Fundamentals of International Finance

advertisement

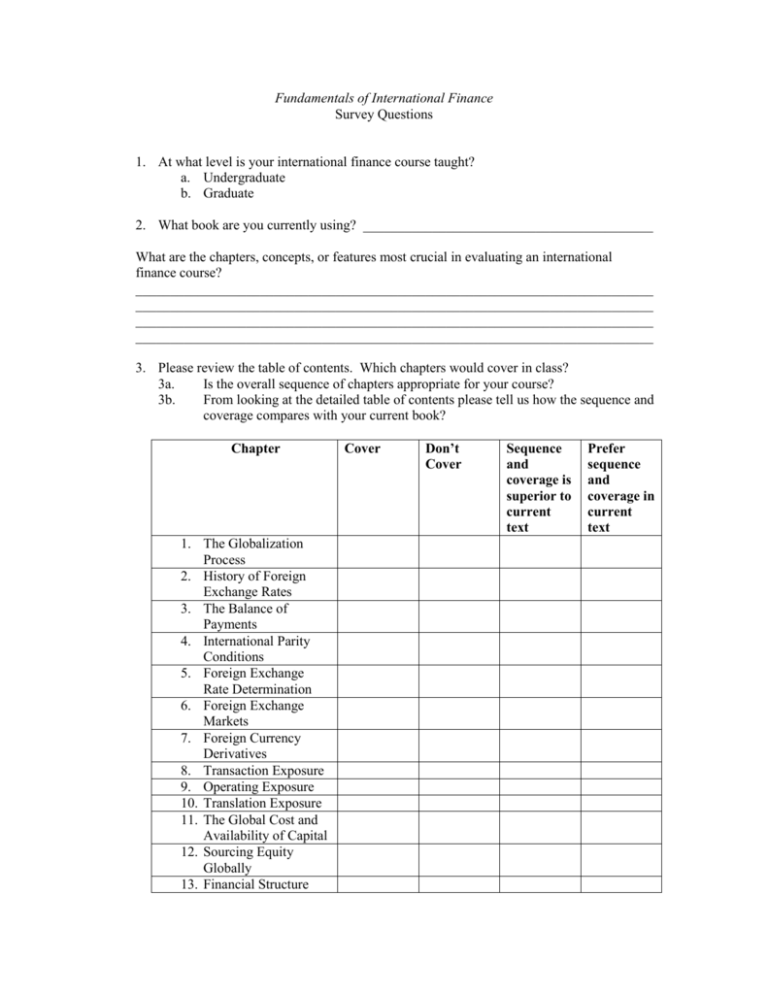

Fundamentals of International Finance Survey Questions 1. At what level is your international finance course taught? a. Undergraduate b. Graduate 2. What book are you currently using? __________________________________________ What are the chapters, concepts, or features most crucial in evaluating an international finance course? ___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________ ___________________________________________________________________________ 3. Please review the table of contents. Which chapters would cover in class? 3a. Is the overall sequence of chapters appropriate for your course? 3b. From looking at the detailed table of contents please tell us how the sequence and coverage compares with your current book? Chapter 1. The Globalization Process 2. History of Foreign Exchange Rates 3. The Balance of Payments 4. International Parity Conditions 5. Foreign Exchange Rate Determination 6. Foreign Exchange Markets 7. Foreign Currency Derivatives 8. Transaction Exposure 9. Operating Exposure 10. Translation Exposure 11. The Global Cost and Availability of Capital 12. Sourcing Equity Globally 13. Financial Structure Cover Don’t Cover Sequence and coverage is superior to current text Prefer sequence and coverage in current text and International Debt 14. Interest Rate and Currency Swaps 15. Foreign Direct Investment Theory and Strategy 16. Multinational Capital Budgeting 17. Adjusting for Risk in Foreign Investment 18. Cross-Border Mergers, Acquisitions and Valuation 19. International Portfolio Theory and Diversification 20. Multinational Tax Management 21. Repositioning Earnings 22. Working Capital Management 23. International Trade Finance 4. Do you or would you like to cover the topics listed below? For each of these topics does the coverage compare favorably or unfavorably with your current book? Coverage is better than current text History of Foreign Exchange Markets (Chapter 2) Corporate Governance (Ch. 1, pp 14-15, Ch 5., coverage of the Asian Crisis, and Chapter 18) Interest Rates and Currency Swaps (Chapter 14) Foreign Direct Investment Theory (Chapter 15) International Portfolio Theory (Chapter 19) International Taxation (Chapter 20) Repositioning of Funds (Chapter 21) Prefer coverage in current text 5. Please review the pedagogy listed below in Fundamentals of International Finance. Overall, does the pedagogy compare favorably or unfavorably with your current book? Pedagogy is superior to current text Prefer the pedagogy in current text Pedagogical Framework (each chapter begins with Learning Objectives and ends with a Chapter Summary) Extensive Use of Illustrations and exhibits in full color (examples: 124, 154, 255) Running Case using hypothetical firm, the Trident Corporation (example: see page 4 for an explanation of how Trident will be used. Then see p. 177 and internet exercise on 193) Spreadsheet Analysis (example: Chapter 7 p 148-154) Mini-case at the end of every chapter, using a real company case (examples, p. 20, 62, 136, 282) Global Finance Perspectives box (examples: 16, 17, 188, 120, 279) Internet Exercise at the end of every chapter 6. Based on your review of the content and pedagogy, how likely would you be to adopt this text for your international finance class. Please rate on a scale of 1 to 10, with 1 being least likely and 10 being most likely. 1 2 3 4 5 6 7 8 9 10 7. Name: __________________________________________________________________ Address: ________________________________________________________________ Social Security Number:____________________________________________________