course), adjustitng entries and generating financial reports SEC filings – 10K, 8K Other information sources – analyst reports, credit services (e.g. Standard and Poor’s, Moody’s and Fitch’s), data services (e.g. Thompson) Accounting and Analytical Techniques Steps to record transactions (e.g. ACME accounting exercise) 1. Journal Entry (debits and credits to accounts) Post to ledge Chapter 3: Accounting Adjustments and Constructing Financial Statements Key Concepts: Financial Statemetn Effects Template Typical transactions and how to record them using the template Capital investment Asset acquisition Revenue and expens recognition Capital distributions Typical Accounting Adjustments Prepaid expenses Unearned revenues Accrued expenses Accrued revenues Trial balance Financial statement preparation Income statement Balance sheet Statement of Stockhlolders; Equity Statement of Cash Flow (only use indirect method) Closing process Accounting and Analytical Techniques Steps to record transactions 1. Templatel Entries 2. Post to ledger (or to a T Account) 3. Create a Trial Balance 4. Generate Financial Statements Chapter 4: Financial Statement Analysis Key Concepts Use perspectives – manager, investors, and creditor Distinguishing between operating and non-operating assets and liabilities Profitability analysis Disaggregation Core versus Transitory; Operating versus Nonoperating Financial Leverage – pros and cons of using leverage Rating Agencies – Standard and Poors, Moody’s Liquidity Analysis Solvency Analysis Limitations of accounting information Horizontal Analysis (common sizing) Accounting and Analytical Techniques ROE Disaggregation – know how to find data, generate the ratio, and interpret the results (you will not need to know Nonoperating return components o ROE o RNOA o FLEV o Spread o NOPAT o NOA o NFO o NFR o NFE Gross Profit Margin Turnover- Accounts Receivable Turnover Average Collection Period Inventory Turnover Average Inventory Days Outstanding Long Term Operating Asset Turnover Accounts Payable Turnover Average Payable Days Outstanding Net Operating Working Capital Turnover Average Cash Cycle Liquidity Ratios Current and Quick Ratio Solvency Ratios Debt to Equity Ratio Long Term Debt to Equity Flow Ratios Times Interest Earned Operating Cash Flow to Liabilities Chapter 5: Operating Income Key Concepts Operating Components Revenue Recognition GAAP and SEC guidelines Know “challenges” Percentage of Completion Employee Stock Options – accounting treatment Foreign Currency Translation – in other comprehensive income Research and Development Income Taxes Deferred income taxes Transitory Income Components Discontinued Operations – definition, operating losses and gain/loss on disposition Extraordinary Items – unusual and infrequent Change in Accounting Principle – show cumulative effect, disclose, and prepare proforma statements showing effect of change if applied to all reported periods Change in Accounting Estimate (e.g. life on depreciation) – apply prospectively only, no cumulative effect Unusual Items Gains and Losses on Asset Sales = proceeds – net book value Restructuring Costs – creation of reserves CISCO example Workforce reduction Consolidation of facilities Impairment of goodwill Write down of inventory Goodwill Write-down Earnings Per Share (basic and diluted) Accounting and Analytical Techniques Percentage of Completion Gain or Loss on Sale Basic EPS Diluted EPS Chapter 6: Operating Assets Key Concepts Accounts Receivable How it is created and issues from a financial analysis standpoint (collectibility, speed of collection) Typical terms – 2/10 n/30 Allowance for uncollectible accounts Analysis of receivables Risk of income shifting Analyze A/R collection period and turnover Inventory Inventory for Merchandising vs. Manufacturing company Inventory Cost Flows Costing methods (FIFO, LIFO, Average Cost) Impact of FIFO/LIFO/Av Cost on financial statements and taxes Lower of cost or market Note disclosure (including LIFO liquidations) Analysis of inventories Property Plant and Equipment Capitalized costs Depreciation (straight line, declining balance) Asset sales, estimates, impairment Analysis of PP&E Accounting and Analytical Techniques Accounting Process for receivables Sales are made on credit Create an allowance for bad debt Cash is received from a customer Write-off a bad debt from a customer Aging of Accounts receivable and adjustment of allowance account Analysis of receivables Accounts receivable turnover Average Collection Period (or Days Sales Outstanding) Accounting Process for inventory Purchase inventory on credit Pay vendor for inventory Sell products Analysis of Inventories