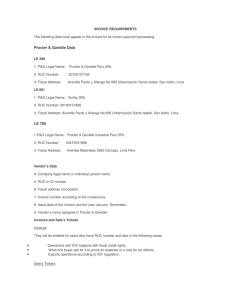

Accounts Payable cutoff procedures for fiscal year ending June 30

advertisement

Accounts Payable cutoff procedures for fiscal year ending June 30, 2014 APRIL – JUNE Remind all requisitioners to use Workflow Vacation Rules if they will be out of the office during this critical period of invoice approvals. Future Year Prepays - Goods or services the majority of which are to be received in FY15, but Prepaid in FY14 must be submitted to Krys Hammers in Accounts Payable. A valid and approved PO must be in created, however the invoice will not be matched to the PO. Instead they will be charged to an accrual account. The PO will be closed. P-card Future Year Prepays – should be sent to Krys Hammers at any time through July 11. Please send a copy of the Transaction Detail and the Additional Transaction Detail screens and include the cardholder’s name. Requisitioners who have ordered goods should be ensuring that the invoices are received and approved through Invoice Approval Workflow. If they do not see the invoices in workflow, they should contact the vendor and have invoices sent to Accounts Payable. Disputes need to be resolved in a timely manner. Fiscal or Fiscal Designees may approve invoices matched to a PO or GL account at any time through noon on June 30 by sending an email to their AP Tech. Please ensure that Purchase Orders for Telecom and Utilities are increased to cover those expenses through June. To ensure no interruptions in payment, please send Purchase Order numbers for FY14 Telecom and Utilities to AP as soon as the PO is created. Each college will be provided a format showing each account with a field where the new PO number can be entered. June 29 - All supplier invoices must be received in order by 4 pm on June 29 in order to be matched to purchase orders and paid in FY 13/14. June 30 – Invoices may be approved through workflow until noon. Invoices not approved by noon will be cancelled from the system and will be sent to Fiscal for standard pay approval in the 13th month. They will not be re-entered until Fiscal approval has been received. All receiving for the 2013 fiscal year must be completed by NOON on June 30, 2014. Items received on the afternoon of June 30 may not be received in CFS. Instead the delivery receipt must be hand stamped and forwarded to AP no later than July 2. June 30 – Processing payments for all invoices for which receiving and approval have been completed will begin at noon. After payments have been processed, all unpaid invoices will be canceled. A list of the canceled invoices will be sent to the College Fiscal Offices. These will not be re-entered in the 13th month until they are approved for standard pay by the Fiscal Agent or Desginee. The fiscal offices will be notified when to begin final closing purchase orders for Funds 1, 2 and 9. July 1 through July 9 - Accounts Payable will process supplier invoices pertaining to procurements in funds 1, 2, and 9, in fiscal year 2014 as “standard pays”. Invoices will be entered into CFS with a June 30th date and be posted as FY14 expense in the General Ledger. As Purchase Orders will be closed, all invoices will be entered to the Holding Account or the appropriate GL account. Invoice approval workflows will be forwarded to the Fiscal Agent. When approved, please include in the approver comments: OK to Pay The account number to be used The date received. July 9 – All invoices to be entered in FY14 must be received by noon on July 9. Invoices must be approved by Close of Business on July 9. July 10 Payments for FY14 expenses will be processed by 8:00 am. Invoices entered into the 13th month and not approved and paid will be canceled. A list of the canceled invoices will be sent to the College Fiscal Offices. AP will close for the Fiscal Year by 10am. July 14 FY15 Prepaid P-card expenses are due to Krys Hammers by Close of Business. Please send the Transaction Detail and Additional Transaction Detail screens. Expense accruals are due to Krys Hammers by Close of Business. o Accrued expenses are deducted from FY14 budgets. o Please send and include the invoice number (if known), the vendor name, the GL account number, and the amount. o Expenses for goods or services received in FY14 that are not accrued are Prior Year Commitments (PYC) and will be deducted from FY15 budgets. o Prior Year Commitments may be matched to a FY15 Purchase Order or the General Ledger account number provided by the Fiscal Agent or designee. July 15 – Accrued invoices will be entered into CFS and sent through workflow for approval. Invoices for goods/services dated on or before June 30 and not accrued will be processed as a Prior Year Commitment (PYC) per Administrative Regulations, Appendix FM-4. o PYCs processed before July 31 will require Fiscal approval. o PYCs processed from August 1 through September 30 will require : Fiscal Approval. An explanation of why the item was submitted after the close of the prior fiscal year. AP Manager approval. o PYCs processed after September 30 will require: Fiscal Approval. College President’s approval. An explanation of why the item was submitted after the close of the prior fiscal year. AP Manager approval. Controller’s approval. o PYCs processed at any time in amounts greater than $100,000 require: Fiscal Approval (Workflow must be manually reassigned to the College President with Fiscal approval comments.) College President’s Approval Controller’s Approval Because of the levels of approval, PYCs must be approved online. Frequently Asked Questions Q. What distinguishes a PYC or Future Year invoice? A. An invoice should be accounted for in the Fiscal Year where the majority of the goods or services were received. Example: An invoice for a subscription that begins in April of the current fiscal year and goes through March of the future fiscal year should be accounted for in the future fiscal year. If it is paid in the current fiscal year, it is a Future Year Prepay. Example: An invoice for goods or services that were provided in June of the current year, but not paid for until the end of July would be a Prior Year Commitment, unless the expense was accrued. Q. What if the PO is still open, as in the case of a Fund 3 or Fund 7? A. Even if a PO is still open, the expense should still be accounted for in the fiscal year where the majority of the goods or services are received. Fund 3 and Fund 7 expenses can be considered PYCs. Additionally, these expenses can be accrued. Q. What are the accounting entries for an Accrual? Accrual Accural 21101 Journal in Old Year Journal Reversed in New Year XXX Expense AP Liability 21100 Cash 10108 XXX XXX XXX Invoice entered in New Year XXX XXX Payment Issued XXX XXX Q. What are the accounting entries for a Future Year Prepay? Future Year Prepay Invoice Entered - Standard Pay Prepay 16100 XXX Cash 10108 Expense XXX Check Issued Expense reversed in New Year AP Liability 21100 XXX XXX XXX XXX