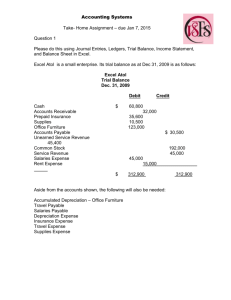

Section 1

advertisement

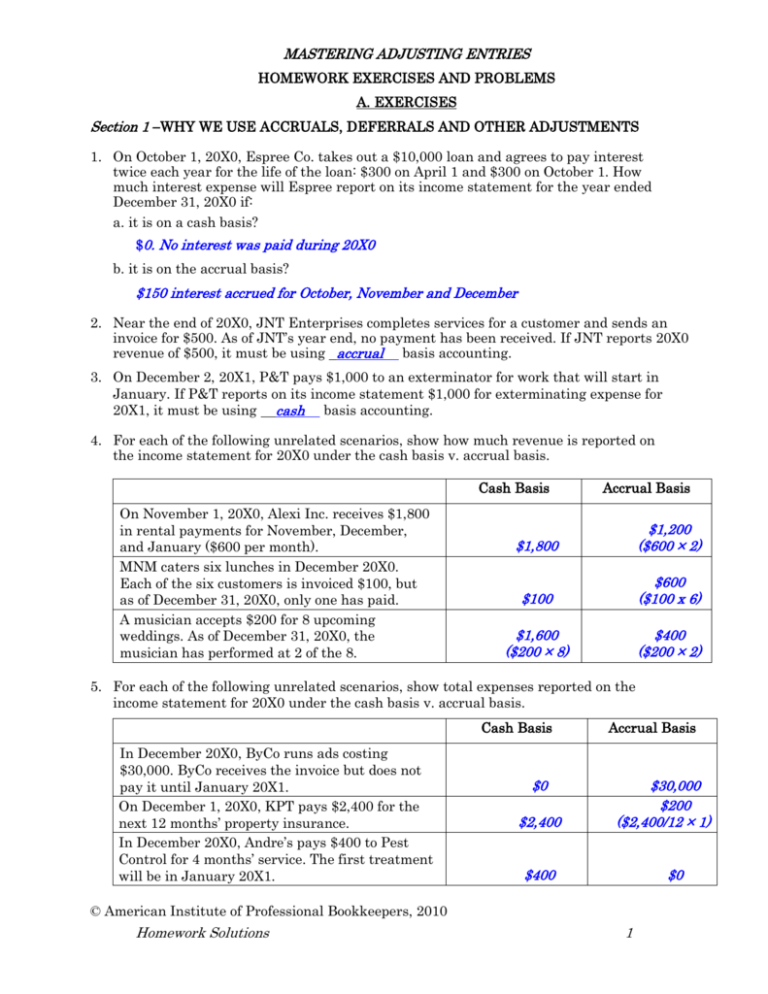

MASTERING ADJUSTING ENTRIES HOMEWORK EXERCISES AND PROBLEMS A. EXERCISES Section 1 WHY WE USE ACCRUALS, DEFERRALS AND OTHER ADJUSTMENTS 1. On October 1, 20X0, Espree Co. takes out a $10,000 loan and agrees to pay interest twice each year for the life of the loan: $300 on April 1 and $300 on October 1. How much interest expense will Espree report on its income statement for the year ended December 31, 20X0 if: a. it is on a cash basis? $0. No interest was paid during 20X0 b. it is on the accrual basis? $150 interest accrued for October, November and December 2. Near the end of 20X0, JNT Enterprises completes services for a customer and sends an invoice for $500. As of JNT’s year end, no payment has been received. If JNT reports 20X0 revenue of $500, it must be using accrual basis accounting. 3. On December 2, 20X1, P&T pays $1,000 to an exterminator for work that will start in January. If P&T reports on its income statement $1,000 for exterminating expense for 20X1, it must be using cash basis accounting. 4. For each of the following unrelated scenarios, show how much revenue is reported on the income statement for 20X0 under the cash basis v. accrual basis. Cash Basis On November 1, 20X0, Alexi Inc. receives $1,800 in rental payments for November, December, and January ($600 per month). MNM caters six lunches in December 20X0. Each of the six customers is invoiced $100, but as of December 31, 20X0, only one has paid. A musician accepts $200 for 8 upcoming weddings. As of December 31, 20X0, the musician has performed at 2 of the 8. Accrual Basis $1,800 $1,200 ($600 × 2) $100 $600 ($100 x 6) $1,600 ($200 × 8) $400 ($200 × 2) 5. For each of the following unrelated scenarios, show total expenses reported on the income statement for 20X0 under the cash basis v. accrual basis. Cash Basis In December 20X0, ByCo runs ads costing $30,000. ByCo receives the invoice but does not pay it until January 20X1. On December 1, 20X0, KPT pays $2,400 for the next 12 months’ property insurance. In December 20X0, Andre’s pays $400 to Pest Control for 4 months’ service. The first treatment will be in January 20X1. $0 $2,400 Accrual Basis $30,000 $200 ($2,400/12 × 1) $400 $0 © American Institute of Professional Bookkeepers, 2010 Homework Solutions 1 Mastering Adjusting Entries Section 2 ACCRUED REVENUE 1. Select the term on the right that best completes the statement on the left. Terms may be used once, more than once, or not at all. Failing to make the entry to accrue revenue __d__ net income. The entry to record accrued revenue __a__ assets. Accrued revenue is revenue that is __e__ but not collected Failing to make the entry to accrue revenue __d__ assets. The entry to record accrued revenue __a__ net income. a. increases b. decreases c. overstates d. understates e. earned f. unearned 2. Kurtz Rentals rents equipment to Ditka on February 1. Lease terms require Ditka to make payments to Kurtz of $2,000 each quarter: April 30, July 31, October 31, and January 31. Kurtz receives payments for April, July, and October. a. What journal entry should Kurtz record on December 31? Rent Receivable Rent Revenue 1,333 1,333 b. If this entry is not recorded, how will it affect Kurtz’s financial statements? Net income will be understated because too little revenue is reported. Assets will be understated as well. 3. Intell licenses technologies to a manufacturer. The agreement calls for Intell to receive $3 for each unit manufactured with licensing fees remitted quarterly. As of December 31, Intell has received the following payments: Period 1/1 to 3/31 4/1 to 6/30 7/1 to 9/30 10/1 to 12/31 Units Manufactured 475 350 525 600 Licensing Fees $1,425 $1,050 $1,575 $1,800 Intell has received checks for the first two quarters, but not the third; the fourthquarter check is not due until January. a. If Intell is on the accrual basis, what adjusting entry should it record at year end to recognize revenue earned from this manufacturer? Licensing Fees Receivable Licensing Fees Revenue 3,375 3,375 Under the accrual method, revenue is recognized in the year earned. Thus, revenue of $3,375 ($1,575 + $1,800 = $3,375) earned from July 1–December 31 is recognized, even though it has not been received b. If this entry is not recorded, how will it affect Intell’s financial statements? Net income will be understated on the income statement. Assets will be understated on the balance sheet. Homework Solutions 2 Mastering Adjusting Entries 4. Your firm holds a $15,000, 8% note receivable issued on August 1, 20X0. Interest is paid once a year on July 31. On July 31, 20X6, you receive the normal interest payment. a. What adjusting entry must you record December 31, 20X6? Interest Receivable Interest Revenue 500 500 $15,000 × 8% = $1,200 annual interest × 5/12 = $500 b. If this entry is not recorded, how will it affect your company’s financial statements? Net income will be understated on the income statement. Assets will be understated on the balance sheet. 