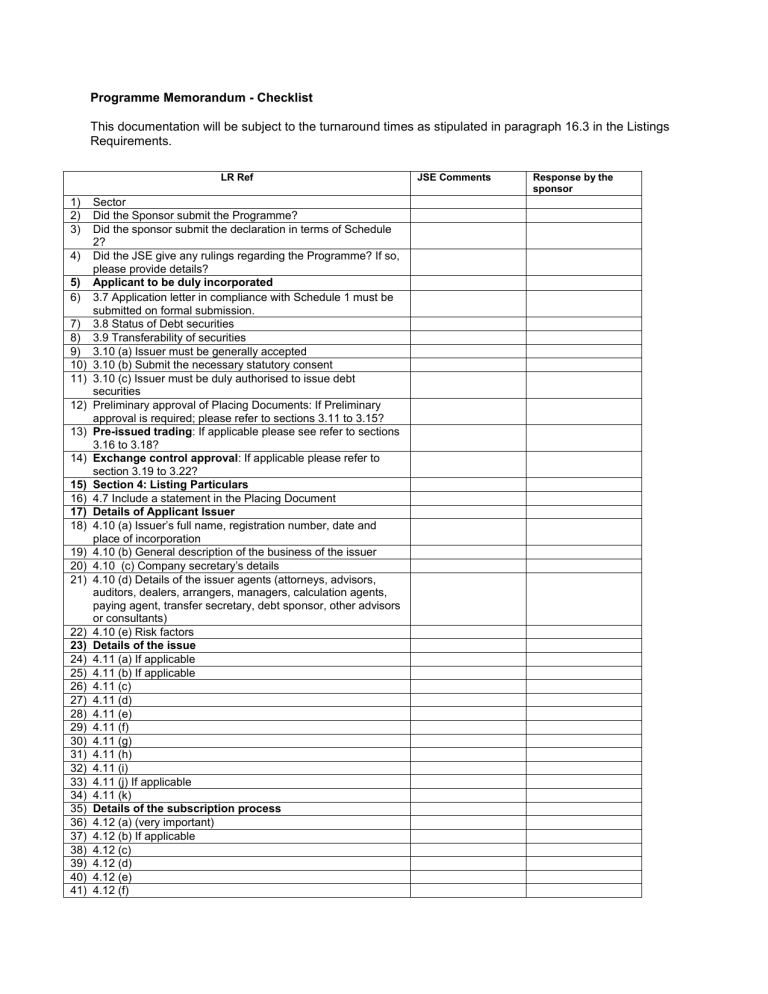

New Debt Listings Checklist-Programme Memorandum

Programme Memorandum - Checklist

This documentation will be subject to the turnaround times as stipulated in paragraph 16.3 in the Listings

Requirements.

LR Ref JSE Comments Response by the sponsor

1) Sector

2) Did the Sponsor submit the Programme?

3) Did the sponsor submit the declaration in terms of Schedule

2?

4) Did the JSE give any rulings regarding the Programme? If so, please provide details?

5) Applicant to be duly incorporated

6) 3.7 Application letter in compliance with Schedule 1 must be submitted on formal submission.

7) 3.8 Status of Debt securities

8) 3.9 Transferability of securities

9) 3.10 (a) Issuer must be generally accepted

10) 3.10 (b) Submit the necessary statutory consent

11) 3.10 (c) Issuer must be duly authorised to issue debt securities

12) Preliminary approval of Placing Documents: If Preliminary approval is required; please refer to sections 3.11 to 3.15?

13) Pre-issued trading : If applicable please see refer to sections

3.16 to 3.18?

14) Exchange control approval : If applicable please refer to section 3.19 to 3.22?

15) Section 4: Listing Particulars

16) 4.7 Include a statement in the Placing Document

17) Details of Applicant Issuer

18)

4.10 (a) Issuer’s full name, registration number, date and place of incorporation

19) 4.10 (b) General description of the business of the issuer

20)

4.10 (c) Company secretary’s details

21) 4.10 (d) Details of the issuer agents (attorneys, advisors, auditors, dealers, arrangers, managers, calculation agents, paying agent, transfer secretary, debt sponsor, other advisors or consultants)

22) 4.10 (e) Risk factors

23) Details of the issue

24) 4.11 (a) If applicable

25) 4.11 (b) If applicable

26) 4.11 (c)

27) 4.11 (d)

28) 4.11 (e)

29) 4.11 (f)

30) 4.11 (g)

31) 4.11 (h)

32) 4.11 (i)

33) 4.11 (j) If applicable

34) 4.11 (k)

35) Details of the subscription process

36) 4.12 (a) (very important)

37) 4.12 (b) If applicable

38) 4.12 (c)

39) 4.12 (d)

40) 4.12 (e)

41) 4.12 (f)

42) 4.12 (g)

43) Details of the guarantee, trustee and representatives : If applicable, please see sections 4.13 (a) to 4.13 (c) (ii)?

44) Taxation

45) 4.14 (a) If applicable

46) 4.14 (b) If applicable

47) 4.14 (c) If applicable

48) Exchange control : If applicable

49) 4.15 (a)

50) 4.15 (b)

51) Financial and legislation information : please see section 5 below?

