Chapter 8 Quiz

advertisement

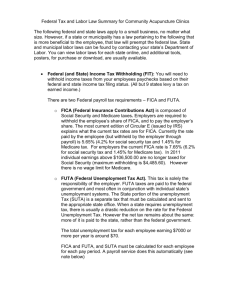

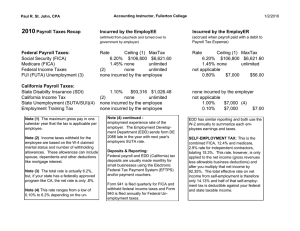

how much FUTA and SUTA will the employer pay this week? The rate for SUTA is 5.4% and FUTA is 0.8%. a) $421.60 b) $0 c) $49.60 d) $12.40 Chapter 8 Quiz Objectives: 1. Recording payroll and payroll taxes. 2. Paying payroll and recording the paying of payroll 3. Calculating employer taxes for FICA, OASDI, FICA Medicate, FUTA, SUTA, and Workers’ compensation insurance. 4. Paying FIT, FICA FUTA, SUTA, and worker’s compensation insurance. 5. Preparing Forms W-2, W-3, 941, 8109 and 940. 9. The general journal entry to record the employer’s monthly payroll tax would include: a) a credit to Salaries Expense. b) a debit to Salaries Payable. c) a credit to FICA-OASDI Payable. d) a credit to Payroll Tax Expense. TRUE/FALSE 1. A banking day is a holiday where the bank is open to the public. 10. Which of the following statements is false? a) Payroll Tax Expense is an expense account. b) FICA-Social Security Tax Payable increases on the debit side of the account. c) Payroll Tax Expense increases on the debit side of the account. d) All of these answers are correct. 2. The SUTA tax rate is set by the federal government. 3. The payroll tax expense is an expense in addition to the salary and wages expense. 4. The FICA taxes are paid by the employee and employer. 5. Federal income taxes are paid to the government at the time the salary and wage expense is recorded. MULTIPLE CHOICE 6. The FICA rate for an employer is: a) twice the individual rate. b) half of the employee rate. c) The employer does not pay FICA taxes. d) equal to the employee rate. 7. Semi-weekly depositors: a) have 3 banking days to make its payroll tax deposit. b) pay more than $50,000 in taxes over the last year. c) must file electronically. d) Both “a” and “b” are correct. 8. Marcy’s cumulative earnings before this pay period were $6,800, and gross for the week is $800. Assuming a wage base limit of $7,000, Chapter 8 TRUE/FALSE 1. ANSWER: False (L.O. 2) 2. ANSWER: False (L.O. 3) 3. ANSWER: True (L.O. 1) 4. ANSWER: True (L.O. 1) 5. ANSWER: False (L.O. 2) MULTIPLE CHOICE 6. ANSWER: d (L.O. 1) 7. ANSWER: d (L.O. 2) 8. ANSWER: d (L.O. 4) 9. ANSWER: c (L.O. 1) 10. ANSWER: b (L.O. 1) Chapter 8