5. Your company, which has a fiscal year ending October 31, sells scented bars of soap for a 12% commission. As of October 31, total sales are $400,000. Your company has received $30,000, which you credited to Revenue. a. How much additional revenue must you record for the fiscal year? $18,000 ($400,000 × 12% = $48,000 revenue earned $30,000 revenue booked) b. What is the journal entry to record the additional revenue? Commissions Receivable Commissions Revenue 18,000 18,000 Section 3 ACCRUED EXPENSES (ACCRUED LIABILITIES) 1. DillCo borrows $200,000 on September 1, 20X0, from First Bancorp. Monthly interest is $1,200. The loan agreement requires DillCo to pay the interest every 6 months. The first interest payment is due February 28, 20X1. a. What adjusting entry must DillCo make on December 31, 20X0 to recognize the accrued interest? Interest Expense Interest Payable 4,800 4,800 $1,200 × 4 months (SeptemberDecember) = $4,800 b. Explain the impact on the financial statements if this entry is not recorded. Because too little interest expense has been recognized net income will be overstated on the income statement. Liabilities will be understated on the balance sheet. 2. Salary expense at QuickDinner Inc. is $7,500 per week for a Monday–Friday workweek. Employees are paid each Friday. a. If the company’s year ends on a Wednesday, what adjusting entry must it record? Salaries Expense Salaries Payable 4,500 4,500 $7,500/5 = $1,500 for each workday × 3 = $4,500 b. Explain the impact on the financial statements if this entry is not recorded. Because too little salaries expense has been recognized, net income will be overstated on the income statement. Liabilities will be understated on the balance sheet. Homework Solutions 3 Mastering Adjusting Entries 3. Salary expense at SlowCooker is $6,000 per week for a Tuesday–Sunday workweek. Employees are paid on Sunday. a. If the company’s year ends on a Tuesday, what adjusting entry must it make? Salaries Expense Salaries Payable 1,000 1,000 $6,000/6 = $1,000 for each workday × 1 = $1,000 b. Explain the impact on the financial statements if this entry is not recorded. Because too little salaries expense has been recognized, net income will be overstated on the income statement. Liabilities will be understated on the balance sheet. 4. Rojo Equipment, which has an October 31 fiscal year, reports income of $200,000 for the year ended 10/31/20X7. On October 31, Rojo discovers the following: A $2,000 utility bill booked on October 30, 20X7, was not paid. Rojo has a $10,000 note payable with a 12% annual interest rate. Payments are due every six months. The last interest payment was made on June 30, 20X7. Rojo’s has 4 salaried employees, each paid $800 a week for a Monday–Friday workweek. Paychecks are distributed on Fridays. October 31 is a Thursday. a. Prepare the adjusting entries required for the year ended October 31, 20X7. Utilities Expense Utilities Payable 2,000 Interest Expense Interest Payable 400 2,000 400 $10,000 × 12% = $1,200 annual interest/12 × 4 months = $400 Salaries Expense Salaries Payable 2,560 2,560 $800 × 4 = $3,200 weekly salaries/5 × 4 = $2,560 b. What Rojo’s net income for 20X7? $195,040 ($200,000 $2,000 $400 $2,560) Homework Solutions 4 Mastering Adjusting Entries Section 4 REVENUE COLLECTED IN ADVANCE (UNEARNED REVENUE) 1. At year end, Bijou records an adjusting entry for unearned revenue. a. If the adjusting entry increases liabilities, what journal entry was recorded when the cash was received? If the AJE increases liabilities, then the entry is: Revenue xxxx Unearned Revenue xxxx Therefore, the original journal entry recorded when cash was received was: Cash xxxx Revenue xxxx b. If the adjusting entry increases revenues, show the journal entry that was recorded when the cash was received. If the AJE increases revenues, then it is: Unearned Revenue xxxx Revenue xxxx Therefore, the original journal entry recorded when cash was received was: Cash xxxx Unearned Revenue xxxx 2. WyCo’s fiscal year ends September 30. On September 10, it collects $30,000 for a painting job and credits Unearned Painting Revenue. As of September 30, 60% of the work has been done. What adjusting entry must WyCo record on September 30? Unearned Painting Revenue Painting Revenue 18,000 18,000 $30,000 × 60% = $18,000 painting revenue is recognized for the year. Thus, $18,000 must be transferred from Unearned Painting Revenue to Painting Revenue. 