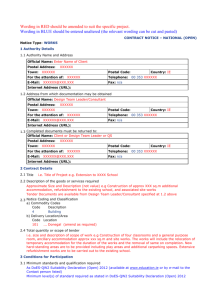

NATIONAL CREDIT INFORMATION CENTRE OF VIETNAM

advertisement

NATIONAL CREDIT INFORMATION CENTRE OF VIETNAM - STATE BANK OF VIET NAM Address: No. 10 Quang Trung, Hadong Dist., Hanoi Telephone: (+844) 33824769 Fax: (+844) 33824693 Email: ncpt@creditinfo.org.vn Web: http://www.cicb.vn No: ……/20xx/S56.E3 ENTERPRISE CREDIT RATING REPORT Requesting Organization: Address: Requesting Individual: Requesting time: (Name of credit Institution) No….., Street……, District……., City ……, Country …… Nguyen Tuan H xxxx Requesting Ref: hh:pp - dd/mm/yy hh:pp - dd/mm/yy Delivery Time: 1. LEGAL INFORMATION Native Name Cong ty AAA Foreign Name AAA Company Shorten Name xxxxxxxxxxxx Address xxxxxxxxxxxx CIC Code xxxxxxxxxxxx Tax Code Telephone xxxxxxxxxxxx Fax xxxxxxxxxxxx Email Website xxxxxxxxxxxx Establishment License Granted date xxxxxxxxxxxx Registration No Granted date Issued by Department of Planning and Investment of …………. xxxxxxxxxxxx Business Line xxxxxxxxxxxx Industry xxxxxxxxxxxx Number of employee xxxxxxxxxxxx Registered Capital Registered Capital Capital Structure A: ….%; B…..% …… Premise ownership and xxxxxxxxxxxx Square description Start year xxxxxx Listed year(if have) ISO, TQM, QA/QC, xxxxxx Listed code(if have) HACCP certificate(if have) Operation Scale xxxxxx Business status Active Other information(if have) Notice xxxxxx 2. GENERAL INFORMATION 1. Domestic market Products/Services Market xxxxxx xxxxxx xxxxxxxxxxxx xxxxxxxxxxxx xxxxxxxxxxxx xxxxxxxxxxxx xxxxxxxxxxxx 0 (USD) xxxxxx (m2) 0 2. Export Product Market Payment method 3. Import Product Market Payment method xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx 3. BOARD OF DIRECTORS Name Tran Gia Ha A Dob xxxxxx Nationality xxxxxx Position Director Year of Experience xxxxxx Qualification xxxxxx 4. THE PARENT COMPANY, BRANCHES, SUBSIDIARY AND AFFILIATE 4.1. The parent company xxxxxx Native Name xxxxxx Foreign Name xxxxxx Shorten Name xxxxxx Address xxxxxx Telephone xxxxxx Email xxxxxx Tax code xxxxxx Registration No The ratio of capital contribution xxxxxx in the Enterprise 4.2. Branches and representative offices information No Name of branches and representative offices 1 xxxxxxxxxxxxx Address xxxxxxxxxxxxx Tel xxxxx 5. BUSINESS CHARACTERISTICS No. Norm 1 The potential of the Enterprise's products or services is replaced by the others 2 The Enterprise's competitive position on the market 3 The marketing strategy (not applied to the small-scale) 4 The brand 5 The Business Awards 6 Contributing to Social Security Activities such as: scholarships, other charities… 7 The investment in technology and R&D 6. THE CHARACTERISTICS OF THE BUSINESS INDUSTRY Content xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx No. Norm 1 The prospect or impact of the economic industry at the time of assessment 2 The prospect or impact of state policies at the time of assessment Content xxxxxxxxxxx xxxxxxxxxxx 7. THE PROBLEMS OF THE ENTERPRISE No. Norm 1 The business violations of the Enterprise 2 The unforeseen risks (such as a natural disaster like an earthquake or explosion...) 3 The law violations of the General Director/Director (impact on the Enterprise's reputation.) 4 The law violations of The Chief Accountant (impact on the Enterprise's reputation.) Content xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx 8. LIST OF CREDIT INSTITIONS (as of dd/mm/20xx) No 1 2 3 4 5 Credit Institution Code xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx Name of Credit Institution and/or branches xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx Latest reported date dd/mm/yyyy dd/mm/yyyy dd/mm/yyyy dd/mm/yyyy dd/mm/yyyy 9. FINANCE INFORMATION Audited financial statement Unaudited financial statement 9.1. Balance sheet Norm A. CURRENT ASSETS I. Cash and cash equivalents 1.Cash 2. Cash equivalents II. Short-term financial investments 1. Short term Securities 2. Provision for the diminution in value if short term investment III. Short-term receivables 1. Trade accounts receivables 2. Prepayment to suppliers 3. Internal receivables 4. Receivable according to the progress of construction Unit: Million VND Year 20xx-3 20xx-2 20xx-1 20xx 5. Other receivables 6. Provision for short-term doubtful debts IV. Inventories 1. Inventories 2. Provision for devaluation of inventories V. Other short-term assets 1. Short-term prepayments 2. VAT deductibles 3. Taxes receivables 5. Other short-term assets B. LONG- TERM ASSETS I- Long-term receivables 1. Long-term trade account receivables 2. Capital of subsidiaries 3. Long-term internal receivable 4. Other long-term receivables 5. Provision for doubtful long-term debts II. Fixed