and Cost of Good Sold Gross Profit Margin Inventory Turnover Average Inventory Days Outstanding Accounting Process for PP&E Purchase fixed asset Depreciate using SL or DB basis Sell asset = proceeds – net book value Impairments Analysis of PP&E PPE turnover Percent used up Chapter 7: Intercorporate Invdstments Key Concepts Passive investments (market method) o Within passive equities– available for sale (B/S at market, hit OCI with market value changes) versus trading securities (B/S at market, hit I/S with market value changes, shown as gains and losses). o Within passive debt – additional classification as held to maturity (do not record market value changes in B/S or I/S) Significant influence (equity method) o Investment at cost o Prorata share of income of investment o Dividends shown as reduction in investment accounts Control (consolidation and purchase method) o Include 100% on line items of bal sheet and income statement, reflect minority interest as one line item o Eliminate intercompany transactions and receivables/payables o Goodwill accounting Purchase method only Goodwill subject to annual impairment tests Disclosure requirements (balance sheet and notes) Derivatives – investments which derive value from other securities, investments or indices o Speculative versus hedging Accounting and Analytical Techniques Accounting for o Passive o Equity o Consolidation Impact of Goodwill impairment on balance sheet and income statement Chapter 8: Nonowner Financing Key Concepts Current Liabilities o Accounts Payable o Accrued Liabilities o Product warranty o Short Term Debt Long Term Liabilities o Bond Coupon or stated rate Market rate (yield) Face amount Term Issued at discount versus premium Amortization of premium or discount o Bond Repurchases o Debt Ratings and agencies Accounting and Analytical Techniques Accounting for bonds o Issuance o Amortization o Retirement Effect of reserves and estimated liabilities on balance sheet and income statements (e.g. warranties) Chapter 9: Owner Financing Key Concepts Contributed Capital o Preferred Stock Cumulative, convertible, liquidation preference, participating, par and $ or % dividends o Common Stock Par value or stated value o Paid in Capital in Excess of Par o Convertible securities – debt or equity Earned Capital o Net Income o Dividends (cash and stock) o Other Comprehensive Income Foreign currency translation Derivatives Securities Pension Plans Major corporate restructurings o Sell Offs – sell part of co to outside entity o Spin Offs – separate legal entities (e.g. Limited Too) o Split Offs - parent exchanges its shares of the subsidiary for shares to itself, end result is two separate publicly traded entities (A&F) Accounting and Analytical Techniques Accounting for stock transactions (preferred or common) o Issuance o Dividends o Repurchase (treasury) o Splits Chapter 10: Off Balance Sheet Financing Key Concepts Leases – operating leases vs. capital leases Pension plans – watch for unfunded liabilities o Defined contribution vs. defined benefit Variable Interest Entities (formerly Special Purpose Entities) – watch for consolidation or non-consolidation Accounting and Analytical Techniques Convert operating leases to capital leases Compute funded vs. unfunded liability for pension Chapter 11: Adjusting and Forecasting Financial Statements Key Concepts: Core vs. transitory items Operating vs. nonoperating items Watch for underreported expenses (e.g. reserves) Common adjustments Accounting and Analytical Techniques Simple forecasting methods based on historical analysis, judgments regarding the future, and key financial relationships and trends. (P&G example) Chapter 12: Valuation of Equity Securities Key Concepts: Discounted cash flow model o FCCF = NOPAT – increase in NOA o Forecast for horizon period o Estimate terminal value based on growth formula o Subtract net financial obligations to get equity value o Determine NPV and stock value per share Residual Operating Income (ROPI) Model – you do not need to know this: o Value = NOA + PV of Expected ROPI o Less commonly used Comparables – as an initial or reasonableness check o Price Earnings o Market to Book Value o Sales multiple Accounting and Analytical Techniques DCF method – know how to estimate value Comparables calculations Key Concepts Bridge between balance sheets, income statements and retained earnings Information from a cash perspective (vs. accrual perspective) Separates activities in Operating, Investing, and Financing activities Accounting and Analytical Techniques o You will not be responsible for the construction of a SCF, since we did not go over this chapter in class.