3. On August 1, InsureCo writes a 2-year policy for a total of $12,000 and receives the entire payment in advance. If InsureCo credits Revenue, what adjusting entry must it record on December 31? Revenue Unearned Revenue 9,500 9,500 The original entry must have been: Cash Revenue $12,000 $12,000 On December 31, InsureCo recognizes 5 months’ revenue, or $2,500 ($12,000/24 × 5). The remaining $9,500 ($12,000 $2,500) must be transferred to Unearned Revenue. Homework Solutions 5 Mastering Adjusting Entries 4. On November 1 ATD enters a 1-year contract to provide security for CorpCo’s warehouses for $12,000 a year and receives the first 3 months’ payment at signing. a. If ATD books the payment as revenue, what adjusting entry must it record at year end? How will its financial statements be misstated if the entry is not recorded? The original entry for 3 months’ service ($12,000/12 × 3 = $3,000) would have been: Cash Revenue 3,000 3,000 At year end, 2 months’ revenue has been earned, so it must record the following AJE: Revenue Unearned Revenue 1,000 1,000 If ATD does not record this AJE, revenue will be understated by $1,000, causing net income to be understated by this amount. Liabilities will be understated by $1,000. b. If ATD books the payment as a liability, what adjusting entry must it record at year end? How will its financial statements be misstated if the entry is not recorded? The original journal entry would have been: Cash Unearned Revenue 3,000 3,000 To recognize 2 months’ revenue earned as of year end, ATD records the following AJE: Unearned Revenue Revenue 2,000 2,000 If ATD does not record this AJE, revenue will be understated by $2,000 and net income overstated by this amount. Liabilities will be overstated by $2,000. 5. The following table shows subscription revenue for three unrelated companies: Beginning balance in Unearned Subscription Revenue Payments received during the year Ending balance in Unearned Subscription Revenue Subscription revenue earned during the year I $ 2,400 Company II III $ 3,000 $ 4,500 40,000 25,000 ? 4,000 39,000 ? ? 2,000 25,000 a. Fill in the missing amounts. I. As of the beginning of the year, ATD has on its books $2,400 for services it had not yet performed. During the year, ATD receives an additional $40,000. If ATD earns $39,000 revenue for the year, then $3,400 remains unearned, as follows: Beginning balance in Unearned Subscription Revenue + Payments received during the year = Ending balance in Unearned Subscription Revenue Subscription revenue earned during the year = Ending balance in Unearned Subscription Revenue $ 2,400 40,000 $42,400 (39,000) $ 3,400 II. $3,000 + $25,000 = $28,000 $24,000 (Subscription Revenue) = $4,000 III. $4,500 + $22,500 (payments received) = $27,000 $25,000 = $2,000 Homework Solutions 6 Mastering Adjusting Entries b. Ignoring dollar amounts, what journal entries may have recorded the payments? The payments may have been recorded as a liability: Cash Unearned Revenue or as revenue: Cash Revenue xxxx xxxx xxxx xxxx 6. On February 1, Alta’s collects $60,000 for a job and credits Revenue. As of April 30, Alta’s year end, 45% of the work is completed. What adjusting entry does Alta record on April 30? Revenue Unearned Revenue 33,000 33,000 $60,000 × 45% = $27,000 revenue must be recognized for the year. Before recording the AJE, Alta’s Revenue account shows a balance of $60,000. Therefore, $33,000 ($60,000 $27,000) must be transferred to Unearned Revenue. Section 5—PREPAID (DEFERRED) EXPENSES 1. On December 1, 20X7, your company pays an annual insurance premium of $3,600 that covers December 1, 20X7, to November 30, 20X8. a. Show the adjusting entry on December 31, 20X7, if the $3,600 payment was recorded in Prepaid Insurance. Insurance Expense Prepaid Insurance 300 300 As of December 31, 20X7, 1 month’s insurance has been used up, so the AJE must transfer $300 ($3,600/12 × 1) from Prepaid Insurance to Insurance Expense. b. Show the adjusting entry on December 31, 20X7, if the $3,600 payment was recorded in Insurance Expense. Prepaid Insurance Insurance Expense 3,300 3,300 As of December 31, 20X7, 1 month’s insurance has been used up, so the ending balance in Insurance Expense must be $300 (the amount that will be reported on the 20X7 income statement). This requires transferring $3,300 to Prepaid Insurance. 2. GilCo pays $900 for office supplies in April and debits Office Supplies. On May 31, GilCo’s year end, a physical count, finds $200 in supplies. a. What is the adjusting entry? Supplies Expense Supplies 700 700 If $900 in office supplies was purchased and $200 of supplies are on hand at year end, $700 of supplies were used up during the year. The AJE must transfer $700 to Supplies Expense b. If this entry is not recorded, how will it affect GilCo’s financial statements? Both net income and total assets will be overstated Homework Solutions 7 Mastering Adjusting Entries 3. The following table shows insurance premiums paid by three unrelated companies: I $ 500 4,000 ? 