assets 1. Tangible fixed assets - Cost - Accumulated depreciation 2. Finance lease assets -Cost -Accumulated depreciation 3.Intangible fixed assets -Cost -Accumulated depreciation 4. Construction in progress III. Investment in real estate -Cost -Accumulated depreciation IV. Other financial long-term investment 1. Investments in subsidiaries 2. Investment in other join venture companies 3. Other long-term investments 4. Provision for devaluation of long-term financial investments V. Other long-term assets 1. Long-term prepayments 2. Deferred tax assets 3. Other long-term assets TOTAL ASSETS A. LIABILITIES I. Current liabilities 1. Short-term borrowings and liabilities 2. Trade accounts payable 3. Advances from customers 4. Taxes and amounts payable to the State budget 5. Payables to employees 6. Accrued expenses 7. Internal payable 8. Payables according to the progress of construction 9. Other current payables 10. Provision for short-term payables II. Long-term liabilities 1. Trade accounts long-term payables 2. Internal long-term payables 3. Other long-term payables 4. Long-term loans 5. Deferred tax payables 6. Provision for unemployment 7.Provision for long-term payables B. EQUITY I. Owner's equity 1. Legal capital 2.Share premiums 3. Other sources of capital 4. Treasury stocks 5. Difference on revaluation of assets 6. Foreign exchange differences 7. Business promotion fund 8. Financial reserved fund 9. Other funds 10. Retained earnings 11. Funds for capital expenditures II. Other sources and funds 1. Bonus and welfare funds 2. Sources of expenditure 3. Fund to form fixed assets C. Minority interests TOTAL RESOURCES ASSET – RESOURCE DIFERENCE 9.2. Income statement Norm 20xx-2 Unit: Million VND Year 20xx-1 20xx 1. Gross sales of merchandise and services 2. Less deductions 3. Net sales of merchandise and services 4. Cost of goods sold 5. Gross profit from sales of merchandise and services 6. Financial income 7. Financial expenses - Including: Interest expense 8. Selling expenses 9. General and administration expenses 10 Operating profit / ( loss) 11. Other income 12. Other expenses 13. Profit/(loss) from other activities 14. Net accounting profit before tax 15. Corporate income tax 16. Deferred income tax 17. Net profit after tax 18. Earnings per share 9.3. Financial ratio comparatives 31/12/20xx-2 31/12/20xx-1 31/12/20xx Percentage In/De Percentage In/De Percentage In/De Figure Figure Figure (%) (%) (%) (%) (%) (%) I. Total Assets 1. Short-term Assets 2. Short-term Receivables 3. Inventories 4. Long-term Assets II. Total resources 1. Liabilities 2. Short-term Liabilities 3. Owner's equity III. Net income 1. Cost of goods sold 2. Net profit after tax 10. SCORING AND EVALUATING ON ENTERPRISE'S NON-FIANCIAL RATIO 10.1. Scoring Criterias Norm Unit Year 20xx-2 Year 20xx-1 Year 20xx Result Score Result Score Result Score 1. Years of operation of the enterprise Year 2. Years of experience as a leader in the General Director Year (Director) position 3. Qualification of the General Director (Director) 4. The potential of the Enterprise's products or services is replaced by the others 5. The Enterprise's competitive position on the market 6. Business scope 7. Ownership right of enterprise's headquarter (only applied to the small-scale) 8. The marketing strategy (not applied to the small-scale) 9. The prospect or impact of the economic industry at the time of assessment 10. The prospect or impact of state policies at the time of assessment Note: The Criterias from 4 to 10 are only applied from the financial year 20xx of new credit rating methods by CIC 10.2. Considering and adjusting non-financial scores (Made by Analysis Experts) Norm Year 20xx Result Score 1. Positive criterias Create jobs for employees (review the number of employees increased every year) The Management Policy (such as ISO, TQM,QA/QC, HACCP) The brand Contributing to Social Security Activities such as: scholarships, other charities… The investment in technology and R&D The Business Awards 2. Negative criterias The law violations of The Chief Accountant (impact on the Enterprise's reputation.) The law violations of the General Director/Director (impact on the Enterprise's reputation.) The business violations of the Enterprise The unforeseen risks (such as a natural disaster like an earthquake or explosion...) 