52) 4.16 (a) For notification

53) 4.16 (b) (i)

54) 4.16 (b) (ii)

55) Other

56) 4.17 (a)

57) 4.17 (b)

58) Responsibility

59) 4.18 (a) Insert a statement (very important)

60) 4.18 (b) Insert a statement (very important)

61) Documents available for Inspection

62) 4.19 (a) (i) current Placing Document

63) 4.19 (a) (ii) any supplementary documents published since the current Placing Document was published

64) 4.19 (a) (iii) any pricing supplements

65) 4.19 (a) (iv) any document incorporated in the Placing

Document by reference; and

66) 4.19 (a) (v) the financial information of the issuer and the guarantor

67) 4.19 (b)

68) 4.19 (c)

69) Signing and date of the Placing Document : refer to sections 4.20 (a) to 4.20 (d)

70) 4.21

Pricing Supplement : details must be provided in the pro-forma pricing supplement in the programme

71) 4.24 if applicable

72) 4.25 Rating Agencies: if applicable

73) Section 5

– Financial Information

74) 5.2 GAAP or IFRS

75) 5.3 Financial Statements

76) 5.3 (a)

77) 5.3 (b)

78) 5.3 (c)

79) Contents of the Financial Information

80) 5.5 (a) income statement

81) 5.5 (b) balance sheet

82) 5.5 (c) statement of changes in equity

83) 5.5 (d) cash flow statement

84) 5.5 (e) accounting policies

85) 5.5 (f) notes thereto

86) 5.5 (g) segmental information

87) 5.5 (h) any material post balance sheet events occurring subsequent to the issue of the latest audited financial statement

88) 5.5 (i) credit risk (if applicable) to draw attention of the potential investor to the risk that they will assume

89) 5.5 (j) adherence to King III Code of Corporate Governance

90) 5.5 (k) Statement of material changes in the financial/trading position of the issuer

91) Report of the independent auditor

92) 5.6 (a) scope of the audit

93) 5.6 (b) audit opinion

94) Profit forecast and estimates : if the issuer makes a profit forecast, please see section 5.7 to 5.14?

95) Section 6

– Specialised Products/Entities

96) Special Purpose Vehicles/Asset-Backed Securities : If

“Special Purpose Vehicle or Asset-Backed Security”, please see sections 6.1 to 6.2 (c) (ii) 13?

97) High Yield Debt Securities : If “High Yield Debt Securities”, please see sections 6.3 to 6.6 (q)?

98) Exchange Traded Funds : If “Exchange Traded Fund”, please see sections 6.7 to 6.12 (g)?

99) Section 8

100) Documents to be submitted for listing

101) 8.2 Annotation of drafts

102) 8.3 Documents to be submitted

103) 8.3 (a)Copy of Placing Document

104) 8.3 (b)Certified copy of registration and copy of incorporation of the issuer

105) 8.3 (c) a copy of the Board of directors resolution or resolution of the governing authority of the Applicant

Issuer authorising the establishment of the Programme

Memorandum and/or issue of Debt Securities

106) 8.3 (d) a reference to the provisions of the act or other legislation, regulation, or applicable rules under which the Applicant Issuer is regulated, if not the

Companies Act

107) 8.3 (e) a copy of the Memorandum and Articles of

Association of the Applicant Issuer or equivalent constitutive documents

108) 8.3 (f) a certified copy of any applicable guarantee in respect of the Debt Security

109) 8.3 (g) confirmation that the Applicant Issuer has appointed a settlement agent

110) 8.3 (h) confirmation from Strate that the Applicant

Issuer has been admitted in terms of the central securities depository rules and directives

111) 8.3 (i) any trust deed relating to the Debt Securities

112) 8.3 (j) a copy of the South African Reserve Bank

Banking Supervision Department's approval

113) 8.3 (k) where the Applicant Issuer is a foreign entity, a copy of the South African Reserve Bank Exchange

Control Department's approval/directive is required

114) 8.3 (l) written confirmation from the trustee or relevant party holding the guarantee or other security that it has the guarantee in its possession

115) 8.3 (m) application letter complying with schedule 1

116) 8.3 (n) a letter from the Debt Sponsor complying with schedule 2

117) 8.3 (o) Confirmation by the applicant issuer

118) 8.3 (o) (i) that all applicable regulatory disclosures have been made;

119) 8.3 (o) (ii) that there are no material matters, other than disclosed in the Placement Document or otherwise in writing to the JSE, that should be taken into account by the JSE in considering suitability for the Listing of

Debt Securities

120) 8.3 (p) the annual financial statements of the

Applicant Issuer and/ or Guarantor in respect of the period of three years prior to the date of such issue or for such shorter period as agreed to by the JSE in terms of section 5.4

121) 8.3 (q) the auditors consent letter

122) 8.3 (s) letter from the legal advisor that all relevant agreements have been signed

123) 8.3 (t) the auditors letter, detailing material subsequent events (if any) since the date of the

Applicant Issuer’s and guarantor’s (if applicable) last audit report );

124) 8.3 (u) a letter from the Debt Sponsor confirming that all agreements referred to in the placing documents are finalised and signed off by all the parties involved.

125) Index Provider : Does the programme make provision for

Indices? If yes, is the index provider accredited? If not, the sponsor must submit the necessary information for approval before formal submission ?