3,000 Beginning balance in Prepaid Insurance Premiums paid during the Year Ending balance in Prepaid Insurance Insurance used up during the year Case II $ 300 2,500 400 ? III $4,500 ? 200 5,500 a. Fill in the missing information. I. $1,500 Beginning balance in Prepaid Insurance + premiums paid during the year insurance expense used up as of year end = ending balance in Prepaid Insurance. To compute: $500 + $4,000 $3,000 = $1,500 II. $2,400 $300 + $2,500 $X = $400 III. $1,200 $4,500 + $X $5,500 = $200 b. Ignoring dollar amounts, give all possible journal entries to record the premium payments. If the payments were recorded as an asset, the original journal entry would have been: Prepaid Insurance xxxx Cash xxxx If the payments were recorded as an expense, the original journal entry would have been: Insurance Expense xxxx Cash xxxx 4. On September 1, BarCo signs a 2-year rental agreement paying $6,000 rent in advance. a. If the prepayment was booked as prepaid rent, what is the year-end adjusting entry? Rent Expense Prepaid Rent 1,000 1,000 [$6,000/24 months × 4 months = $1,000] b. If the prepayment was booked as rent expense, what is the year-end adjusting entry? Prepaid Rent Rent Expense 5,000 5,000 $6,000/24 months × 4 months = $1,000 of rent expense used up during the year. That leaves $5,000 of prepaid rent to be used up in the future. 5. In August, JemCo, which has an October 31 year end, pays $1,200 for office supplies and records it in Supplies Expense. On October 31, a physical count reveals $440 of supplies unused. a. What adjusting entry must JemCo record on October 31? Supplies Supplies Expense 440 440 Because $440 of supplies had not been used up by year end, the AJE must transfer this amount out of Supplies Expense and into the Supplies account. b. If this entry is not recorded, how will it affect JemCo’s financial statements? Supplies expense will be overstated by $440 and net income will be understated by the same amount. Total Assets will be understated by the same $440 Homework Solutions 8 Mastering Adjusting Entries Section 6 OTHER END-OF-PERIOD ENTRIES 1. GoCo purchases a building for $350,000. If the building has an estimated life of 30 years and a residual value of $50,000, what is the adjusting entry in the year of purchase? Depreciation Expense Accumulated Depreciation 10,000 10,000 [$350,000 $50,000)/30 = $10,000] 2. For 20X9, PyCo has credit sales of $200,000. Based on past experience, Pylo estimates that 3% of credit sales will be uncollectible. At year end, the balance in Allowance for Doubtful Accounts is $4,000. What is the adjusting entry to record 20X9 bad debt expense? Bad Debt Expense 6,000 Allowance for Doubtful Accounts 6,000 $200,000 × 3% = $6,000. Under the percentage of credit sales method, the current balance in the Allowance account is not used to compute the AJE. 3. At the end of 20X9, Spend Co has accounts receivable of $70,000, of which it estimates 10% will be bad debt. Allowance for Doubtful Accounts has a debit balance of $4,000. a. What does the debit balance in Allowance for Doubtful Accounts imply about 20X8? Too little bad debt expense was recorded in 20X8. b. What is the 20X9 adjusting entry for bad debt? Bad Debt Expense 11,000 Allowance for Doubtful Accounts 11,000 $70,000 × 10% = $7,000. To obtain a credit balance of $7,000 in the Allowance account the AJE must be for $11,000. c. What is the term for the difference between the closing balances in Accounts Receivable and Allowance for Doubtful Accounts? Net realizable value 4. Match the terms in the lefthand column below with the descriptions on the right. 1. Percentage of credit sales method a. Required to recognize bad debt under GAAP 2. Direct write-off method b. Estimate of bad debt expense based on the age of outstanding receivables 3. Allowance method c. Estimate of bad debt based on credit sales 4. Percentage of accounts receivable method d. Required to recognize bad debt under tax law 1. c. 2. d Homework Solutions 3. a. 4. b. 9 Mastering Adjusting Entries 5. Below are PruCo’s entries to two accounts for the year. a. What do the debits to the Allowance account represent? Show the three journal entries that led to the three debits in the Allowance account. Each debit to the Allowance account represents a specific accounts receivable being written off during the year. Allowance for Doubtful Accounts Accounts Receivable Allowance for Doubtful Accounts Accounts Receivable Allowance for Doubtful Accounts Accounts Receivable 200 100 400 200 100 400 b. Pruco uses the percentage of credit sales method. If it estimates that 2% of its $250,000 in credit sales will