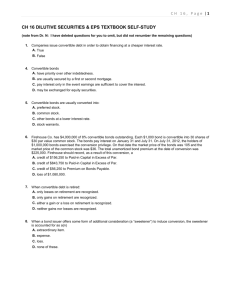

ch16-dilutive-securities-and-earnings-per-share

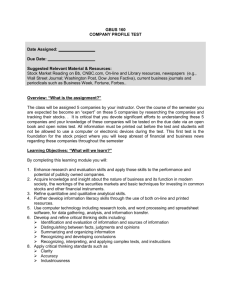

advertisement