Study Guide for APC and MPC

advertisement

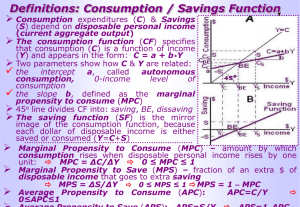

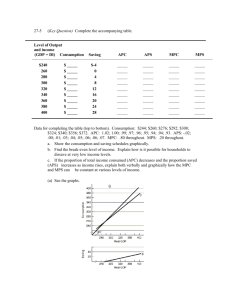

Study Guide for APC and MPC Practice Problems for test on Average and Marginal Propensities to Consume and Save Test: Monday Read: Pages 177-179, Section 9.3 in your ORANGE REVIEW (5 Steps to a 5) book. The explanation on the multiplier is easier in this book than in your textbook. 1. What is the formula for MPC? 2. What is the formula for MPS? 3. What is the formula for APC? 4. What is the formula for APS? 5. What is the difference between the APC and the MPC? * Make sure to memorize all of the above formulas for the test. 6. If the MPC is .8, what is MPS? 7. If MPC is .9, what is MPS? 8. If MPC is .75, what is MPS? 9. If MPC is .55, what is MPS? 10. If MPC is .62, what is MPS? 11. If MPC is .88, what is MPS? 12. If MPC is .6, what is MPS? * In questions 6-12, note that the two numbers added always equal 1 13. If the MPC is .8, what is the government or investment multiplier? 14. If the MPC is .9, what is the government or investment multiplier? 15. If the MPC is .75, what is the government or investment multiplier? 16. If the MPC is .6, what is the government or investment multiplier? 17. If the MPC is .8, what is the tax multiplier? 18. If the MPC is .9, what is tax multiplier? 19. If the MPC is .75, what is tax multiplier? 20. If the MPC is .6, what is tax multiplier? 21. If the government raises taxes by $200, and the MPC is .9, how much will the decrease in GDP be? 22. If the government increases spending by $500, and the MPC is .5, how much will the increase in GDP be? 23. If the APC is .75, and a persons income is 1,000, how much of this income (in dollar amount) will be consumed? 24. How much (in dollar amount) will be saved? Consumption Schedule (in billions) Disposable Income Consumption $200 $210 $250 $220 $300 $230 $350 $240 25. Using the information above, calculate the marginal propensity to consume. 26. At the disposable income level of 250 billion in the above chart, what is the amount of savings (in dollar amount)? What is the amount of consumption (in dollar amount) 27. Suppose that disposable income is $5,000, consumption is $4700, and the MPC is .6. If disposable income then increases by $100, what will consumption equal? What will savings equal? 28. When disposable income increases by $X a. Consumption increases by more than $X. b. Savings increases by less than $X. c. Savings increases by exactly $X d. Savings remains constant e. Savings decreases by more than $X. 29. Which of the following events most likely increases real GDP? a. Increase in interest rates b. Increase in taxes c. Decrease in net exports d. Increase in government spending e. A lower value of consumer wealth 30. The tax multiplier increases in magnitude when a. The MPS increases b. The spending multiplier falls c. The MPC increases d. Government spending increases e. Taxes increase Answers: 1. MPC= ΔC/ ΔDI 2. MPS= ΔS/ ΔDI 3. APC= C/DI 4. APS= S/DI 5. The difference between APC and MPC—APC is the amount a person is likely to consume (spend) of their total income. MPS is the amount the person is likely to spend of every additional dollar they receive. 6. 7. 8. 9. 10. 11. 12. .2 .1 .25 .45 .38 .22 .4 13. If MPC is .8, this means that the MPS is .2. The Government or Investment Multiplier (MG MI) is equal to 1/ MPS or 1/.2 =5. The MG or MI is 5. 14. If MPC is .9, this means that the MPS is .1. The Government or Investment Multiplier (MG MI) is equal to 1/ MPS or 1/.1 =10. The MG or MI is 10. 15. If MPC is .75, this means that the MPS is .25. The Government or Investment Multiplier (MG MI) is equal to 1/ MPS or 1/.25 =4. The MG or MI is 4 16. If MPC is .6, this means that the MPS is .4. The Government or Investment Multiplier (MG MI) is equal to 1/ MPS or 1/.4 =2.5. The MG or MI is 2.5. 17. If MPC is .8, this means that the MPS is .2. The Tax Multiplier (MT) is equal to –(MPC/ MPS) or . -8/.2 = -4. The MT is -4. 18. If MPC is .9, this means that the MPS is .1. The Tax Multiplier (MT) is equal to –(MPC/ MPS) or -.9/.1 = -9. The MT is -9. 19. If MPC is .75, this means that the MPS is .25. The Tax Multiplier (MT) is equal to –(MPC/ MPS) or -.75/.25 = -3. The MT is -3. 20. If MPC is .6, this means that the MPS is .4. The Tax Multiplier (MT) is equal to –(MPC/ MPS) or -.6/.4 = -9. The MT is -1.5 * Notice that when govt (G) or businesses (I) spend money, the impact on GDP is positive because money is being added to the economy (or in other words, GDP increases). When the govt increases taxes, it is taking money out of the economy, which is why the tax multiplier is always negative (or in other words, tax increases cause GDP to decrease). 21. If the government raises taxes by $200 and the MPC is .9, this means that the MT is -9 (MT= -MPC/MPS or -.9/.1= -9). GDP will change by -$1800 (tax increase x multiplier or 200 x -9), or in other words, GDP will decrease by $1800. 22. If the government increases spending by $500 and the MPC is .5, this means that the MG is 2 (MG- 1/MPS or 1/.5=2). GDP will change by $1000 (govt spending x multiplier or $500 x 2). 23. If the APC is .75, this means that a person will spend 75 percent of their income, or in this case, $750. 24. They will save $250 of that $1000 if the APC is .25. 25. The MPC ΔC/ ΔDI. The change in consumption, using the chart is $10, and the change in DI is $50. Therefore MPC= 10/50 or 1/5 or .2. 26. At the DI level on $250 on the chart, C is equal to $220 which means that S=30 * Remember that C+S= DI 27. If DI is $5000 and consumption is $4700, this means that savings is $300. A person’s income goes up by an additional $100 and the MPC is .6. This means that of that additional income, the person will spend 60 percent and save 40 percent. Thus, consumption will go up by $60 making consumption $4760, and savings will go up by $40, making savings $340. DI = C + 5000 = 4700 + 5100 = 4760 + S 300 340 additional income is $100, MPC is. .6, MPS is .4 Answers to 28-30 can be found in your ORANGE REVIEW book, Pages 177-179, Section 9.3