not be collected, what adjusting entry does PruCo record to recognize bad debt expense for the year? Bad Debt Expense Allowance for Doubtful Accounts 5,000 5,000 $250,000 × 2% = $5,000 c. Now assume that Pruco uses the percentage of accounts receivable method. If it estimates that $4,000 of its receivables will not be collectable, what adjusting entry does PruCo record to recognize bad debt expense for the year? Bad Debt Expense Allowance for Doubtful Accounts 3,450 3,450 $4,000 $550 current balance = $3,450 required adjustment Homework Solutions 10 Mastering Adjusting Entries Section 7 FROM UNADJUSTED TRIAL BALANCE TO FINANCIAL STATEMENTS 1. For each account listed below, fill in the normal balance as “debit” or “credit.” Account Accounts Payable Accounts Receivable Accumulated Depreciation—Equipment Normal balance CREDIT DEBIT CREDIT Advertising Expense DEBIT Cash DEBIT Depreciation Expense—Automobiles DEBIT Depreciation Expense—Equipment DEBIT Equipment DEBIT Fees Earned CREDIT Interest Earned CREDIT Interest Expense DEBIT Interest Payable CREDIT Interest Receivable DEBIT B. Anders, Capital CREDIT B. Anders, Withdrawals DEBIT Land DEBIT Long-term Notes Payable CREDIT Notes Receivable DEBIT Office Supplies DEBIT Office Supplies Expense DEBIT Repairs Expense DEBIT Salaries Expense DEBIT Salaries Payable CREDIT Unearned Fees CREDIT Wages Expense DEBIT Homework Solutions 11 Mastering Adjusting Entries 2. Shown below, in alphabetical order, are the accounts of A-Plus, Inc. Use the worksheet on the following page to set up a trial balance for the fiscal year ending June 30, 20X7. Accounts Payable $ 49,000 Accumulated Depreciation—Building 75,000 Accumulated Depreciation—Equipment 33,000 Building 110,000 Cash 155,000 Depreciation Expense—Building 4,000 Depreciation Expense—Equipment 5,000 Equipment 72,000 Insurance Expense 1,000 Interest Expense 1,100 Interest Payable 9,000 Land Long-term Notes Payable Postage Expense Prepaid Insurance Professional Fees Property Taxes Payable J. Crow, Capital 75,000 107,000 200 4,000 142,000 9,000 193,900 J. Crow, Withdrawals 49,000 Rent Expense 35,000 Rent Payable 3,400 Repairs Expense 18,900 Short-term Investments 27,000 Supplies 2,700 Supplies Expense 3,400 Telephone Expense 900 Unearned Professional Fees 500 Utilities Expense 1,300 Wage Expense 68,000 Wages Payable 11,700 Homework Solutions 12 Mastering Adjusting Entries A-Plus, Inc. Trial balance June 30, 20X7 Cash Short-term Investments Supplies Prepaid Insurance Equipment Accum. Depreciation—Equipment Building Accum. Depreciation—Building Land Accounts Payable Interest Payable Rent Payable Wages Payable Property Taxes Payable Unearned Professional Fees Long-term Notes Payable J. Crow, Capital J. Crow, Withdrawals Professional Fees Depreciation Expense—Building Depreciation Expense—Equipment Wage Expense Interest Expense Insurance Expense Rent Expense Supplies Expense Postage Expense Repairs Expense Telephone Expense Utilities Expense Totals Homework Solutions Debit 155,000 27,000 2,700 4,000 72,000 Credit 33,000 110,000 75,000 75,000 49,000 9,000 3,400 11,700 9,000 500 107,000 193,900 49,000 142,000 4,000 5,000 68,000 1,100 1,000 35,000 3,400 200 18,900 900 1,300 633,500 633,500 13 Mastering Adjusting Entries Important—the following question is optional: Neither certification nor the certification exam requires presentation of the financial statements, but only through the adjusted trial balance. Recommended: Focus on the adjustments and adjusted trial balance. 3. Below is the adjusted trial balance for Shady’s Illusions. Use this information to prepare Shady’s income statement and balance sheet for the year. Debit Credit No. Account title 101 Cash 109 Office Supplies 25,000 111 Equipment 80,000 112 Accumulated Depreciation—Equipment 44,000 200 Accounts Payable 33,000 201 Wages Payable 12,000 300 S. Shady, Capital 301 S. Shady, Withdrawals 400 Entertainment Revenue 510 Rent Expense 511 Gas and Oil Expense 512 Wages Expense 513 Depreciation Expense—Equipment 12,500 514 Legal Expense 11,400 Totals Homework Solutions 158,000 129,700 25,000 228,000 26,800 3,000 105,000 446,700 446,700 14 Mastering Adjusting Entries Shady’s Illusions Income Statement For the year ended December 31, 20X4 Entertainment revenue $228,000 Less: Rent expense $ 26,800 Gas and oil expense 3,000 Wage expense 105,000 Depreciation expense 12,500 Legal expense 11,400 Net income 158,700 $ 69,300 Shady’s Illusions Balance Sheet December 31, 20X4 Assets Cash $158,000 Office supplies 25,000 Equipment (net) 36,000 Total assets $219,000 Liabilities and Capital Accounts payable Wages payable S. Shady, Capital* Total liabilities and capital $33,000 12,000 174,000 $219,000 * S. Shady, Capital = $129,700 + $69,300 $25,000 Homework Solutions 15 Mastering Adjusting Entries Section 8 APPLYING YOUR KNOWLEDGE TO THE TRIAL BALANCE Important—the following question is optional: Neither certification nor the certification exam requires presentation of the financial statements, but only through the adjusted trial balance. Recommended: Focus on the adjustments and adjusted trial balance. 