CREDIT REPORT

COMPANY REPORTED

EXAMPLE , A.S.

Principal Address:

Example Street 1

000 00 Blansko

Czech Republic

Telephone: +000-000000000, +000-000000000

Fax: +000-000000000

Email: example@ example.cz

Web: www. example.cz

Registered office:

Gellhornova 0000/0

000 00 Blansko

Czech Republic

Former company addresses

Former Registered office:

Example Street 1

000 00 Blansko

Czech Republic

ICON number: 00000000

National ID: 00000000

VAT number: CZ00000000

Registration status: 11.10.2006 - registered company

Activity status: 11.10.2006 - active company

Date of Last

Research:

15.06.2011

CREDIT INFORMATION

SUMMARY

Insolvency

Information:

According to available information sources the company is not in a

insolvency/preliminary/debt regulation proceeding.

Maximum

Credit:

EUR 0,00

Due to negative impact of debt collection cases we refrain from a credit

advice.

Maximum Credit is to be understood as the highest possible engagement for a supplier

delivering goods or rendering services on open terms with an average respite of 60 days. (It is

assumed that, on the average, the company in question has 5 suppliers, who deliver goods or

render services at the same time.)

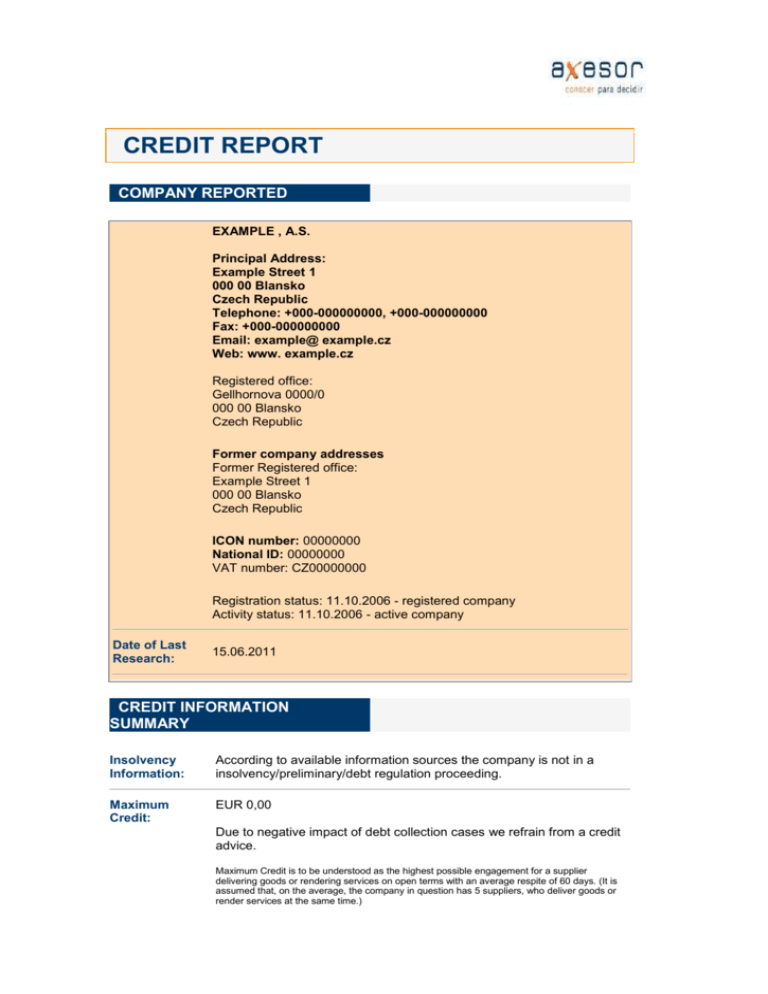

Credit Scoring:

score: 2 - Very high risk of insolvency

Insolvency / preliminary / debt

regulation proceedings

0

Very High

Risk

1

2

Medium High

Risk

3

4

5

Low Risk

6 7 8 9 10

▲

The Credit Scoring is expressed as an scoring with values from 0 (Insolvency/preliminary/debt

regulation proceedings) to 10 (excellent risk). The scoring denominates the probability of default

for the company within 12 months from the date the scoring score was set.

