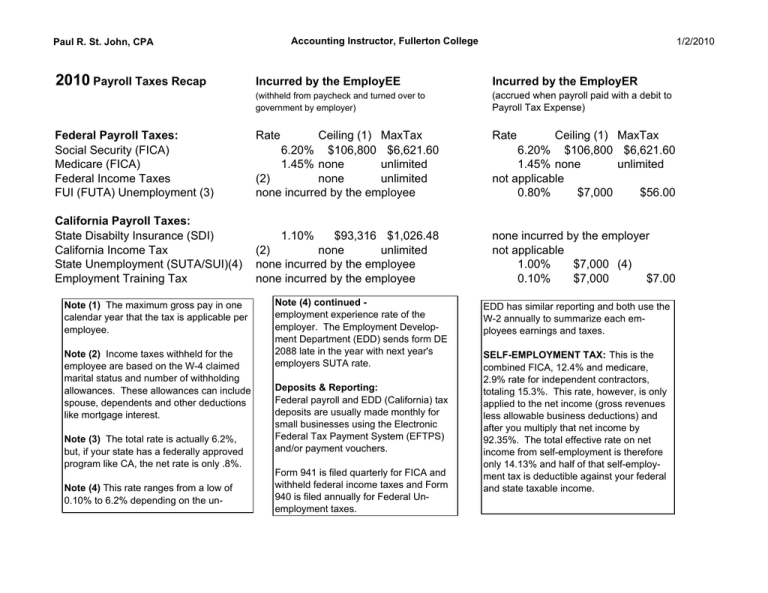

2010 Payroll Taxes Recap Incurred by the EmployEE Incurred by the EmployER

advertisement

Accounting Instructor, Fullerton College Paul R. St. John, CPA 2010 Payroll Taxes Recap Federal Payroll Taxes: Social Security (FICA) Medicare (FICA) Federal Income Taxes FUI (FUTA) Unemployment (3) California Payroll Taxes: State Disabilty Insurance (SDI) California Income Tax State Unemployment (SUTA/SUI)(4) Employment Training Tax Note (1) The maximum gross pay in one calendar year that the tax is applicable per employee. Note (2) Income taxes withheld for the employee are based on the W-4 claimed marital status and number of withholding allowances. These allowances can include spouse, dependents and other deductions like mortgage interest. Note (3) The total rate is actually 6.2%, but, if your state has a federally approved program like CA, the net rate is only .8%. Note (4) This rate ranges from a low of 0.10% to 6.2% depending on the un- 1/2/2010 Incurred by the EmployEE Incurred by the EmployER (withheld from paycheck and turned over to government by employer) (accrued when payroll paid with a debit to Payroll Tax Expense) Rate Rate Ceiling (1) MaxTax 6.20% $106,800 $6,621.60 1.45% none unlimited (2) none unlimited none incurred by the employee 1.10% $93,316 $1,026.48 (2) none unlimited none incurred by the employee none incurred by the employee Note (4) continued employment experience rate of the employer. The Employment Development Department (EDD) sends form DE 2088 late in the year with next year's employers SUTA rate. Deposits & Reporting: Federal payroll and EDD (California) tax deposits are usually made monthly for small businesses using the Electronic Federal Tax Payment System (EFTPS) and/or payment vouchers. Form 941 is filed quarterly for FICA and withheld federal income taxes and Form 940 is filed annually for Federal Unemployment taxes. Ceiling (1) MaxTax 6.20% $106,800 $6,621.60 1.45% none unlimited not applicable 0.80% $7,000 $56.00 none incurred by the employer not applicable 1.00% $7,000 (4) 0.10% $7,000 $7.00 EDD has similar reporting and both use the W-2 annually to summarize each employees earnings and taxes. SELF-EMPLOYMENT TAX: This is the combined FICA, 12.4% and medicare, 2.9% rate for independent contractors, totaling 15.3%. This rate, however, is only applied to the net income (gross revenues less allowable business deductions) and after you multiply that net income by 92.35%. The total effective rate on net income from self-employment is therefore only 14.13% and half of that self-employment tax is deductible against your federal and state taxable income.