1. Using Thorne’s unadjusted trial balance below and facts ah, complete the following worksheet by filling in the adjustments, adjusted trial balance and financial statements. Thorne Construction Unadjusted trial balance For the year ended July 31, 20X8 Debit Cash 12,500 Accounts Receivable 40,000 Allowance for Doubtful Accounts Office Supplies 1,850 Prepaid insurance 6,500 Prepaid Rent Equipment 154,000 Accum. Depreciation Equipment Accounts Payable Interest Payable Wages Payable Long-term Notes Payable W. Thorne, Capital W. Thorne, Drawing 25,000 Constuction Revenues Bad Debt Expense Depreciation Expense–Equipment Wage Expense 29,400 Interest Expense 900 Insurance Expense Rent Expense 10,800 Office Supplies Expense Repairs Expense 100 Utilities Expense 6,750 Totals 287,800 a. b. c. d. e. f. g. h. Credit 2,000 38,500 23,000 30,000 82,300 112,000 287,800 A physical count of office supplies as of July 31, 20X8 shows $800 in supplies on hand. On March 1, 20X7, Thorne Construction prepaid $9,000 for an 18-month insurance policy of which 5 months ($2,500) was used up during fiscal year 20X7. The equipment has a 28-year life and no salvage value. Thorne uses straight-line depreciation. July’s eletric bill for $420 is not included because it arrived after the worksheet was prepared. There are $1,800 of accrued wages as of the fiscal year end. Thorne’s rent of $800 a month is payable quarterly, in advance. Its most recent payment was $2,400 on June 30, 20X8 to cover July, August, and September 20X8. Thorne estimates bad debt at 2% of credit sales. The long-term note payable bears interest at 1% a month payable by the 10th of the following month. The interest for July has neither been paid nor recorded. Homework Solutions 16 a. Supplies Expense Office Supplies 1,050 1,050 $1,850 $800 supplies on hand = $1,050 supplies expense b. Insurance Expense Prepaid Insurance 6,000 6,000 $9,000/18 = $500 a month × 12 months = $6,000 c. Depreciation Expense Equipment 5,500 Accumulated Depreciation—Equipment 5,500 ($154,000 $0)/28 = $5,500 d. Utilities Expense Utilities Payable 420 e. Wage Expense Wages Payable 1,800 f. Prepaid Rent Rent Expense 1,600 420 1,800 1,600 $800 × 2 months (August amdSeptember) was not used up as of year end. g. Bad Debt Expense Allowance for Doubtful Accounts 2,240 2,240 $112,000 × 2% = $2,240 h. Interest Expense Interest Payable 300 300 $30,000 × 1% = $300 Homework Solutions 17 Mastering Adjusting Entries Unadjusted trial balance Cash Accounts Receivable Allow. for Doubtful Accts Office Supplies Prepaid Insurance Prepaid Rent Equipment Accum. Depr.– Equip. Accounts Payable Interest Payable Utilities Payable Wages Payable Long-term Notes Payable W. Worthington, Capital W. Worthington, Drawings Constuction Revenues Bad Debt Expense Depr. Exp.– Equipment Wage Expense Interest Expense Insurance Expense Rent Expense Supplies Expense Repairs Expense Utilities Expense Totals Dr 12,500 40,000 Cr Thorne Construction Worksheet July 31, 20X8 Adjusted Adjustments trial balance Dr 2,000 1,850 6,500 1,600 Cr 2,240 1,050 6,000 154,000 5,500 38,500 23,000 Dr 12,500 40,000 800 500 1,600 154,000 300 420 1,800 30,000 82,300 25,000 25,000 112,000 2,240 5,500 1,800 300 6,000 29,400 900 10,800 1,600 1,050 100 6,750 287,800 Net Income Homework Solutions 287,800 420 18,910 18,910 2,240 5,500 31,200 1,200 6,000 9,200 1,050 100 7,170 298,060 Cr Income statement Dr Cr 800 500 1,600 154,000 44,000 23,000 300 420 1,800 30,000 82,300 298,060 18 Dr 12,500 40,000 4,240 112,000 Balance sheet 2,240 5,500 31,200 1,200 6,000 9,200 1,050 100 7,170 63,660 48,340 112,000 112,000 Cr 4,240 44,000 23,000 300 420 1,800 30,000 82,300 25,000 112,000 234,400 112,000 234,400 186,060 48,340 234,400 B. PROBLEMS FOR SECTIONS 1–8 1. Danza Inc. reported income of $440,000 for the year ended June 30, 20X8. However, the records show that at year end, the following items had not been recorded: On May 1, 20X8, Danza received a $12,000 advance for a six-month job and credited Revenue for $12,000. Interest on a $12,000 note payable bearing a 10% interest rate is paid quarterly. The last payment was made at the end of May 20X8. Danza’s payroll is 14 salaried employees, each earning $900 a week for a 5-day workweek. Friday is payday. June 30 was a Tuesday. a. Prepare the adjusting entries necessary for the year ended June 30, 20X8. Revenue Unearned Revenue 8,000 8,000 $12,000/6 = $2,000 earned each month × 2 = $4,000 earned for the year $12,000 $4,000 = $8,000 of unearned