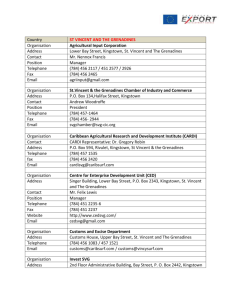

St. Vincent and the Grenadines

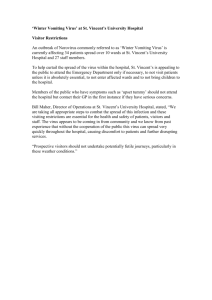

advertisement