Evaluation - Morgan Park High School

advertisement

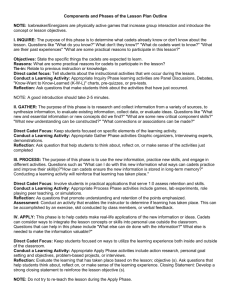

CORE LET 3 Unit 3: Foundations for Success Chapter 11: NEFE High School Financial Planning Program Lesson 4: NEFE Unit 3 - Investing: Making Your Money Work for You Time: (a) 90-minute block with Part 1 and 2 or (b) 45-minute periods with activities for Days 1 and 2 Competency: Forecast personal savings and investments McRel Standards: LW3 - Manages money effectively, SR1 - Sets and manages goals Linked Program Outcomes: Maximize potential for success through learning and self-management [self management, study skills, personal success, life skills] Lesson Question: How can I plan to meet future financial goals? Thinking Processes* Core Abilities Defining in Context – Circle Map* (Alt. = Mind or Concept Map, Sunshine Wheel) Describing Qualities - Bubble Map* (Alt. = Star Diagram, Brainstorming Web) Comparing/Contrasting - Double Bubble Map* (Alt. = Venn Diagram) Classifying -Tree Map* (Alt. = Matrix, KWL, T-Chart, Double T, P-M-I) Part-Whole - Brace Map* (Alt. = Pie Chart) Sequencing -Flow Map* (Alt. = Flow Chart, Linear String) Cause and Effect - Multi-Flow Map* (Alt. = Fishbone) Seeing Analogies - Bridge Map* (Alt. = Analogy/Simile Chart) Build your capacity for life-long learning Communicate using verbal, non-verbal, visual, and written techniques Take responsibility for your actions and choices Do your share as a good citizen in your school, community, country, and the world Treat self and others with respect Apply critical thinking techniques * Thinking Map Multiple Intelligences Bloom’s Taxonomy Authentic Assessment Lesson Objectives Observation Checklist Describe reasons for saving and investing Visual/Spatial Knowledge Portfolio Logical/Mathematical Comprehension Rubric Verbal/Linguistic Application Test and Quizzes Describe how time, money, and rate of interest relate to meeting specific financial goals Musical/Rhythmical Analysis Thinking Map Describe basic investment principles Naturalist Synthesis Graphic Organizer Interpersonal Evaluation Notebook Entries Describe various savings and investment alternatives Bodily/Kinesthetic Intrapersonal Structured Reflection Logs Metacognition Performance What? So What? Now What? Project Define key words: bond, capital gain, compounding, diversification, earned interest, inflation, interest, invest, mutual fund, rate of return, Rule of 72, savings, stocks, time value of money Socratic Dialog E-I-A-G Legend: Indicates item is not used in lesson Indicates item is used in lesson Learning Materials: Student Learning Plan, Student Guide, Exercise 3-1, Visuals 3A-3H, and 3I, Saving and Investing Plan Assessment Task, Thinking Map® samples, Graphic Organizer samples, Useful Websites Supplies: Chart Paper, Markers, Financial Literature, Media Resources, or Web Searches. Resources: NEFE Financial Planning Program Instructor Manual, Cadet Notebooks, Financial Function Calculators, LET CM, Computer with Internet Access, Computer, Monitor, MS Excel Software, Overhead Projector, Classroom Performance System (CPS) McRel Standards: Grade-level benchmarks for the McRel Standards can be found in your JROTC Instructor’s Desk Reference. Lesson Preview/Setup: Energizer – Display “$1,000,000” to focus discussion on what cadets would do with that amount of money. Inquire – Guide cadets to the learning objectives and key words in their Student Learning Plan to preview the lesson activities. Guide cadets to complete the “What Do You Think?” activity. Gather –Prepare a briefing or guide cadets to read Unit 3 in the student guide so cadets examine principles of savings and investing. Display Thinking Map® samples, collect financial resources, and distribute chart paper and markers so cadet teams can design maps to explain savings and investing products. Process – Have access to a time value of money calculator and prepare to demonstrate how to calculate the time value of money (TVM). Copy and distribute Exercise 3-1 so cadets can calculate the time value of money. Apply –Copy and distribute Saving and Investing Plan Assessment Task so cadets can prepare a personal Saving and Investing Plan. Option: Provide access to Excel software to chart Saving and Investment Plans. 1 Chapter 11: NEFE High School Financial Planning Program Lesson 4: NEFE Unit 3 - Investing: Making Your Money Work for You Lesson Plan Instructor Materials: Instructor reference materials, notes, and visual masters can be found on pages 58-84 in the NEFE HSFPP Financial Planning Instructor’s Manual which is located on the LET CM in the NEFE HSFPP Resource folder. Additional resources, including the Student Manual can also be found in this folder. In addition, there are online games and activities on the NEFE web site for students: http://hsfpp.nefe.org/home/ Learning Activities: Specific activity instructions can be found on the Instructor’s Manual pages noted below. Cadet Notebook: Direct cadets to record responses to reflection questions in Cadet Notebooks. Self-paced Option: Cadets independently complete activities listed on Student Learning Plan. Instructor Manual Pages Learning Activities Student Guide Pages Icebreaker/Energizer: Ask cadets what they would do if they won or inherited $1 million. For example, would they spend it all, save any, invest some, or give away money? 