Payment

Practices:

Payments are made irregularly.

Further Scoring Researched company is categorized as a big company.

Information:

Turnover volume of CZK 555.533.000 in the year 2009 increased by

19,89% compared with 2008. In the previous period this change was

422,70%.

Fixed assets increased by EUR 781.068 and are 14,05% of total assets.

Working capital of CZK 222.057.000 increased for 86,79% compared

with the last period.

The indebtedness of the company is caused mainly by the liabilities to

sole shareholder, prepayments.

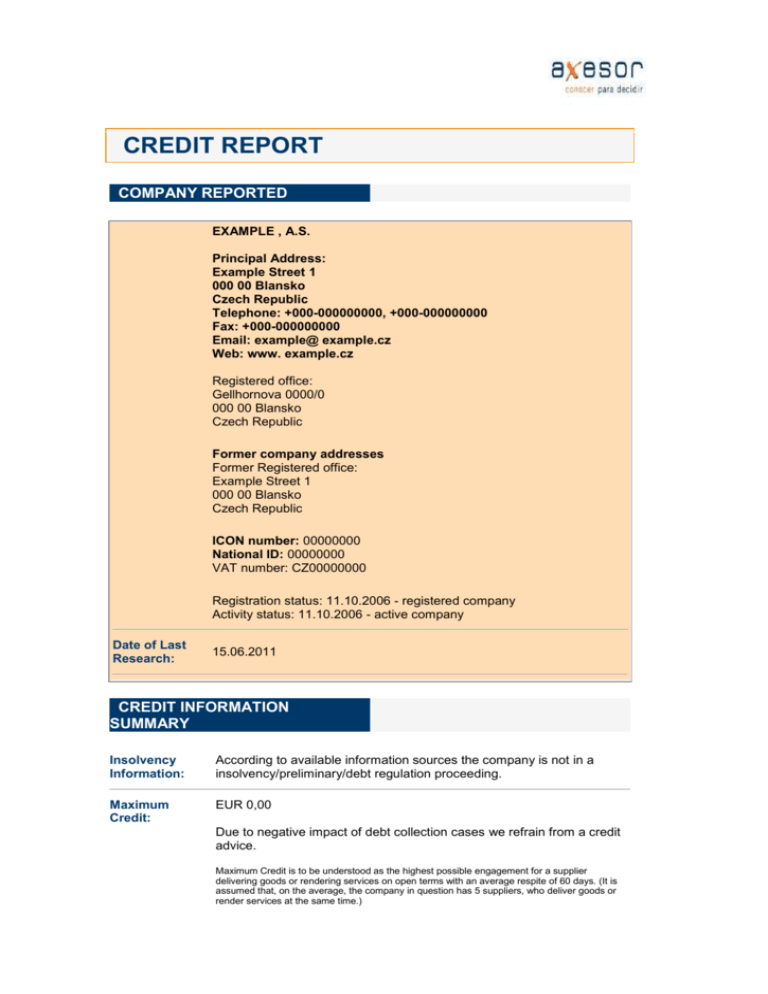

Debt Collection

Distribution of

debt amounts

Medium level of

outstandings

High level

Medium level

Low level

0%

100%

0%

0%

court

25%

closed negative

0%

open

75%

closed positive

CZK 69.315,10 (Invoice date: 20.08.2008)

Status: closed negative (10.03.2010) - debtor will not pay - debtor has

no money

Case received on: 17.06.2009

EUR 5.870,03 (Invoice date: 01.02.2010)

Status: closed positive (11.06.2010) - whole amount paid, debtor refuses

to pay expenses and fees

Case received on: 05.05.2010

EUR 2.908,50 (Invoice date: 13.07.2010)

Status: closed positive (06.12.2010) - whole amount paid, debtor refuses

to pay expenses and fees

Case received on: 07.10.2010

EUR 893,81 (Invoice date: 01.02.2011)

Status: closed positive (10.06.2011) - whole amount paid, debtor refuses

to pay expenses and fees

Case received on: 10.05.2011

COMPANY DETAILS

Established:

2006

Registration:

No. B 0000

11.10.2006

Brno, Czech Republic

Legal Form:

11.10.2006

joint stock company

Capital:

Nominal capital:

CZK 102.000.000,00 since 31.01.2007

Shareholders:

Management:

Related

Companies:

Address

Equity

capital

Full Name

Function

T..., o... a... s...