revenue as of June, 30, 20X8. Interest Expense Interest Payable 100 100 $12,000 × 10% = $1,200 annual interest/12 months × 1 month = $100 Salaries Expense Salaries Payable 5,040 5,040 $900 × 14 = $12,600 weekly salaries/5 × 2 = $5,040 b. What is Danza’s net income for 20X8? $426,860 ($440,000 $8,000 $100 $5,040) 2. Mikado Co. reported income of $224,000 for the year ended December 31, 20X9. However, a review of the books shows the following items unaccounted for at year end: On August 1, 20X9, Mikado received a $27,000 advance for a 9-month job, recording the payment in Unearned Revenue. Interest on a $20,000 note payable with a 12% interest rate is paid every 3 months, the last interest payment having been at the end of June 20X9. Mikado’s payroll is 7 salaried employees, each earning $1,000 a week for a Monday–Friday workweek. Payday is Friday. December 31 was a Thursday. Homework Solutions 19 Mastering Adjusting Entries a. Prepare the adjusting entries for the year ended June 30, 20X8. Unearned Revenue Revenue 15,000 15,000 $27,000/9 = $3,000 earned each month × 5 = $15,000 revenue for 20X9. Interest Expense Interest Payable 1,200 1,200 $20,000 × 12% = $2,400 annual interest/12 months × 6 months = $1,200 Salaries Expense Salaries Payable 5,600 5,600 $1,000 × 7 = $7,000 weekly salaries/5 × 4 = $5,600 b. What is Mikado’s net income for 20X9? $232,200 ($224,000 + $15,000 $1,200 $5,600) 3. You are handed the following unadjusted trial balance: Champion Professional Services Unadjusted trial balance December 31, 20X7 Debit Cash Accounts receivable 25,000 -0- Supplies 3,800 Prepaid insurance 9,800 Prepaid rent Equipment 500 60,000 Accumulated depreciation—Equipment 22,900 Accounts payable 6,000 Salaries payable -0- Unearned Fees 4,000 F. Mercury, Capital F. Mercury, Withdrawals 51,000 14,000 Fees Earned Depreciation Expense—Equipment Salaries Expense Insurance Expense Rent Expense Supplies Expense Credit 71,900 -024,800 -05,500 -0- Advertising Expense 6,000 Utilities Expense 6,400 _______ 155,800 155,800 Totals Homework Solutions 20 Mastering Adjusting Entries Using the data below, complete the worksheet on the following page by filling in the adjustments and adjusted trial balance for Champion for the year ended December 31, 20X7. a. 8 employees are paid weekly. At year end, 3 days’ wages have accrued at $120 a day for each employee. b. A physical count shows $600 of office supplies on hand at year end. c. $2,600 of prepaid insurance coverage has expired. d. Annual depreciation on the equipment is $8,450. e. On November 1, Champion contracted for a new job for which it is paid $1,000 a month. It received a 4-month advance and booked it as unearned fees. f. A client renewed its contract for 3 months at $1,300 a month, starting on November 1. The first payment is due on February 28th. g. The balance in Prepaid Rent is December’s rent. a. Salaries Expense Salaries Payable 2,880 2,880 $120 8 employees 3 days = $2,880 b. Supplies Expense Supplies 3,200 3,200 $3,800 beginning balance $600 ending balance = $3,200 used up during the year c. Insurance Expense Prepaid Insurance 2,600 d. Depreciation Expense Accumulated Depreciation 8,450 e. Unearned Fees Fees Earned 2,000 2,600 8,450 2,000 $1,000 monthly fee 2 months (JanuaryFebruary 20X8) unearned as of year end f. Accounts Receivable Fees Earned 2,600 2,600 $1,300 2 months earned as of year end g. Rent Expense Prepaid Rent Homework Solutions 500 500 21 Mastering Adjusting Entries Champion Professional Services trial balance December 31, 20X7 Unadjusted trial balance Adjustments Dr Cr Dr Cr Cash Adjusted trial balance Dr Cr 25,000 25,000 Accounts Receivable (f) 2,600 -0- 2,600 Supplies 3,800 (b) 3,200 600 Prepaid Insurance 9,800 (c) 2,600 7,200 Prepaid Rent Equipment (d) 8,450 31,350 6,000 6,000 Salaries Payable (a) 2,880 -0- Unearned Fees 4,000 F. Mercury, Capital 2,880 (e) 2,000 2,000 51,000 51,000 14,000 (e) 2,000 (f) 2,600 71,900 -0- 14,000 24,800 (d) 8,450 (a) 2,880 8,450 27,680 -0- (c) 2,600 2,600 (g) 500 6,000 (b) 3,200 3,200 Insurance Expense Rent Expense 0 60,000 22,900 Accounts Payable Depreciation Exp.— Equipment Salaries Expense 500 60,000 Acc. Depreciation— Equipment F. Mercury, Withdrawals Fees Earned (g) 500 5,500 Supplies Expense -0- Advertising Expense 6,000 6,000 Utilities Expense 6,400 6,400 Total 155,800 Homework Solutions 155,800 22,230 22,230 169,730 76,500 169,730 22 Mastering Adjusting Entries Important—the following question is optional: Neither certification nor the certification exam requires presentation of the financial statements, but only through the adjusted trial balance. Recommended: Focus on the adjustments and adjusted trial balance. 