10.3. Considering impacts of the parent company Content 1. The impact of the parent company's rating Year 20xx Result Score 2. The impact of the parent company's bad debts 11. SCORING ON LOAN AND INTEREST EXPENSE RATIOS Unit: Times Fiscal year 20xx 20xx-1 20xx-2 Result Score 12. SCORING AND EVALUATING ON ENTERPRISE'S FIANCIAL INDEXES 12.1. Scoring Criterias Year 20xx-2 Year 20xx-1 Year 20xx Comparative to Comparative to Comparative to Content Unit industry industry industry Result Score Result Score Result Score average average average LIQUIDITY RATIOS 1. Current ratio Times 2. Quick ratio Times PERFORMANCE RATIOS 3. Inventory turnover Times 4. Average Days Receivables Period 5. Asset turnover Times INSOLVENCY RATIOS 6. Liabilities/Total % assets 7. Liabilities/Owner's % equity 8. Overdue debt/Total % outstanding loans PROFITABILITY RATIOS 9. Net profit after % tax/Turnover 10. Net profit after % tax/Total assets 11. Net profit after % tax/Owner's equity Note: Scores are ranged from minimum of 0 to maximum of 5. Background are marked as higher (>), smaller (<) or equal (=). 12.2. Considering and Adjusting financial scores (Made by Analysis Expert) Norm Year 20xx Result Score Unit 1. Growth rate of total assets 2. Growth rate of net profit after tax % % 13. SYNTHESIZING THE RESULT OF SCORING AND CREDIT RATING OF THE ENTERPRIS 13.1. Credit Rating Chart and Indexes Content Credit Rating Fiscal year 20xx-2 xxxxx Fiscal year 20xx-1 xxxxx Fiscal year 20xx xxxxx 13.2. Other assessment on the Enterprise's Operations (Made by Analysis Expert) (if have) Analyst and Supervisor Tran Xuan AA Note: The report is made by CIC data, standard and program. You are requested to use information provided by CIC as regulated by law, not to provide to any third party or not to use for illegal competition. All comment and further request, please contact Credit Rating Division Tel: 04.33553905/33553906/33117063 and Website: http://creditinfo.org.vn or http://www.cicb.vn CREDIT RATING INDEXES AAA+ AAAOptimal Enterprises are assessed by experts that they have Enterprises are assessed by experts that they have good AAA very strong financial capability, good debt payment financial capability, long-term growth prospect. However, type history, currently strong business situation and long- existing restrictive policies could have impacts on their term growth prospects. Lowest risk. business operations. Low risk. AA+ AAVery good Enterprises are assessed by experts that they have Enterprises are assessed by experts that they have good but AA good and sustainable growth prospects, fairly good type unsustainable growth prospects and good debt payment business situation and good debt payment history. low history. Relatively low risk risk. A+ AEnterprises are assessed by experts that they have A Good type good and stable growth prospects, are not affected by Enterprises are assessed by experts that they have efficient but not stable business operations with certain business competitive pressures and economic risks. Relatively environmental and competitive risks. Medium risk. low risk. BBB+ BBBFairly Enterprises are assessed experts that they have stable Enterprises are assessed by experts that they have efficient BBB good type and efficient business operations, fairly good debt business operations but certain restrictive financial capability. payment history. Medium risk. Medium risk. BB+ BBFairly Enterprises are assessed by experts that they have not BB average Enterprises are assessed by experts that they have not promoted their financial capability and easily been affected by promoted their financial capability and have type large economic changes due to business environmental inefficient business operations. Medium risk pressuress as well as competition. Medium risk. B+ BAverage Enterprises are assessed by experts that they have weak B Enterprises are assessed by experts that they have type financial autonomy and low debt payment capability. High weak financial autonomy. Relatively high risk. risk. CCC+ CCCEnterprises are assessed by experts that they have Fairly Enterprises are assessed by experts that they have poor CCC weak type poor competition and management capacity due to competitive and management capability and low-debt certain pressure from business environment as well as payment history. Very high risk. competition. High risk. CC+ CCCC Weak type Enterprises are assessed by experts that they have Enterprises are assessed by experts that they have very weak very weak financial autonomy and weak debt financial autonomy, weak debt payment capability and bad payment capability. Very high risk. business situation. very high risk. C+ CVery weak Enterprises are assessed by experts that they have Enterprises are assessed by experts that they have the weakest C type extremely weak autonomy, weak management autonomy, weakest management capability, signs of capability and legal problems. Extremely high risk. bankruptcy due to legal problems. Highest risk.