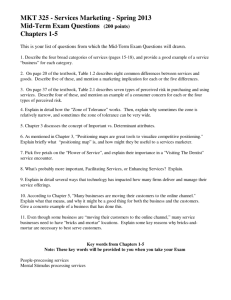

Product Positioning Using Perceptual Maps

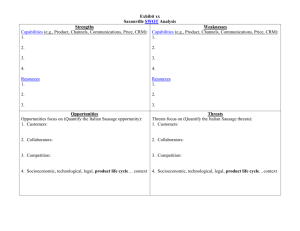

advertisement

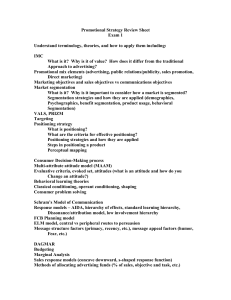

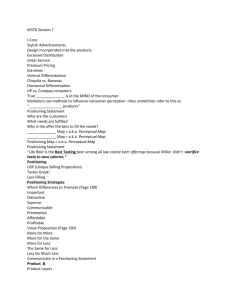

OBSERVATIONS Positioning is a good diagnostic procedure – a “snapshot.” Positioning strategy involves several snapshots (changes in taste, preferences, number of competitors). Product market boundaries are constantly changing The multi-product company must simultaneously develop several positioning strategies (or develop a corporate positioning). There exists a synergy between position and dropp/add decisions within a product line and between lines. In a situation of corporate mergers the end result might be too many items on one line and a gap in other lines. Essentially, consumer goods are commodities. Positioning can assist in changing a commodity into a brand. Note—A brand can lose its identity and become a commodity. All marketing mix variables should be incorporated into a positioning strategy. Product Positioning Using Perceptual Maps A key to positioning is the perceptions of consumers. Companies can obtain 3 types of data from consumers/target market(s): 1. 2. 3. Evaluations of the important attributes for a product class. Judgments of existing brands with the important attributes. Ratings of an “ideal” brand’s attributes. From these data, it is possible to develop a perceptual map, a means of displaying or graphing in two dimensions the location of brands in the minds of consumers. _________________ 1. MDS positioning based on similarity of brands e.g. rank/rate all brands according to their similarity to an anchor brand and rotate the brands until all brands have served as an anchor. 2. 3. MDS positioning based on the brand’s position on the relevant dimensions or various product attributes i.e. identify the position of each brand on the major dimensions (frame of reference along which brands are compared perceptually) MDS positioning based on both perceptions and preferences i.e. the ideal point approach to product positioning Approaches to Product Positioning I. General Approaches: 1. 2. II. head-to-head differentiation Ways to Position a Product: 1. 2. 3. 4. 5. 6. 7. Positioning by attribute/benefits e.g. Volvo – “durability” Positioning by price/quality e.g. Mobile vs. “no name” gas station Positioning by use/application Positioning by product user e.g. The Pepsi Generation Positioning by product class Parkay Margarine is advertised as tasting just like butter. Positioning by the competition 7-Up the Uncola Positioning by combination of ways (hybrid positioning) Product Optimization Using magnitude estimation consumer senory reactions and experimental/brand product liking are estimated and evaluated. Sensory reaction (perception = Level of input Or incredient F F e.g. dark coffee or yellow lemon-lime soft drink The model is linear. Sensory reaction (preference) = f(level of input) The function is curvilinear liking sugar coffee + sugar liking sugar milk coffee + sugar + milk Children Adult liking liking input input Adult liking Children Compromise Solution liking input Cost constraints (or an ingredient substitute) liking sugar coffee + sugar liking sugar milk coffee + sugar + milk