4. Using the adjusted trial balance from Problem 3, complete the Income Statement and Balance Sheet columns of the worksheet for Champion. When the worksheet is complete, prepare Champion’s financial statements. Champion Professional Services.Worksheet December 31, 20X7 Adjusted trial balance Dr Cash Accounts Receivable Supplies Prepaid Insurance Prepaid Rent Equipment Salaries Payable Unearned Fees F. Mercury, Capital Insurance Expense Rent Expense Supplies Expense Advertising Expense Utilities Expense Totals Net Income Homework Solutions Dr 31,350 6,000 2,880 2,000 51,000 14,000 76,500 8,450 27,680 2,600 6,000 3,200 6,000 6,400 169,730 Cr 25,000 2,600 600 7,200 0 60,000 14,000 Fees Earned Salaries Expense Cr Balance sheet 31,350 6,000 2,880 2,000 51,000 Accounts Payable Depreciation Expense– Equipment Dr 25,000 2,600 600 7,200 0 60,000 Acc. Depreciation–Equipment F. Mercury, Withdrawals Cr Income statement 169,730 76,500 8,450 27,680 2,600 6,000 3,200 6,000 6,400 60,330 16,170 76,500 76,500 109,400 76,500 109,400 23 93,230 16,170 109,400 Mastering Adjusting Entries Champion Professional Services Income Statement For the year ended December 31, 20X7 Revenue $76,500 Less: Salaries expense $27,680 Insurance expense 2,600 Rental expense 6,000 Supplies expense 3,200 Advertising expense 6,000 Utilities expense 6,400 Depreciation expense 8,450 Net income 60,330 $16,170 Champion Professional Services Balance Sheet December 31, 20X7 Assets Cash Accounts receivable Supplies Prepaid insurance Equipment (net) Total assets $25,000 2,600 600 7,200 28,650 $64,050 Liabilities and Capital Accounts payable $ 6,000 Salaries payable 2,880 Unearned fees 2,000 F. Mercury, capital* Total liabilities and capital * 53,170 $64,050 F. Mercury, capital = $51,000 + $16,170 net income $14,000 withdrawals Homework Solutions 24 Mastering Adjusting Entries 5. Below are the 20X8 unadjusted and adjusted trial balances for Olympic Consulting. Analyze the differences between the unadjusted and adjusted trial balances, determine each adjustment that Olympic must have made at year end and insert it in the Adjustments column. Label each adjustment “(a)”, “ (b),” etc., then put the same letter in the corresponding worksheet cell with a brief explanation of the adjustment. Cash Accounts Receivable Office Supplies Prepaid Rent Office Equipment Accum. Depreciation— Office Equipment Accounts Payable Salaries Payable Utilities Payable Unearned Consulting Fees Texiera, Capital Texiera, Withdrawals Consulting Fees Earned Depreciation Expense—Office Equipment Salaries Expense Supplies Expense Rent Expense Utilities Expense Total Homework Solutions Olympic Consulting Trial balance December 31, 20X8 Unadjusted trial balance Adjustments Dr Cr Dr Cr 2,500 10,000 (a) 1,000 4,000 (b) 1,800 1,800 (c) 700 15,900 4,100 4,000 0 0 2,200 30,500 (d) 500 (e) (f) 600 400 Adjusted trial balance Dr Cr 2,500 11,000 2,200 1,100 15,900 4,600 4,000 600 400 (a) 1,400 800 30,500 2,100 2,100 (a) 2,400 42,000 0 32,000 0 6,700 7,800 82,800 82,800 (d) 44,400 500 500 (e) 600 (b) 1,800 (c) 700 (f) 400 6,400 32,600 1,800 7,400 8,200 85,300 6,400 85,300 25 Mastering Adjusting Entries (a) Accounts Receivable 1,000 Unearned Consulting Fees 1,400 Consulting Fees Earned 2,400 The firm must have recorded this adjustment because at some point during the year $1,400 was received for services not yet performed. The initial entry debited Cash and credited Unearned Consulting Fees. As of year end, $2,400 of consulting services had been completed, but not recorded. Of this amount, $1,000 has not yet been paid. (b) Supplies Expense Office Supplies 1,800 1,800 When the office supplies were purchased the entry must have debited Office Supplies and credited Cash. At year end, $2,200 of supplies were on hand, so Olympic must have recorded an AJE to account for supplies used up during the year. (c) Rent Expense Prepaid Rent 700 700 Based on the trial balance, Olympic prepaid the rent debiting Prepaid Rent and crediting Cash. At year end, $700 of rent had been used up, so Olympic had to have recorded an AJE to reduce the balance in Prepaid Rent by crediting it $700 and transferring this amount to Rent Expense, which it debited for $700. (d) Depreciation Expense 500 Accumulated Depreciation 500 Based on the information, Olympic must have debited Depreciation Expense for $500 and credited Accumulated Depreciation for the same amount in order to record depreciation expense on the equipment for the year. (e) Salaries Expense Salaries Payable 600 600 Olympic must debited Salary Expense for $600 and credited Salaries Payable for the same amount to accrue salaries owed but not paid as of year end. (f) Utilities Expense Utilities Payable 400 400 The firm apparently debited Utilities Expense for $400 and credited Utilities Payable for the same $400 to accrue utilities expense incurred, but not paid as of year end. Homework Solutions 26