Registration: Russian

Federation

Shareholder Example Street 100,00%

24.03.2010 - 13

Present

000000 SizraŇ,

Russian

Federation

Full Name

Function

Address

B... S...

22.03.2010 Present

Chairman of the executive Example Street 55board

34

000000 Syzran

Russian

Federation

M... S...

22.03.2010 Present

Member of the executive

board

Example Street

5/1.359

St. Petersburg

Russian

Federation

T... S...

16.06.2010 Present

Chairman of the

supervisory board

Example Street

Moskva

Russian

Federation

shareholder of

Č... B... S...L H..., s.r.o. , Czech Republic , National ID: 00000000

other relationship

Č... B... S...,a.s. , Czech Republic , National ID: 00000000

KEY DATA ON OPERATIONS

Subject of

Operation:

NACE

main activity:

2800 Manufacture of machinery and equipment n.e.c.

4610 Wholesale on a fee or contract basis

4690 Non-specialised wholesale trade

7320 Market research and public opinion polling

7022 Business and other management consultancy activities

7310 Advertising

6920 Accounting, bookkeeping and auditing activities; tax consultancy

NACE codes given are based on the most recent NACE Revision 2.

The company is active in the sector 'Mechanics and precision'.

Note: the Scoring for this industry in the emerging markets of CEE is 'B-'

(Last scoring: 'B-')

Key Data:

Amounts shown in Euro (EUR)

Turnover

Fixed assets

Equity

Liabilities

Profit after taxation

Loss after taxation

Operating result - profit

Operating result - loss

2009

21.007.109

3.502.061

4.402.609

20.492.948

0

16.487

1.339.497

0

Return on assets (ROA)

(Net result / TOTAL ASSETS) * 100

Return on equity (ROE)

(Net result / Equity capital) * 100

Workforce:

Total workforce

Motor Vehicles:

Total number of vehicles

2008

18.577.740

2.720.993

4.685.430

12.909.270

371.662

0

804.226

0

2007

3.193.178

2.366.220

3.875.585

3.279.231

221.850

0

193.142

0

2006

5.751

50.630

8.538

0

19.934

0

20.076

2009

NEGATIVE

2008

2,10

2007

2,98

2006

NEGATIVE

NEGATIVE

7,93

5,72

NEGATIVE

2011

266

2010

266

2009

276

2008

120

2009

5

FINANCIAL INFORMATION

Financials:

Amounts shown

in Euro (EUR)

2009

2008

2007

2006

24.919.606,73

17.703.311,68

7.437.216,34

59.309,18

3.502.060,88

505.917,94

2.720.992,70

225.042,10

2.366.220,01

69.627,55

5.750,98

3.210,67

2.542.370,96

2.327.559,94

2.217.347,45

2.540,31

3.214,22

3.407,91

2.197.920,21

2.312.645,34

2.204.380,09

2.540,31

453.771,98

168.390,67

79.245,01

453.771,98

168.390,67

79.245,01

20.604.764,61

14.912.076,02

5.038.794,04

17.005.672,15

337.606,35

11.457.461,31

309.718,55

1.160.975,43

3.212.629,99

2.919.653,60

3.551.977,52

1.360.030,25

1.668.711,41

269.613,14

48.856,12

48.856,12

225.242,56

225.242,56

325.841,08

325.841,08

24.521,05

24.521,05

812.781,24

70.242,96

32.202,29

25.826,48

24.919.606,73

17.703.311,68

7.437.216,34

59.309,18

4.402.609,19

3.857.061,83

4.685.430,20

4.089.487,61

3.875.585,33

3.674.086,88

50.629,79

70.564,16

BALANCE SHEET

ASSETS

TOTAL

ASSETS

FIXED ASSETS

Intangible fixed

assets

Tangible fixed

assets

from that: Land

and structures

from that:

Individual

movable assets

and sets of

movable assets

Non-current

financial assets

from that: Equity

investments in

subsidiaries and

in associates

CURRENT

ASSETS

Inventories

Long-term

receivables

Short-term

receivables

from that : Trade

receivables

Liquid assets

from that: Cash

on hand and at

bank

ACCRUALS

27.731,72

3.210,67

EQUITY & LIABILITIES

TOTAL

LIABILITIES

EQUITY

Share capital

Statutory funds

Retained

earnings

Profit or loss for

the current

period

LIABILITIES

Reserves

Long-term

liabilities

Short-term

liabilities

from that : Trade

payables

from that:

Payables to

subsidiaries

(short term)

from that: Shortterm

prepayments

received

Bank loans and

borrowings

from that: Shortterm bank loans

and borrowings

ACCRUALS

BALANCE

SHEET TOTAL

64.095,29

497.939,12

49.394,60

174.885,73

-20.351,56

-16.487,05

371.662,26

221.850,01

-19.934,38

20.492.947,63

602.041,97

2.407.146,91

12.909.269,51

180.859,59

2.412.076,02

3.279.230,60

9.185,22

55.363,45

8.538,26

12.207.827,57

10.145.778,21

3.214.681,94

8.538,26

3.872.527,89

1.301.178,73

520.783,81

2.505,03

1.886.897,33

2.157.846,20

266.767,52

3.795.159,77

4.138.681,74

2.110.726,89

5.275.931,18

170.555,69

5.275.931,18

170.555,69

24.049,91

24.919.606,73

108.611,98

17.703.311,68

282.400,40

7.437.216,34

141,13

59.309,18

PROFIT & LOSS ACCOUNT

Turnover

Change in

internally

produced

inventory

Own work

capitalized

Other operating

revenues

Total operating

income

Costs of sold

goods

Purchased

consumables

and services

Staff costs

Taxes and

charges

21.007.109,09

5.351.900,17

18.577.740,36

10.208.002,57

1.134,43

3.193.177,72

349.146,32

11.562,57

1.206.466,25

74.532,92

7.312,15

35,28

27.566.609,95

28.860.275,84

3.561.198,76

35,28

3.100,78

157.886,30

458.864,64

19.944.223,86

24.312.765,62

1.028.492,18

12.031,19

4.165.551,14

10.323,31

3.003.808,84

2.525,86

1.774.475,90

3.025,72

7.515,08

352,82

Depreciations of

intangible and

tangible assets

Other operating

expenses

Total operating

expenses

OPERATING

PROFIT / LOSS

Financial income

Financial

expenses

there of :

Interest

expenses

PROFIT/LOSS

BEFORE TAX

Corporation

income tax

PROFIT OR

LOSS FOR THE

CURRENT

PERIOD

367.063,72

317.977,71

84.359,92

70,56

1.736.850,07

261.085,72

18.838,70

141,13

26.227.112,88

28.056.050,04

3.368.057,06

20.110,79

1.339.497,07

804.225,80

193.141,70

-20.075,50

550.160,71

1.882.699,94

320.142,73

591.452,17

14.461.133,92

14.373.388,08

282,26

141,13

386.159,95

134.311,60

235.501,77

6.957,84

532.916,37

280.887,54

23.444,89

161.254,11

59.037,53

-16.487,05

371.662,26

221.850,01

-19.934,38

-19.934,38

The company is obliged by law to publish its financial statements.

The balance sheet data are from official sources.

2010-The complete financial statement has not been published and are not officially

available.

2010 The financial data have not been issued yet.

Approximate

Exchange

Rates:

Financial data

source:

2010: 25,29 CZK = 1 EUR

2009: 26,445 CZK = 1 EUR

2008: 24,942 CZK = 1 EUR

2007: 27,762 CZK = 1 EUR

2006: 28,343 CZK = 1 EUR

2010: 19,111 CZK = 1 USD

2009: 19,057 CZK = 1 USD

2008: 17,035 CZK = 1 USD

2007: 20,308 CZK = 1 USD

2006: 22,609 CZK = 1 USD

Date: 02.06.2008

Financials have been audited

Auditor: Ing. P... P..., č. osv. 000

Company: F... s.r.o., č. osv. 000

Date: 17.03.2009

Financials have been audited

Auditor: Ing. J... Š..., č. osv. 0000

Company: F... s.r.o., č. osv. 000,

Date: 30.03.2010

Financials have been audited

Auditor: Ing. J... Š...

Company: F... s.r.o.