1. Lead a discussion about the reality of actually receiving this amount of money. Total time: 10 minutes Phase 1--Inquire: (Addresses Student Learning Activities 1 and 2) Multiple Intelligences: Intrapersonal/Introspective 1. Distribute or reference Lesson 4 Student Learning Plans. 2. Guide cadets to preview the information in the Student Learning Plan including the competency, core abilities, performance standards, learning objectives, key words, learning activities, and assessment activities. 3. Distribute NEFE Financial Planning Program student guides. 66 4. Guide cadets to complete the “What Do You Think?” activity. 28 Total time: 10 minutes Phase 2--Gather: (Addresses Student Learning Activities 3, 4, and 5) Multiple Intelligences: Verbal/Linguistic; Visual/Spatial 73-75 1. Brief cadets on savings and investment principles using selected notes and Visuals 3B-F found in the instructor manual. Reference Unit 3: Investing: Making Your Money Work for You in the NEFE student text during the briefing. 2. Form 4-8 cadet teams. Assign each team 1-2 investment products (savings, bonds, certificates of deposit, money market accounts, stocks, real estate, collectibles, and mutual funds). 3. Direct teams to examine information about their assigned products using information from the NEFE student guide, pp. 33-37. If time allows, guide cadets to gather additional information about their selected topics using Unit 3: Foundations for Success 33-37 2 Chapter 11: NEFE High School Financial Planning Program Lesson 4: NEFE Unit 3 - Investing: Making Your Money Work for You financial literature, media resources, or web searches. 4. Guide each cadet team to create a Thinking Map® of choice to present the investment product to the class. Direct cadets to place copies of the team maps in their Cadet Notebooks. Option: 1. Invite a local financial representative to share information about the various ways to save and invest. 2. Direct cadets to summarize what was learned during the presentation and to place their summaries in their Cadet Notebooks. Reading and assignments can be assigned for homework Total time: 30 minutes Phase 3--Process: (Addresses Student Learning Activities 6 and 7) Multiple Intelligences: Logical/Mathematical 68-69 1. Demonstrate how to use a financial function calculator and TVM function in Excel. [Outlined in Instructor Manual] 41 2. Guide cadets to complete Assignment 3-1: Time Value of Money using a financial function calculator tool that is available (financial function calculators, TVM function in Excel or a TVM calculator from the web) with a partner. 3. Guide students to use an online tool to estimate the cost of having a child. If the classroom has internet available to each student, visit the website given below and compare the total cost of a child for a dual parent household and a single parent household. http://www.babycenter.com/cost-of-raising-child-calculator If the internet is not available, distribute Exercise 1: The Cost of Raising a Child to the students. Ask them to compare the total cost of a child for a dual parent household and a single parent household. Option: 1. Schedule a financial planner or investment advisor to give a brief presentation about the time value or money. 2. Direct cadets to summarize what was learned during the presentation and to place their summaries in their Cadet Notebooks. Total time: 20 minutes Phase 4--Apply: (Addresses Student Learning Activities 8-9 and Assessment Task) Multiple Intelligences: Logical/Mathematical 1. Distribute the Saving and Investing Plan Assessment Task and scoring guide. 2. Guide cadets to consider their financial goals to complete the assessment task. Option: Direct cadets to use spreadsheet software to chart their savings and investing plan. Total time: 20 minutes Unit 3: Foundations for Success 3 Chapter 11: NEFE High School Financial Planning Program Lesson 4: NEFE Unit 3 - Investing: Making Your Money Work for You Homework: Students will need time to finish and revise their Saving and Investing Plans in preparation for assessment. Assessment: (Addresses Student Assessment Activities 1 and 2) Guide cadets to complete the Saving and Investing Plan Assessment Task. Direct cadets to selfassess and peer edit work using the scoring guide. Direct cadets to submit their plans for instructor feedback and a grade. Direct cadets to place their plans in Cadet Portfolios. Note on Cadet Portfolios: As cadets work through the lessons in this chapter, you may want them to compile their documents in a Cadet Portfolio. Portfolios can be arranged by topic, chapter, or LET depending on your needs. Refer to the Cadet Portfolio Assessment Task in your JROTC Instructor’s Desk Reference for ideas on setting up and evaluating Cadet Portfolios. Note on using the Classroom Performance System: Use the Classroom Performance System with cadets to ask questions during lecture, administer tests, quizzes and other class work, grade homework, and/or engage in team activities. Unit 3: Foundations for Success 4