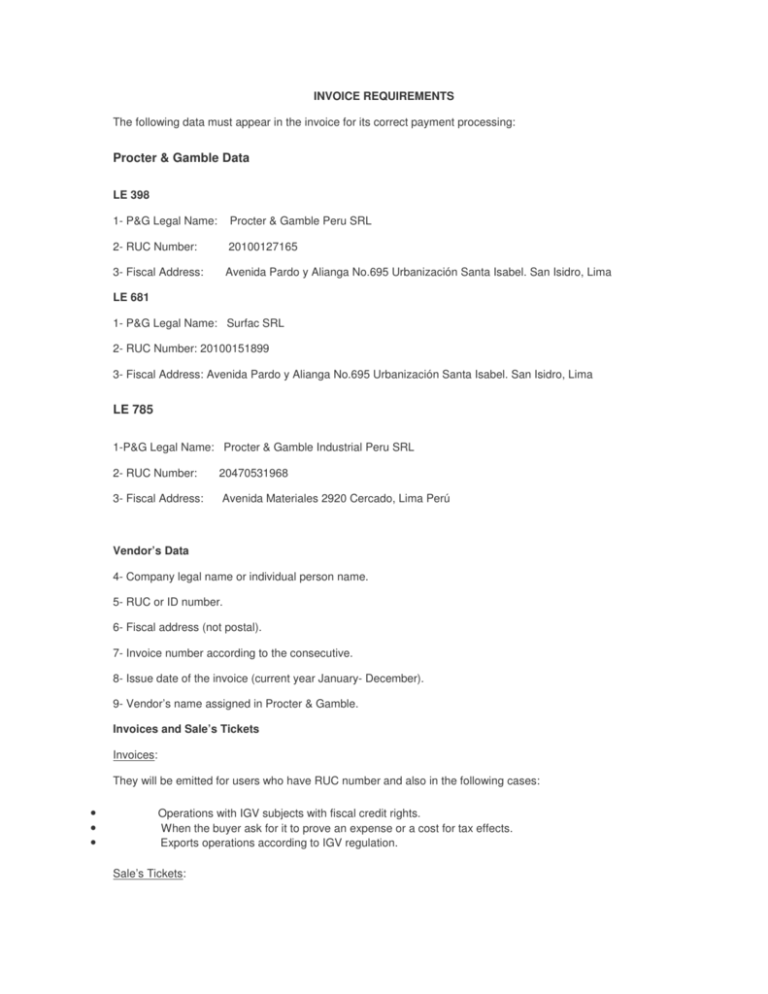

Procter & Gamble Data LE 785

advertisement

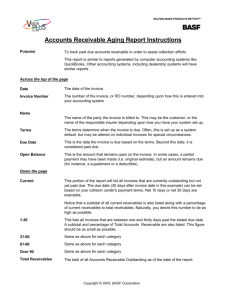

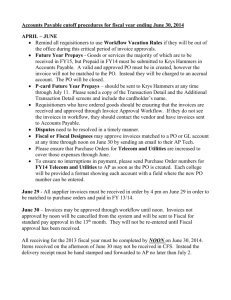

INVOICE REQUIREMENTS The following data must appear in the invoice for its correct payment processing: Procter & Gamble Data LE 398 1- P&G Legal Name: Procter & Gamble Peru SRL 2- RUC Number: 20100127165 3- Fiscal Address: Avenida Pardo y Alianga No.695 Urbanización Santa Isabel. San Isidro, Lima LE 681 1- P&G Legal Name: Surfac SRL 2- RUC Number: 20100151899 3- Fiscal Address: Avenida Pardo y Alianga No.695 Urbanización Santa Isabel. San Isidro, Lima LE 785 1-P&G Legal Name: Procter & Gamble Industrial Peru SRL 2- RUC Number: 20470531968 3- Fiscal Address: Avenida Materiales 2920 Cercado, Lima Perú Vendor’s Data 4- Company legal name or individual person name. 5- RUC or ID number. 6- Fiscal address (not postal). 7- Invoice number according to the consecutive. 8- Issue date of the invoice (current year January- December). 9- Vendor’s name assigned in Procter & Gamble. Invoices and Sale’s Tickets Invoices: They will be emitted for users who have RUC number and also in the following cases: • • • Operations with IGV subjects with fiscal credit rights. When the buyer ask for it to prove an expense or a cost for tax effects. Exports operations according to IGV regulation. Sale’s Tickets: • They will be emitted for consumers or final users operations. Printed Information: • • • • Full name or legal name. Commercial name if exists. Address of the Main House and establishment where the emission point is located. Number, serial, and receipt name Printing and printer data. Information not necessarily printed: • The rest f the requirements (according the scan model). Invoiced product or service 9- Sold product or delivered service description. The operation nature must be equal to the mentioned in the purchase order. 10- Purchase order number of 13 digits, for example G4P4500000000 or L6P4500000000 for logistic suppliers. 11- Purchase order item number that you are invoicing. 12- Lines or items must be the same that Purchase order has in terms of: price, quantity, unit of measure and currency. Delivered service month (on service cases). 13- Unit price, total amount of each product and of the invoice indicated in numbers and letters, should be the same that PO mentions. 14- Granted discounts and Subtotal. 15- Detail or description of the goods sold or given service, split detail for taxable or non taxable items, unitary price and amount of the operation, expressed in the currency used for payment. 16- Taxes description and amount. 17- Payment term agreed. 18- Attach a purchase order copy and/or Purchasing contact name for invoices created without purchase order. Important notes A- If your invoice does not have a PO number created, please write the buyer’s name in the invoice. B- Every invoice from local supplier must be presented in the reception places and/or mailbox located in the plant, if you give your invoice to a PG contact or present it in another place payment terms will be affected and there is a risk of missing invoice. C- Consignment Invoices should match the consignment report (MRKO report provided by the plant). D- Each credit note must include credit parking number (10 digits), provided by your P&G contact. E- All invoices related to International purchases (suppliers outside Perú) have to be sent to the corresponding Border (broker) where the material is going to be nationalized.