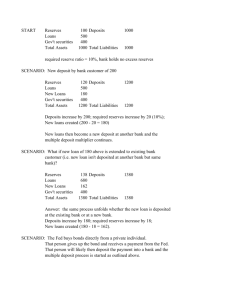

Asset/Liability Management (ALM)

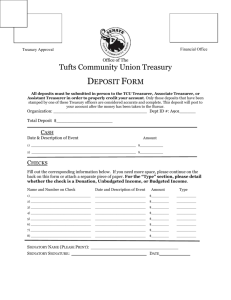

advertisement