Clean opinion

Bankers:

Č... o... b..., a. s.

B...

Ratios:

2009

1,18

2008

1,45

2007

1,57

2006

3,25

Liquidity Ratio - 3.stage

current assets / (Short-term

liabilities + Short-term bank credits

and loans)

Liquidity Ratio - 2.stage

0,19

0,30

1,21

3,25

(Short-term receivables + Liquid

assets) / (Short-term liabilities +

Short-term bank credits and loans)

Liquidity Ratio - 1.stage

0,00

0,02

0,10

2,87

Liquid assets / (Short-term liabilities

+ Short-term bank credits and

loans)

Return on assets (ROA)

NEGATIVE

2,10

2,98 NEGATIVE

(Net result / TOTAL ASSETS) * 100

Return on equity (ROE)

NEGATIVE

7,93

5,72 NEGATIVE

(Net result / Equity capital) * 100

Return on sales ( ROS )

NEGATIVE

2,00

6,95

Net profit / Turnover

Receivables Maturity Date (day)

55,82

57,36

406,01

(Short-term receivables / Turnover)

* 365

Liabilities Maturity Date (day)

212,11

199,34

367,46

(Short-term liabilities / Turnover) *

365

Debt Ratio

82,24

72,92

44,09

14,40

(Liabilities / Total Liabilities) * 100

Stock rotation in days

311,17

170,90

284,91

stock / (production consumption +

expenses on sold goods) * 360

Net working capital

EUR

EUR

EUR

EUR

Current assets - Short-term liabilities 8.396.937,04 4.766.297,81 1.824.112,10 19.193,45

Average values of ratios of enterprises with 100 or more employees in the sector of

manufacture of machinery and equipment n.e.c. are following:

Liquidity Ratio - 3.stage: 1,54

Liquidity Ratio - 2.stage: 1,07

Liquidity Ratio - 1.stage: 0,35

ROA: 5,33 %

ROE: 14,97 %

ROS: 5,17 %

Receivables Maturity Date: 85,49 days

Liabilities Maturity Date: 118,98 days

Debt Ratio: 47,75 %

Stock rotation date: 87,49 days

Net working capital: 43 631 591 CZK

Currency

Conversion

Information:

Financial values have been converted to EUR.

Find below the exchange rates used for the listed financial dates:

2009: 1 EUR = 26,45 CZK (yearly average rate 2009)

2008: 1 EUR = 24,94 CZK (yearly average rate 2008)

2007: 1 EUR = 27,76 CZK (yearly average rate 2007)

2006: 1 EUR = 28,34 CZK (yearly average rate 2006)

ADDITIONAL INFORMATION

Contact With

Company:

Name and surname: Mrs. Š...

Function: assistant

Date: 15.06.2011

Information given in report has been confirmed.

CODES AND DEFINITIONS

Credit Scoring

10

9

8

7

6

5

4

3

2

1

0

Excellent risk

Very low risk

Low risk

Moderate risk

Acceptable risk

Medium high risk

Significant risk

High risk

Very high risk of insolvency

Extremely high risk of insolvency

Insolvency/preliminary/debt regulation proceedings

Payment Practices

Payments are made very correctly. - According to our experiences payments are made regularly. Payments are made mostly according to terms - Payments are made irregularly. - Payments are

made slowly. - Payments are made very slowly. - Payments are extremely slow, constantly legal

actions occur. - Payments stopped.

Sector Scoring

In a good sector economic environment with robust corporate financial health, payment

behaviour has been satisfactory. Corporate default probability is low on average.

The essentially good economic environment in the sector could experience short-term

B+, B, B- deterioration with negative consequences on corporate financial health. Payment

behaviour has been generally satisfactory and default probability acceptable.

In a very uncertain economic environment with vulnerable corporate financial health,

C+, C, Cpayment behaviour is relatively poor. Default probability is high enough to cause concern.

With a very poor economic environment prevailing in the sector, weakened corporate

D

financial health gives rise to generally bad payment behaviour. Default probability is high.

A+, A, A-

Distribution of debt amounts

High level

Medium level

Low level

> 25000 Euro

> 500 Euro & < 25000 Euro

< 500 Euro

© 2013 axesor conocer para decidir S.A. NIF. A-18/413302. All rights reserved.